Polyethylene Terephthalate (PET) Market Report Scope & Overview:

The Polyethylene Terephthalate (PET) Market size was USD 40.29 billion in 2023 and is expected to Reach USD 79.15 billion by 2032 and grow at a CAGR of 7.79% over the forecast period of 2024-2032.

The Polyethylene Terephthalate (PET) market has experienced significant growth, driven by its diverse applications and recyclable nature. One of the key trends is the increasing adoption of PET in the production of smart textiles, especially in electronics, fashion, and healthcare sectors. In 2024, innovations in smart textiles production have enhanced efficiency and scalability, making it a promising area for future growth. In India, efforts to integrate smart textiles into mainstream industries, including fashion and fitness, are gaining momentum despite challenges. PET’s popularity also stems from its widespread use in the automotive industry, where it is employed for its lightweight properties, and in textiles, where it is used in fiber form under the name "polyester." Its versatility as a material that can be molded into various shapes has made it an essential component in many applications, from bottles and packaging to fibers and fabrics.

Get E-PDF Sample Report on Polyethylene Terephthalate (PET) Market - Request Sample Report

The recycling of PET plays a crucial role in its continued demand. As the most widely recycled plastic, PET is often reused to create products like fiberfill or carpet fibers, with advanced techniques enabling it to be recycled into its original form. Innovations in PET recycling processes, such as breaking down the polymer into its chemical components for resynthesis, have contributed to the market’s growth, making it a sustainable option for many industries. Despite its numerous benefits, PET has some health concerns associated with its exposure to antimony, which can cause cancer, and phthalates, which are endocrine disruptors. This has prompted ongoing research to address these issues and improve the safety of PET-based products. However, its environmental sustainability and wide range of applications continue to fuel the growth of the PET market.

Polyethylene Terephthalate (PET) Market Dynamics

DRIVERS

- The growing emphasis on sustainability has significantly boosted the demand for Polyethylene Terephthalate (PET) in packaging.

As consumers and industries seek to reduce plastic waste, PET is increasingly favored for its recyclability and lighter environmental footprint compared to alternative materials. PET is widely used in the packaging of food, beverages, and consumer goods due to its durability, ease of use, and ability to be recycled multiple times. This trend is driving growth, especially as the global focus shifts toward a circular economy where materials are reused. Additionally, technological advancements are making PET more efficient and cost-effective to produce. Companies are innovating to improve PET’s recyclability and introduce more eco-friendly versions, further enhancing its market appeal. As sustainability regulations tighten and consumer demand for green products rises, the PET market is expected to grow steadily, with increasing adoption across industries such as beverage packaging, textiles, and automotive sectors.

RESTRAINT

- Environmental concerns over plastic waste, particularly Polyethylene Terephthalate (PET), have become a major global issue despite its recyclability.

PET, commonly used in packaging such as bottles, is widely recognized for its durability and ability to be recycled. However, a large portion of PET waste still ends up in landfills or oceans, contributing to long-term environmental damage. As PET is not biodegradable, its persistence in natural ecosystems leads to pollution, particularly affecting marine life. The slow recycling rate and inadequate waste management systems exacerbate the problem. This growing environmental concern has prompted governments and regulatory bodies to impose stricter regulations on plastic waste disposal and encourage more sustainable practices. Increased efforts are being made to improve recycling technologies, promote waste reduction, and enhance public awareness. These measures aim to mitigate the negative environmental impact and promote a more circular economy for PET and other plastics.

Polyethylene Terephthalate (PET) Market Segementation

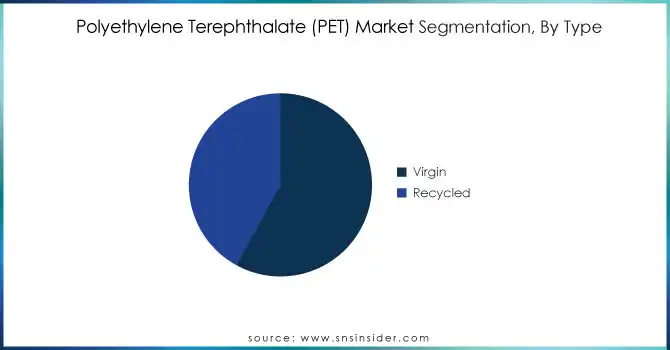

By Type

Virgin segment dominated with the market share over 58% in 2023, primarily due to its extensive application in packaging, particularly within the food and beverage industry. Renowned for its high purity, exceptional transparency, and durability, virgin PET is a preferred material for producing bottles, containers, and various other packaging solutions. Its superior properties, such as resistance to impact and ability to preserve the freshness of contents, make it ideal for single-use plastic products, which remain in high demand globally. Additionally, the cost-effectiveness and ease of manufacturing associated with virgin PET further bolster its dominance in the market. While environmental concerns around single-use plastics are rising, virgin PET continues to be widely utilized due to its reliability and established infrastructure for production and distribution.

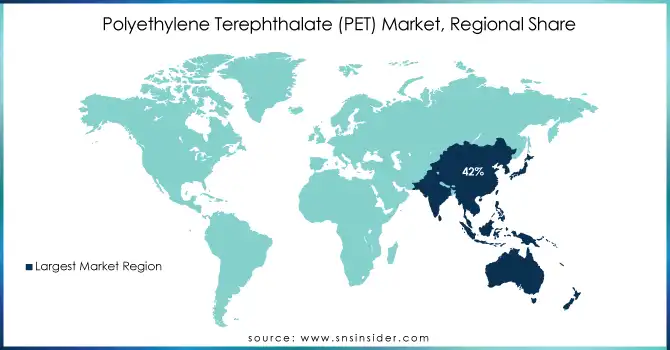

Polyethylene Terephthalate (PET) Market Regional Analysis

Asia-Pacific region dominated with the market share over 42% in 2023, owing to its substantial production and consumption, particularly in nations like China and India. This dominance stems from several key factors, including the rapid expansion of the food and beverage industry, which heavily relies on PET for packaging due to its lightweight, durability, and recyclability. Additionally, the region's robust manufacturing capabilities and access to raw materials facilitate large-scale production, making it a global hub for PET supply. The growing population, coupled with increasing urbanization, further fuels demand for PET-based packaging solutions for bottled beverages, packaged food, and consumer goods.

North America is the fastest-growing region in the Polyethylene Terephthalate (PET) Market, driven by the increasing emphasis on sustainable and recyclable packaging solutions. The region's growth is fueled by advancements in packaging technologies that enhance product durability and eco-friendliness. Rising consumer awareness about environmental issues has prompted a shift towards PET due to its recyclability and reduced environmental footprint. Additionally, the demand for PET in sectors like food and beverage, pharmaceuticals, and personal care is accelerating as companies adopt innovative, sustainable packaging strategies.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Some of the major key players of the Polyethylene Terephthalate (PET) Market

- Indorama Ventures Public Co Ltd (PET resins, fibers, and packaging)

- SABIC (PET resins, specialty chemicals)

- Far Eastern New Century Corporation (PET resin, textile fibers, and packaging)

- LyondellBasell Industries Holdings B.V. (PET resins and polymers)

- LOTTE Chemical CORPORATION (PET resins, polyester films)

- BASF SE (PET resins, performance materials, and chemicals)

- LANXESS (PET resins, engineering plastics)

- DuPont (PET resins, polyester fibers)

- NAN YA PLASTICS CORPORATION (PET resins, fibers, and films)

- Eastman Chemical Company (PET resins, copolyester, and specialty plastics)

- M&G Chemicals (PET resin and preforms)

- Reliance Industries Limited (PET resin, packaging materials)

- Kraton Polymers (PET resins and specialty polymers)

- Zhejiang Materials Industry Group Corp. (PET resins and packaging)

- Perstorp (PET production and specialty chemicals)

- Toray Industries, Inc. (PET resins and fibers)

- China National Petroleum Corporation (CNPC) (PET resins and raw materials)

- PETROCHINA (PET resins and raw materials)

- Alpek S.A.B. de C.V. (PET resins and polyester fibers)

- Shenzhen Yida Petrochemical Company (PET resins and polymer products)

Suppliers for (Producing high-performance PET resins, particularly for advanced applications in automotive, packaging, and industrial products) of Polyethylene Terephthalate (PET) Market

- Indorama Ventures Public Company Limited

- SABIC

- Alpek S.A.B. de C.V.

- Reliance Industries Limited

- Lotte Chemical

- M&G Chemicals

- Toray Industries, Inc.

- Eastman Chemical Company

- PetroChina Company Limited

- Ineos Group Limited

RECENT DEVELOPMENT

In April 22, 2024: Far Eastern New Century Corporation (FENC) has started construction on the expansion of its green PET production facility in Malacca, Malaysia, aiming to produce 50,000 metric tons annually by mid-2025. This move strengthens FENC's leadership in sustainable materials and supports the global push for eco-friendly packaging solutions.

In April 8, 2024: SABIC and Pashupati Group have partnered to enhance used plastics recycling in India, focusing on converting plastic waste into pyrolysis oil for SABIC’s certified circular polymers. This collaboration aims to reduce plastic pollution and lower demand for virgin plastics by recycling and upcycling waste into valuable products.

In 2023: Indorama Ventures Co Ltd partnered with Evertis, a leader in green PET barrier films, to develop PET film suitable for food packaging trays using flakes from recycled PET trays. This collaboration is a significant step toward reducing PET tray waste and incineration, supporting the EU's recycling goals, and promoting a circular economy for PET trays.

In 2023: SABIC launched the SABIC Material Finder website, offering customers a streamlined platform to search, compare, and manage the selection of specialty thermoplastic materials for various applications.

| Report Attributes | Details |

| Market Size in 2023 | USD 40.29 Billion |

| Market Size by 2032 | USD 79.15 Billion |

| CAGR | CAGR of 7.79% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Virgin, Recycled) • By Application (Sheets & Films, Packaging, Consumer Goods, Others) • By End-User (Food & Beverage, Automotive, Electrical & Electronics, Healthcare, Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Indorama Ventures Public Co Ltd, SABIC, Far Eastern New Century Corporation, LyondellBasell Industries Holdings B.V., LOTTE Chemical CORPORATION, BASF SE, LANXESS, DuPont, NAN YA PLASTICS CORPORATION, Eastman Chemical Company, M&G Chemicals, Reliance Industries Limited, Kraton Polymers, Zhejiang Materials Industry Group Corp., Perstorp, Toray Industries, Inc., China National Petroleum Corporation, PETROCHINA, Alpek S.A.B. de C.V., Shenzhen Yida Petrochemical Company, and Others |

| Key Drivers | • The growing emphasis on sustainability has significantly boosted the demand for Polyethylene Terephthalate (PET) in packaging. |

| Restraints | • Environmental concerns over plastic waste, particularly Polyethylene Terephthalate (PET), have become a major global issue despite its recyclability. |