Functional Endoscopic Sinus Surgery Market Size:

Get more information on Functional Endoscopic Sinus Surgery Market - Request Free Sample Report

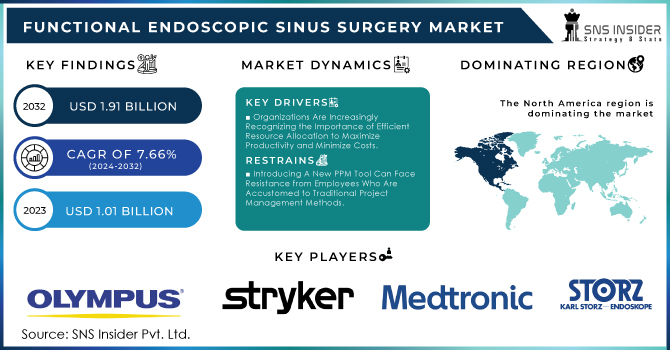

The Functional Endoscopic Sinus Surgery Market Size was valued at USD 1.01 Billion in 2023, and is expected to reach USD 1.91 Billion by 2032, and grow at a CAGR of 7.66% over the Forecast Period of 2024-2032.

The high prevalence of chronic sinusitis is driving the demand for functional endoscopic sinus surgery market. Chronic rhinosinusitis affects approximately 20% of CRS patients. This renders nasal polyps a very concerning and relevant predisposition to sinusitis. However, the problem is more than just medical, and nasal polyps are one of the most relevant economic drivers of the disease. The cost of CRS is very high due to the relevant prevalence of the disease. Around one in eight people have CRS, and it is one of the prime reasons for visits to a physician. The direct cost to the United States for CRS amounts to ten to thirteen billion dollars per year. The indirect costs are even higher due to the lost productivity, amounting to over twenty billion dollars. The disease needs to be addressed, and chronic sinusitis, in particular, can be a perplexing problem that requires intense treatment, including multiple medications, a lifestyle change, and sometimes even surgical interventions. Overall, chronic sinusitis is a problem that may be troubling both to the patient and from a global public health perspective. It is one of the leading reasons for physician visits and associated high associated costs, only a portion of which is directly related to healthcare.

AI application in the case of sinus surgeries represents a new progress in otolaryngology, which provides more effective and less dangerous procedures. Robotic-assisted technology changes the FESS as well as other types of operations by providing more control and coordination. In this way, robotic systems increase the qualifications of surgeons and allow for managing complex manipulations with extreme precision. On the one hand, the systems enhanced the visualization and magnifying opportunities for the examination of the tissue. On the other hand, surgeons and AI systems manage to direct the robot with special instruments to the necessary tissue with more spatial flexibility.

MARKET DYNAMICS:

Key Drivers:

-

The Growing Complexity of Projects, Especially in Industries Like Technology, Healthcare, And Construction, Has Made Effective Management A Necessity.

-

Organizations Are Increasingly Recognizing the Importance of Efficient Resource Allocation to Maximize Productivity and Minimize Costs.

Restraints:

-

Implementing A PPM Solution Can Require a Significant Upfront Investment, Which May Be a Barrier for Smaller Organizations or Those with Limited Budgets.

-

Introducing A New PPM Tool Can Face Resistance from Employees Who Are Accustomed to Traditional Project Management Methods.

Opportunity:

-

As Economies in Emerging Markets Continue to Grow, There Is Increasing Demand for Efficient Project Management Tools.

-

AI Can Enhance PPM Capabilities by Automating Tasks, Providing Predictive Analytics, And Improving Risk Management.

KEY MARKET SEGMENTATION:

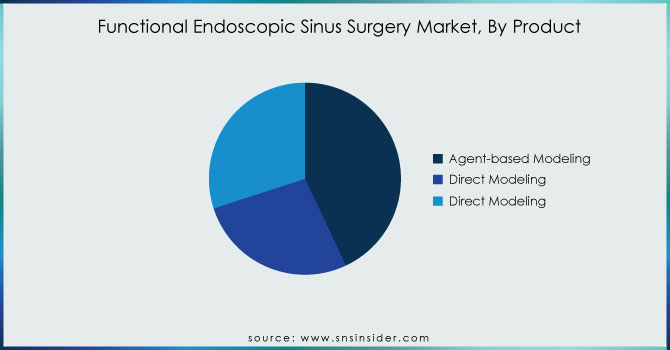

By Product

The highest growth rate of the functional endoscopic sinus surgery industry, by product segment, was observed in the endoscopes segment which amounted to 43% in 2023. The functional endoscopic sinus surgery market, by product, is segmented into endoscopes, surgical instruments, and navigation systems. The surgical instruments segment accounted for the largest market share in 2023 owing to the growth in new surgical methods or techniques with improved sets of instruments. The endoscopes segment is anticipated to register the highest CAGR during the forecast period. The growth of this market segment is attributed to the increase in innovations in endoscopes technology such as 3D endoscopes.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Indication

The fungal sinusitis segment dominated the Functional endoscopic sinus surgery industry, by indication in 2023 & holds 31% of the overall growth. The functional endoscopic sinus surgery market, by indication, is segmented into chronic sinusitis, recurrent sinusitis, nasal polyposis, fungal sinusitis, and other indications. The fungal sinusitis segment accounted for the largest market share in 2023. The growth of this market is anticipated to be due to the increasing elderly population with weakened immune systems exposure of humans to indoor and outdoor fungal spores in the air and continuous inhalation of spores that get deposited along the airway mucosa.

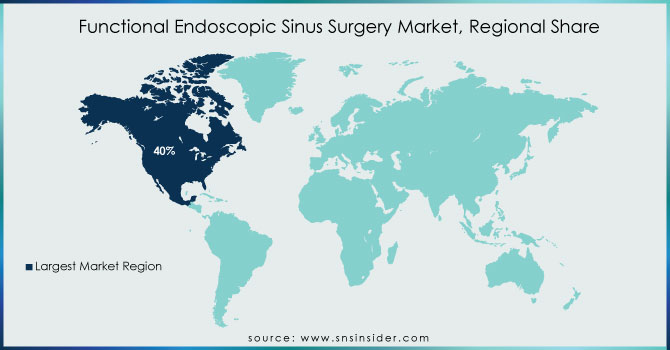

REGIONAL ANALYSIS:

In 2023, North America accounted for 40% of the global market. The region has a well-established healthcare system with considerable government funding for healthcare programs and research and development of new treatment methods leading to an accommodating environment for novel ways of treating sinusitis. The prevalence of severe and chronic cases of sinusitis in the region is rising, attributed in part to air pollution, allergies, and lifestyle changes. In addition, the region has embraced World Sinus Health Awareness Month, educating patients on the condition and the available treatment options aimed at alleviating sufferings by ensuring that healthcare providers and institutions, as well as the population at large, are in a better position to diagnose sinusitis and react accordingly. In North America, the sinusitis market will be driven by big pharmaceutical and biotechnology firms that specialize in the development of drugs for respiratory conditions, including sinusitis. These companies have the financial muscle and the capacity required to establish laboratories for researching and manufacturing drugs.

KEY PLAYERS:

The key market players are Olympus, Stryker Corporation, Medtronic, Karl Storz, Smith & Nephew, Conmed Corporation, Johnsons & Johnsons, Sinusys, Dalent Medical, B. Braun Melsungen AG, and other players.

RECENT DEVELOPMENTS

-

In 2024, Integra acquired Acclarent, Inc. a leader in ENT surgical interventions. The acquisition has intensified the scope of Integra’s market-leading brands and Integra’s depth with Acclarent’s innovative product portfolio. The acquisition has also provided an immediate scale and accretive growth through the dedicated sales channel.

-

In 2022, Medtronic acquired Intersect ENT, which is a leader in ENT care for sinus procedures. The acquisition has expanded the existing ENT portfolio of Medtronic with innovative solutions for sinus procedures, postoperative care and clinical outcomes, care protocol and disease state awareness, and relevant education for patients. Both companies have combined their capabilities to prevent nasal polyps and improve patient quality and outcomes.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.01 Billion |

| Market Size by 2032 | US$ 1.91 Billion |

| CAGR | CAGR of 7.66% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Endoscopes, Surgical Instruments & Navigation Systems) •By Procedure (Frontal Sinus Surgery, Ethmoid Sinus Surgery, Maxillary Sinus Surgery, Sphenoid Sinus Surgery & Others), •By Indication (Chronic Sinusitis, Recurrent Sinusitis, Nasal Polyposis, Fungal Sinusitis & Others) •By End User (Hospitals & Ambulatory Surgery Centres (ASCs) & Specialty Clinics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Olympus, Stryker Corporation, Medtronic, Karl Storz, Smith & Nephew, Conmed Corporation, Johnsons & Johnsons, Sinusys, Dalent Medical, B. Braun Melsungen AG, and other players |

| Key Drivers | •The Growing Complexity of Projects, Especially in Industries Like Technology, Healthcare, And Construction, Has Made Effective Management A Necessity. •Organizations Are Increasingly Recognizing the Importance of Efficient Resource Allocation to Maximize Productivity and Minimize Costs. |

| RESTRAINTS | •Implementing A PPM Solution Can Require a Significant Upfront Investment, Which May Be a Barrier for Smaller Organizations or Those with Limited Budgets. •Introducing A New PPM Tool Can Face Resistance from Employees Who Are Accustomed to Traditional Project Management Methods. |