Mechanical Keyboard Market Size & Trends:

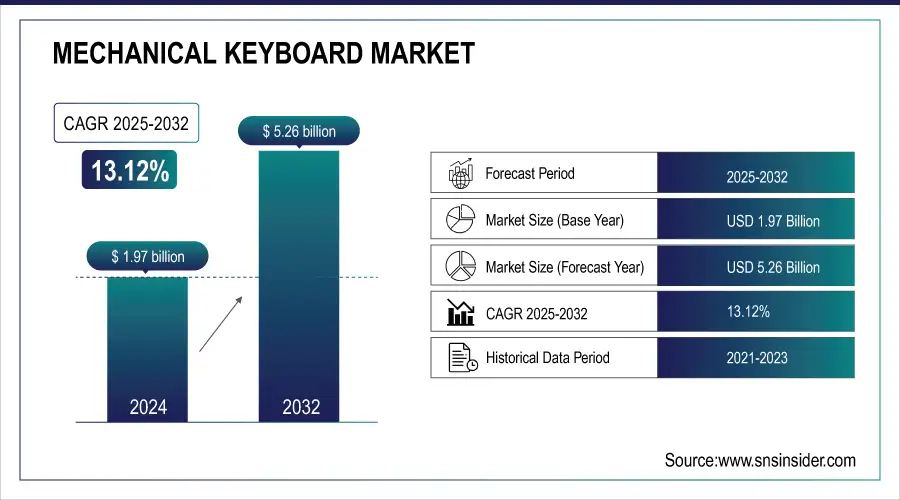

The Mechanical Keyboard Market size was valued at USD 1.97 billion in 2024 and is expected to reach USD 5.26 billion by 2032, growing at a CAGR of 13.12% over the forecast period of 2025-2032.

The mechanical keyboard market growth can be primarily attributed to the rise in demand for gaming peripherals, the growth of the e-sports sector, remote work trends, improved typing experience, and the mechanical switches' durability.

Growing interest shown by gaming communities due to rapid development of e-sports and professional gaming in the market is driving the growth of mechanical keyboard market. Moreover, the work-from-home boom has also increased the need for performance-oriented fire, ergonomic keyboards. Mechanical switches are preferred for their tactile feedback, reliability, and customizability, making them a favourite amongst gamers and professionals. Wireless technology, customization features, and RGB lighting options also attract users. Market expansion is also aided by growing disposable money and awareness of typing comfort.

To Get more information on Mechanical Keyboard Market - Request Free Sample Report

-

As of early 2024, around 30% of U.S. employees continue to work remotely or hybrid, driving demand for ergonomic, high-performance home office gear, including mechanical keyboards.

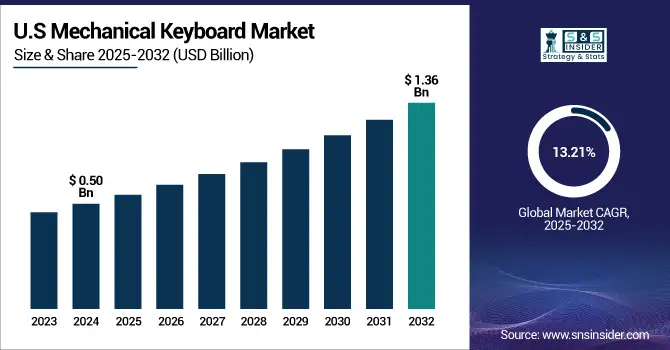

The U.S. Mechanical Keyboard market size is estimated to be valued at USD 0.50 billion in 2024 and is projected to grow at a CAGR of 13.21%, reaching USD 1.36 billion by 2032. The growth in the U.S. mechanical keyboard market trend is propelled by sound consumer inclination for high-end technology products, narrow but increasing DIY keyboard culture, an affluent and tech-savvy user base, and growth in specialty retail and online customization platforms.

Mechanical Keyboard Market Dynamics:

Key Drivers:

-

Mechanical Keyboards Gain Popularity Driven by PC Gaming E-sports and Ergonomic Remote Work Needs

A factor fuelling the mechanical keyboard market is increasing penetration of PC gaming along with the e-sports ecosystem, wherein performance and sturdiness is a top priority. The direct and general benefit with mechanical switches is they are giving us better tactile feedback, more precision and they tend to last longer now, that is why they are becoming a go to for gamers and professionals. Especially with the rise of remote and hybrid work, the need for ergonomic typing solutions is also having a larger media presence. In addition, quieter and low-profile versions of switches are widening their reach, making keyboards even more appealing even to non-gamers.

-

E-sports audience surpassed 500 million worldwide in 2023, reflecting the growing importance of competitive gaming and demand for professional-grade gaming equipment.

Restraints:

-

Low Awareness and Bulkiness Limit Mechanical Keyboard Adoption in Non-Gaming Markets of Developing Economies

A key restraining factor for the growth of global mechanical keyboard market is low consumer awareness level in non-gaming segments in lesser-developed economies. It has yet to truly take off, however, with many general users unfamiliar with why mechanical switches might be better than standard membrane alternatives. Moreover, the bulkiness and weighted nature of mechanical keyboards can turn users off who are looking for something portable. Casual users who value plug-and-play simplicity over customization could also be scared off by the learning curve associated with the different types of switches.

Opportunities:

-

Customization Wireless Growth and Emerging Markets Drive Mechanical Keyboard Demand Across Asia and Latin America

The customization and do-it-yourself keyboard space, where there is a rabid demand for customized layouts, keycaps, and switch types, amounts to considerable growth potential. Increased adoption of wireless mechanical keyboards, bolstered by strides in latency and battery life, also creates new potential markets. Moreover, we can see the emerging markets in Asia and Latam with rising disposable incomes and interest in high-performance tech accessories. Partnering with content creators and e-sports teams also help to increase brand awareness and reach the consumer.

-

Razer reported in 2023 that wireless products accounted for over 40% of its total gaming peripherals revenue, highlighting the strong consumer shift toward wireless gaming gear.

Challenges:

-

Supply Chain Complexities and Hybrid Alternatives Challenge Mechanical Keyboard Production and Market Differentiation

A key challenge is the complexity within the supply chain, where mechanical keyboard parts often depend upon highly specialized manufacturing processes. It can delay or disrupt the production time. Lastly, the plethora of membrane and hybrid products available at lower price points with similar features RGB lighting, programmable keys, and so on farther muddles things for consumers, and dilutes the ability for brands to differentiate themselves. Another growing concern as user expectations change is that of compatibility across multiple platforms and software ecosystems.

Mechanical Keyboard Market Segmentation Analysis:

By Connectivity

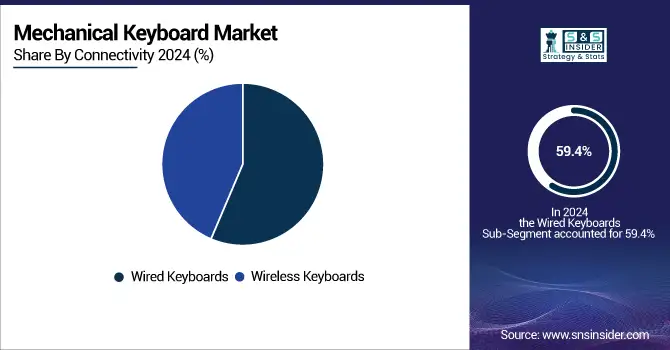

Wired Keyboards were the most popular, with 59.4% market share in 2024, as they offer a stable connection, no latency, and a low price point. These characteristics make them most favored by gamers, programmers, and workers that need stable performance without worrying about battery handling. Wired mechanical keyboards are also popular in environments with a need for no interruption, such as game tournaments or various office spaces. The broad compatibility and plug-and-play positioning of the range of sound cards further enhances the market's position in this space.

The Wireless Keyboards segment is projected to achieve the highest CAGR between 2025 and 2032, due to BLE (Bluetooth Low Energy) and other low-latency wireless technologies. More and more users are attracted by the mobility and design of wireless setup in home or hybrid workspaces. Longer battery life, multi-device pairing ability, and lower latency are speeding up the adoption of consumer and professional applications. Market growth of wireless keyboard is further propelled by augmentation in demand for minimalistic desk setups & portable peripherals.

By Product Type

Non-Tactile Linear Switches accounted for 43.3% of the mechanical keyboard market share in 2024. Non-Tactile Linear Switches are not only quiet with a very smooth keystroke feel but also ultra-responsive, so it is undeniably popular among competitive gamers and fast typists. They are perfect for high-speed typing since they require no tactile bumps to actuate, and so are commonly used in e-sports and gaming setups where speed and consistency are paramount. With the constant demand from the gaming community, brands continue to introduce products centred around linear switches.

Over 2025-2032, the fastest CAGR is anticipated to be for Tactile Non-Click Switches. They provide the same tactile bump feel without the loud sound making them popular among professionals and office users who want just a little feedback while keeping noise to a minimum. With hybrid and remote work models on the rise, there is a concurrent need for quieter ergonomic keyboards. Rapid growth will be driven by, among other things, their increasing use in productivity as well as casual gaming.

By Application

The mechanical keyboard market in 2024 was dominated by the Gaming segment, accounting for a staggering 63.7% of the market share, driven by the rise in PC gaming, e-sports tournaments, and the demand for high-performance peripherals. For the tactile feedback, much faster response time, durability needed for competitive gameplay, mechanical keyboards are best suited for gamers. Customizable RGB lighting, programmable keys, and durable switch options have turned mechanical keyboards into a permanent feature of gaming setups. And big brands are still focused on innovations that put the gamer first in order to stay on top in this domain.

The Office/Industrial segment is anticipated to achieve the fastest CAGR over 2025-2032 due to the rising prevalence of remote and hybrid work as well as the heightened emphasis on ergonomics within office spaces. To achieve better typing comfort, less strain on hands, and long term durability, professionals are now switching to mechanical keyboards. On top of that, the introduction of silent switch options and more low-profile minimalist designs have made mechanicals more office-friendly than ever, an important driving force for the popularity’s explosion in the commercial and industrial sectors.

Mechanical Keyboard Market Regional Outlook:

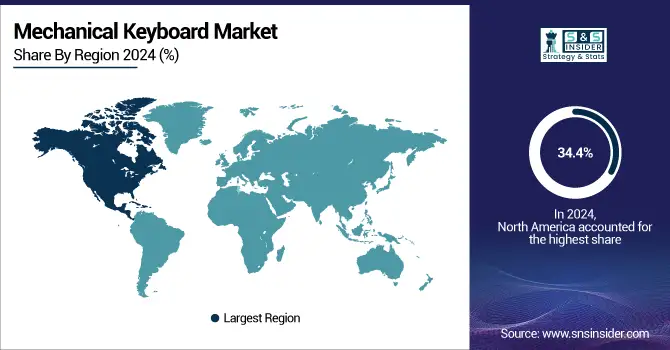

North America led the mechanical keyboard market with a 34.4% share in 2024, due to the presence of a well-established gaming ecosystem, increased adoption of advanced PC peripherals, and availability of tech-savvy consumer base. There is a broad e-sports culture in the region and a burgeoning market for high-end, custom keyboards for both gamers and professionals. Ergonomic and Performance keyboard have also increased in the home office due to remote and hybrid work environments. Additionally, the proliferation of prominent peripheral manufacturers and strong online and retail distribution channels have further corroborated positive market growth. Ongoing developments with high consumer demand for quality and a smooth typing experience will help the region continue to maintain its dominance in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

With its huge gaming population, better e-sports infrastructure, high disposable income and a tendency to adopt modern tech accessories way before the rest of the planetary inhabitants, the U.S. has decidedly dominated the North American mechanical keyboard market; this is further driven by the rampant rise of remote work, fuelling demands for premium, ergonomic keyboards.

The mechanical keyboard market is expected to register the fastest CAGR of 13.81% over 2025-2032 in Asia Pacific. An ever-growing population of gamers, increasing internet access and increasing disposable incomes will help drive this growth. High-performance peripherals, catering to an increasing demand in the region, particularly among younger consumers and tech lovers. Other key factors include rising demand for ergonomic typing solutions and an expanding work-from-home culture. Furthermore, trends towards customization, RGB lighting, and wireless features are bringing in a wider variety of consumers.

China held the largest share in the Asia Pacific mechanical keyboard industry, owing to its large gaming community and strong manufacturing sector, rising urbanization, and growing demand for performance-based high-end technology items. A highly developed e-sports industry and plethora of e-commerce platforms further underpin its position.

Driven by a large gaming culture and an integration of technology into work environments, Europe is an important market for mechanical keyboards. This growth is primarily driven by growing awareness regarding the ergonomic benefits of ergonomic keyboards and the rising demand for customizable keyboards by professionals and gamers. This is because the region has a long-standing retail and wider e-commerce structure that can facilitate an easier access of gaming peripherals which are usually higher in quality. They are also experiencing a growing e-sport participation rate and a rising remote work trend that spike the demand for premium mechanical keyboards in Europe.

Latin America and Middle East & Africa (MEA) are two emerging markets for mechanical keyboards as there are rise in disposable income and interest of gaming and technology entertains individuals. With the growing penetration of the internet and the increase in e-commerce platforms, high-end peripherals become increasingly accessible. The increasing population of young people is one of the most important factors leading to growth of the e-sports market. Still, low awareness and adoption continue to provide greater prospect for education and market development in developing markets where demand for high-performance and ergonomics keyboards should soon grow, following trends seen in more mature markets.

Key Players:

Some of the major Mechanical Keyboard companies are Corsair, Razer, Logitech, SteelSeries, Keychron, Ducky, HyperX, Glorious PC Gaming Race, Varmilo, and Cooler Master and others.

Recent Developments:

-

In November 2024, Corsair launched Mac-specific versions of its K65 Plus Wireless keyboard and M75 mouse, featuring pre-lubricated MLX Red v2 switches and Mac-specific key layouts.

-

In June 2024, Logitech unveiled the G515, a low-profile mechanical keyboard aimed at high-performance gaming, featuring a slim design and responsive switches.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.97 Billion |

| Market Size by 2032 | USD 5.26 Billion |

| CAGR | CAGR of 13.12% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Non-Tactile Linear Switches, Tactile Non-Click Switches, and Tactile Click Switches) • By Connectivity (Wired Keyboards, and Wireless Keyboards) • By Application (Gaming, and Office/Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Corsair, Razer, Logitech, SteelSeries, Keychron, Ducky, HyperX, Glorious PC Gaming Race, Varmilo, and Cooler Master. |