Game Streaming Market Report Scope & Overview:

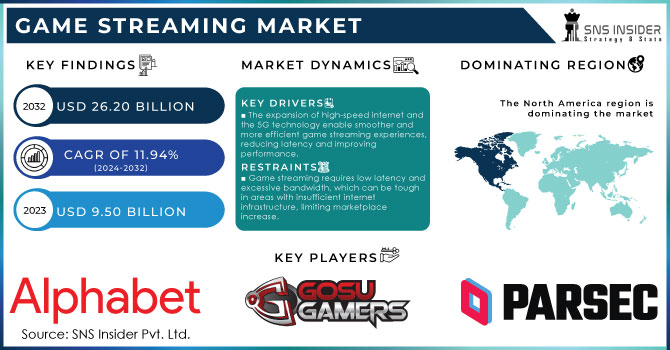

The Game Streaming Market size was valued at USD 9.50 Billion in 2023. It is expected to Reach USD 26.20 Billion by 2032 and grow at a CAGR of 11.94% over the forecast period of 2024-2032.

The rise of smartphones and portable devices fuels the mobile gaming industry, prompting game streaming services to adapt. The companies are developing specialized mobile apps for easy access, optimizing streaming technology to reduce latency on mobile networks, and modifying their platforms to enhance mobile gaming. They are also leveraging mobile-specific features like accelerometer inputs and touch controllers to enhance gameplay. Live streaming has increased in popularity, with Twitch at the forefront. Originally focused on gaming, Twitch is now increasing into music, talk shows, and creative content to remain competitive against opponents like Facebook Gaming and YouTube Gaming. Twitch's strong monetization options for streamers reinforce its market position. To enhance user experience, these platforms are incorporating interactive features like chatbots and polls to boost audience engagement. For instance, according to recent data, Twitch remains the dominant platform with over 2.5 million concurrent viewers daily. YouTube Gaming follows with around 1.4 million viewers. This indicates a high engagement rate, reflecting a strong audience base.

Get More Information on Game Streaming Market - Request Sample Report

Game streaming platforms are diversifying revenue streams beyond traditional subscriptions. They are adopting microtransactions, in-game purchases, and virtual goods sales, allowing users to customize their experiences and support developers. Hybrid models combining free-to-play content with premium subscriptions or ad-supported features cater to a wider audience. Online platforms are also placing importance on accessibility and compatibility across different platforms, allowing players to stream games through web browsers without needing to download applications, thus broadening access to high-quality gaming experiences. For example, the average time users spent watching game streaming platforms rose by 12% in 2023, reaching 2.5 hours per day. This demonstrates an increase in user interaction and consumption of content. In the video game industry, more than 3 billion active gamers globally, more than 50% of gamers globally are male, and they are taking their hobby to the next level by subscribing to at least one gaming service. The rise of esports is another indicator of the popularity of gaming, with the USA its boasting over 3,000 active esports players.

Market Dynamics

Drivers

-

The expansion of high-speed internet and the 5G technology enable smoother and more efficient game streaming experiences, reducing latency and improving performance.

-

The increase in the number of gamers and the growing availability of affordable gaming devices and mobile gaming boosts the demand for game streaming.

-

Continuous improvements in AI, machine learning, and other technologies are enhancing game streaming high-quality and experience, attracting more users.

The increasing high-speed internet deployment and 5G technology drastically drive the game streaming market. Fast internet allows for smooth streaming and seamless gaming experiences by minimizing latency and buffering issues. By 2024, the global average broadband speeds have increased to around 100 Mbps, with certain areas like South Korea and Hong Kong offering speeds over 200 Mbps. This increase in internet velocity directly improves game streaming by decreasing lag and enhancing responsiveness.

5G technology is predicted to similarly revolutionize game streaming. According to the latest study, 5G connections are projected to reach 2.3 billion by 2025, with 5G coverage increasing unexpectedly. The low latency and excessive data transfer rates of 5G, with theoretical speed up to 10 Gbps, offer a large development over preceding generations of mobile networks. This development supports high-definition game streaming and real-time interactions, making cloud gaming greater accessible and exciting. The improved network infrastructure, pushed by way of both high-pace broadband and 5G, as a consequence, plays an important role in improving the fine and attraction of game streaming services, fuelling the market.

Restraints

-

Game streaming requires low latency and excessive bandwidth, which can be tough in areas with insufficient internet infrastructure, limiting marketplace increase.

-

Users are regularly worried about the security of their private data and the ability for cyberattacks, that can deter them from adopting recreation streaming services.

-

Some game streaming services may have a limited selection of games compared to standard gaming platforms, which may reduce their attractiveness to gamers.

High latency and massive bandwidth requirements are great restraints in the game streaming market. Game streaming offerings rely on fast, consistent internet connections to deliver a smooth gaming experience. Based on a report from 2024, online gaming works best with latencies below 40 milliseconds, but some areas experience latencies exceeding 100 milliseconds, leading to gameplay interruptions. Moreover, for optimal performance, high bandwidth is necessary for streaming high-definition games, typically ranging from 20-30 Mbps for 1080p quality and up to 50 Mbps for 4K resolution. In regions with slower internet speeds or unstable connections, users may additionally encounter frequent buffering and quality degradation. The global average speed of broadband is around 100 Mbps, however, it varies drastically by region, with many growing regions lagging. This disparity in internet quality limits the adoption of game streaming services in areas with inadequate infrastructure, restraining overall marketplace growth.

Segment Analysis

By Solutions

The web-based segment held the largest share of the market in 2023 and accounted for 59.89% of the revenue share. Various online gaming streaming services have adopted subscription-based models, offering a wide game library for a monthly or yearly charge. This method corresponds to what consumers prefer in terms of subscription services, providing gamers with a cost-efficient and convenient option to play different games without buying each game separately. Subscription models offer platform providers and game developers a consistent and lasting source of revenue.

The app-based game streaming segment is also expanding, prompting developers and platform providers to optimize the gaming experience for mobile platforms. This involves making user interfaces intuitive and responsive on smaller screens, integrating tailored input methods such as touch controls and gamepad support, and ensuring smooth performance across various mobile hardware configurations and network conditions. Additionally, optimizing for diverse mobile ecosystems like iOS and Android, each with its unique capabilities and limitations, is critical for delivering a consistent and high-quality gaming experience across different devices. These efforts are essential for meeting the growing demand for mobile game streaming and ensuring a positive user experience.

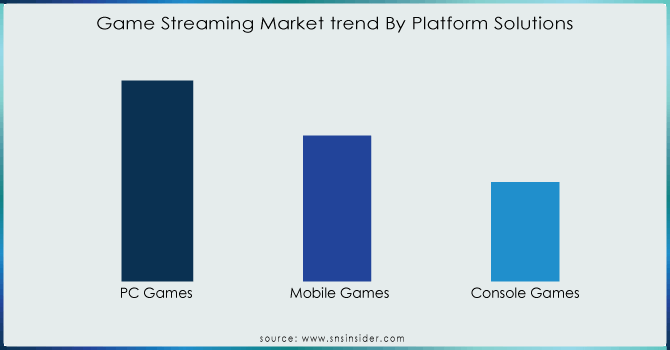

By Platform Solutions

In 2023, the PC games segment led the market with the highest share of revenue 47%. PC gaming is essential to the e-sports scene, providing famous titles like League of Legends, Counterstrike Global Offensive, and Dota 2. Streaming structures allow enthusiasts to look at excessive-degree competitive play, boosting interest and engagement. The e-sports activities industry is significantly growing, with sponsorships, advertising, and merchandise sales reaping rewards for each player and streamer, and also increasing the worldwide profile of PC gaming.

The mobile games segment grew with an annual growth rate of 12.01% during the forecast period, mobile games including PUBG Mobile, Clash Royale, and Free Fire are also making tremendous strides in the e-sports area, attracting more audiences and players. Prize pools within the mobile gaming e-sports atmosphere exceed $5 million. Additionally, mobile game streamers are exploring new strategies such as in-stream ads and viewer donations. Streamers can earn revenue by displaying ads for the duration of their broadcast or receiving tips from their audience, top streamers earning up to $100,000 annually. This trend allows streamers to create sustainable income streams while supplying visitors with ways to aid their preferred content material creators. The developing e-sports scene in both PC and mobile gaming continues to drive market boom and innovation.

Need any customization research on Game Streaming Market - Enquiry Now

Regional analysis

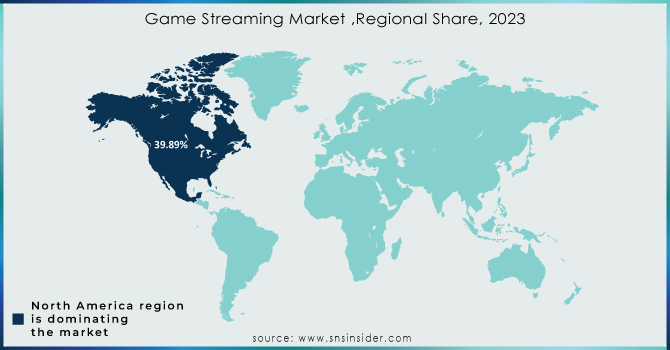

North America region dominated the game streaming market and held larges revenue share of 39.89% in 2023. North American streamers focus on making strong groups by using interacting with visitors in chat, creating Discord servers for discussions, and organizing community events, fostering viewer loyalty and engagement. In the U.S. game streaming market has experienced a tremendous boom due to platforms like Twitch, YouTube Gaming, and Facebook Gaming, which attract millions of visitors and content material creators. Major e-sports events and tournaments are frequently streamed on that platform, driving their growth.

Asia Pacific game streaming market is anticipated to grow with the fastest CAGR of about 12.05% from 2024-2032. This growth is driven by cloud gaming offerings like Google Stadia, which permit users to play high-demand video games without powerful hardware. In China, major platforms like Douyu, Huya, and Bilibili are famous. India’s market is developing due to the increasing adoption of smartphones and the affordable cost of mobile data, with cellular e-sports tournaments gaining recognition. Japan's market remains motivated by traditional gaming culture, with a focus on retro and nostalgia-driven content. In Europe, The UK market is growing with numerous monetization strategies, along with subscriptions and virtual item income. France specializes in accessible gaming experiences through cloud services and device optimization. Germany has come to be a significant e-sports hub, a website hosting fundamental tournaments and attracting huge audiences and investments.

Key Players

The Major players in the market are Meta Platforms Inc., Parsec Cloud Inc., GosuGamers, Alphabet Inc. (Youtube), Amazon.com Inc., NVIDIA Corp., AfreecaTV Corp., Apple Inc., Genvid Holdings Inc., Huya, Sony Group Corp., others in the final report.

Recent Developments

-

In January 2024, AfreecaTV announced its plans to launch a beta model of a brand-new live-streaming platform known as SOOP in the first 1/2 of the year. This move demonstrates AfreecaTV's determination to creating a dynamic and inclusive area where customers, streamers, and partners can actively make contributions to the evolution of the live-streaming network.

-

In August 2023, GeForce NOW launched the Ultimate KovvaK's Challenge, designed to assist gamers improve their aim while presenting a limited-time Steam discount. Utilizing its GPUs and superior software, GeForce NOW enhances customers' gaming experiences by excellent graphics quality. GeForce Experience, one of the offerings, is a gaming software that optimizes PC settings for individual packages, permitting gamers to capture and share their gameplay effects.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.50 Billion |

| Market Size by 2032 | USD 26.20 Billion |

| CAGR | CAGR of 11.94% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solutions (Web-based, App based) • By Revenue Model (Subscription, Advertisement, Others {Donations, Merchandise, Brand deals and sponsorships}) • By Platform Solutions (PC Games, Mobile Games, Console Games |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Practo, Google, Netflix, Inc., Meta Platforms Inc., Parsec Cloud Inc., GosuGamers, Alphabet Inc. (Youtube), Amazon.com Inc., NVIDIA Corp., AfreecaTV Corp., Apple Inc., Genvid Holdings Inc., Huya, Sony Group Corp. |

| Key Drivers | • The expansion of high-speed internet and the 5G technology enable smoother and more efficient game streaming experiences, reducing latency and improving performance. • The increase in the number of gamers and the growing availability of affordable gaming devices and mobile gaming boosts the demand for game streaming. |

| RESTRAINTS | • Game streaming requires low latency and excessive bandwidth, which can be tough in areas with insufficient internet infrastructure, limiting marketplace increase. |