Shipbuilding Anti-Vibration Market Report Scope & Overview:

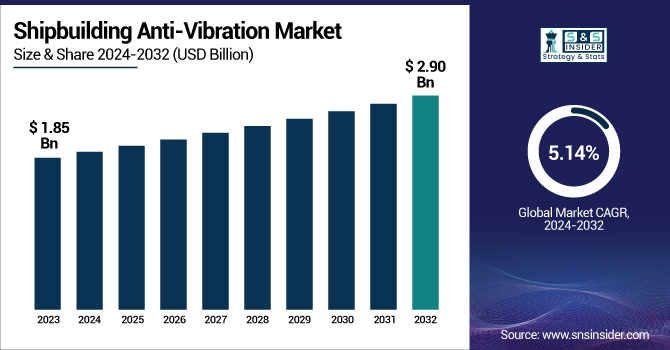

The Shipbuilding Anti-Vibration Market Size was estimated at USD 1.85 billion in 2023 and is expected to arrive at USD 2.90 billion by 2032 with a growing CAGR of 5.14% over the forecast period 2024-2032. The Shipbuilding Anti-Vibration Market report provides a unique perspective by analyzing production output and utilization rates across key shipbuilding regions, highlighting fluctuations in demand and capacity utilization. It also explores technological advancements and adoption rates, showcasing innovations in damping materials and smart vibration control systems. Additionally, export/import data offers insights into trade dynamics and supply chain shifts. Emerging trends such as increased adoption of noise & vibration compliance standards, integration of AI-driven monitoring systems, and sustainability-focused anti-vibration solutions further distinguish this report.

To Get more information on Shipbuilding Anti-Vibration Market - Request Free Sample Report

The U.S. Shipbuilding Anti-Vibration Market is projected to grow from USD 0.61 billion in 2023 to USD 0.92 billion by 2032, at a CAGR of 4.76%. This steady growth is driven by increasing demand for advanced vibration control solutions in naval and commercial shipbuilding, ensuring enhanced durability and operational efficiency. The market's expansion is further fueled by technological advancements and rising defense investments.

Shipbuilding Anti-Vibration Market Dynamics

Drivers

-

The growing shipbuilding industry, driven by rising commercial and naval vessel demand, is boosting the adoption of advanced anti-vibration solutions for durability, comfort, and regulatory compliance.

The global shipbuilding industry is experiencing steady growth due to increasing demand for commercial and naval vessels, driving the adoption of advanced anti-vibration solutions. Growing maritime trade, offshore exploration, and naval modernization programs are driving ship production with the need for effective vibration-controlled systems to improve structural integrity and onboard comfort. Moreover, strict noise and vibration regulations issued by institutions such as the International Maritime Organization (IMO) require shipbuilders to use advanced damping technologies. Market trends involve the development of light-weight and high-performance anti-vibration materials, development of smart vibration monitoring systems, and increasing use of electric and hybrid propulsion, which need improved vibration control methods. In addition, luxurious cruise ships and high-speed ships are focusing on increasing the comfort level of passengers, which is driving the growth of noise & vibration reduction technologies. Shipbuilding anti-vibration market is expected to witness continuous growth due to the continuous innovations in ship pattern and growing concern over crew health and safety.

Restraint

-

The high cost of advanced anti-vibration systems limits their adoption in cost-sensitive shipbuilding projects, as they require specialized materials, engineering, and testing.

The installation of advanced anti-vibration systems significantly increases the overall cost of shipbuilding, making it a major restraint for cost-sensitive projects. Producing these systems demands high-tech materials, precise engineering, and sophisticated technologies all of which significantly contribute to the cost of production. Also, the implementation of anti-vibration solutions would require bespoke design changes and testing, which adds to the overall cost. If only smaller shipyards and budget scrimpers, they'll be disinterested and choose conventional or worse systems. Also, shipbuilders working on narrow margins may overlook vibration control in favor of other necessities. Although these systems improve vessel lifespan, crew comfort, and equipment reliability, their cost can prevent mass adoption, especially in commercial and mid-range ship segments. Instead, manufacturers are looking for cost-effective solutions, more modular anti-vibration technologies, and even retrofitting opportunities that provide better vibration reduction at a lower price.

Opportunities

-

The integration of IoT and AI-driven vibration control systems enables real-time monitoring, predictive maintenance, and optimized damping, enhancing ship performance and reducing operational costs.

The integration of IoT and AI-driven vibration monitoring systems is transforming the shipbuilding anti-vibration market. These intelligent systems allow for real-time monitoring, predictive maintenance, and automated corrective actions to reduce vibrations and improve ship performance. IoT Sensors Monitoring vibration levels, with AI analyzing the data to detect anomalies, predict potential failures and optimize damping solutions. Not only does this technology increase operational efficiency but also decreases maintenance costs and prolongs equipment life. AI-fuelled systems can also adjust to shifting marine variables for continued performance consistency. Digitalization and Automation are the future of the Maritime Industry, creating demand for more intelligent solutions for Vibration Control. Better safety, lower downtime and compliance with strict noise and vibrations regulations for ship operators. The increasing use of electric and hybrid propulsion systems further enhances the demand for advanced anti-vibration technologies, providing new avenues for innovation and market growth.

Challenges

-

Keeping up with evolving maritime vibration and noise regulations demands continuous investment, innovation, and compliance to avoid penalties and operational restrictions.

Keeping up with evolving regulatory standards in the shipbuilding anti-vibration market presents a significant challenge for manufacturers. Organizations like the International Maritime Organization (IMO) and classification societies such as ABS and DNV regularly update noise and vibration guidelines to enhance crew safety, environmental compliance, and structural integrity. Governments are mandating compliance with the latest standards; this means continuous investments in research, testing, and certification, resulting in higher costs for manufacturers. Shipbuilders must also implement anti-vibration solutions that comply with strict noise limits and structural vibration that vary by vessel type and region. Compliance is a huge challenge in addition to the need for real time monitoring and predictive maintenance. Failing to comply can lead to penalties, restrictions on their operations or damage to their reputation for shipbuilders and operators alike. Manufacturers face new guidelines for the smart vibration control technologies along with advanced less-trauma materials that are efficient yet cost effective, as regulations trend toward stricter rules. This development is a challenging adaptation as it necessitates rigorous cooperation with regulatory bodies and shipbuilders'; to ensure feasibility of adherence to the standards.

Shipbuilding Anti-Vibration Market Segmentation Analysis

By Product Type

The bearing pads segment is the fastest-growing in the Shipbuilding Anti-Vibration Market, driven by advancements in material technology and their increasing adoption in ship structures. These pads are vital for vibration and noise damping, increasing the longevity and efficiency of marine crafts. Increasingly, shipbuilders are integrating high-performance bearing pads to optimize structural integrity, reduce maintenance costs, and meet strict maritime safety regulations. The need for lightweight and corrosion-resistant materials has also driven innovation in this segment. This makes using effective anti-vibration solutions, such as bearing pads, an essential part of modern shipbuilding, as well as retrofitting existing vessels, as industry trends strive towards creating more eco-friendly and efficient designs.

By Function Type

The HVAC Vibration segment dominated with a market share of over 42% in 2023, owing to the HVAC systems criticality in providing in-flight comfort and operational efficiency in aviation. Ships are subjected to constant vibrations caused by engines, waves, and mechanical parts, making vibration isolation essential for HVAC systems to operate efficiently. Vibration isolation: Excessive vibrations can cause equipment wear, noise disturbances, and shorten the overall lifespan of a system. Shipbuilders overcome these challenges by leveraging advanced anti-vibration mounts, dampers, and isolators to promote proper HVAC operations. Moreover, strict marine regulations and increasing need for noise reduction in commercial and passenger vessels are also spurring the adoption of anti-vibration solutions in this segment.

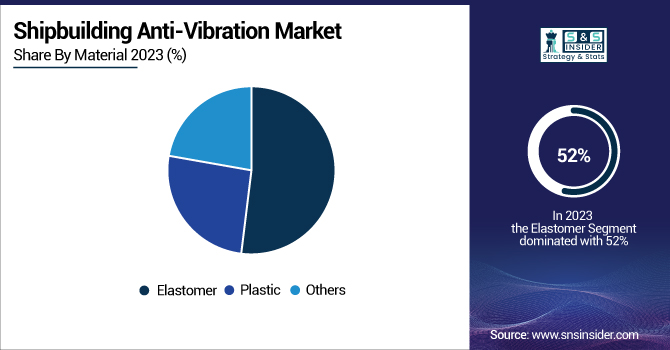

By Material

The Elastomer segment dominated with a market share of over 52% in 2023, due to its superior vibration-dampening properties, flexibility, and durability, demanding marine environments. Elastomers, particularly rubber-based materials, effectively absorb and isolate vibrations, reducing noise and structural fatigue in ships. Their resistance to saltwater, extreme temperatures, and mechanical stress makes them ideal for marine applications, including engine mounts, dampers, and shock absorbers. Additionally, elastomers offer long service life and minimal maintenance, making them a cost-effective solution for shipbuilders. The increasing focus on enhancing vessel efficiency and reducing onboard noise further drives the demand for elastomer-based anti-vibration solutions. With continuous advancements in material engineering, elastomers remain the preferred choice for ensuring safety, comfort, and longevity in ship structures.

By Application

The Fishing boats segment dominated with a market share of over 32% in 2023, thereby leading the overall market owing to its excellent vibration-dampening properties, flexibility, and durability, and demanding marine environments. Rubber-based elastomers absorb and isolate vibrations from ships and other noisy or vibrating machinery, minimizing structural fatigue and noise. They are used in a variety of marine applications such as engine mounts, dampers, and shock absorbers, due to their resistance to saltwater, extreme temperatures, and mechanical stress. Elastomers also provide long life and low maintenance, making them an economical alternative for shipyards. Elastomer-based anti-vibration solutions are further propelled by the growing emphasis on enhancing vessel performance and minimizing onboard noise. Due to ongoing developments in material engineering, elastomers are still the best option and demand remains for safe, comfortable, and durable ship structures.

Shipbuilding Anti-Vibration Market Regional Outlook

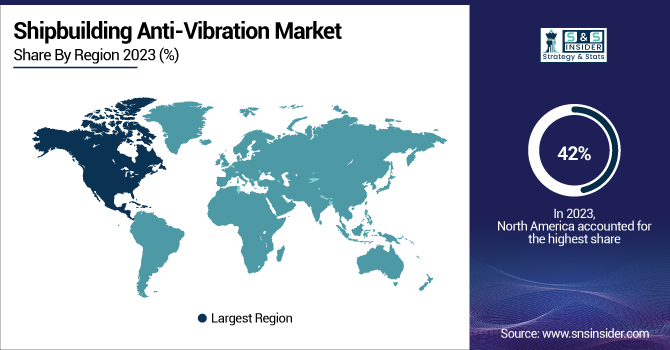

North America region dominated with a market share of over 42% in 2023, mainly due to the presence of a well-developed naval and commercial shipbuilding industry. Several prominent shipbuilders and defense contractors in this region are focused on developing advanced vibration control systems to improve the performance and durability of vessels. Strict government regulations, especially in the U.S., require anti-vibration technologies for noise reduction, structural integrity, and crew safety. The increasing use of anti-vibration solutions is also the result of innovations in marine engineering and a growing need for high-performance vessels. North America dominates the shipbuilding anti-vibration systems market, supported by the presence of key market players and continuous investments in research and development.

Asia-Pacific is experiencing the fastest growth in the Shipbuilding Anti-Vibration Market, driven by the booming shipbuilding industry in China, South Korea, and Japan. They are responsible for the majority of ship production around the world, where the majority of the work involves commercial vessels, naval ships and offshore structures. In addition, increasing government spending on naval modernization along with growing marine trade and offshore exploration activities are further supplementing demand for anti-vibration solutions that improve vessel performance and durability. Moreover, strict environmental norms and growing adoption of advanced vibration control technologies in shipbuilding activity boosts the regional market expansion during the projection period. Due to the region's increased shipbuilding capabilities and technological development, the Asia-Pacific region is also expected to grow fast, making this one of the leading shipbuilding anti-vibration markets in the world.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players in the Shipbuilding Anti-Vibration Market

-

Trelleborg (Mounts, Bearings, Isolators)

-

Parker LORD (Vibration Isolators, Engine Mounts)

-

Hutchinson Paulstra (Anti-Vibration Mounts, Shock Absorbers)

-

GMT Rubber-Metal-Technic Ltd. (Marine Mounts, Dampers)

-

Continental (Engine Mounts, Rubber Bushings)

-

Vibracoustic (Rubber-Metal Mounts, Insulators)

-

ITT Inc. (Noise & Vibration Control Solutions)

-

Bridgestone Corporation (Engine Mounts, Vibration Control Products)

-

Sumitomo Riko Company Limited (Vibration Isolators, Rubber Components)

-

Eaton Corporation (Hydraulic Dampers, Anti-Vibration Systems)

-

Barry Controls (Shock Mounts, Anti-Vibration Pads)

-

Fabreeka International (Vibration Isolation Pads, Shock Control)

-

Meggitt PLC (Aerospace & Marine Vibration Control)

-

Tech Products Corporation (Marine Mounts, Rubber Vibration Isolators)

-

VMC Group (Shock & Vibration Isolation Systems)

-

VibraSystems Inc. (Marine Vibration Mounts, Shock Absorbers)

-

Enidine Inc. (Hydraulic Vibration Isolators, Shock Absorbers)

-

Silentblok (Rubber Mounts, Anti-Vibration Bushes)

-

Advanced Antivibration Components (AAC) (Rubber & Metal Isolators)

-

Karman Rubber Company (Rubber Vibration Mounts, Shock Absorbers)

Suppliers for (advanced rubber and polymer-based anti-vibration mounts for marine applications) Shipbuilding Anti-Vibration Market

-

Christie & Grey

-

Dynamics Corporation

-

GERB

-

Trelleborg Antivibration Solutions

-

Polymax India

-

Horiaki India Private Limited

-

VibraSystems Inc.

-

Karman Rubber Company

-

AMC Mecanocaucho

-

LORD Corporation

Recent Development

In January 2025: ITT Inc.'s Enidine brand introduced the ULTRA-HERM isolator at the 2025 WEST Conference (Booth 1915) in San Diego. Engineered for superior shock and vibration attenuation in shipboard applications, this advanced isolator incorporates a specialized elastomer for enhanced durability in demanding defense environments. The ULTRA-HERM is designed to withstand extreme temperatures, significantly minimize fire, smoke, and toxicity risks, and deliver improved damping performance compared to conventional High Energy Rope Mounts (HERMs).

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.85 Billion |

| Market Size by 2032 | USD 2.90 Billion |

| CAGR | CAGR of 5.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Mounts, Bearing Pads, Bellows, Washers, Others) •By Function Type (Engine Vibration, HVAC Vibration, Generators & Pumps, Others) •By Material (Elastomer, Plastic, Others) •By Application (Tugs, Yachts, Fishing Boats, Motorboats, Sailboats, Cruise Ships, Container Ships, Oil Tankers, Bulk Carriers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Trelleborg, Parker LORD, Hutchinson Paulstra, GMT Rubber-Metal-Technic Ltd., Continental, Vibracoustic, ITT Inc., Bridgestone Corporation, Sumitomo Riko Company Limited, Eaton Corporation, Barry Controls, Fabreeka International, Meggitt PLC, Tech Products Corporation, VMC Group, VibraSystems Inc., Enidine Inc., Silentblok, Advanced Antivibration Components (AAC), Karman Rubber Company. |