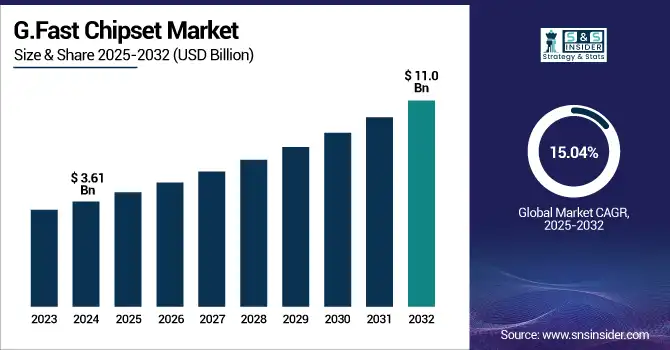

G.Fast Chipset Market Size & Growth:

The G.Fast Chipset Market Size was valued at USD 3.61 billion in 2024 and is expected to reach USD 11 billion by 2032 and grow at a CAGR of 15.04% over the forecast period 2025-2032.

To Get more information on G.Fast Chipset Market - Request Free Sample Report

Increase in demand for high speed broadband and cost effective last-mile connections is driving the global market of G.Fast chipset. A comprehensive G.Fast Chipset Market Analysis reveals the role of chipset innovations and deployment trends in expanding broadband access. Rise in deployment of G.Fast design in metropolitan areas and enhanced performance of chipsets are expected to drive the market over the forecast period.

IN October 2024, Qualcomm has created a G.Fast chipset family that provides 1 Gbps copper loop throughput up to 100 meters with support for both G.fast and VDSL 35b standards.

The U.S. G.Fast Chipset Market size was USD 1.07 billion in 2024 and is expected to reach USD 2.88 billion by 2032, growing at a CAGR of 13.34% over the forecast period of 2025–2032.

The U.S. market for G.Fast chipset is growing at a good pace on account of increasing demand for high-speed and stable broadband services. Rising installations of G.Fast technology in metropolitan cities for last-mile connectivity are expected to propel the market growth owing to the superiority of the chipset performance and increased adoption levels by service providers.

In November 2024, Broadcom Ltd. BCM65400 extends the G.Fast market to point-to-point coaxial cable for multi-dwelling units (MDUs) and apartment buildings. It provides a scalable platform for DSL system vendors.

G Fast Chipset Market Dynamics

Key Drivers:

-

Increasing Adoption of High-Speed Broadband in Urban Areas Accelerates the Market Growth.

High demand of the ultra-fast internet in the high populated urban areas is one of the key drivers of G.Fast chipset market. More consumers and businesses are using high-speed broadband for online activities like video streaming, remote working or cloud computing, prompting telecommunications companies to upgrade their networks. G.Fast is the technology that can offer faster data speeds over copper wire and is a relatively cheap way to upgrade a network without completely overhauling it.

MaxLinear offers G.fast/xDSL transceivers such as the XWAY VRX619, with support for G.fast, VDSL, and ADSL access. The transceivers enable service providers to offer gigabit speeds over legacy copper infrastructure.

Restrain:

-

Limited Compatibility of G.Fast Technology with Long-Distance Transmission Restrains Market Expansion.

G.Fast technology can deliver lightning-fast internet over a short range but is ineffective on longer transmission distances. This constraint provides a constraint to the applicability in rural or even sub-urban areas where homes or houses are widely separates. As a result, when installing it in such areas, the contacted telecom operator needs to apply other solutions or deploy expensive infrastructure, such factors may hinder the overall growth potential of the G.Fast chipset market trends.

Opportunities:

-

Expansion of 5G Networks and Edge Computing Creates New Opportunities for the Market.

Strong backhaul and last-mile connectivity are increasingly needed given the rise of 5G and edge computing advancements. G.Fast chipsets, as a form of next-generation DSL technology, can play a key part in enabling such networks to provide high-speed data transfer where fiber deployment is not possible. A G.Fast site that is combined with 5G deployments and edge networks suddenly becomes a big business proposition, and we have lots of room for chipset makers to offer exciting new products that bridge the gaps in these hybrid telco networks.

February 2024, Lattice enhanced its ORAN solution stack with integrated 5G small cell bridging functionality. The release adds a new 5G datapath reference design for outdoor integrated radio use cases, facilitating the deployment of next-gen wireless infrastructure.

Challenges:

-

Competition from Fiber-to-the-Home (FTTH) and Emerging Wireless Alternatives.

A challenge from FTTH deployments and new wireless technologies in the near term ahead of a G.Fast ramp. These of course offer high bandwidth and long transmission distances, which is attractive to consumers and service providers. With investments moving towards fiber, and wireless future-proof networks, the G.Fast chipsets are also under pressure to differentiate on cost, performance, and system integration limiting long-term market penetration.

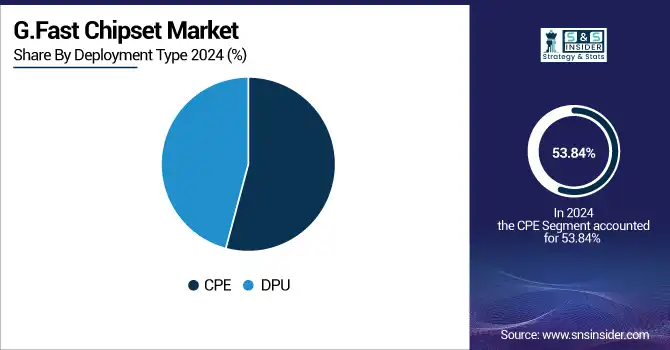

G.Fast Chipset Industry Segment Analysis:

By Deployment Type

The CPE segment dominated the G.Fast Chipset Market with a 53.84% share in 2024, driven by growing broadband demand in residential and small business settings. ADTRAN and Sagemcom have introduced cutting-edge G.Fast-enabled modems and gateways. These advancements enhance connectivity, enrich user experience, and solidify the segment's leadership in driving overall G.Fast chipset adoption.

The DPU market is projected to the fastest CAGR of 15.79% during the period 2025-2032, with growing fiber-to-the-distribution point installations. Nokia and Huawei introduced weather-resistant, compact G.Fast DPUs to support quicker, cost-efficient rollouts. Such developments strengthen network modernization activities, greatly accelerating G.Fast chipset adoption and leading to robust market growth.

By End-user

The Residential segment dominated with a 62.45% in G.Fast Chipset Market share in 2024, driven by growing demand for fast broadband for streaming, work-from-home, and smart home devices. Top G.Fast Chipset companies like Sagemcom and Zyxel launched advanced G.Fast-compatible home gateways, improving data rates and customer experience. These technologies facilitate easy last-mile connectivity, establishing G.Fast as a vital solution for new digital homes and cementing its grip on residential broadband equipment.

The Commercial/Enterprise segment is expected to fastest at a CAGR of 16.00% during the forecast period of 2025 to 2032 with the rising need of fast and secure connectivity at offices, retail, and public buildings. Suppliers such as ADTRAN and NetComm introduced G.Fast capable business gateways and multi-tenant units. These progressions facilitate opportunities for enterprises to invest effectively in network upgrades, increase commercial utilization of G.Fast chipset, and also constitute to high share of market over the forecast period.

By Copper Line Length

The Copper-line length below 100 meters segment dominated the G.Fast Chipset Market with a 37.87% market share in 2024, well-suited for multi-dwelling units and dense urban environments. Broadcom and Sckipio, among other companies, have created high-performance chipsets tailored for short loops, providing ultra-high speeds and low latency. These solutions accommodate dense network conditions, and thus short-loop G.Fast deployments are extremely effective and commercially viable for residential and mixed-use infrastructure upgrades.

The Copper-line length segment of over 250 meters is expected at the fastest CAGR of 16.09% during the period 2025-2032, motivated by rising broadband rollout in rural and suburban spaces. Huawei and ADTRAN are leading the innovation with advanced G.Fast chipsets and amplifiers to provide coverage for longer loops. Such innovations make G.Fast Chipset Industry beyond urban spaces, driving market penetration and filling the gaps in connectivity in under-served areas.

G.Fast Chipset Market Regional Analysis:

North America dominated the G.Fast Chipset Market with a revenue share of 42.21% in 2024, led by strong demand for ultra-fast broadband in cities. North American market leaders such as ADTRAN and Cisco have launched new G.Fast chipsets, which provide scalable connectivity solutions for home and business applications. These advancements enhance North America's broadband infrastructure, boosting market growth as G.Fast becomes an important solution to access high-speed internet from the last mile.

The Asia Pacific region is expected to the fastest CAGR of 16.55% during 2025-2032, fueled by growing urbanization and rising need for high-speed internet in developing nations. Huawei and ZTE have introduced G.Fast-enabled solutions with customized regional needs, extending broadband services in congested cities. This development makes G.Fast a key technology to fill the connectivity gap, accelerating G.Fast Chipset market growth in the region.

Europe is seeing strong growth in the G.Fast chipset market, fueled by growing demand for high-speed broadband. Germany paces the region, with Deutsche Telekom's mass-scale G.Fast rollouts improving broadband services without costly infrastructure overhauls. This strategic uptake makes Germany the market leader in Europe's G.Fast space.

The MEA and Latin America regions' G.Fast chipset market is slowly increasing. UAE and Saudi Arabia are leading the MEA due to telecom chipset market infrastructure growth, with South Africa and others also implementing G.Fast. In Latin America, Argentina and Brazil aim at enhancing broadband, filling gaps in connectivity at an affordable cost using last-mile solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in the G.Fast Chipset Market are:

Major Key Players are Chunghwa Telecom Co., Ltd, Metanoia Communications, Inc., .Century link, Inc., BT Group PLC, Swisscom AG, EXFO Inc., BT Group PLC, Contends, ARRIS International plc, Alcatel-Lucent.

Recent Development:

-

April 2024, Nokia launched G.fast CPE models supporting 106/212 MHz profiles, offering gigabit speeds, VDSL2 fallback, auto-profile detection, and compatibility with twisted pair and coaxial interfaces for flexible deployment.

-

May 2024, Qualcomm introduced the Snapdragon X80 5G modem, capable of up to 10 Gbps download speeds. While primarily focused on mobile connectivity, the advancements in modem technology could influence future G.Fast deployments.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.61 Billion |

| Market Size by 2032 | USD 11 Billion |

| CAGR | CAGR of 15.04.% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Deployment Type (CPE, DPU) •By End-user (Residential, Enterprise/commercial) •By Copper Line Length (Copper-line length of Shorter than 100 Meters, Copper-line length of 100 meters–150 meters, Copper-line length of 150 meters–200 meters, Copper-line length of 200 meters–250 meters, Copper-line length longer than 250 meters) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Chunghwa Telecom Co., Ltd, Metanoia Communications, Inc., .Century link, Inc., BT Group PLC, Swisscom AG, EXFO Inc., BT Group PLC, Contends, ARRIS International plc, Alcatel-Lucent. |