Food Waste Management Market Report Scope & Overview:

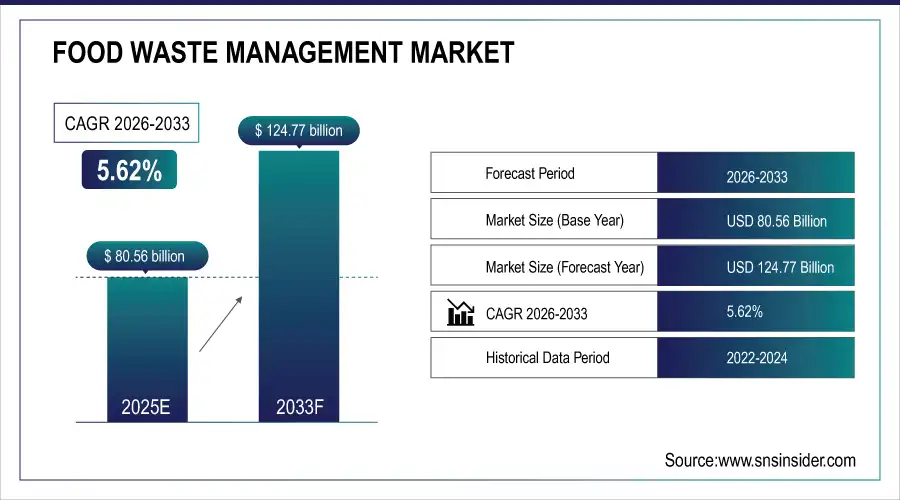

The Food Waste Management Market Size was valued at USD 80.56 billion in 2025E and is expected to reach USD 124.77 billion by 2033, growing at a CAGR of 5.62% over the forecast period of 2026-2033.

To Get more information Food Waste Management Market - Request Free Sample Report

The Food Waste Management Market is growing due to rising global awareness about sustainability, food security, and environmental concerns associated with improper waste disposal. Increasing food loss across supply chains from production to consumption has pushed governments, NGOs, and private companies to implement stricter regulations and sustainable waste handling practices. Rapid urbanization, population growth, and higher food consumption patterns are further intensifying the volume of waste generated, thereby creating strong demand for efficient collection, recycling, composting, and energy recovery solutions.

In January 2024, the U.S. Department of Agriculture invested USD 11.5 million via 38 cooperative agreements across 23 states to support composting and food waste diversion programs, particularly diverting food waste from landfills.

Market Size and Forecast:

-

Food Waste Management Market Size in 2025E: USD 80.56 Billion

-

Food Waste Management Market Size by 2033: USD 124.77 Billion

-

CAGR: 5.62% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

U.S. Food Waste Management Market Insights

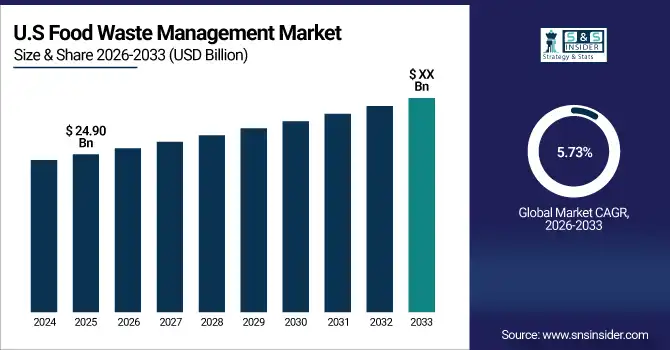

The U.S. Food Waste Management Market was valued at USD 24.90 billion in 2025E and is projected to grow at a CAGR of 5.73% through 2033. Growth is driven by investments in advanced waste collection, composting facilities, and innovative recycling technologies. Expansion of retail, e-commerce, and foodservice partnerships further strengthens adoption, while government support for sustainability programs and small-scale waste management initiatives enhances market penetration.

Key Food Waste Management Market Trends

-

Rising adoption of circular economy models converting food waste into energy, compost, and animal feed, reducing landfill dependency.

-

Growth of government mandates and zero-waste policies enforcing food waste reduction targets and mandatory recycling programs.

-

Increasing use of AI, IoT, and blockchain technologies for real-time food waste tracking, supply chain optimization, and predictive analytics.

-

Expansion of composting and anaerobic digestion facilities supported by public and private investments in renewable energy and organic fertilizers.

-

Rising initiatives in food donation and recovery programs through collaborations between NGOs, governments, and businesses to redirect edible surplus.

-

Integration of smart inventory management and redistribution solutions by e-commerce platforms and retailers to minimize waste.

Food Waste Management Market Growth Driver

• Rising Demand for Efficient Food Waste Solutions and Sustainable Practices

Consumers are increasingly adopting food waste management solutions to minimize losses, reduce environmental impact, and comply with sustainability goals. Large food retailers, restaurants, and food processing companies are investing in technologies such as anaerobic digestion, composting, and smart inventory tracking to streamline waste management. Governments in Europe and North America are providing subsidies and tax incentives for adopting sustainable waste management systems, further fueling growth.

For instance, in 2024, Veolia invested USD 15 million to expand its anaerobic digestion and organic waste processing facilities in Germany to serve growing demand for commercial and municipal food waste solutions.

Food Waste Management Market Restraint

• High Infrastructure Costs and Regulatory Complexity

Implementing advanced food waste management systems involves high upfront capital expenditure on specialized equipment, technology integration, and trained workforce. Regulatory compliance, including permits for composting, waste-to-energy facilities, and biohazard handling, adds additional complexity and costs. These factors can limit the adoption of food waste management solutions, especially for small- and medium-sized enterprises.

For example, in 2023, a major U.S. grocery chain faced delays in expanding its organic waste-to-energy plant due to local zoning and environmental approval requirements, highlighting regulatory challenges in scaling operations.

Food Waste Management Market Opportunity

• Strategic Investments, Partnerships, and Technological Innovation

Food waste management companies are leveraging investments, partnerships, and digital solutions to expand globally and improve efficiency. Innovations such as AI-driven predictive waste analytics, IoT-enabled tracking, and blockchain for supply chain transparency are creating new opportunities. Companies are entering emerging markets with growing urbanization and hospitality sectors, where food waste is significant. For instance, in 2025, Spoiler Alert launched a digital B2B platform in Southeast Asia to connect food producers, retailers, and NGOs, facilitating the redistribution of surplus food and reducing waste, supported by government incentives for sustainable business practices.

Food Waste Management Market Segment Highlights:

-

By Waste Type: Fruits & Vegetables – 37% share (largest); Dairy & Dairy Products fastest-growing at 5.9% CAGR, driven by perishable nature and increasing adoption of dairy-specific waste management solutions.

-

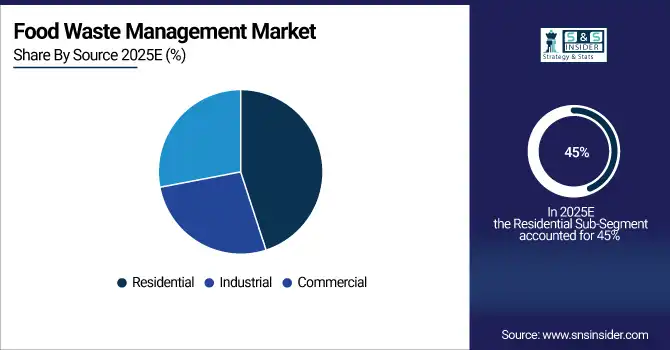

By Source: Residential – 45% share (largest); Industrial fastest-growing at 5.8% CAGR, supported by rising investments in food processing and manufacturing facilities integrating waste management systems.

-

By Service Type: Collection – 40% share (largest); Disposal/Recycling (Composting) fastest-growing at 5.5% CAGR, fueled by government incentives, sustainability mandates, and adoption of eco-friendly waste treatment technologies.

Food Waste Management Market Segment Analysis:

By Waste Type

Fruits & Vegetables continue to dominate the market with a 37% share in 2025, driven by their high perishability, widespread household and commercial usage, and the need for timely disposal solutions. Dairy & Dairy Products are the fastest-growing sub-segment, expected to register a CAGR of 5.9%, fueled by the increasing adoption of specialized dairy waste management solutions in both industrial and residential sectors. Growth is further supported by investments in cold chain logistics and recycling technologies specific to dairy waste.

By Source

Residential sources lead the market with a 45% share in 2025, owing to household food consumption patterns and the increasing awareness of food waste reduction practices. Industrial sources are the fastest-growing segment, projected at a CAGR of 5.8%, supported by rising investments in food processing and manufacturing facilities that integrate waste management systems. Implementation of automated sorting, recycling, and composting processes in industrial setups is driving this growth.

By Service Type

Collection services dominate with a 40% market share in 2025, benefiting from organized logistics networks, urban collection schemes, and partnerships with municipal authorities. Disposal/Recycling (Composting) is the fastest-growing sub-segment, growing at a CAGR of 5.5%, fueled by government incentives, sustainability mandates, and the adoption of eco-friendly waste treatment technologies. Investments in modern composting facilities and community-based recycling programs have accelerated adoption.

Food Waste Management Market Regional Analysis

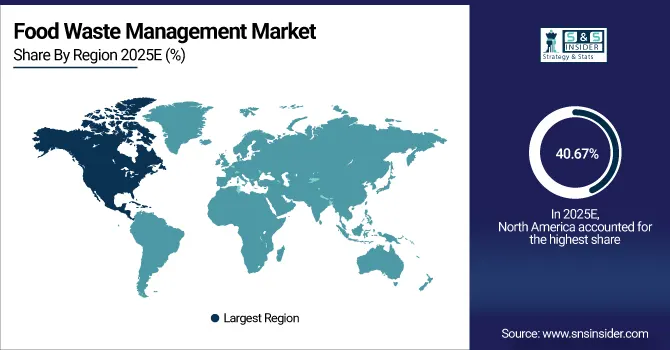

North America Food Waste Management Market Insights

North America accounts for 40.67% share in 2025 and is one of the fastest-growing regions in the market. Growth is fueled by mature waste collection and recycling infrastructure, high consumer awareness of sustainable solutions, and widespread retail and e-commerce penetration. The U.S. leads the region with advanced cold chain logistics, R&D investments in eco-friendly disposal technologies, and government incentives supporting sustainable waste practices. In 2025, companies such as Veolia and Waste Management expanded operations and introduced innovative recycling and composting programs to meet increasing domestic and commercial demand.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Food Waste Management Market Insights

Asia Pacific is the largest market with a 24.56% share in 2025, driven by rapid urbanization, rising disposable incomes, and increasing exposure to global food trends. Lower manufacturing costs, expanding retail networks, and supportive government policies for food processing and waste management solutions contribute to market growth. China and Japan are leading markets, with local players investing in advanced waste collection, recycling, and composting infrastructure. Adoption of e-commerce and cold chain systems enhances accessibility in semi-urban and urban areas, sustaining strong CAGR growth in the region.

Europe Food Waste Management Market Analysis

Europe holds a 18.34% market share in 2025, supported by strong consumer preference for premium, artisanal, and sustainable waste management solutions. Germany, Italy, and France are key contributors, with investments in industrial and artisanal waste collection, recycling facilities, and eco-friendly technology adoption. The region benefits from well-established retail chains, specialty stores, and government regulations promoting sustainable food and waste management practices. Tourism in urban and leisure destinations also boosts demand for efficient food waste management services.

Latin America (LATAM) and Middle East & Africa (MEA) Food Waste Management Market Insights

LATAM and MEA hold 6.43% and 10.00% market share in 2025, respectively, and are emerging as strategically important regions. Brazil leads LATAM due to a strong dairy industry and growing adoption of premium and plant-based waste management solutions. Chile and Argentina are investing in cold chain and collection infrastructure to expand artisanal offerings. In MEA, the UAE and Saudi Arabia are witnessing rising adoption of premium and imported solutions, supported by growing disposable incomes, tourism, and hospitality sector expansion. Government initiatives promoting sustainable production and waste management practices are driving market growth in both regions.

Competitive Landscape for Food Waste Management Market:

Veolia Environnement

Veolia provides comprehensive food waste collection, recycling, and composting solutions across residential, commercial, and industrial sectors.

-

In January 2025, Veolia inaugurated a new advanced food waste recycling facility in France to expand capacity for organic waste processing and sustainable energy generation.

SUEZ Group

SUEZ specializes in waste management and recycling services, including food waste treatment and circular economy solutions.

-

In March 2025, SUEZ launched a pilot project in Germany for high-efficiency anaerobic digestion of commercial food waste to produce biogas and compost.

Waste Management, Inc.

Waste Management, Inc. is a leader in integrated waste solutions, focusing on residential and commercial food waste collection and recycling.

-

In February 2025, the company expanded its organic waste processing operations in California with a new composting and bioenergy facility serving North American clients.

Republic Services, Inc.

Republic Services offers food waste collection, transportation, and recycling services with a focus on sustainability and regulatory compliance.

-

In April 2025, Republic Services implemented a large-scale food waste-to-energy project in Texas, converting commercial food waste into renewable energy and soil amendments.

Food Waste Management Market Key Players

Some of the Food Waste Management Companies

-

Veolia Environnement

-

SUEZ Group

-

Waste Management, Inc.

-

Republic Services, Inc.

-

Clean Harbors, Inc.

-

Stericycle, Inc.

-

GFL Environmental Inc.

-

Covanta Holding Corporation

-

Biffa PLC

-

Remondis SE & Co. KG

-

Advanced Disposal Services, Inc.

-

Waste Connections, Inc.

-

Cleanaway Waste Management

-

FCC Environment

-

DS Smith

-

Leanpath

-

Spoiler Alert

-

Misfits Market

-

Full Harvest

-

Chanzi

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD80.56 Billion |

| Market Size by 2033 | USD 124.77 Billion |

| CAGR | CAGR of5.62% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Waste Type: (Cereals, Dairy & Dairy Products, Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Oilseeds & Pulses, Roots & Tubers, Others) • By Source: (Residential, Commercial, Industrial) • By Service Type: (Collection, Transportation, Disposal/Recycling – Landfill, Incineration, Composting) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Veolia Environnement, SUEZ Group, Waste Management, Inc., Republic Services, Inc., Clean Harbors, Inc., Stericycle, Inc., GFL Environmental Inc., Covanta Holding Corporation, Biffa PLC, Remondis SE & Co. KG, Advanced Disposal Services, Inc., Waste Connections, Inc., Cleanaway Waste Management, FCC Environment, DS Smith, Leanpath, Spoiler Alert, Misfits Market, Full Harvest, Chanzi |