Food Packaging Market Report Scope & Overview:

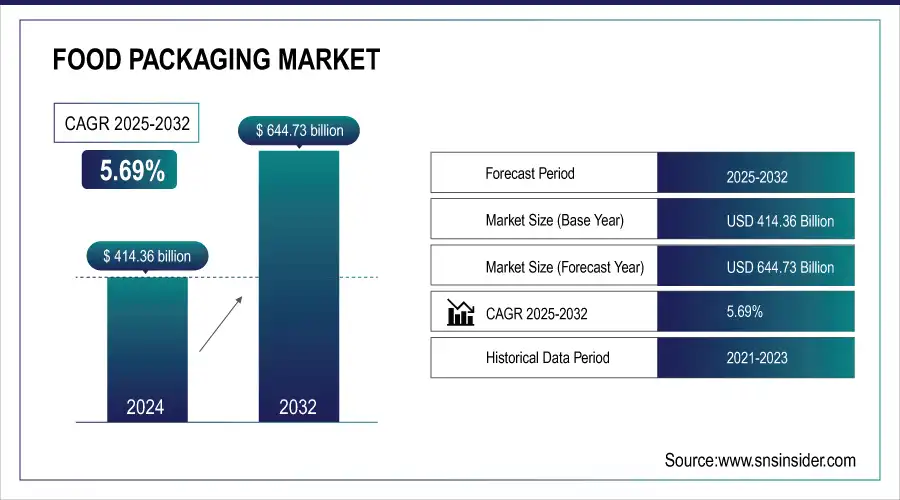

The Food Packaging Market size was valued at USD 414.36 billion in 2024 and is expected to reach USD 644.73 billion by 2032, growing at a CAGR of 5.69% over the forecast period of 2025-2032.

To Get more information On Food Packaging Market - Request Free Sample Report

The food packaging market is changing due to new moves related to sustainability and recent regulations. Some key developments include the introduction of a new lightweight MAP tray by Klöckner Pentaplast, which exhibits high-performance with material reduction, and IIT Roorkee has developed edible Kodo millet cups, presenting a move towards biodegradable solutions. Smart packaging technologies curb wastage by enhancing freshness monitoring and spoil-proofing in the food packaging market, with an upsurge in circularity and innovation being observed across this landscape.

Material preferences are being dictated by governmental impacts as the FDA bans PFAS grease-proofing agents in U.S. food-contact packaging. Sustainable practices are being promoted through consumer education and recycling initiatives, and a strong example is the collaborations by Tetra Pak. The selection and deployment of packaging materials are being driven by several factors, including sustainability, safety, and supply chain performance.

Food Packaging Market Dynamics:

Drivers:

-

Growing adoption of biodegradable coatings to replace traditional plastic-based food packaging layers

Biodegradable Coatings have emerged as a key material used in the food packaging market for imparting barrier properties without the use of petroleum-based plastics. Plant-based coatings, such as those from polylactic acid and chitosan, boost shelf life while also cutting down on environmental harm. The U.S. Department of Agriculture identified bio-based packaging technologies as an area for expanded investment in 2024 based on the call made by NASA to meet its sustainability goals. This presents a model in line with current global regulatory direction towards lower single-use plastics usage and is being followed by the growth of both flexible food packaging and rigid food packaging across various regions.

-

Integration of printed electronics in smart packaging solutions for real-time freshness tracking

Smart packaging solutions, such as modules for the real-time tracking of temperature, humidity, and spoilage indicators, are being implemented by manufacturers in printed electronics. Products included in this class are perishable items required by the Food and Drug Administration to have smart labels to meet food safety using its requirements imposed in 2024. The technology is most popular with high-value products such as seafood and premium dairy. Such advancements increase consumer confidence and also cater to predictive logistics, which is crucial, especially in the global food packaging market.

Restraints:

-

Supply chain instability in specialty raw materials for sustainable food packaging

Moving toward more sustainable food packaging can often involve using specialty bio-based polymers and coatings, both of which have volatile supply chains. Imports of certain plant resin sites from climate-driven agricultural bean factories fell by only 9% between 2022 and 2024, according to USDA trade data. These shortages drive costs as well as production timings, in particular for new packaging offerings such as compostable trays and pouches. This barrier to widespread adoption could be a drag, particularly in geographies where the sustainable packaging material supply chain is heavily import-dependent.

Food Packaging Market Segmentation Analysis:

By Packaging Type

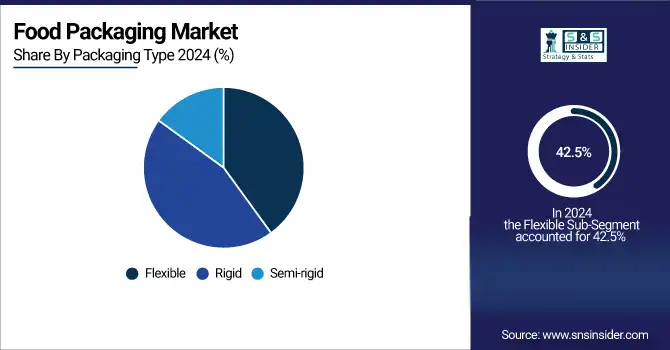

Flexible packaging held a dominant food packaging market share of 42.5% in 2024, owing to its lightweight design, minimum material use, and long shelf life for perishable products. Their bag, wrap, and vertically formed (pouch) packaging are particularly well-suited to a variety of bakery, snack, and ready-to-eat meal products. Flexible formats promote a cost-effective transportation and storage solution that is also in line with sustainability goals. Further, the continuous innovations in barrier films and printing technologies propel its dominance as the most used packaging type in the food sector across the globe.

Rigid packaging is the fastest growing with the highest CAGR of 5.9% during the forecast period from 2025 to 2032, due to increasing need for robust & unbreakable containers across dairy, beverages, and processed food categories. This trend is further supported by an increased uptake in e-commerce food delivery, as well as consumer preference for rigid formats that are both reusable and recyclable. In addition, the environmental issues are resolved with the introduction of lightweight rigid plastics and molded fiber alternatives, providing a more sustainable alternative for manufacturers who can now meet their top priorities in product protection and sustainability.

By Material

Plastic held a dominant food packaging market share of 37.8% in 2024 due to light weight, easy availability, and low price, making it suitable for most food packaging applications. It is one of the best for moisture, oxygen, and other contaminants barrier protection- making it a highly sought-after packaging material today. Additionally, the material is compatible with a wide range of packaging formats, including bottles, trays, and flexible films, which drives its adoption. Continuing advances in recyclable and bio-based plastics reinforce their presence, matching global sustainability requirements without compromising on either performance or cost.

Biopolymers are the fastest-growing with the highest CAGR of 7.2% during the forecast period from 2025 to 2032, due to rising demand for eco-friendly and biodegradable packaging solutions. Increased environmental consciousness among consumers, combined with stronger government mandates against single-use plastics, drives its acceptance. The materials are being utilized in fresh produce, ready meals, and bakery packaging, driven by improvements in material strength along with barrier performance. Additionally, increasing investments in biopolymer production facilities will escalate the demand for sustainable food packaging and drive the growth of the market.

By Packaging Format

Bottles held a dominant food packaging market share of 30.1% in 2024, primarily driven by PET bottles used in beverages and dairy products. According to the International Bottled Water Association (2024), growth in bottled water and juice consumption will drive demand for lightweight and recyclable packaging. Compared to these formats, bottles generally offer convenience and resealability as well as superior barrier protection. Also, popular culture among food consumers in North America and Europe will continue to remain high on packaging convenience in areas such as PET recycling programs that are supported by governments of these countries, or energy-efficient/lightweight bottle designs.

Pouches are the fastest-growing with the highest CAGR of 6.17% during the forecast period from 2025 to 2032, because of their versatility, ease of use, especially on the go, and cost-effectiveness. For example, packaging such as spouted pouches has been deployed globally and used to lower material use and distribution costs for products like baby food and sauces. The USDA (2024) says that because pouched foods have a longer shelf life and don't break, almost all exports increased. Rapid growth in e-commerce grocery and on-the-go consumers fuels demand for this segment.

By Application

Bakery and confectionery held a dominant food packaging market share of 31.4% in 2024 as a result of high consumption of packed bread, cakes, chocolates, and snacks. This segment relies heavily on technology and packaging innovations that maintain freshness, improve presentation as well, and support portion control. The rising need for portable and luxury confectionery items also increases the growth of this market. With better designs, thinner materials, and enhanced barrier properties, bakery and confectionery packaging has emerged as an important sales driver in developed as well as emerging markets.

Ready-to-eat meals are the fastest-growing segment with the highest CAGR of 7.8% during the forecast period from 2025 to 2032, on account of changing consumer lifestyles, urbanization, and rising demand for convenience. Especially, there is a greater call for packaging solutions offering product protection, convenience of use, and respecting the microwave oven use. Variety in portion-controlled and resealable packs further drives gains for the segment. A growing workforce and increased penetration of fast-food chains and delivery services across many parts of the world, on the other hand, are boosting the deployment, which makes it a key growth enabler in this market.

By End-user

Chain restaurants held a dominant food packaging market share of 38.5% in 2024, largely due to the widespread appeal of branded carryout and delivery containers. Off-premise dining now comprises more than 65% of restaurant sales (National Restaurant Association, 2024), magnifying the necessity for long-lasting and FDA-compliant packaging. New advances, including recyclable and biodegradable grease-resistant fiber containers, help further sustainability initiatives while adhering to essential food safety standards. High-quality packaging solutions that can be easily customized are in continuous demand throughout the developed markets of the world, due to chain restaurants and their large scale and a persistently customer-focused approach.

Furthermore, quick service restaurants are expected to grow at the highest CAGR of 6.05% during the forecast period ending 2032, owing to higher demand due to the rise in demand for food delivery and ‘on-the-go’ consumption trends. According to the U.S. Environmental Protection Agency (2024), the use of compostable clamshells and eco-friendly service ware is an upward trend. Partnerships between quick service brands and sustainable packaging suppliers accelerate market penetration. These are all driving growth in this rapidly changing segment of the market as consumer preference changes, towards a more convenient, safe, and environmentally friendly pack.

Food Packaging Market Regional Outlook:

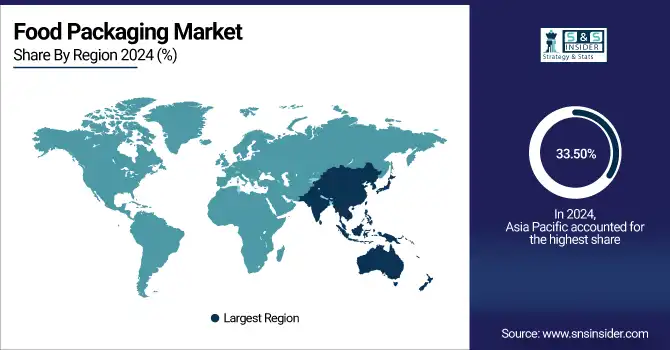

Asia Pacific dominates the food packaging market with a significant market share of 33.50% and is the fastest-growing region with the highest CAGR of 6.00% during the forecast period. This is due to increasing urban population, disposable incomes, and demand for ready-to-eat food packaging in countries Asia-Pacific region such as China and India. Sustainable packaging materials are being encouraged by governments to reduce the environmental footprint, and advances in vacuum food packaging technologies lengthen product shelf life. Growing industrialization and modern retail boost the demand for flexible food packaging.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America is the second-dominating region in the food packaging market, holding a significant market share of 29.00%, due to increasing consumer demand for convenient and sustainable pack formats. Furthermore, stringent FDA regulations and recycling innovation in plastic food packaging are increasing the adoption of rigid food packaging in beverages and dairy. The U.S. leads this market, holding a market share of around 83% with a market size of USD 99.74 billion in 2024 and is projected to reach a value of USD 153.74 billion by 2032, on account of various measures promoting packaging recycling and reduction in plastic waste. Canada exhibits rapid growth as the government is focused on massive landfill reduction and the adoption of eco-friendly materials to contribute to a stable environment.

Europe ranks third in both market value, with a significant 25.00% share of the market, primarily driven by stringent regulations promoting sustainable food packaging and circular economy initiatives. Germany and France have banned plastic, while also setting the highest recycling targets, maintaining growth in food packaging films with compostability and improved barrier properties. Rapidly expanding retail sectors and supportive regulatory policies, including additional emphasis of the European Union on extended producer responsibility (EPR) alongside deployment of advanced, sustainable smart packaging solutions, are fuelling market growth via innovation in traceability as well as freshness monitoring technologies.

Key Players in the Food Packaging Market:

The major food packaging market competitors include Amcor plc, Tetra Pak International S.A., Berry Global Inc., Mondi Group, Smurfit Kappa Group, WestRock Company, International Paper Company, DS Smith Plc, Crown Holdings, Inc., Sonoco Products Company, Huhtamaki Oyj, Graphic Packaging International, LLC, Sealed Air Corporation, Stora Enso Oyj, Constantia Flexibles Group GmbH, Packaging Corporation of America, Ball Corporation, ProAmpac LLC, Plastipak Packaging Inc., and Coveris Group.

Recent Developments:

-

In April 2025, Amcor and Berry completed their combination, creating a leading packaging company focused on sustainable solutions and broadening product offerings across multiple sectors.

-

In February 2025, Berry Global and Mars introduced packaging solutions using 100% recycled content, targeting significant reductions in virgin plastic use for consumer food products.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 414.36 billion |

| Market Size by 2032 | USD 644.73 billion |

| CAGR | CAGR of 5.69% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Packaging Type (Flexible, Rigid, and Semi-rigid), •By Material (Plastics, Paper & Paper-Based Materials, Glass, Metal, and Others), •By Packaging Format (Cups, Bottles, Cans, Pouches, Trays, and Others), Application (Bakery & Confectionery, Dairy Products, Fruits & Vegetables, Meat & Seafood, Sauces & Dressings, and Others), •By End User (Quick Service Restaurants, Café & Kiosks, Full-Service Restaurants, Chain Restaurants, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Amcor plc, Tetra Pak International S.A., Berry Global Inc., Mondi Group, Smurfit Kappa Group, WestRock Company, International Paper Company, DS Smith Plc, Crown Holdings, Inc., Sonoco Products Company, Huhtamaki Oyj, Graphic Packaging International, LLC, Sealed Air Corporation, Stora Enso Oyj, Constantia Flexibles Group GmbH, Packaging Corporation of America, Ball Corporation, ProAmpac LLC, Plastipak Packaging Inc., and Coveris Group |