Smart Advertising Market Size & Trends:

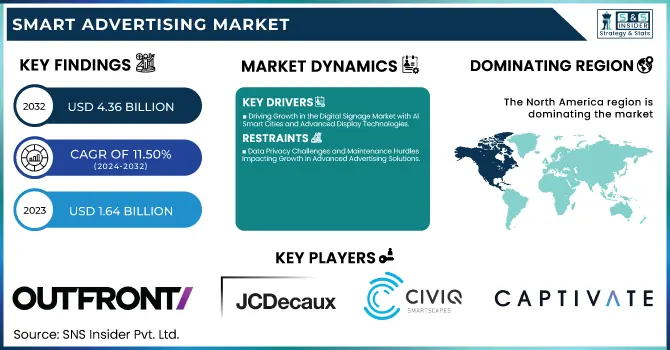

The Smart Advertising Market Size was valued at USD 1.64 billion in 2023 and is expected to reach USD 4.36 billion by 2032, growing at a CAGR of 11.50% over the forecast period 2024-2032. The Smart Advertising Market has many advances that are marching along with technological development in the future. Real-time statistics allow advertisers to monitor impressions, engagement rates, and conversions to gain campaign insights and improve performance over time. Targeting & Reach are improved based on geolocation data, which means that ads will appear in some of the most visited places you can imagine.

To Get more information on Smart Advertising Market - Request Free Sample Report

For operational & infrastructure, integrated cloud-based content management systems are being adopted and IoT-enabled displays are used to streamline content delivery and system maintenance. On the other hand, content effectiveness is propelled by smarter content optimization, AI-powered personalization, and elements to brace interactive viewing that deepens engagement and engage better brand recall.

Smart Advertising Market Dynamics

Key Drivers:

-

Driving Growth in the Digital Signage Market with AI Smart Cities and Advanced Display Technologies

The increasing adoption of digital signage solutions across various industries is a major factor driving the growth of the portable digital signage market as it allows organizations to attract the attention of end-users by delivering content in an engaging format. Increasing the use of AI and data analytics in advertising platforms is perfecting the targeted marketing strategies, improving customer engagement, and marketing ROI. Moreover, growing investments in the development of smart city projects, which, in turn, are boosting the demand for digital billboards, interactive kiosks, and other smart advertising solutions, are further propagating the growth of the digital signage market. Moreover, the increasing speed of growth in the retail sector along with the trend for customized consumer experiences foster the market expansion. In addition, progress in display technologies like OLED, LED, and 4K are enhancing the visual quality, drawing advertisers towards digital modes.

Restrain:

-

Data Privacy Challenges and Maintenance Hurdles Impacting Growth in Advanced Advertising Solutions

There are several restraints such as data privacy issues related to personalized advertisement. With advanced advertising solutions utilizing AI, IoT, and data analytics to provide tailored content, the apprehension for user data collecting and privacy safeguarding is also surging. Regulations like GDPR and CCPA are stricter and obligate businesses to implement strong data security measures, complicating marketing strategies. Moreover, the requirement for regular content updates and maintenance creates operational challenges, especially for resource-constrained businesses or those lacking technical proficiency.

Opportunity:

-

Unlocking Growth Opportunities in Smart Advertising with IoT Real-Time Data and Digital Transformation

Strong IoT and real-time data analysis in smart advertising cannot be ignored for the opportunity it has to offer and capitalize on. They provide advertisers with the ability to serve targeted content derived from customer behavior, demographics, and geographical location, which makes a campaign much more effective. Thirdly, the increasing trend of programmatic advertising provides another opportunity for growth in automating billboard advertisement placement and allowing for real-time bidding to reach the desired audience. Also, the rising acceptance of digital posters over traditional posters in indoor areas, such as malls, restaurants, or events arenas, is estimated to provide potential opportunities as well. Room for market growth is also available with expanding digital transformation initiatives in developing regions, particularly in the retail, healthcare, and transportation sectors.

Challenges:

-

Overcoming Integration Technical Issues and Workforce Gaps in Advanced Advertising System Deployment

There is a further technical difficulty involved in combining intelligent advertising systems with existing infrastructure. Integrating hardware, software solutions, and content management systems for seamless connectivity can be difficult to synchronize, particularly among larger deployments. Moreover, hardware repair problems like display faults, connectivity problems, or environmental deterioration can affect system work. This creates challenges with adoption in industries like retail and hospitality, where uptime is critical to customer experience. Finally, deploying advanced advertising solutions and analyzing complex campaign data creates a shortfall in skilled professionals, which is a workforce issue, especially for small and medium-sized enterprises (SMEs). These challenges need to be overcome for the market to continue growing.

Smart Advertising Market Segmentation Outlook

By Component

The hardware segment held the largest share of the smart advertising market in 2023, being 47.5% of the overall market share. The high demand for digital billboards, interactive kiosks, and digital signage displays in industries such as retail, transportation, and hospitality is attributable to this segment growth. The significant hardware market share was also attributed to the increased adoption of LED and OLED display technology.

The software type segment is expected to hold the fastest CAGR between 2024 and 2032. The increasing adoption of AI analytics, content management systems (CMS), and cloud-based platforms allows the processing of data in real-time & permits personalized advertising to emerge this growth. With businesses slowly shifting focus towards ubiquitous marketing as well as dynamic content delivery, the demand for smart advertising software is also anticipated to boost the growth of the associated market, in turn creating new growth opportunities worldwide.

By Product

The digital billboard segment is expected to hold the largest share at 41.5% of the smart advertising market in 2023. When you look at the market drivers behind this dominance, it was largely due to the trend in multiple digital billboard placements including highways, shopping centers, and transportation hubs. The market is high on its strong market positioning ability to display dynamic content give better visibility and enable better engagement.

The digital poster category is expected to experience the highest CAGR during the forecast period (2024 – 2032) The growth is primarily due to the increasing demand for cost-effective and flexible advertising solutions in indoor environments such as retail shops, restaurants, and event venues. Digital posters have become preferable as they are highly suitable for updating content with ease and have energy-efficient solutions while also being a digitized form of poster choice that aids businesses in their marketing solutions that focus more towards custom-specific audiences and create unique selling points through appearance which has visual elements.

By End Use

In 2023, the corporate segment represented the largest share of the smart advertising market with 36.7% of the total smart advertising market. The growth in this segment was bolstered by the high penetration of digital signage solutions across corporate offices, conference rooms, and business events to improve communication, branding, and employee engagement. They were followed by the growing emphasis on digital transformation in business ecosystems, which boosted the propensity for smart advertising implementations.

The food & beverage segment is expected to register the highest CAGR in the forecasted period 2024 to 2032. Digital menu boards, interactive displays, and promotional screens are being adopted in restaurants, cafes, and fast-food chains, which is driving this growth. Such solutions also allow businesses to display dynamic content, update menus in real-time, and engage customers, which is predicted to fuel a positive growth outlook for the food & beverage segment.

Smart Advertising Market Regional Analysis

North America was observed to be the leading region in smart advertising having 35.8% of the total market share in the year 2023. This is due to the availability of a well-established digital infrastructure, significant adoption of AI-driven advertising solutions, and prominent industry players in this market in the region. We have seen digital billboards in the US, especially in such busy hubs as the New York Times Square or Las Vegas Strip in which advertisers can benefit from dynamic content for large audiences. Big box retailers such as Walmart and Target are also heavy users of digital signage for in-store marketing that drives engagement. This has further pushed North America to the front row of the market with growing interactive kiosk usage at international airports and public places.

The Asia-Pacific region is expected to grow at the highest CAGR from 2024 to 2032. This growth is primarily attributed to continuous investments in smart city initiatives and also accelerate towards digitalization in countries namely China, India, and Japan. Entire businesses and practices have shifted, from the gigantic digital billboards at Tokyo's Shibuya Crossing that promote brands to fast-food chains in India adopting digital menu boards to optimize the in-store customer experience. It is due to the expanding retail space and some more factors, i.e. Increasing demand for personalized content by the consumer in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Smart Advertising Market are:

-

Outfront Media, Inc. (Billboard Advertising)

-

JCDecaux Group (VIOOH Platform)

-

CIVIQ Smartscapes (Smart City Kiosks)

-

Captivate, LLC (Office Elevator Displays)

-

Intersection (LinkNYC Kiosks)

-

Exterion Media Limited (Transport for London Advertising)

-

Clear Channel Outdoor Holdings, Inc. (Digital Billboards)

-

Lamar Advertising Company (Digital Transit Displays)

-

IKE Smart City (Interactive Kiosks)

-

Changing Environments, Inc. (Smart Urban Furniture)

-

Coniq (IQ Reach Platform)

-

InMobi (Pulse Consumer Insights)

-

Proxim.ai (Audience Location Analysis)

-

The Trade Desk (Programmatic Advertising Platform)

-

Integral Ad Science (Ad Verification Services)

Recent Trends

-

In February 2025, JCDecaux Top Media expanded its presence in Latin America by acquiring High Traffic Media, strengthening its digital out-of-home advertising network in Panama’s high-traffic locations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.64 Billion |

| Market Size by 2032 | USD 4.36 Billion |

| CAGR | CAGR of 11.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Product (Interactive Kiosk, Digital Billboard, Digital Poster, Others) • By End Use (Corporate, Government, Education, Food & Beverage, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Outfront Media, JCDecaux Group, CIVIQ Smartscapes, Captivate, Intersection, Exterion Media, Clear Channel Outdoor, Lamar Advertising, IKE Smart City, Changing Environments, Coniq, InMobi, Proxim.ai, The Trade Desk, Integral Ad Science. |