Paper Dyes Market Report Size:

Get E-PDF Sample Report on Paper Dyes Market - Request Sample Report

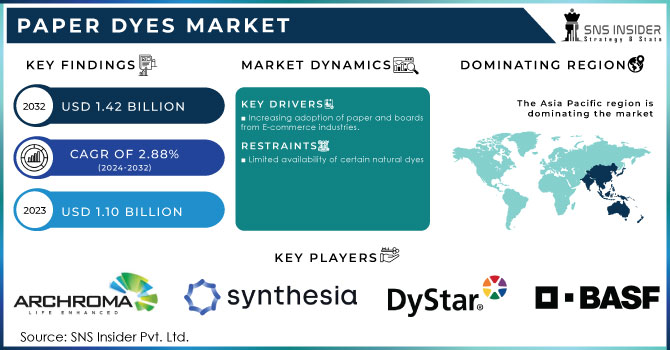

The Paper Dyes Market Size was valued at USD 1.10 billion in 2023 and is expected to reach USD 1.42 billion by 2032 and grow at a CAGR of 2.88% over the forecast period 2024-2032.

The paper dyes market is driven by the increasing demand for aesthetically pleasing paper products across various industries. The rising consumer preference for visually appealing and eco-friendly paper products has fueled the demand for high-quality dyes. Additionally, the increasing adoption of digital printing technologies has created a need for dyes that can withstand the printing process without losing their vibrancy. Moreover, the expanding packaging industry, driven by e-commerce and retail sectors, has further propelled the demand for paper dyes. However, the availability of counterfeit and low-quality dyes in the market poses a threat to the growth of the industry.

The growing use of such printed materials as specialty papers, both coated, and uncoated, textured, and decorative, is one of the crucial drivers behind a rising demand for high-quality and varied paper dyes. The reason for this phenomenon is the growing use of such papers in high-end packaging, printing, and artistic projects. For example, in 2023, the packaging industry witnessed a major shift towards premium packaging solutions, and specialty papers are one of the crucial materials. According to the U.S. Census Bureau, in 2022, the production of coated and textured papers in the United States has grown by approx. 7.5% in comparison to the previous year, which demonstrates a growing use of these materials for luxury packaging and marketing purposes.

Moreover, the EU’s regulation of sustainable packaging has contributed to the expanding use of specialty papers that require eco-friendly and high-performance dyes. In 2023, many leading manufacturers of paper dyes have introduced new product lines specifically designed for the use of specialty papers, such as Archroma and BASF, which ensure better vibrancy, color resistance, and environmental safety of their products.

Moreover, the most important driver for the use of various paper dyes is the significant increase in demand for aesthetically pleasing and brand-specific packaging in the food and beverages sector. Both the growing number of products on store shelves and the popularity of ordering items online have made the visual appeal of packaging crucial for companies. Even examples of personalized or customized packaging, which in some cases are intended to convey a specific idea, rely on distinctive color schemes to reinforce the desired impression.

Therefore, a driver for the use of paper dye in PPC is the need for vibrant and long-lasting colors. Modern paper dyes do not fade over time and allow food products decorated with them to stand out. Moreover, as more purchases are made online, brands prefer packaging that is visually stunning, consistent, and able to attract the eye of the online shopper. Thus, the food and packaging industry relies on dye solutions that offer exceptional color intensity, consistency, and durability, providing support for their use in the creation of memorable brand packaging.

For instance, in 2023, BASF launched a new range of eco-friendly paper dyes designed specifically for the packaging industry. These dyes offer enhanced color vibrancy and are formulated to meet stringent environmental regulations, aligning with the growing demand for sustainable packaging solutions.

These developments underscore the active role key players are taking to meet the evolving demands of the packaging industry, particularly in providing dyes that enhance aesthetic appeal, sustainability, and performance in packaging applications.

Market Dynamics

Drivers

- Increasing adoption of paper and boards from E-commerce industries.

Paper dyes are experiencing a surge in demand, primarily driven by the e-commerce industry's need for paper packaging and boards. The retail sector's growing reliance on cardboard, coupled with the implementation of plastic bans in various countries, serves as the key catalysts propelling the global market's growth. In response to the restrictions on plastic usage, food delivery giants like Swiggy, Zomato, and others are actively exploring green packaging alternatives, with a particular focus on paper. This significant shift towards sustainable packaging solutions is a major driving force behind the flourishing paper dyes market.

In 2022, Amazon expanded its Frustration-Free Packaging program, which emphasizes the use of recyclable and biodegradable materials, including paper and boards. This shift has led to a higher demand for paper products that require specialized dyes to ensure vibrant colors and branding elements are maintained throughout the packaging's lifecycle.

Restrain

- Limited availability of certain natural dyes

The paper dyes market faces a challenge due to the restricted accessibility of specific natural dyes. These dyes, derived from natural sources such as plants, minerals, and insects, offer unique and vibrant colors that are highly sought after in various industries, including paper production. However, the limited supply of these natural dyes hinders their widespread use and availability in the market. One reason for the scarcity of certain natural dyes is the geographical limitations of their sources. Some plants or insects that produce these dyes may only thrive in specific regions or climates, making it difficult to obtain a consistent and reliable supply. Additionally, the extraction process for these dyes can be complex and time-consuming, further contributing to their limited availability.

Market segmentation

By Type

The direct dye type held the largest market share around 38.23% in 2023. Direct dyes are popular for their ease of application and ability to produce bright, vibrant colors with minimal processing. This type of dye is known for its strong affinity to paper fibers, resulting in excellent color uptake and stability. Additionally, direct dyes are cost-effective and offer a wide range of hues, making them suitable for various paper products, including packaging, printing, and specialty papers. The significant market share of direct dyes is also supported by their ability to deliver consistent and high-quality results across different paper grades, which is crucial for meeting the diverse needs of manufacturers and consumers.

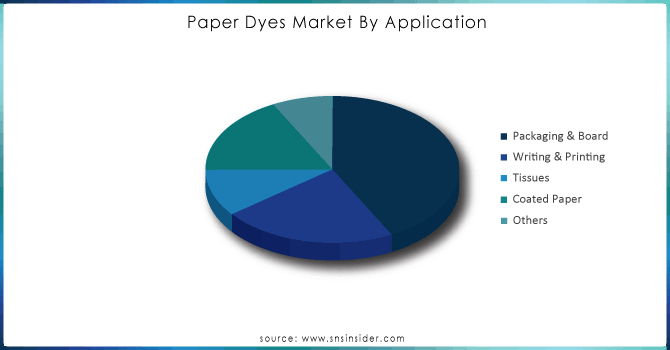

By Application

The packaging and board segment held the largest market share around 42.23% in 2023. Paper-based packaging offers a cost-effective solution for transporting and preserving various items. This type of packaging is designed to be both durable and lightweight, while also being customizable to meet the specific needs of products or customers. It encompasses a range of options, such as corrugated cardboard, paperboard packages, paper bags, and paper shipping sacks. With the growing concerns surrounding single-use plastic, paper packaging has become increasingly popular due to its wide variety of colors and designs. As a result, paper dyes are extensively utilized in the production of these packaging materials.

Need any customization research on Paper Dyes Market - Enquiry Now

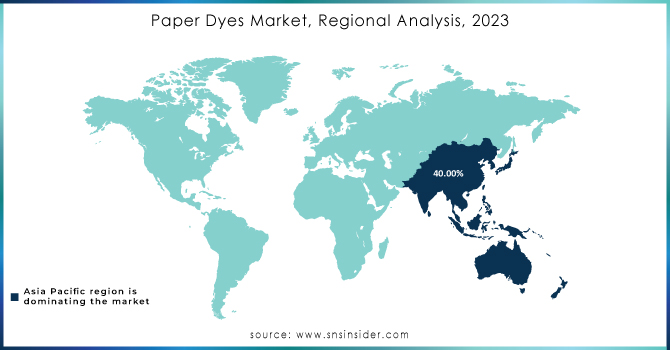

Regional Analysis

Asia Pacific dominated the paper dyes market with a revenue share of more than 40% in 2023. This region has faced significant criticism from the environmental community due to its extensive use of single-use plastics. The alarming amount of plastic waste dumped into the Pacific Ocean has resulted in a massive patch, larger than the area of France, floating in the East Pacific Ocean. This plastic pollution has had severe consequences, not only for marine life but also for countries like India, Bangladesh, and Sri Lanka, where the accumulation of plastic waste in drainages has led to hygiene issues and the breeding of disease-carrying mosquitoes. To combat these challenges, governments in the Asia Pacific region have implemented stringent policies to either ban or restrict the use of plastics, leading to a growing preference for paper packaging. Moreover, Asia Pacific leads the world in both paper production and consumption, accounting for a staggering 45.5% of global production. Additionally, this region holds the largest market share in the flexible packaging industry, occupying 41% of the market. As a result of these government measures and the increasing demand from various industries, the Asia Pacific region dominated the paper dyes market.

Europe is the second largest region for the paper dyes market and is expected to grow with a CAGR of about 3.7% during the forecast period. This growth is attributed to various factors, such as the increasing demand for colored paper products across industries like packaging, printing, and stationery. 26% of paper production is done in the European region. The European market's growth can also be attributed to the rising awareness among consumers regarding the environmental impact of paper production. As a result, there is a growing preference for eco-friendly and sustainable paper dyes, which comply with stringent regulations and standards. This shift towards environmentally conscious practices has led to the adoption of innovative and eco-friendly dyeing techniques in the paper manufacturing process.

Key Players

The major key players are BASF, dystar, Synthesia, KEMIRA OYJ, Archroma, Keystone Aniline, Atul Ltd, Vipul Organics, Standard Colors, Axyntis Group, and other key players are mentioned in the final report.

Recent Development:

-

In August 2023, BASF plans to relocate paper dye production from Grenzach, Germany to Ankleshwar, India, resulting in a reduction of the paper dye product range.

-

In August 2023, Vipul Organics, a specialty chemicals maker, entered the paper segment with a range of products including colorants, dispersions, and dyes. Two categories of products have already been launched in this segment. One range of pigment dispersions is specifically developed for paper applications, while the other consists of direct dyes for paper coating applications.

-

In September 2022, Kemira signed an agreement to sell its colorant dye business to ChromaScape, LLC, a US-based company. This agreement also includes the sale of one Kemira manufacturing site located at Goose Creek, Bushy Park in South Carolina. Kemira will retain its APAC-related colorants business.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.10 Billion |

| Market Size by 2032 | US$ 1.42 Billion |

| CAGR | CAGR of 2.88% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Sulphur Dyes, Acid Dyes, Basic Dyes, and Direct Dyes) • By Form (Liquid Form and Powder Form) • By Application (Packaging & Board, Writing & Printing, Tissues, Coated Paper, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF, dystar, Synthesia, KEMIRA OYJ, Archroma, Keystone Aniline, Atul Ltd, Vipul Organics, Standard Colors, Axyntis Group |

| Key Drivers | • Increasing adoption of paper products in various industries. • Increasing adoption of paper and boards from E-commerce industries |

| Market Restraints | • Lack of awareness among consumers about the benefits of using paper products with natural dyes • Limited availability of certain natural dyes |