Sulfur Bentonite Market Report Scope & Overview:

Get E-PDF Sample Report on Sulfur Bentonite Market - Request Sample Report

The Sulfur Bentonite Market size was valued at USD 144.8 million in 2023. It is anticipated to reach USD 224.4 million by the year 2032 with a projected CAGR of 5.0% during the forecast period of 2024-2032.

The Sulfur bentonite market is growing in response to the increasing demand for sulfur-enriched fertilizers in agriculture. Sulfur Bentonite is a highly critical element that has formed an inseparable part of enhanced crop yield and more fertile soils in the agricultural sector of plant growth. Another key trend causing the development of the Sulfur bentonite market is the growing awareness of the deficiencies of sulfur in the soils, which is now gaining ground, as continually depleted levels of these important nutrients are due to modern farming practices. This has made farmers increasingly interested in Sulfur Bentonite, understanding its benefits in improving crop quality and productivity. Additionally, the increasing global population is demanding more from agricultural yields to uphold food security.

Sulfur bentonite fulfills this demand by enhancing plant growth and health, leading to increased food production. For instance, in a country like India and China, where Sulfur deficiency in the soil is a common feature, Sulfur bentonite has been hugely useful in increasing the yield and quality of crops, hence a visible benefit to the farmer and a booster for the regional food supply chains. Another major driver in the Sulfur Bentonite market could be trending toward sustainable agricultural practices. Slow release is an attribute of Sulfur Bentonite that becomes innately in line with these objectives—environmentally benign processes and soil health improvement. It gradually releases sulfur into the soil, reducing the probability of nutrient loss and ensuring its efficient utilization by plants for better crop performance. It also reduces the frequency of fertilizer applications thereby mitigating costs and environmental footprints.

Government policies and initiatives also support the Sulfur Bentonite market. Most countries subsidize and incentivize sulfur-based fertilizers to improve the agricultural yield. For instance, in the United States and most European countries, government initiatives on micronutrient fertilizers, such as Sulfur Bentonite, which improves crop health and enhances yield, have been forwarded. Similarly, in February 2024, the government-initiated actions to limit urea use, including the PM-PRANAM scheme to reduce chemical fertilizers. It promoted Sulfur-coated urea (SCU) to improve nitrogen uptake and provide Sulfur, increasing efficiency by 10-15%. Sulfur was crucial for oil seeds and pulses, covering 30.92 and 26.34 million hectares in 2020-21, with fertilizers like single super phosphate and Bentonite Sulfur meeting India's needs. Coupled with this supportive regulatory backdrop and advances in technologies related to production, such as improved granulation methods for better nutrient availability and application efficiency, the circumstances remain quite supportive of the Sulfur Bentonite market outlook.

Key Drivers:

-

Growing population and increasing need for higher agricultural productivity

-

Increasing adoption of sulfur-based fertilizers in the agriculture industry

A major driver of the Sulfur bentonite market is the ever-increasing adoption of fertilizer products containing sulfur in the agriculture industry. Increasingly, farmers try to use Sulfur Bentonite due to its potential for correcting the deficiency of sulfur content in the soil, adjudged to be a prime requisite for optimum crop growth. Sulfur helps in synthesizing amino acids and proteins in plants and hence improves overall yield and quality of crops. This has fostered increased awareness by farmers about value created by sulfur-based fertilizers in improving nutrient uptake efficiency and driving sustainable farming practices. In response, that improves demand for Sulfur Bentonite, entailing sustained agriculture performance across several regions of the world.

Restraints:

-

Limited availability of raw materials

-

Strict regulations by various governments on the use of sulfur-based fertilizers

Opportunities:

-

Fast Growing agricultural sector

-

Positive Attributes of Sulfur Bentonite to Fuel Demand

Challenges:

-

Threats to Environmental and Human Health associated with the use of Sulfur Bentonite.

Key Market Segments

By Type

-

Sulfur-85%

-

Sulfur-90%

-

Others

The Sulfur-90% segment contributed to the largest share of around 60% in the Sulfur Bentonite market in 2023. This range of Sulfur Bentonite has higher contents of Sulfur, particularly 90% Sulfur content preferred by Agricultural industries since it is an effective way to rectify Sulfur deficiencies in the soils, which are very essential for crop growth and yield. The Bentonite Sulfur-90% formulations have been specifically proven for their effectiveness in improving the plants' nutrient uptake and hence enhancing agricultural productivity. This is because WDG Sulfur, with the formulation, enjoys high acceptance in most parts of the globe due to proof of its efficiency in enhancing the yield and quality of crops.

By Application

-

Fruits and Vegetables

-

Cereals and Crops

-

Oilseeds

-

Others

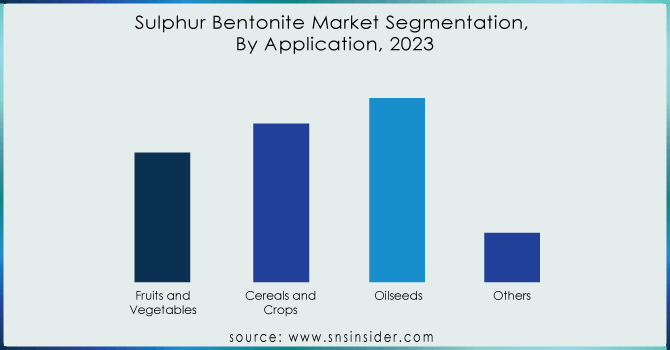

The Sulfur bentonite market was dominated by the oilseeds segment, which contributed a revenue share of about 38% in 2023. Sunflower, groundnut, sesame, safflower, mustard, and rapeseed, among others, are the major oilseed crops worldwide, and Sulfur bentonite provides them with additional oil content. The quality and yield of pulses is also enhanced by this product; hence, it is abetted by its important advantages accruing to the oilseeds sector. The segment of cereals and crops is likely to grow at a decent CAGR of approximately 5% during this period, which goes without saying as maize, wheat, and grains see their output increasing for global food and feed needs.

Get Customised Report as per Your Business Requirement - Enquiry Now

Regional Insights

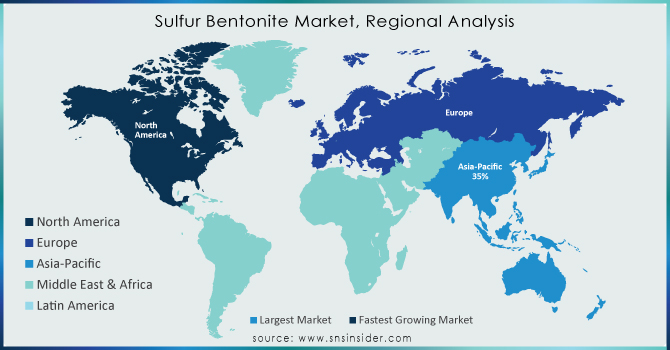

Asia Pacific dominated the Sulfur bentonite market with the largest share in 2023 with a revenue share of about 35%. Countries like China, India, and other Southeast Asian countries have vast cultivation areas for growing a range of crops. The agricultural environment in countries in Asia Pacific ranges from staples like rice and wheat to high-value fruits and vegetables. Sulfur Bentonite finds great acceptance in these agricultural practices to make the land more fertile and raise the yield of crops by compensating for the lack of sulfur. Further to this, government initiatives that emphasize sustainable farming extend the market where the use of sulfur fertilizers enhances the agriculture productivity of the country. A rapidly growing population that has an increasing demand for food means that, in turn, Asia Pacific remains central in fostering the demand for Sulfur Bentonite both to serve the country's food production and to contribute to the global food supply.

Regional Coverage:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major key players are Tiger Sul, Deepak Fertilizers, H Sulphur Corp, Devco Australia, Coogee Chemicals, National Fertilizer Limited, NTCS Group, Galaxy Sulfur, Chung Kwang, Coromandel International, and other key players mentioned in the final report.

Recent Development:

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 144.8 Million |

| Market Size by 2032 | US$ 224.4 Million |

| CAGR | CAGR of 5.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Sulfur-85%, Sulfur-90%, Others) •By Application (Fruits and Vegetables, Cereals and Crops, Oilseeds, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tiger Sul, Deepak Fertilizers, H Sulphur Corp, Devco Australia, Coogee Chemicals, National Fertilizer Limited, NTCS Group, Galaxy Sulfur, Chung Kwang, Coromandel International |

| Key Drivers | Growing population and increasing need for higher agricultural productivity Increasing adoption of sulfur-based fertilizers in the agriculture industry |

| Restraints | Limited availability of raw materials Strict regulations by various governments on the use of sulfur-based fertilizers |