Electrocoating Market Report Scope & Overview:

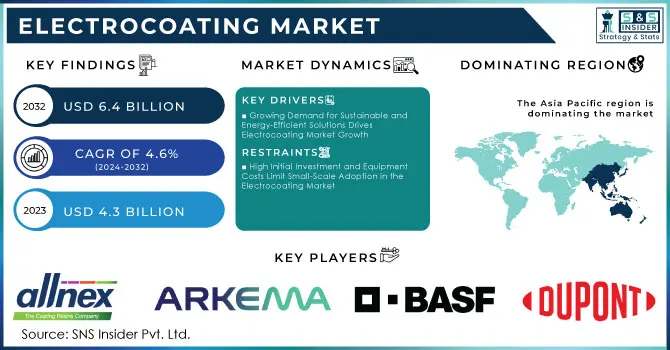

The Electrocoating Market Size was valued at USD 4.3 billion in 2023 and is expected to reach USD 6.4 billion by 2032 and grow at a CAGR of 4.6% over the forecast period 2024-2032.

Get More Information on Electrocoating Market - Request Sample Report

The electrocoating market is expanding as industries increasingly turn to sustainable and energy-efficient coating solutions. Electrocoating technology, which applies a uniform, resilient coating to surfaces through an electrical current, is highly favored in sectors like automotive, appliance, and industrial manufacturing due to its consistent finish and reduced material waste. This shift is driven by environmental regulations and the need for sustainable production methods. For instance, PPG Industries achieved a significant milestone in August 2024 by winning the Altair Enlighten Award for its sustainable electrocoat technology, reflecting the company’s commitment to reducing the environmental impact of its manufacturing processes through innovations that lower material consumption and enhance product sustainability.

Several recent developments emphasize the electrocoating industry’s pivot toward eco-friendly solutions that align with corporate sustainability targets. Axalta Coating Systems made notable strides by earning the BIG Innovation Award in January 2023 for its advanced sustainable electrocoat technology. This recognition highlights the growing market demand for coatings that offer both material protection and environmental compliance. Axalta’s achievement underscores the industry trend toward developing coatings that minimize ecological footprints while maintaining high-performance standards, demonstrating how electrocoating companies are advancing to meet both regulatory demands and customer expectations.

Research investments by major players further illustrate the push toward electrocoating innovation. In September 2022, BASF Coatings opened a specialized electrocoat research center to bolster its development capabilities, facilitating more precise and adaptable electrocoating solutions. This new facility enables BASF to test and refine technologies tailored for diverse industrial applications, emphasizing the company’s dedication to technological leadership in the electrocoating space. The research center supports BASF's goal to offer customized, high-performing electrocoats that can meet varied sector needs, thereby enhancing the practical applications of electrocoating across multiple industries.

Technological advancements in related fields are also driving growth in the electrocoating market. In September 2023, researchers made a breakthrough in lithium-ion battery technology that could extend battery life, with implications for the electrocoating market by increasing the durability and efficiency of battery coatings used in electric vehicles and renewable energy storage. Additionally, Sunfire’s acquisition of an electroplating specialist in January 2022 to advance its alkaline electrolysis technology underscores the strategic role of electrocoating expertise in the clean energy sector. This acquisition highlights the synergy between electrocoating technology and energy transition efforts, as durable, efficient coatings are crucial for enhancing the longevity and performance of infrastructure in renewable energy applications.

Electrocoating Market Dynamics:

Drivers:

-

Growing Demand for Sustainable and Energy-Efficient Solutions Drives Electrocoating Market Growth

The electrocoating market is seeing robust growth as industries worldwide focus on adopting environmentally sustainable and energy-efficient solutions. Stringent regulations aimed at reducing industrial emissions and environmental impact are pushing manufacturers to seek alternatives that ensure compliance while delivering high-quality results. Electrocoating technology, with its minimal material wastage and energy savings, is emerging as a preferred choice for various applications, especially in the automotive and industrial manufacturing sectors. This process provides an even coating and ensures consistent protection of metal parts, reducing the need for reworks and enhancing product durability. Companies like PPG and Axalta have developed advanced, sustainable electrocoats that are both efficient and eco-friendly, catering to the rising demand for green production practices. As companies prioritize sustainable solutions, electrocoating is positioned as a competitive, cost-effective, and environmentally responsible option, contributing to its accelerated adoption across industries.

-

Increasing Adoption of Electrocoating in the Automotive Sector Fuels Market Expansion

The automotive industry’s focus on improving vehicle longevity and reducing production costs is significantly driving the electrocoating market forward. Electrocoating provides a high-quality, corrosion-resistant finish, which is essential for automotive parts exposed to varying environmental conditions. The consistent thickness and uniform application achievable through electrocoating enhance the durability of metal components, which is crucial for meeting the stringent safety and performance standards in the automotive sector. Leading automakers are integrating electrocoating into their production lines to ensure reliable, cost-effective, and high-performance finishes. Additionally, as electric vehicle (EV) production grows, the need for efficient and eco-friendly coating solutions has become more pressing, with electrocoating emerging as an ideal technology. The automotive industry’s demand for robust coating solutions that contribute to vehicle longevity and sustainability is propelling electrocoating market growth.

Restraint:

-

High Initial Investment and Equipment Costs Limit Small-Scale Adoption in the Electrocoating Market

Despite the benefits of electrocoating, the market faces a significant restraint due to high initial investment and equipment costs, which limit adoption by smaller manufacturers. Electrocoating systems require specialized equipment, including tanks, rectifiers, and advanced handling systems, to ensure the uniform application of coatings. For small to medium-sized enterprises (SMEs) with limited capital resources, these costs can be prohibitive, creating a barrier to entry. Additionally, the maintenance of electrocoating systems requires specialized knowledge and expertise, adding to operational expenses over time. This challenge often leads smaller manufacturers to opt for traditional coating methods that are less costly upfront, even if they lack the efficiency and sustainability of electrocoating. Consequently, while large players can leverage electrocoating for cost savings and sustainability benefits, high setup costs restrain broader market penetration among SMEs.

Opportunity:

-

Rising Demand for Electrocoating in Renewable Energy Storage Presents Growth Opportunities

The surge in renewable energy technologies, particularly energy storage solutions like lithium-ion batteries, is creating new opportunities for the electrocoating market. The need for corrosion-resistant and durable coatings is critical in the production of batteries and other energy storage devices, where material stability and longevity are essential for optimal performance. Electrocoating’s precision application and durability make it an ideal technology for protecting sensitive battery components from environmental damage and wear. Recent advancements in electrocoating techniques further enhance its suitability for high-tech applications in renewable energy. As global energy systems increasingly rely on renewable sources, electrocoating solutions are expected to play a vital role in ensuring the reliability and longevity of energy storage infrastructure. Companies focusing on energy applications represent a significant growth area, as they seek high-performance coatings that align with green energy goals.

Challenge:

-

Managing Wastewater and Chemical Disposal Poses Environmental Challenges in the Electrocoating Industry

The electrocoating industry faces environmental challenges related to wastewater management and the disposal of chemicals used in the coating process. Electrocoating generates wastewater containing chemicals that require careful handling to prevent environmental contamination. Improper disposal of these chemicals could lead to significant ecological impact, prompting regulatory scrutiny and raising operational costs for electrocoating facilities. To address these challenges, companies must implement robust wastewater treatment systems, which require additional investment and expertise. Moreover, adherence to strict environmental regulations adds complexity and operational costs, particularly for small to medium-sized enterprises. Addressing these environmental issues is essential for the electrocoating industry to maintain compliance and uphold its reputation as an eco-friendly solution.

Electrocoating Market Segments

By Type

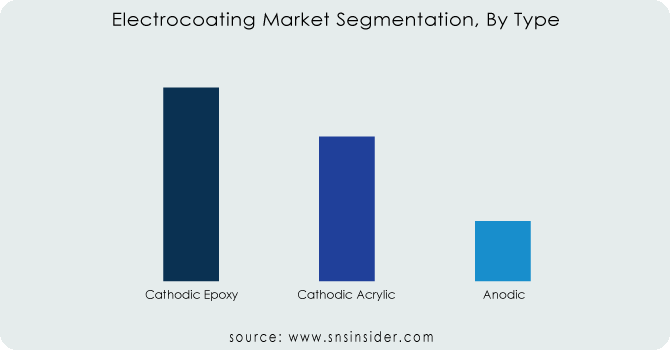

In 2023, the Cathodic segment dominated the electrocoating market, holding a market share of around 70%. Cathodic electrocoating is highly preferred due to its superior corrosion resistance, which is especially crucial in automotive and industrial applications. This type of coating is commonly used for protecting metal substrates exposed to harsh environments, such as vehicle bodies and heavy machinery. Automotive manufacturers, including those producing electric vehicles, rely on cathodic electrocoating to ensure long-lasting durability and resistance against rust, making it an ideal solution for components that endure extreme conditions. The high adoption of cathodic coatings in sectors focused on durability and environmental exposure reinforces its leading position in the market.

By Application

The Passenger Cars segment dominated the electrocoating market in 2023 with a market share of 40%. Electrocoating in passenger cars is essential for providing corrosion resistance, improving aesthetic appeal, and enhancing the lifespan of vehicle components. Automakers increasingly apply electrocoating to various parts, including car frames and underbodies, to meet both safety standards and consumer expectations for vehicle longevity. The growing production of electric and conventional passenger cars has driven demand for electrocoating, as it ensures critical protection against rust and wear. Major automotive manufacturers are investing in advanced electrocoating technologies, which strengthens this segment's dominance in the market.

By End-User

The Industrial segment dominated the electrocoating market in 2023, accounting for approximately 50% of the market share. Electrocoating’s robustness and durability make it ideal for industrial applications, where equipment and components are frequently exposed to harsh conditions. Industries such as automotive manufacturing, heavy-duty equipment, and appliances benefit from electrocoating to protect metal parts against corrosion and wear. For example, manufacturers of heavy machinery and industrial equipment prioritize electrocoating to ensure that parts withstand operational stresses and environmental factors. The reliance on electrocoating in various industrial applications supports its dominance in this end-user segment.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Electrocoating Market Regional Analysis

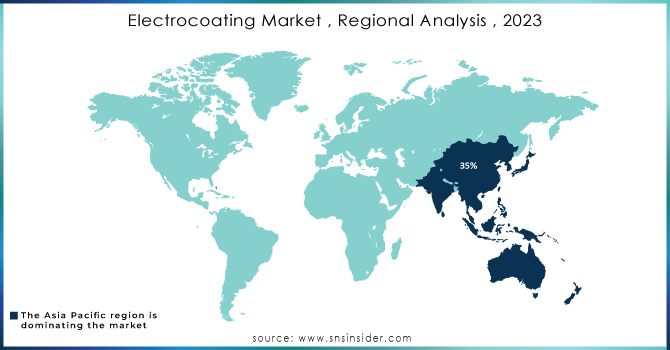

In 2023, Asia-Pacific dominated the electrocoating market, holding a market share of around 40%. This dominance is largely due to the rapid expansion of the automotive and industrial manufacturing sectors in countries like China, Japan, and India. These countries have become major production hubs for automotive giants, which increasingly adopt electrocoating for its corrosion resistance and cost-effectiveness. China’s large-scale manufacturing capabilities and the growth of electric vehicle (EV) production have further fueled demand for electrocoating technologies. Additionally, substantial government investments in infrastructure and industrial expansion across Asia-Pacific contribute to high electrocoating adoption in construction and machinery. The region’s focus on technological advancements and sustainable manufacturing solutions bolsters its lead in the global electrocoating market.

North America is expected to emerge as the fastest-growing region in the electrocoating market, with a highest CAGR from 2024-2032. This growth is primarily driven by the increasing focus on sustainability and the adoption of eco-friendly coating solutions in industries such as automotive, aerospace, and heavy machinery. U.S.-based automotive manufacturers are intensifying their use of electrocoating for both electric and conventional vehicles to meet regulatory standards and enhance product longevity. Moreover, North America’s growing renewable energy sector and battery manufacturing industry have spurred demand for durable, corrosion-resistant coatings for energy storage solutions. Supportive government policies promoting green manufacturing practices further accelerate electrocoating market expansion in the region, making North America a key area for future growth.

Key Players

-

Allnex GmbH (UCECOAT 7701 BC, EBECRYL, RESYDROL)

-

Arkema (REAFREE, SYNAQUA, CRAYVALLAC)

-

Axalta Coating Systems (AquaECT, AquaEC, Voltatex)

-

BASF SE (Cathoguard, Ecovio, Joncryl)

-

DuPont (Tyzor, Crolite, Voltatex)

-

FAWER Y-TEC Automotive Chassis System Co., Ltd. (Chassis E-coat, Component E-coat)

-

Hawking Electrotechnology Limited (Hawkcoat, Zinc Rich E-coat)

-

IFB Industries Limited (IFB E-Coat, Aquatech Coatings)

-

KCC Corporation (Korecoat, KCC E-coat)

-

Luvata Oy (Luvacote, EcoShield)

-

NOROO Paint & Coatings Co., Ltd. (Norex, Eclear)

-

Nippon Paint Holdings Co., Ltd. (Aqua Coatings, Fine Coat Eco)

-

PPG Industries, Inc. (Powercron, Envirocron, Aquacron)

-

Solvay (Halar, Radel, Ryton)

-

Tatung Fine Chemicals Co., Ltd. (Tatcoat, Aquaseal)

-

The Sherwin Williams Company (E-Coat Shield, Powdura, Excelo)

-

Valspar (Aquaguard, Valspar E-Coat)

-

Henkel AG & Co. KGaA (Bonderite, Loctite E-Coat)

-

Kansai Paint Co., Ltd. (Eco Coating, E+Coat)

-

Nippon Paint Holdings (Aquatech, NipponGuard)

Recent Developments

-

May 2024: Allnex launched UCECOAT 7701 BC, an eco-friendly, MIT-free coating specifically designed for wood furniture. This sustainable product, which uses the mass balance approach, offers fast reactivity and high scratch and stain resistance, bridging eco-friendly waterborne coatings with high-performance energy-curable systems.

-

February 2024: Arkema expanded its environmentally friendly coatings in India, focusing on VOC reduction and carbon footprint. Their Navi Mumbai facility now offers advanced waterborne, high-solid, and UV/LED/EB technologies, supported by a state-of-the-art production unit and applications lab for development and technical support.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.3 billion |

| Market Size by 2032 | US$ 6.4 Billion |

| CAGR | CAGR of 4.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Cathodic, Anodic) •By Application (Passenger Cars, Commercial Vehicles, Automotive Parts & Accessories, Heavy-Duty Equipment, Home Appliances, Others) •By End-User (Industrial, Commercial, Residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Allnex GmbH, NOROO Paint & Coatings Co., Ltd., Arkema, Hawking Electrotechnology Limited, IFB Industries Limited, Luvata Oy, Solvay, KCC Corporation, atung Fine Chemicals Co., Ltd., Axalta Coating Systems, PPG Industries, Inc., Valspar, The Sherwin Williams Company and other key players |

| Key Drivers | •Growing Demand for Sustainable and Energy-Efficient Solutions Drives Electrocoating Market Growth •Increasing Adoption of Electrocoating in the Automotive Sector Fuels Market Expansion |

| Restraints | •High Initial Investment and Equipment Costs Limit Small-Scale Adoption in the Electrocoating Market |