Automotive Airbag Fabric Market Report Scope & Overview

The Automotive Airbag Fabric Market size was valued at USD 3.9 billion in 2023 and is expected to reach USD 5.85 billion by 2031 and grow at a CAGR of 5.2% over the forecast period 2024-2031.

Airbag fabrics are in high demand due to stricter safety regulations. Advancements in fabric technology are crucial for the airbag fabric market. Manufacturers are constantly improving airbag fabric strength, durability, and performance through material innovations, weaving techniques, and coatings. These innovations aim to make airbags lighter, more tear-resistant, and more efficient while reducing costs. Airbags are essential for occupant safety and expand rapidly during accidents to cushion passengers. They are made from advanced materials like Nylon 6,6 and sometimes aramid fabrics, but aramid's high cost limits its use. Key airbag fabric properties include high tensile strength and minimal air permeability. The market is driven by vehicle sales and is closely tied to vehicle production.

Get More Information on Automotive Airbag Fabric Market - Request Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Advanced Airbag Technology Fuels Demand for Innovative Airbag Fabrics

Smarter airbags with advanced sensors and deployment systems require smarter fabrics. As airbag technology gets more complex, the fabrics need to keep pace. They must inflate quickly, resist tearing during deployment, and effectively protect passengers. This constant push for better airbag performance drives manufacturers to develop innovative airbag fabric materials.

-

Airbag Fabric Market Driven by Lightweight Materials for Improved Fuel Efficiency in Cars

RESTRAINTS:

-

High cost of advanced airbag fabrics like aramids can limit their widespread adoption.

-

Limited consumer awareness about the importance of advanced airbag fabrics can hinder market growth.

OPPORTUNITIES:

-

Development of airbag fabrics for external car surfaces can improve pedestrian protection in accidents.

-

Creating eco-friendly airbag fabrics using bio-based materials aligns with the automotive industry's sustainability goals.

CHALLENGES:

-

Balancing safety regulations, advanced materials, and affordability is challenging for airbag fabric manufacturers.

-

Developing innovative airbag fabrics requires complex R&D to balance lightweight materials, strength, and affordability.

The constant search for better airbag fabrics presents challenges for researchers. Exploring new materials, combining them effectively and developing new manufacturing methods are crucial for improved performance. However, achieving this balance can be tricky as lighter materials are desired for fuel efficiency, but strength and affordability remain paramount. This highlights the ongoing complexity of material science in the automotive safety field, where researchers must constantly innovate while keeping these crucial factors in balance.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has disrupted the automotive airbag fabric market in several ways. The production slowdowns are anticipated by up to 20% due to potential scarcity of raw materials like neon gas, critical for nylon 6,6 production, a key airbag fabric. This scarcity is likely due to sanctions and export restrictions. The war's impact on global energy prices can increase production costs by 10-15%, decreasing profit margins for manufacturers. This can lead to cost-cutting measures that might affect fabric quality or innovation. The war disrupts established supply chains, potentially causing delays and raising fabric delivery times by 5-10%. Additionally, the war's impact on global economic stability might lead to decreased car sales by 5-10%, directly impacting airbag fabric demand. This overall disruption can hinder advancements in airbag fabric technology and potentially delay the adoption of lighter weight or more efficient airbag materials.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can negatively impact the automotive airbag fabric market in several ways. Consumer spending tends to decrease during economic downturns, leading to a potential 15-20% reduction in demand for new vehicles. This directly translates to lower demand for airbag fabrics. The supplier delays due to budget constraints or logistical issues can disrupt production and inflate lead times by 5-10%. Thus, as consumers become more price-sensitive, airbag fabric manufacturers might face pressure to reduce costs by 10-15%. This pressure could lead to compromises in material quality or innovation. Automakers might scale back on R&D projects for new safety features, potentially slowing down innovation in airbag fabrics. Consumers may prioritize affordability over safety features, leading to a higher demand for airbag fabrics used in lower-cost vehicles which typically have less stringent performance requirements.

KEY MARKET SEGMENTS:

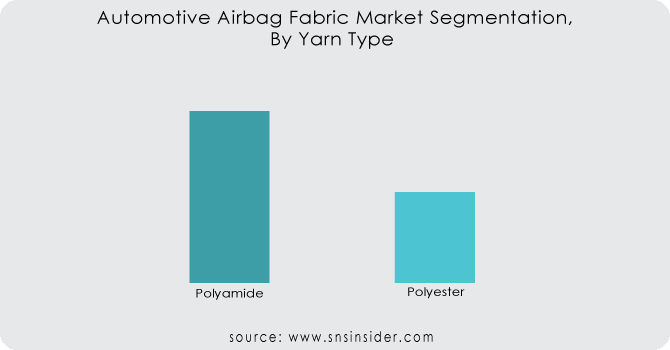

By Yarn Type

-

Polyamide

-

Polyester

Polyamide is the dominating sub-segment in the Automotive Airbag Fabric Market by yarn type holding around 70-75% of market share. Polyamide offers exceptional strength, high tear resistance, and good gas permeability, making it ideal for withstanding the rapid inflation of airbags during deployment. Additionally, its flame retardant properties are crucial for passenger safety.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Coating Type

-

Neoprene Coated

-

Silicone Coated

-

Uncoated

Silicone Coated Fabric is the dominating sub-segment in the Automotive Airbag Fabric Market by coating type holding around 55-60% of market share. Silicone coating enhances fabric performance by improving gas retention and reducing air permeability. It also offers good heat resistance and flame retardancy, making it suitable for the harsh environment within an airbag.

By Vehicle Type

-

Passenger Cars

-

Light Commercial Vehicles

-

Heavy Trucks

-

Buses

-

Coaches

Passenger Cars is the dominating sub-segment in the Automotive Airbag Fabric Market by vehicle type holding around 65-70% of market share. Passenger cars account for the majority of vehicle production globally. Additionally, stricter safety regulations for passenger cars compared to other vehicle types drive the demand for airbags and consequently, airbag fabrics in this segment.

By Airbag Type

-

Front Airbag

-

Side Airbag

-

Knee Airbag

-

Curtain Airbag

-

Other Airbags

Front Airbag is the dominating sub-segment in the Automotive Airbag Fabric Market by airbag type holding around 45-50% of market share. Front airbags are the most crucial for occupant safety in frontal collisions. Regulations mandate their presence in most regions, leading to higher demand for their corresponding fabrics compared to other airbag types.

REGIONAL ANALYSES

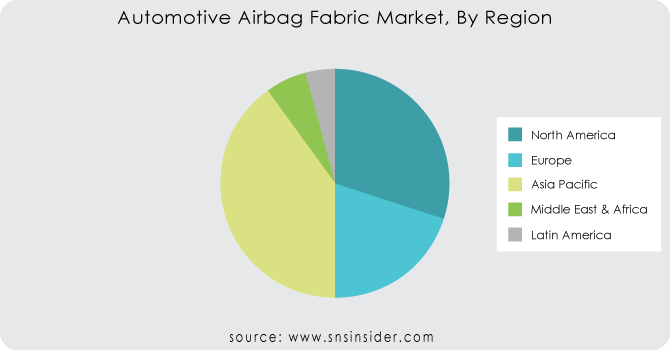

The Asia Pacific is the dominating region in the Automotive Airbag Fabric Market holding 40-45% of market share due to its growing car production, particularly in China and India. Rising incomes, urbanization, and a growing middle class fuel car demand, with stricter safety regulations further pushing airbag fabric needs.

North America is the second highest region in this market with 30-35% of share with its established automotive industry and preference for feature-rich, safe vehicles. Robust connectivity infrastructure encourages advanced in-car systems often bundled with airbags.

Europe is experiencing the fastest growth in this market with 20-25% of share due to a rising safety awareness among consumers. The demand for premium vehicles and government regulations mandating advanced safety features with integrated airbags are accelerating the European market.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Robert Bosch GMBH, Takata Corporation, Delphi Automotive PLC, Toyoda Gosei Co., Ltd., Trw Automotive, Asahi Kasei Co., Ltd, Global Safety Textiles (Hyosung), Toray Industries, Inc., HMT (Xiamen) New Technical Materials Co., Ltd., Asahi Kasei Co., Ltd., Autoliv AB, Kolon Industries, Takata Corporation, Teijin Limited, Toray Industries, Toyobo Co., Ltd., Toyota Boshoku Corporation and other key players.

Robert Bosch GMBH-Company Financial Analysis

RECENT DEVELOPMENT

-

In Jan. 2023: Toray Industries in Japan has created a new eco-friendly material: recycled nylon 66 made from leftover bits of silicone-coated airbag fabric. This innovation could reduce waste and potentially lower production costs.

-

In April 2023: Autoliv, a top name in car safety, announced plans to build a state-of-the-art airbag factory in Vietnam. This new facility will focus on supplying airbag cushions and fabrics throughout Asia.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.9 Billion |

| Market Size by 2031 | US$ 5.85 Billion |

| CAGR | CAGR of 5.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Yarn Type (Polyamide, Polyester) • By Coating Type (Neoprene Coated, Silicone Coated, Uncoated) • By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Trucks, Buses, Coaches) • By Airbag Type (Front Airbag, Side Airbag, Knee Airbag, Curtain Airbag, Other Airbags) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Robert Bosch GMBH, Takata Corporation, Delphi Automotive PLC, Toyoda Gosei Co., Ltd., Trw Automotive, Asahi Kasei Co., Ltd, Global Safety Textiles (Hyosung), Toray Industries, Inc., HMT (Xiamen) New Technical Materials Co., Ltd., Asahi Kasei Co., Ltd., Autoliv AB, Kolon Industries, Takata Corporation, Teijin Limited, Toray Industries, Toyobo Co., Ltd., and Toyota Boshoku Corporation |

| Key Drivers | • Due to a rise in passenger safety concerns, the market is rising. • An increase in the number of installed airbags. |

| RESTRAINTS | • Market expansion is impeded by cost difficulties in price-sensitive regions. • OEMs only provide one or two airbags, as more airbags increase the vehicle's overall cost. |