Gait Biometrics Market Size & Trends:

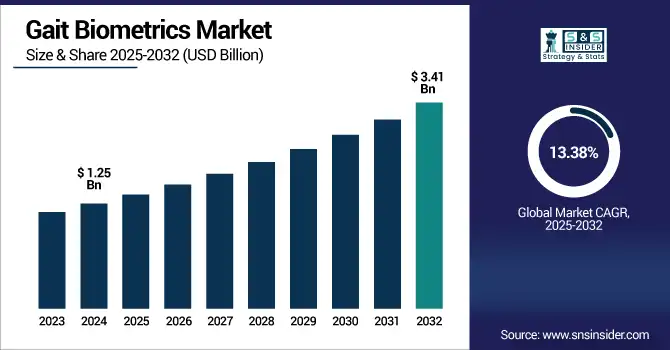

The Gait Biometrics Market size was valued at USD 1.25 Billion in 2024 and is projected to reach USD 3.41 Billion by 2032, growing at a CAGR of 13.38% during 2025-2032.

To Get more information on Gait-Biometrics-Market - Request Free Sample Report

The gait biometrics market is witnessing significant growth due to increasing need for non-intrusive and contactless process of identification. Gait recognition studies the signature and characteristic of walking of individuals, which is an alternative identifying method where facial or fingerprint recognition cannot be applied. The development of artificial intelligence, machine learning, and computer vision is contributing to making gait biometry accurate and scalable. The technology is being exploited in domains, such as security, elder care, sport analytics, and healthcare for applications, such as surveillance and fall detection. Its capability to run on normal video and not needing subject cooperation makes it well suited for real-time and passive surveillance. With growing privacy and security concerns, gait biometric is becoming an integral part of future biometric solutions.

China introduces AI-enabled gait recognition in big cities, allowing it to identify people by how they walk, even when their faces are hidden. Launched (pun intended) by Watrix, the 94% accurate system is a major step forward for gait biometrics, and a huge boon to surveillance and national security.

The U.S Gait Biometrics Market size was valued at USD 0.38 Billion in 2024 and is projected to reach USD 0.84 Billion by 2032, growing at a CAGR of 10.64% during 2025-2032. The Gait Biometrics market growth is primarily driven by increasing demand for convenient and secure person identification systems and growing advancements in AI and sensor technologies. Growth is further driven by rising penetration in public safety, healthcare applications, and border security, positioning gait biometrics as one of the fastest expanding sectors in the broader biometrics market.

Gait Biometrics Market Dynamics:

Drivers:

-

Growing Need for Contactless Identification Drives Gait Biometrics Growth

The rising demand for improved security measures alongside the need for seamless, non-intrusive identification are driving growth for the gait biometrics market. This make the technology suitable for high-pass, low-cooperation traffic, and security sensitive applications where individuals cannot cooperate. When combined with other forms of biometrics, such as 3D facial recognition, gait biometrics further contributes to the accuracy of an identification regime. Moreover, focus toward privacy-preserving characteristics and regulatory compliances would propel its adoption in various industries. With security systems globally, pushing the envelope in terms of automation, and ensuring a less intrusive verification process, gait biometrics is steadily emerging as a go-to solution for an effective, accurate, and efficient identity verification across a multitude of applications. This unique balance of convenience, security, and regulation landscape makes gait biometrics among the leading players for biometric authentication in the future.

Europe introduces the €3.2 Million PopEye Project, to test gait recognition to verify identity without contact on the EU outer border. The three-year program is intended to improve both safety and the customer experience with AI-driven, privacy-ensuring biometric tech.

Restraints:

-

Intensive Computational Demand Leads to Higher Costs and Hindered Real-Time Performance

Gait biometrics technology requires analyzing a sequence of images to accurately identify walking patterns, which demands significant computational power. This high-demand of processing involves high operational costs due to the need for more powerful hardware and software resources in processing the data efficiently. The problem is that many of the gait recognition systems cannot offer the real-time identification, and are not suitable for time-critical security applications. The need for high performance computing infrastructure may further limit deployment in resource-constrained, or mobile systems. However, despite its inherent advantages, the widespread application of gait biometrics is slowed down by a few limiting issues. Overcoming computational barriers is necessary to improve system speed, lower costs, and facilitate broader adoption in multiple application areas.

Opportunities:

-

Advancements in Humanoid Robotics Drive Expanding Gait Biometrics Market Opportunities

The rapid advancement in humanoid robotics, characterized by more natural and human-like walking patterns enabled by sophisticated AI and sensor technologies, is creating substantial growth opportunities in the gait biometrics market. Enhanced gait analysis is increasingly sought after across various sectors, such as industrial automation, security, healthcare, and robotics, where precise movement recognition is crucial. The continuous improvements in multi-sensor fusion and machine learning algorithms are expanding the application scope and improving the accuracy of gait biometrics systems. Additionally, growing investments in research and development and the push for more efficient, non-intrusive identification methods are accelerating market adoption worldwide. These factors collectively position gait biometrics as a vital technology for future smart environments and autonomous systems, promising significant commercial potential and technological innovation.

Engine AI’s SE01 Humanoid Robot, endorsed by Nvidia and funded by SenseTime, represents a new breakthrough in gait biometrics with its human walking pattern and sophisticated artificial intelligence, indicating rapid progress and intensifying competition in China’s robotics sector.

Challenges:

-

Complex Integration Processes Leading to Delayed Adoption of Gait Biometrics in Existing Systems

There are significant and inherent challenges associated with ergonomic integration of gait biometrics into current biometric systems and infrastructure and the commercial acceptance of such gait biometric products and services. A lot of existing security and identification schemes are based on older biometrics, such as fingerprint or facial recognition, which have their own data formats and protocols. Such incompatibility necessitates a great deal of customization, and it is time-consuming and cost expensive to be in effect. Furthermore, old hardware may not have the required sensors and the required computational capabilities to enable gait analysis and may require expensive retrofits. Complicated software integration also requires a particular set of skills to make it work smoothly and to any SQL or other data across platforms. The challenges of integrating these different technologies may put bottleneck the technology's potential to be used in security/ID applications and the technology's ability to be applied to other modalities along with gait biometrics.

Gait Biometrics Market Segmentation Analysis:

By Component

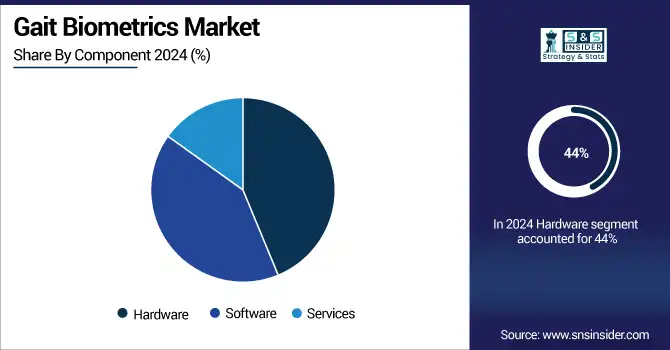

The Hardware segment held a dominant Gait Biometrics Market share of around 44% in 2024, owing to rise in the adoption of advanced sensors and cameras for capturing accurate movement data. The evolution of wearable technology and surveillance systems is driving this growth, which allows for more highly accurate and reliable gait recognition. Various systems for highlighting highlights depend on enhanced hardware, giving excellent performance and enable application also in security and in healthcare.

The Software segment is expected to experience the fastest growth in the Gait Biometrics Market over 2025-2032 with a CAGR of 15.53% driven by development of advanced AI and machine learning algorithms which improves gait analysis precision. Emerging need for real-time processing, cloud-based services, and the integration with other biometric systems is driving the software market growth. Growing market for software Software-based solutions are also gaining ground due to advancing data analytics and easy-to-use interfaces, and they are one of the primary forces shaping the developing gait biometrics market.

By Application

The Security and Surveillance segment held a dominant Gait Biometrics Market share of around 59% in 2024, which is increasingly used for public safety and crime deterrence. Demand is driven by increased use of advanced surveillance technologies by governments and private enterprises. Gait recognition allows non-contact remote identification, which is effective in crowded and high-risk scenarios, and has attracted a large amount of investment and innovation in this important application sector.

The Sports and Fitness segment is expected to experience the fastest growth in the Gait Biometrics Market over 2025-2032 with a CAGR of 19.52%, due to increasing awareness of health monitoring and performance optimization. Gait biometrics technology offers detailed movement analysis that helps athletes prevent injuries and improve training efficiency. Integration with wearable devices and fitness apps further drives adoption, making this segment a key growth area with high potential for innovation and personalized health solutions.

By End User

Security Agencies segment held the largest share in Gait Biometrics Market share of around 44% in 2024 and expected to fastest growing 13.02% during 2025-2032 owing to the increasing number of criminal activities and growing need for safety in public spaces are de-doubling the demand of gate recognition technologies. Biometric systems with cloud support play a vital role in government and private security sector, advanced and noninvasive authentication techniques, which can be used in developed countries to develop secure mechanism. This move toward advanced approach of identification is likely to drive the market substantially. For this reason, the Security Agencies sector is set to experience significant growth and lead to a growing demand for innovative gait biometrics solutions, in-line with the worldwide need for improved surveillance and threat detection tools.

Gait Biometrics Market Regional Outlook:

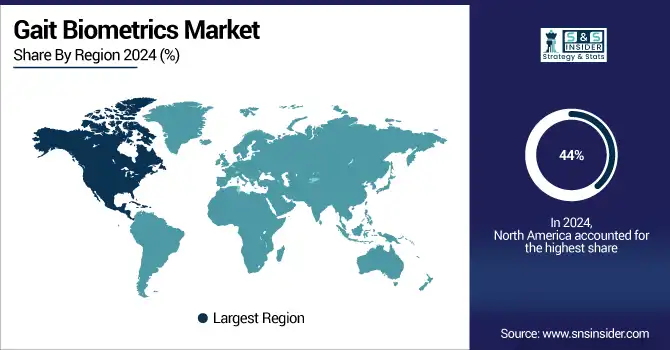

In 2024, the North America dominated the Gait Biometrics market and accounted for 44% of revenue share. The growth is fueled by rising investments on high-end security infrastructure and government programs encouraging the use of biometric. The industry in the region concentrates on promoting public safety and with technology progression at a developing stage and the growth in demand for contactless verification is encouraging the adoption of gait recognition systems across the sectors.

The Gait Biometrics market in the U.S. is developing because of emergence of new technologies in the security sector, government support in the form of various initiatives introduced in the economy, and increasing need for security.

Asia-Pacific is projected to register the fastest CAGR of 15.15% during 2025-2032, This growth is fueled by increasing investments in advanced surveillance technologies, rising demand for enhanced security, and expanding applications in healthcare and sports. Government support and technological innovations also contribute significantly to market expansion.

In 2024, Europe emerged as a promising region in the Gait Biometrics market, growing investments in biometric security solutions and stringent policies that are being enacted that are resulting in the improved privacy of data. Increasing adoption in healthcare and law enforcement end users, along with a greater emphasis on advanced border security in the region, had been driving demand. Advancements in AI and government support continue to accelerate the market growth prospects.

LATAM and MEA is experiencing steady growth in the Gait Biometrics market, owing to security issues and growing adoption of enhanced biometric technologies. Increasing investment in public safety infrastructure, increasing government initiatives, and rising awareness of identity verification solutions are propelling the market to grow. Furthermore, the developing technological potential and partnership with international tech players are considered enabling driving factors to promote continual market growth of these regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Gait Biometrics companies are NEC Corporation, Intel Corporation, Idemia SA, GaitBetter, Motek Medical, Noraxon USA Inc., MindMaze, Aratek, BioSensics, CIR Systems Inc. and Others.

Recent Developments:

-

In March 2024, NVIDIA unveiled its next-gen Blackwell GPU architecture at GTC 2024, aiming to supercharge AI and data center workloads. The launch signals NVIDIA's continued dominance in AI infrastructure following record-breaking revenue growth.

-

In September 2024, NEC launches a biometric system that identifies up to 100 people per minute using facial and movement analysis.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.25 Billion |

| Market Size by 2032 | USD 3.41 Billion |

| CAGR | CAGR of 13.38% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Application (Healthcare, Sports and Fitness, Security and Surveillance, Research, Others) • By End-User (Hospitals and Clinics, Research Institutes, Sports Academies, Security Agencies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The key companies operating in the Gait Biometrics market include NEC Corporation, Intel Corporation, Idemia SA, GaitBetter, Motek Medical, Noraxon USA Inc., MindMaze, Aratek, BioSensics, CIR Systems Inc., and others. |