Fire Sprinkler Systems Market Size & Trends:

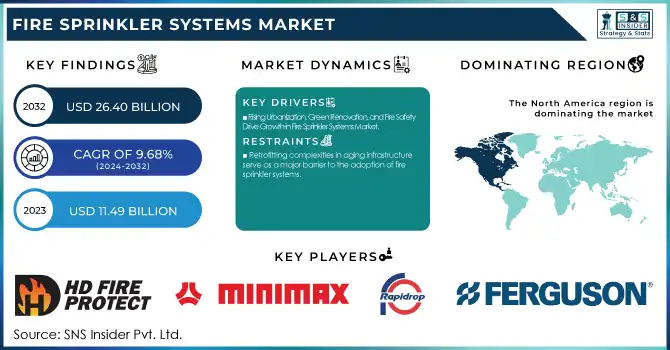

The Fire Sprinkler Systems Market size was valued at USD 11.49 Billion in 2023 and expected to reach USD 26.40 Billion by 2032, growing at a CAGR of 9.68% during 2024-2032. The fire sprinkler systems market growth is driven by growing fire safety standards, increasing installation of automated fire protection system and enhancing awareness about fire in residential, commercial and industrial sectors. Furthermore, vital performance metrics including failure and effectiveness rates, customer penetration rates, and regulatory compliance figures indicate the development of the market and the increasing dependency on fire sprinkler systems to avoid the breaking out of fire globally.

To Get more information on Fire Sprinkler Systems Market - Request Free Sample Report

Fire Sprinkler Market Dynamics:

Drivers:

-

Rising Urbanization, Green Renovation, and Fire Safety Drive Growth in Fire Sprinkler Systems Market

The global fire sprinkler systems market is witnessing significant growth, driven by rapid urbanization, increasing construction activities, and stringent fire safety regulations. Governments worldwide are investing heavily in infrastructure, including commercial and residential buildings, industrial facilities, and public infrastructure. In Europe, the EU’s Green Deal and Renovation Wave Strategy aim to renovate 35 million buildings by 2030, prioritizing energy efficiency while ensuring fire safety through advanced sprinkler systems.

Similarly, in the U.S., fire-related incidents remain a major concern, with an estimated 346,400 residential fires in 2021 causing 2,540 deaths and USD 8.21 billion in property losses. This has heightened awareness and regulatory enforcement for fire prevention measures, further accelerating market demand. As modern buildings integrate energy-efficient materials and smart technologies, the risk of fire incidents increases, necessitating the adoption of reliable sprinkler systems. Additionally, the construction sector’s expansion, combined with rising fire safety awareness and government funding initiatives, reinforces the market’s growth trajectory.

Restraints:

-

Retrofitting Complexities in Aging Infrastructure Serve as a Major Barrier to the Adoption of Fire Sprinkler Systems

Many older buildings were built before 21st-century fire safety codes, so installing sprinkler systems pose integration issues without extensive renovations. Space restrictions, antiquated plumbing systems, and poorly designed building structure present challenges to placing the required pipes and water supply features. Governments set further constraints on heritage and historical buildings through preservation laws that prevent transformation. Expensive retrofitting (labor, material, and fire codes compliance) deter property owners from upgrading fire safety measures. The issue and process is already complicated enough, which let normal business or residential operations disruptive alone. These challenges hinder the implementation of fire sprinkler systems in existing structures, especially in areas with heavy amounts of aging facilities that demand improved fire safety.

Opportunities:

-

Investment in Infrastructure Creates Growth Potential for the Fire Sprinkler System Market

Increased investment in infrastructure provides a significant opportunity for the fire sprinkler system market, driven by both government and private sector initiatives aimed at developing public facilities and transportation hubs. These investments demonstrate the need for contemporary fire protection systems that adhere to evolving safety legislation and community expectations.

The need to upgrade fire stations is long overdue, almost 20,000 fire stations in the U.S. are more than 40 years old, with an estimated USD 70 billion needed to modernize fire response systems and the issue has always been about more than just one fire station. To illustrate, alongside the trend of increasing demand for emergency management fire safety goals, Mountain View has budgeted USD 200 million toward a new public safety facility. As new constructions and retrofitting projects arise, the fire sprinkler system market is poised for robust growth, aligning with the ongoing focus on enhanced safety measures.

Challenges:

-

Maintenance and Logistical Obstacles Affecting Fire Sprinkler System Adoption

Fire sprinkler systems require consistent maintenance and inspections to ensure they operate effectively during emergencies, posing a significant challenge for the market. Furthermore, logistical issues, including scheduling inspections and working with certified professionals, can hinder compliance efforts. These obstacles may discourage potential buyers from investing in fire sprinkler systems, impacting overall market growth. It is essential to educate property owners on the long-term advantages of maintaining these systems, despite the related expenses, to encourage adoption and enhance fire safety standards across different sectors.

Fire Sprinkler Systems Market Segmentation Analysis:

By Component

In 2023, the product segment of the fire sprinkler systems market accounted for approximately 74% of the total revenue, underscoring its dominance within the industry. This segment encompasses various types of sprinklers, including wet, dry, pre-action, and deluge systems, each tailored to specific applications and environments. The increasing focus on fire safety regulations and the demand for advanced fire protection solutions in residential, commercial, and industrial settings have significantly driven this segment's growth. As property owners and businesses prioritize fire safety measures, the product segment's robust performance reflects the overall market's expansion, highlighting the necessity for efficient fire suppression systems that meet evolving safety standards and consumer expectations.

The services segment of the fire sprinkler systems market is projected to be the fastest-growing segment during the forecast period of 2024-2032. The demand for ongoing maintenance, inspections, and upgrades to comply with changing safety standards underpins this growth. As property owners and facility managers realize the necessity of having operable fire protection systems, the impulse toward service-related offerings, from installation to system testing and repair, is booming. Moreover, technological advancements (remote monitoring and smart systems) are promoting service contract deployments that offer long-term support. This fire sprinkler systems market trend is emblematic of a larger industry shift toward proactive management of fire safety, and it has played a significant role in the rapid growth of this segment and its importance in raising overall fire safety standards.

By Product

The Wet-Pipe Sprinkler System segment accounted for the largest fire sprinkler systems market share of approximately 54% in terms of revenue in 2023. The simplicity of the system, reliability and cost-effectiveness are all reasons for this dominance. However, they can also provide various advantages, including an active water-filled system that can help provide fast fire response to minimize the amount of damage and increase safety. The surging adoption of these systems in commercial, residential, and industrial areas, also boosts the market growth. In addition, strict fire safety regulations and growing awareness related to fire hazards are also propelling the demand for efficient fire protection solutions, further allowing the wet-pipe segment to account for the largest share of the overall fire sprinkler system market.

The Dry-Pipe Sprinkler System segment is projected to be the fastest-growing segment in the fire sprinkler system market over 2024-2032 as dry-pipe systems are increasingly deployed in freezing-prone conditions (unconditioned warehouses and outdoor facilities) where wet-pipe systems may fail, business owners need to protect their assets with effective detection and prevention systems. Dry-pipe systems are constantly filled with pressurized air, which helps in delivering water when a fire is detected, further ensuring effective protection in difficult conditions. Moreover, the surging advancements in technology including improved materials and enhanced detection mechanisms, are making the dry-pipe systems cost-effective and more efficient.

By End-Use

The commercial segment emerged as the dominant force in the fire sprinkler system market, capturing approximately 49% of the revenue share in 2023. This significant market presence rising attention paid to fire safety regulations, as well as, the escalation in the concern for fire hazards in commercial spaces. As commercial construction projects, especially in the retail, hospitality, and healthcare sectors, increase, so does the importance of comprehensive fire protection solutions. At the same time, companies are now realizing the need to protect their property, staff, and consumers from possible fire emergencies. These factors further boost market growth owing to strict regulatory frameworks and building codes requiring the installation of advanced fire sprinkler systems in commercial buildings. As companies prioritize safety, the integration of cutting-edge fire protection technologies and services in commercial properties is expected to continue, solidifying the commercial segment's leadership in the fire sprinkler system market.

The residential segment is poised to be the fastest-growing sector in the fire sprinkler system market during the forecast period from 2024-2032 due to increasing awareness both on home safety and fire hazards globally. With higher number of people moving into homes, there is expected to appear a higher demand for these fire protection solutions, mainly due to the implementation of strict building codes and regulations that encourage installation of the sprinkler system in new developments and refurbishments. Also, improvements in the technology behind sprinklers, such as ever more efficient and compact systems, make sprinklers easier to install and a more attractive option for homeowners. The push for smart home integration further complements this trend, with fire sprinkler systems becoming part of comprehensive home safety solutions.

Fire Sprinkler Systems Market Regional Outlook:

North America held a dominant position in the fire sprinkler system market in 2023, accounting for approximately 40% of the total revenue. This leadership is primarily driven by stringent fire safety regulations and building codes across the region, which mandate the installation of fire sprinkler systems in both commercial and residential properties. The U.S., particularly, has been proactive in enforcing these regulations, leading to increased adoption of advanced fire protection technologies. Additionally, the growing awareness of fire hazards and the need for enhanced safety measures contribute to market growth. The presence of key manufacturers and service providers in North America further strengthens the region's market dominance, ensuring continued innovation and improvements in fire sprinkler system solutions. As urban development continues, North America is expected to maintain its leading position in the fire sprinkler system market.

The Asia-Pacific region is projected to be the fastest-growing market for fire sprinkler systems during the forecast period over 2024-2032. Rising awareness for fire safety, rapidly growing industrialization, and urbanization in countries including Japan, China, India, and Australia are expected to drive the region’s growth. As cities grow and developers continue to break ground on new buildings, advanced fire protection systems are in demand. Regional governments are developing more strict regulations and standards regarding fire safety, which is likely to increase the adoption of fire sprinklers in commercial, residential, and industrial sectors. Increasing investments toward infrastructure development and disaster management initiatives are some additional factors that augment market growth. The presence of key manufacturers and innovative solutions tailored to local needs are also contributing to the rapid expansion of the fire sprinkler system market in the Asia-Pacific region, positioning it as a significant player in the market globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

Fire Sprinkler System Companies are:

-

HD Fire Protect Pvt. Ltd. (India - Fire Protection Systems)

-

Minimax GmbH & Co. KG (Germany - Fire Suppression & Protection Systems)

-

Potter Electric Signal Company, LLC (USA - Fire Alarm & Sprinkler Monitoring Systems)

-

Rapidrop Global Ltd. (UK - Fire Sprinkler Systems & Components)

-

Reliable (USA - Fire Sprinklers & Suppression Systems)

-

Victaulic Company (USA - Fire Protection Piping & Sprinkler Systems)

-

Viking Group Inc. (USA - Fire Sprinklers & Suppression Systems)

-

Cosco Fire Protection (USA - Fire Sprinklers, Alarms & Suppression Systems)

-

Ferguson Enterprises, LLC. (USA - Fire Protection Products & Plumbing Supplies)

-

Kaufman Fire Protection Services (USA - Fire Sprinkler & Suppression Systems)

-

American Fire Protection Group, Inc. (USA - Fire Alarm, Sprinkler & Suppression Systems)

-

Guardian Fire Protection Services, LLC (USA - Fire Extinguishers, Sprinklers & Alarms)

-

Fike Corporation (USA - Fire Suppression & Explosion Protection Systems)

-

Koorse Fire & Security (USA - Fire Alarm & Security Systems)

-

Honeywell International Inc. (USA - Fire Detection & Security Systems)

-

Emerson Electric Co. (USA - Fire Protection Controls & Automation)

-

Cintas Corporation (USA - Fire Protection Equipment & Safety Services)

List of Suppliers who Provide Raw Material and Component in Fire Sprinkler Systems Market:

Raw Material Suppliers

-

Nucor Corporation

-

Tata Steel

-

ArcelorMittal

-

U.S. Steel Corporation

-

Baoshan Iron & Steel Co., Ltd. (Baosteel)

-

JFE Steel Corporation

-

Thyssenkrupp AG

Component Suppliers:

-

Victaulic

-

Mueller Water Products

-

Anvil International

-

Reliance Worldwide Corporation (RWC)

-

Tyco Fire Protection Products

-

GF Piping Systems

-

Grinnell Mechanical Products

-

Nibco Inc.

-

ASC Engineered Solutions

-

BrassCraft Manufacturing Company

Recent News

-

June 22, 2024 – To resolve the interpretational issues of sprinklers (including fire water sprinklers), the GST Council has recommended a uniform 12% GST on all varieties of sprinklers. This decision, taken in the 53rd GST Council meeting, is expected to standardise tax classifications and de facto practices.

-

November 12, 2024 – Canadian company Wildfire Innovations Inc. has introduced the RainStream tower, a mobile sprinkler system designed for wildfire suppression. The telescoping steel tower can be towed by a pickup truck and deployed to create artificial rainfall, helping protect communities from approaching forest fires.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.49 Billion |

| Market Size by 2032 | USD 26.40 Billion |

| CAGR | CAGR of 9.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Product, Service) • By Product(Wet-pipe Sprinkler System, Dry-pipe Sprinkler System, Pre-action Sprinkler System, Deluge Sprinkler System) • By End Use(Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | HD Fire Protect Pvt. Ltd. (India), Minimax GmbH & Co. KG (Germany), Potter Electric Signal Company, LLC (USA), Rapidrop Global Ltd. (UK), Reliable (USA), Victaulic Company (USA), Viking Group Inc. (USA), Cosco Fire Protection (USA), Ferguson Enterprises, LLC (USA), Kaufman Fire Protection Services (USA), American Fire Protection Group, Inc. (USA), Guardian Fire Protection Services, LLC (USA), Fike Corporation (USA), Koorse Fire & Security (USA), Honeywell International Inc. (USA), Emerson Electric Co. (USA), and Cintas Corporation (USA). |