Intelligent Voice Control Chip Market Size & Trends:

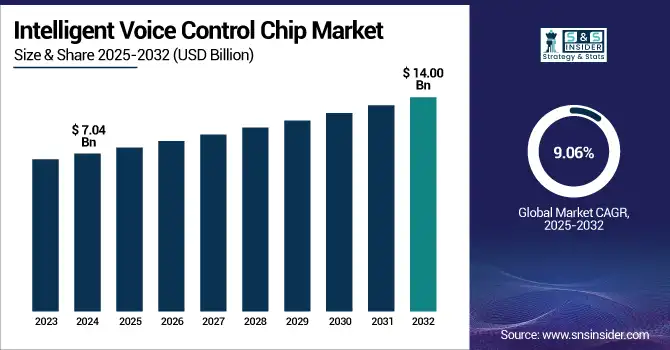

The Intelligent Voice Control Chip Market Size was valued at USD 7.04 billion in 2024 and is expected to reach USD 14.00 billion by 2032 and grow at a CAGR of 9.06% over the forecast period 2025-2032.

To Get more information on Intelligent Voice Control Chip Market - Request Free Sample Report

The global intelligent voice control chip market is witnessing consistent growth fueled by increasing use of voice-enabled devices in consumer electronics, automotive systems, and smart home solutions. Voice recognition capabilities are propelled by the incorporation of AI and edge computing, boosting demand across industries. Enhancements in high-efficiency and low-power chips are also propelling the wide adoption in IoT and connected environments.

According to recent research, the number of digital voice assistants in use is expected to reach 8 billion in 2024. Despite being accessible everywhere, three out of every four consumers (74%) are using their mobile voice assistants at home.

The U.S. intelligent voice control chip market size was USD 1.10 billion in 2024 and is expected to reach USD 2.18 billion by 2032, growing at a CAGR of 9.05% over the forecast period of 2025–2032.

The U.S. market is growing progressively on the strength of broad consumer voice assistant utilization across consumer devices, automotive platforms, and smart homes. Industry expansion is powered by improved artificial intelligence voice processing technologies, the higher demand for free hands inputs, and massive funding for intelligent technology. Market progress also relies on innovation through the efforts of prominent domestic semiconductors.

According to a research, over 50% of households in North America now use voice-enabled devices, with Alexa and Google Assistant leading as the most widely adopted platforms.

Intelligent Voice Control Chip Market Dynamics:

Key Drivers:

-

Rising Integration of Voice Assistants in Consumer Electronics Accelerates the Market Expansion

The growing integration of intelligent voice assistants, such as Amazon Alexa, Google Assistant, and Apple Siri in consumer devices is driving the intelligent voice control chip market growth considerably. Consumers are soon adopting smart speakers, TVs, smartphones, and wearables with in-built voice interaction functionality for greater convenience and hands-free usage. Manufacturers are incorporating sophisticated voice control chips to address the burgeoning demand for responsive and accurate voice interfaces. With user preferences shifting toward hassle-free human-machine interaction, OEMs are putting more focus on embedded voice technologies, in turn driving chip innovations. This intelligent voice control chip market trend is set to continue, making consumer electronics the core application area within the Intelligent Voice Control Chip Market.

According to research, in 2024, Google Assistant leads with 88.8 million users, while Amazon Alexa consumes about 36MB of bandwidth daily.

Restraints:

-

Limited Infrastructure and Connectivity in Emerging Regions Restricts the Adoption of Intelligent Voice Control Chips in Smart Devices

The use of smart voice control chips depends on stable internet infrastructure and stable power supply, particularly when cloud processing is used. In most emerging and underdeveloped countries, limited broadband penetration, unreliable electricity, and low smartphone penetration restrict the uptake of smart, voice-controlled products. Even in high mobile usage markets, poor network quality impacts the responsiveness and efficiency of voice interfaces. This infrastructure shortage limits market development, especially in rural regions where voice technology has the most to gain. With no upgrading of digital infrastructure, producers are at a disadvantage for expanding voice chip technologies in such high-potential areas.

Opportunities:

-

Expansion of Smart Home Ecosystems Presents a Significant Opportunity for Voice Chip Integration in Everyday Connected Devices

As people spend money on connected systems, smart locks, lighting, appliances, and HVAC systems, the demand for voice control that responds quickly and is localized is on the increase. Voice chips provide easy-to-use, hands-off control, maximizing user experience and ease of access. As more interest develops in secure and personalized smart surroundings, chipmakers are creating tiny, power-conscious solutions specifically for embedded smart home uses. This trend toward local edge voice processing creates new paths for innovation and market growth, especially as interoperability and privacy become consumers' highest priorities.

Challenges:

-

Ensuring High Voice Recognition Accuracy in Noisy and Multilingual Environments Remains a Key Technical Challenge for Chip Developers

Consistently accurate voice recognition across many different real-world environments continues to be a major challenge for chip makers. Background noise, dialects, multiple languages, and simultaneous speech inputs can impair system reliability and user satisfaction. Chips need to be designed to screen out ambient sound, recognize diverse voice patterns, and function well in both quiet and noisy environments. Additionally, automotive, factory, and public space applications call for greater robustness. Making performance stable and cloud independent is also an added complexity. Substantially defeating these engineering challenges with minimal power draw and responsiveness in real-time is important for building expanded applications and keeping user confidence intact.

Intelligent Voice Control Chip Market Segment Analysis:

By Type

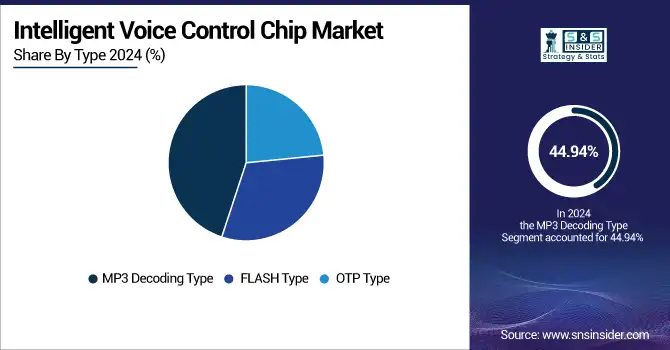

The MP3 decoding type segment dominated in the intelligent voice control chip market with a 44.94% revenue share in 2024, fueled by its capacity for delivering high-fidelity audio play in compressed audio formats. Such dominance is projected in smart speaker, automotive infotainment system, and portable media device applications. Players, such as Conexant have been at the forefront of this segment, and their AudioSmart™ CX20921 Voice Input Processor, embedded in Amazon's AVS development kit, represents the cutting edge in far-field voice processing and MP3 decoding capabilities. Equally, SigmaTel's STMP35xx SoC, which was common in MP3 players, reflected the combination of low-power MP3 decoding and voice features. These innovations highlight the segment's importance in contributing to user experiences in a range of voice-enabled devices.

The FLASH type segment is expected to the fastest CAGR of 10.21% during the forecast period of 2025-2032 due to its reprogrammability and flexibility in dynamic applications. The demand is driven by the need for high update frequency devices and customized voice commands, like smart home systems and car interfaces. Players including MediaTek have been pioneering, providing FLASH-based voice control solutions that have kept pace with changing consumer demands. Their partnership with VVDN Technologies to create AIoT solutions is reflective of the focus on updatable and flexible voice chip applications. As the trend is toward customizable and upgradable voice-controlled products, the growth pattern of the FLASH Type segment is set to pick up further.

By Application

The consumer electronics segment was the dominant contributor to the intelligent voice control chip market share with over 33.56% revenue in 2024. The segment’s expansion is driven by the widespread adoption of voice control functions in products like smartphones, smart TVs, and home appliances. Even manufacturers, such as LG, have continued to develop their AI-driven ThinQ platform to better their voice interactions across multiple products. In the same fashion, Sensory, Inc. has introduced technologies, such as TrulyHandsfree, for handsfree voice trigger across multiple consumer products. These breakthroughs showcase the importance of voice control chips to user experience, and highlight the advantages of this segment in the market.

The automotive segment is anticipated to grow with the fastest CAGR of 10.02% over 2025-2032 in the intelligent voice control chip market. The growth is driven by the rising need for hands-free, voice-controlled features in cars, improving safety, and convenience for drivers. Intelligent voice control chips companies, such as SoundHound AI have collaborated with car makers to embed sophisticated voice assistants in cars, with the voice assistants providing services including navigation, climate control, and entertainment through voice commands. Nio Inc.’s work on its Nomi AI system is also part of this movement towards custom voice assistants in automobiles. These developments underscore the massive potential of voice control chips in the emerging automotive environment.

Intelligent Voice Control Chip Market Regional Outlook:

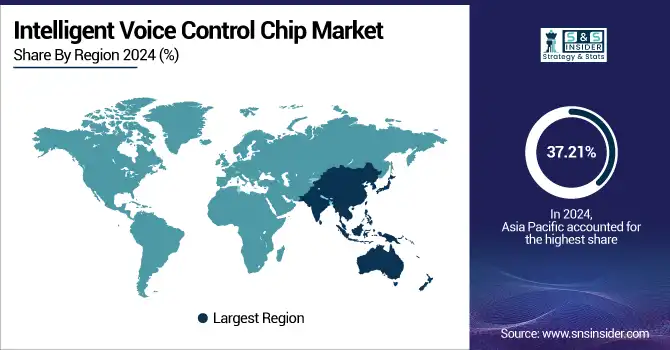

The Asia Pacific region dominated in market, with a 37.21% share revenue in 2024. This is due to the speedy embracement of smart devices and innovation in AI-based voice technologies in the region. Chinese players such as iFlytek have played a major role, launching platforms such as SparkGen and the Xinghuo 4 large language model, improving voice recognition quality. Besides, Unisound's creation of the Swift AIoT chip, in partnership with Baidu, indicates the region's focus on the convergence of AI and IoT technologies. These breakthroughs reflect Asia Pacific's central role in defining the future of voice-controlled applications in diverse industries.

-

China is the largest market in the Asia Pacific intelligent voice control chip market on account of a large manufacturing base of consumer electronics, huge market of AI-based control devices, and government support. Great enterprises, such as iFlytek, Baidu promote the innovation of the industry with the program of voice chip development.

North America is expected to have the fastest CAGR of 9.94% during 2025-2032 in the Intelligent Voice Control Chip Market. This development is fueled by the rising demand for sophisticated voice-enabled solutions across industries, such as automotive, healthcare, and consumer electronics. Leaders, such as SoundHound AI are leading the way, embedding their Chat AI platform into vehicles from manufacturers including Peugeot and Kia, optimizing in-car voice experience. Additionally, Sensory, Inc.'s TrulyHandsfree technology continues to lead the way in voice activation for a range of devices. These developments underscore North America's emphasis on promoting voice control technologies, cementing its role as one of the major growth areas in the industry.

-

The U.S. dominated the North American IVCC market due to high industrial development, implementation of new technologies and higherd investments in manufacturing and construction sectors. Huge players such as Sensory and SoundHound push forward, for example, in voice recognition and AI-based chip solutions.

European intelligent voice control chip manufacturers is projected to grow steadily, on account of escalating demand for voice enabled consumer electronics, automotive infotainment, and enterprise. This is being driven by the technological progress, and with a strong emphasis on energy-efficient, high-performance chip design. The U.K. is at the forefront of adoption, driven by smart devices and voice assistant integration powered by AI.

-

Germany leads the European Intelligent Voice Control Chip Market, supported by the presence of a robust semiconductor industry, high R&D spending, and technology leadership in voice recognition. The nation is a global leader in voice-enabled device uptake, and the likes of Infineon Technologies are pressing forward with chip production.

In the Middle East and Africa, and especially in the UAE, the market is expanding due to the increasing investment in AI and the support of the government. On the other hand, a steady growth from Latin America, especially Brazil due to the growing usage of voice communication technology in the different industry verticals.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Major players in the intelligent voice control chip market are ARC, Mouser Electronics, Mythic, UC-Davis, WayTronic, Chirag International, Dhwaj International, S M Semiconductors, Dongguan City Zhigan Electronic Technology Co., and Guangzhou Jiuxin Electronic Technology Co., Ltd.

Recent Developments:

-

October 2023, NXP's SLN-SVUI-IOT launched an RT106V MCU with integrated voice intelligent technology. It enables touchless voice user interfaces for IoT applications, supporting 360° far-field voice recognition up to 3 meters away.

-

November 2024, WayTronic's WTK6900H-24SS offers offline voice recognition with neural networks, accurate up to 5 meters, strong noise immunity, global language support, and is designed for high-performance speech recognition in smart devices.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 7.04 Billion |

| Market Size by 2032 | USD 14.00 Billion |

| CAGR | CAGR of 9.06% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (OTP Type, FLASH Type, MP3 Decoding Type) •By Application (Consumer Electronics, Automobile, Smart Lock, Kids Toys, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ARC, Mouser Electronics, Mythic, UC-Davis, WayTronic, Chirag International, Dhwaj International, S M Semiconductors, Dongguan City Zhigan Electronic Technology Co., Guangzhou Jiuxin Electronic Technology Co., Ltd. |