DIGITAL FREIGHT MATCHING MARKET KEY INSIGHTS:

Get More Information on Digital Freight Matching Market - Request Sample Report

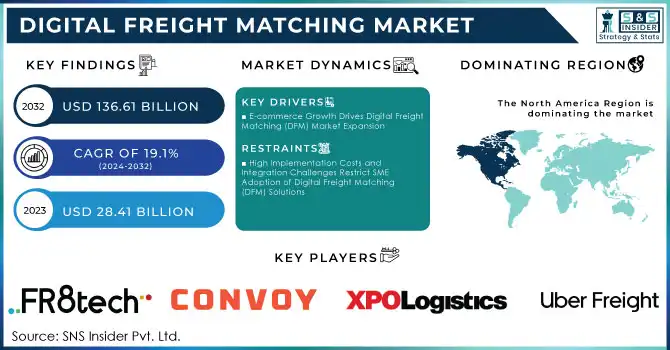

The Digital Freight Matching Market Size was valued at USD 28.41 Billion in 2023 and is expected to reach USD 136.61 Billion by 2032 and grow at a CAGR of 19.1% over the forecast period 2024-2032.

The Digital Freight Matching (DFM) market, a segment of the logistics and transportation industry, DFM platforms have been very much in growth over the last few years. The basic objective of DFM platforms is to digitally, with the aid of AI and ML, match a freight shipper with a carrier to optimize the process of logistics and transport. This market changes the way freight moves by reducing inefficiencies, lowering costs, and improving transparency in the supply chain.

Better capacity management, reduction of empty miles, and efficiency in the freight process are some of the technological benefits, as the world's economy becomes increasingly interlinked, expanding opportunities to transport cargo more efficiently and effectively ensures the growth of the digital freight matching market. The development of e-commerce has greatly influenced the freight sector, enlarged the volumes in shipments, and brought novel demands on logistics solutions. During 2023, e-commerce accounted for 18.6% of global retail sales. With return rates reaching up to 30% in some sectors, DFM platforms are very important to deal with the complexities of reverse logistics. E-commerce companies are further demanding speed, with 50% of their customers demanding same-day or next-day delivery options. The insatiable demand becomes a business case for the integration of DFM solutions that help clean and optimize freight operations.

MARKET DYNAMICS

KEY DRIVERS:

-

E-commerce Growth Drives Digital Freight Matching (DFM) Market Expansion

With e-commerce, demand for transportation will shift from large bulk shipments to smaller deliveries made more frequently. This demand often puts further pressure on logistics companies to improve their operational efficiency to accommodate the developments. DFM platforms help organizations manage this increasing volume with data-driven algorithms for cargo to immediately match available carriers, optimize routes to avoid empty miles, and so on.

This growth in e-commerce, in combination with the demand for faster and more flexible deliveries, directly supports the growth of DFM platforms in logistics. According to the 2024 survey, the growth in e-commerce has increased the demand for fast and efficient options for delivery purposes, which boosted the adoption of DFM solutions. The same-day delivery demand is likely to increase in 2024 by over 20% and will reach a market value of about USD 10 billion. Moreover, 68% of the consumers prefer short delivery windows at the time of checkout, highlighting the demand for DFM platforms with faster, more flexible delivery solutions. Also, 80% of consumers are willing to wait for sustainable delivery, which tallies with many eco-friendly capabilities of multiple DFM systems.

-

AI and Machine Learning Boost Efficiency in Digital Freight Matching (DFM) Market

These technologies will match freight with carriers more accurately, reducing costs on operational levels and improving the use of fleets. Machine learning refines algorithms that suggest better decisions as it continually learns from past data and reduces delays and empty miles. AI can predict the fluctuation in demand by adjusting routes automatically; this cuts down on all inefficiencies involved in the logistics process.

Technological advancements in Artificial Intelligence (AI) and Machine Learning (ML) are driving the expansion of Digital Freight Matching. These technologies provide real-time route optimization, predictive analytics, and better freight-carrier matches that enhance supply chain efficiency. AI-powered systems also optimize fuel consumption by as much as 10 % and find fewer delays because they learn from past data; predictive analytics can save up to 30 % of possible delays and enhance operational performance. AI also makes multi-stop routes optimized for last-mile deliveries and improved in speed by 20% and in cost efficiency. With evolutionary development using machine learning, DFM platforms reduce empty miles, enhance fleet utilization, and automate logistics functions. This increasing dependency on AI and ML is further making DFM solutions attractive for companies looking at reducing their operational complexity while enhancing delivery performance.

RESTRAIN:

-

High Implementation Costs and Integration Challenges Restrict SME Adoption of Digital Freight Matching (DFM) Solutions

The DFM market is creating fast growth, but high initial investment and integration challenges by small and medium-sized enterprises (SMEs) will be a significant restraint. A highly capital-intensive solution often means that the integration of DFM solutions can be costly in terms of setting up necessary software updates, infrastructure, and training. The cost can be challenging for SMEs with limited resources to embrace advanced platforms in DFM. In addition, DFM technology integration into the existing systems running in legacy within the logistics operations proves to be a lengthy process. Although DFM solutions promise long-term cost savings and efficiency improvements, high initial costs coupled with technical challenges may ward many SMEs against taking up these systems. As a result, the balancing act between high technology investments and cheaper operational budgets becomes one of the greater restraints in the broad adoption of DFM in the logistics industry.

Small and medium-sized enterprises will face massive hurdles in implementing DFM solutions for various reasons, such as high initial costs and integration difficulties. The implementation of such DFM platforms requires significant upfront investments in software, infrastructure, and training, where some organizations even go up to USD 50,000 to USD 100,000 on system deployment. For instance, 60% of SMEs find that the integration of new DFM technologies with existing legacy systems is quite complex and time-consuming and causes disruption to operations during the transition phase.

KEY MARKET SEGMENTS

BY TRANSPORTATION MODE

The Full Truckload (FTL) segment of the Digital Freight Matching (DFM) market accounted for 44% of the revenue in 2023, reflecting its dominant position in the logistics industry. FTL shipments, characterized by large-scale, single shipments that fill an entire truck, benefit from DFM platforms that optimize routes, reduce empty miles, and enhance cost efficiency. These platforms help optimize routes and reduce operational costs by up to 10%. Additionally, demand for FTL services is expected to grow by 5-7% annually, driven by e-commerce and the need for faster, more reliable delivery solutions.

The Intermodal segment of the Digital Freight Matching (DFM) market is growing at the highest CAGR rate of 21.74% owing to increasing demands for efficient and cost-effective multi-modal transportation solutions. Companies, such as Uber Freight and Loadsmart, are incorporating intermodal capabilities into their DFM platforms to maximize containerized freight transportation benefits through reductions in costs and transit times by combining rail, road, and sea transport.

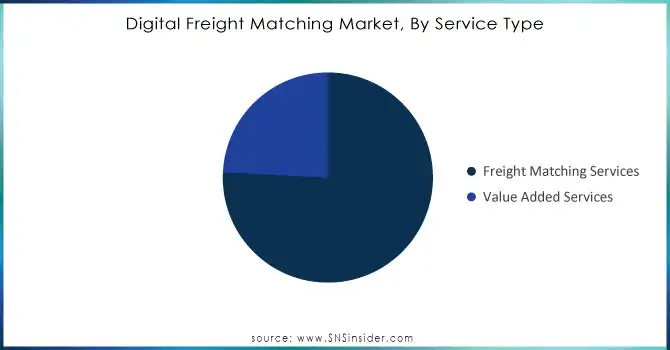

BY SERVICE TYPE

In 2023, the Freight Matching Services segment held a major share in the Digital Freight Matching (DFM) market, accounting for 76% of the revenue. Growth in this segment is driven by the rapid adoption of digital platforms to connect shippers and carriers, thus improving operational efficiency and cost savings. Companies like Uber Freight and Transfix have gained much momentum with their high-tech freight matching services driven by AI, which help in route optimization, reducing empty miles, and freight tracking. Such solutions reduce the idle time reduce kilometers covered in an empty vehicle and ensure cost-effectiveness. Ontruck's model experienced a 100% increase in team productivity through advanced freight matching services, which entails the market's increasing reliance on automation.

The Value-Added Services (VAS) segment in the Digital Freight Matching (DFM) market is expected to grow with the highest CAGR of 20.63% during the forecast period. This growth can be attributed to the increasing demand for improved logistics solutions that involve real-time tracking, cargo insurance, and flexible payments. Companies like Uber Freight and Loadsmart have introduced VAS features and integrated advanced analytics, predictive tools, and customized solutions into their platform.

Need Any Customization Research On Digital Freight Matching Market - Inquiry Now

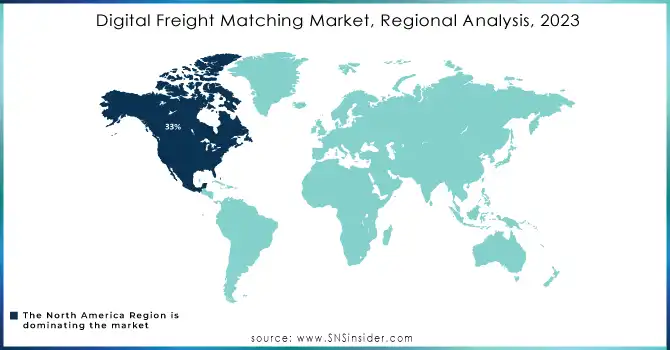

REGIONAL ANALYSIS

In 2023, North America dominated the market of Digital Freight Matching, and it accounted for approximately 33% market share. This leadership of the region is owed to its advanced infrastructure, massive internet and smartphone usage, and strong logistics and e-commerce sector. Major logistics companies like Uber Freight, Convoy, and C.H. Robinson have played an immense role in this domination by the region. Uber Freight is growing at warp speed in North America. With high technology adoption rates, the company's growth reflects the increased use of digital tools in logistics. By 2025, AI-powered logistics, including digital freight matching, will add billions in value to the global market, while North America continues to be at the forefront of this development.

The Asia Pacific region emerged as the fastest-growing market for Digital Freight Matching (DFM), projected to grow at an impressive CAGR of 20.78% from 2024 to 2032. The growth is driven by a variety of factors, particularly in the booming e-commerce sector in the region, particularly in countries like China, India, and Southeast Asia. They are growing well in the Asia Pacific region, with retail e-commerce being led by Southeast Asia, India, and the Philippines. Retail e-commerce sales in Southeast Asia are expected to grow at an annual rate of 18%, and nearly half of the region's population will be digital buyers by 2024. This rapid digital adoption is driving demand for digital freight matching (DFM) solutions to streamline logistics, optimize supply chains, and support the growth of cross-border trade in the region.

Key Players

Some of the major players in the Digital Freight Matching Market are:

-

Uber Freight (Uber Freight App, Marketplace for Shippers and Carriers)

-

Redwood (Redwood Logistics Management Platform, Redwood Supply Chain Cloud)

-

XPO, Inc. (XPO Connect, XPO Smart Technology)

-

Convoy, Inc. (Convoy Driver App, Convoy Marketplace)

-

Full Truck Alliance (Full Truck Alliance App, Trucking Platform for Shippers)

-

Freight Technologies, Inc. (Fr8App, Fr8Network)

-

Freight Tiger (Freight Tiger Platform, Freight Tiger Dashboard)

-

Cargomatic Inc. (Cargomatic Freight Management System, Cargomatic Carrier Network)

-

Roper Technologies, Inc. (TransCore Freight Solutions, Roper Digital Freight Services)

-

Coyote Logistics (CoyoteGo, Coyote TMS)

-

Echo Global Logistics (EchoShip, Echo Global Freight Matching)

-

J.B. Hunt (J.B. Hunt 360, J.B. Hunt On-Demand)

-

Loadsmart (Loadsmart Freight Platform, Loadsmart Real-Time Freight Matching)

-

Transfix (Transfix Digital Freight Marketplace, Transfix Carrier Platform)

-

Trucker Path (Trucker Path App, Trucker Path Load Board)

-

Stryker Corporation (Stryker Transportation Logistics Software, Stryker Freight Management)

-

DHL Supply Chain (DHL Freight Management Solutions, DHL Digital Freight Network)

-

Kuehne + Nagel (KN FreightNet, Kuehne + Nagel TMS)

-

Maersk Line (Maersk Spot, Maersk Freight App)

-

Geodis (Geodis Freight Matching Platform, Geodis Supply Chain Optimization)

SUPPLIERS

-

Intel

-

NVIDIA

-

Qualcomm

-

Samsung Electronics

-

Micron Technology

-

Broadcom

-

Texas Instruments

-

STMicroelectronics

-

Honeywell

-

Siemens

RECENT TRENDS

-

In March 2024, Uber Freight was looking to expand aggressively in Europe and target a market share tenfold greater by 2028. Strategically the company planned this move to exploit the growth of digital freight matching in the entire continent of Europe. This company would entirely rely on technology to transform its logistics solutions to address demand.

-

In November 2024, Redwood Logistics helped enhance cost-effectiveness and service levels for Harbison-Walker International through its innovative transportation management solutions. With the Oracle Transportation Management system, Redwood streamlined operations, improved freight procurement, and supported the logistics needs of Harbison Walker.

-

In October 2023, Convoy, the digital freight company, had been under immense pressure both operationally as well as through leadership changes. That brought a review of its scale-up approach in the context of financial distress triggered by such high goals set in the logistics space.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 28.41 Billion |

| Market Size by 2032 | US$ 136.61 Billion |

| CAGR | CAGR of 19.1 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Freight Matching Services, Value Added Services) • By Platform Type (Web-based, Mobile-based (Android, iOS)) • By Transportation Mode (Full truckload (FTL), Less-than-truckload (LTL), Intermodal, Others) • By Industry Type (Food & Beverages, Retail & E-Commerce, Manufacturing, Oil & Gas, Automotive, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Uber Freight, Redwood, XPO, Inc., Convoy, Inc., Full Truck Alliance, Freight Technologies, Inc., Freight Tiger, Cargomatic Inc., Roper Technologies, Inc., Coyote Logistics, Echo Global Logistics, J.B. Hunt, Loadsmart, Transfix, Trucker Path, Stryker Corporation, DHL Supply Chain, Kuehne + Nagel, Maersk Line, Geodis. |

| Key Drivers | • E-commerce Growth Drives Digital Freight Matching (DFM) Market Expansion • AI and Machine Learning Boost Efficiency in Digital Freight Matching (DFM) Market |

| Restraints | • High Implementation Costs and Integration Challenges Restrict SME Adoption of Digital Freight Matching (DFM) Solutions |