Forklift Market Size & Overview

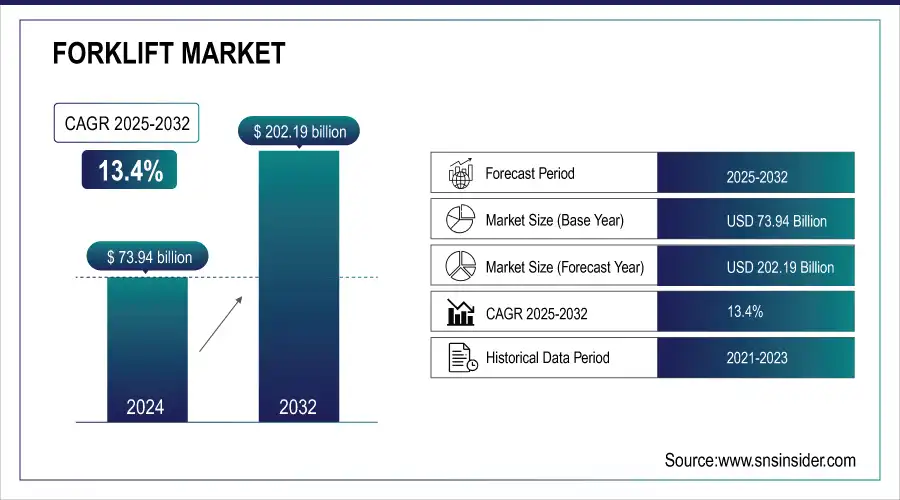

The Forklift Market Size was was valued at USD 73.94 billion in 2024 and is expected to reach USD 202.19 billion by 2032, growing at a CAGR of 13.4% from 2025-2032.

Get More Information on Forklift Market - Request Sample Report

The forklift market is poised for continued growth, fueled by the growing industrial and logistics sectors, along with advancements in electric and autonomous technologies. Within industrial environments, forklifts play a vital role in keeping material flowing smoothly throughout production lines. They efficiently handle heavy loads and navigate tight spaces in warehouses and manufacturing plants, ensuring efficient operations. Similarly, the logistics industry relies heavily on forklifts for tasks like loading and unloading trucks and containers at ports and distribution centres.

Forklift Market Size and Forecast

-

Forklift Market Size in 2024: USD 73.94 Billion

-

Forklift Market Size by 2032: USD 202.19 Billion

-

CAGR: 13.4% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Forklift Market Trends

-

Growing demand for efficient material handling in warehousing, logistics, and manufacturing is driving forklift market growth.

-

Adoption of electric and hybrid forklifts is increasing due to sustainability goals and emission regulations.

-

Integration with automation, IoT, and telematics is enhancing operational efficiency and safety.

-

Rising e-commerce and retail expansion is boosting demand for versatile lifting solutions.

-

Focus on ergonomic design and operator safety is shaping market trends.

-

Expansion of rental and leasing services is improving accessibility for small and medium enterprises.

-

Collaborations between OEMs, technology providers, and end-users are accelerating innovation and smart forklift deployment.

Forklift Market Growth Drivers

-

Businesses seek to improve operational efficiency and reduce labour costs, leading to wider forklift adoption.

Businesses are increasingly turning to forklifts to streamline their material handling processes. These powerful machines can efficiently move heavy objects and palletized goods, significantly reducing the reliance on manual labour. This translates to cost savings for companies, allowing them to allocate resources more effectively. The forklifts can expedite tasks within warehouses and production facilities. Their ability to quickly load, unload, and transport materials keeps operations running smoothly, ultimately boosting overall productivity. This efficiency is especially crucial in today's fast-paced business environment, where timely product delivery is paramount. As businesses strive to remain competitive, the rising adoption of forklifts to optimize their operations is a significant driver of the forklift market's growth.

-

Stricter emission regulations and a focus on sustainability push the popularity of eco-friendly electric forklifts.

Forklift Market Restraints:

-

Fluctuations in raw material prices can disrupt forklift production and cause price increases, impacting affordability for buyers.

Steel and other metals are key components in forklift manufacturing, and their cost fluctuations can significantly impact the industry. When raw material prices surge, it disrupts production schedules and can lead to delays in forklift deliveries. This can put a strain on manufacturers' ability to meet demand and fulfil orders on time. These price hikes are often passed on to consumers in the form of increased forklift costs. This can make them less affordable for businesses, potentially leading them to postpone or even cancel their forklift purchases. This price sensitivity can hinder market growth, especially for smaller businesses with tighter budgets. Thus, managing the impact of raw material price fluctuations is crucial for the long-term stability and growth of the forklift market.

-

Limited availability and high cost of charging infrastructure can hinder wider adoption of electric forklifts, especially in large warehouses.

Forklift Market Opportunities:

- Rising Urbanization and Infrastructure Expansion in Emerging Economies Fuel Forklift Market Growth

The rapid urbanization and continuous development of infrastructure in emerging economies are creating substantial demand for forklifts across construction, warehousing, and logistics sectors. As cities expand, the need for efficient material handling, transportation of construction materials, and streamlined warehouse operations is intensifying. Governments’ investments in roadways, commercial complexes, and industrial facilities further amplify the requirement for advanced material handling solutions. Forklifts play a critical role in improving operational efficiency, reducing labor costs, and ensuring timely project execution. Consequently, these trends are expected to act as key growth drivers for the global forklift market over the forecast period.

Forklift Market Segment Analysis :

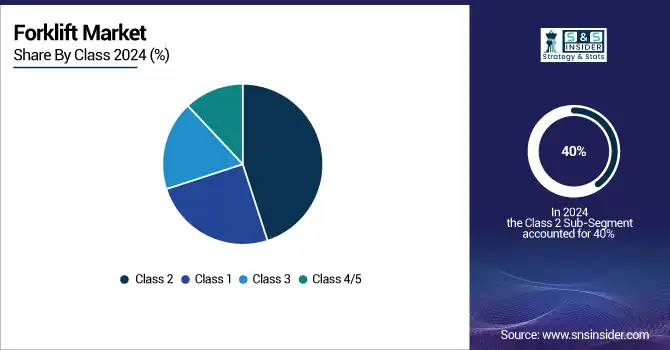

By Class

The Class 2 is the dominating sub-segment in the Forklift Market by class holding around over 40% of market share. This dominance can be attributed to their versatility and movability. Class 2 forklifts, typically with load capacities between 3 and 5 tons, excel in confined spaces like warehouses and retail stores. Their ability to handle palletized goods efficiently makes them ideal for various material handling tasks. Additionally, their compact size allows for smoother navigation in tight aisles and around corners. This flexibility is crucial for optimizing operations and maximizing storage capacity, particularly in busy warehouse environments.

By Power Source

Internal Combustion Engine (ICE) forklifts is the dominating sub-segment in the Forklift Market by power source. Despite the rise of electric models, ICE forklifts, powered by gasoline, propane, or diesel, remain the preferred choice for many businesses. This is primarily due to their lower upfront costs compared to electric forklifts. Additionally, their extended runtime on a single tank of fuel makes them suitable for continuous operation in demanding applications, especially in outdoor environments like construction sites. Thus, the tide is gradually shifting as advancements in battery technology and concerns over stricter emission regulations pave the way for wider adoption of electric forklifts.

By Load Capacity

The 5-15 ton is the dominating sub-segment in the Forklift Market by load capacity. This segment caters to a wide range of industries, including manufacturing, warehousing, and logistics. Forklifts within this range offer the perfect balance between movability and power, enabling them to handle a variety of loads, from palletized goods to machinery and building materials. Their ability to operate effectively both indoors and outdoors makes them highly versatile for various material handling needs. The growth of the manufacturing and construction sectors further fuels the demand for these mid-range capacity forklifts, solidifying their position as the leading segment in the market.

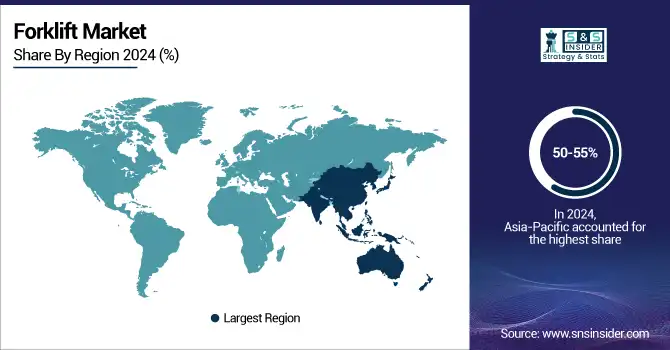

Forklift Market Regional Analysis

Asia Pacific Forklift Market Insights

The Asia-Pacific is the dominating region in the Forklift Market holding around 50-55% of market share. This dominance stems from the region's rising economies, particularly in China and India, where rapid industrialization and burgeoning manufacturing and logistics sectors fuel the demand for efficient material handling solutions like forklifts. Government initiatives further propel the region’s growth by promoting infrastructure development.

Get Customized Report as per your Business Requirement - Request For Customized Report

Europe Forklift Market Insights

Europe holds a significant position in the forklift market, driven by advanced manufacturing, robust logistics infrastructure, and growing e-commerce activities. Strong industrial automation adoption, stringent safety regulations, and technological innovations in electric and automated forklifts are accelerating market growth. Countries such as Germany, France, and the U.K. are investing in smart warehousing solutions, collaborative robotics, and eco-friendly material handling equipment, enhancing operational efficiency and sustainability across the region.

Middle East & Africa and Latin America Forklift Market Insights

The Middle East & Africa and Latin America forklift markets are emerging with substantial growth potential, fueled by industrial expansion, logistics modernization, and rising e-commerce demand. Investments in warehouses, ports, and construction sectors are driving forklift adoption, particularly electric and counterbalance models. Governments are promoting industrial automation and safety standards, while regional players are forming partnerships with global manufacturers, enhancing technology transfer, operational efficiency, and sustainable material handling practices.

Forklift Market Competitive Landscape:

Toyota Industries Corporation

Toyota Industries Corporation is a global leader in manufacturing industrial equipment, particularly forklifts, material handling solutions, and logistics technologies. The company emphasizes innovation, integrating autonomous systems, AI, and fuel cell technologies to enhance warehouse efficiency, safety, and sustainability. With operations spanning Japan, North America, and Europe, Toyota Industries continually advances automation and smart logistics solutions, positioning itself as a key driver in next-generation material handling and industrial mobility.

-

2025 – Toyota Industries began full-scale operations of its autonomous forklift at Coca-Cola Bottlers Japan’s Hakushu Plant, advancing precision logistics in cold-storage warehousing.

-

2023 – Toyota Industries launched Japan’s first AI-powered cloud-based forklift safety evaluation service, developed jointly with Fujitsu to enhance operational safety for material handling.

-

2025 – TMHNA integrated Toyota Material Handling and The Raymond Corporation into a unified organization, enhancing forklift and material-handling solutions across North America.

-

2025 – Toyota Material Handling Europe partnered with Plug Power and STEF to deliver hydrogen fuel cell-powered forklifts supporting STEF’s low-carbon logistics across France and Spain.

Crown Equipment Corporation

Crown Equipment Corporation designs and manufactures forklifts, warehouse solutions, and material handling technologies globally. The company focuses on safety, efficiency, and data-driven innovation, providing advanced vehicles and smart software systems. Crown continues expanding its global footprint by introducing narrow-aisle turret trucks, real-time operational insights, and localized service facilities, reinforcing its leadership in the industrial mobility and warehouse automation sector.

-

2024 – Crown Equipment expanded its lineup with the new TSP 1000/1500 Series narrow-aisle turret trucks, featuring the Gena® operating system for enhanced safety, performance, and real-time data insights.

-

2024 – Crown Equipment opened a new sales and service facility in Goodyear, Arizona, aimed at increasing productivity and uptime for local forklift customers.

Key Players

Some of the Forklift Market Companies

- Toyota Industries Corporation

- Hyster-Yale Material Handling Inc.

- Mitsubishi Nichiyu Forklift Corporation

- Crown Equipment Corporation

- KION Group AG

- Komatsu Limited

- Anhui Heli Co. Ltd.

- CLARK

- Doosan Corporation

- Hangcha Group Co., Ltd.

- Lonking Holdings Limited

- EP Equipment Co., Ltd.

- Tailift Group

- Nichiyu Forklift Co., Ltd.

- Baoli

- Atlet AB

- Big Joe Forklifts

- Bulmor

- Godrej & Boyce

- Jungheinrich AG

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 73.94 Billion |

| Market Size by 2032 | US$ 202.19 Billion |

| CAGR | CAGR of 13.4% From 2025 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Class (Class 1, Class 2, Class 3, Class 4 & 5) • by Power Source (Internal Combustion Engine, Electric) • by Capacity (<5 ton, 5 ton - 15 ton, above 16 ton) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Toyota Industries Corporation (Japan), Hyster-Yale Material handling Inc. (U.S.), KION Group AG (Germany), Mitsubishi Nichiyu Forklift Corporation (Japan), Crown Equipment Corporation (U.S), Komatsu Limited (Japan), Anhui Heli Co. Ltd.; CLARK, Doosan Corporation; Hangcha; |