Refrigeration Monitoring Market Size & Trends:

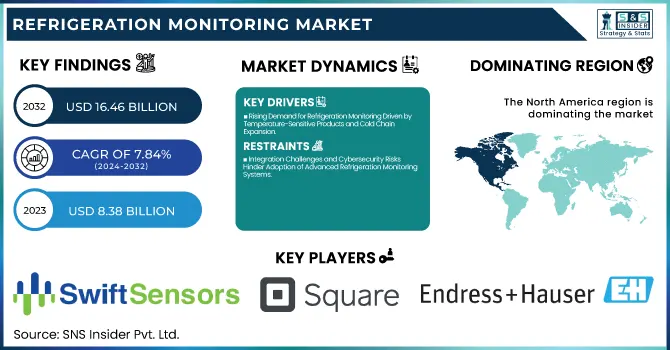

The Refrigeration Monitoring Market Size was valued at USD 8.38 Billion in 2023 and is expected to reach USD 16.46 Billion by 2032 and grow at a CAGR of 7.84% over the forecast period 2024-2032. Refrigeration monitoring Market dynamics are gradually changing, with increasing focus on parameters that can help improve the reliability and efficiency of refrigeration systems. Adoption & Penetration Metrics track the growing incorporation of smart sensors, IoT-enabled platforms, and cloud solutions across sectors.

To Get more information on Refrigeration Monitoring Market - Request Free Sample Report

Operational Metrics focus on system uptime, downtime minimization, and predictive maintenance efficacy during production to maintain continuous performance. Infrastructure & System Metrics monitor for network uptime of monitoring locations, data delivery and transfer, sensor calibration frequency, and system reliability. Finally, Performance & Efficiency Metrics can be used to track energy consumption, cooling efficiency, and response time and help industries enhance product safety by lowering wastage and analyzing the refrigeration condition of the products at every point in the supply chain process.

Refrigeration Monitoring Market Dynamics

Key Drivers:

-

Rising Demand for Refrigeration Monitoring Driven by Temperature-Sensitive Products and Cold Chain Expansion

A growing refrigeration monitoring market is impacted by an assortment of major forces Increasing the need for transporting temperature-sensitive products in sectors like food & beverages, pharmaceuticals, and chemicals is one of the key driving factors. As regulations tighten on the proper storage and transport of food, many companies are turning to new solutions to ensure the quality and safety of their products. The expansion of energy efficiency is also responsible for the increasing trend for smart sensors and IoT-based systems for real-time monitoring, predictive analysis, and alarms. Furthermore, the growing cold chain logistics industry, particularly for perishables and vaccines, is driving an increased need for monitoring technologies.

Restrain:

-

Integration Challenges and Cybersecurity Risks Hinder Adoption of Advanced Refrigeration Monitoring Systems

The advanced monitoring systems come with an integration complexity that is one of the most significant restraints. While IoT-based sensors and software platforms have evolved to allow them to be supported, many traditional refrigeration units will need extensive modification or upgrading to support modern functionality. This integration challenge can disrupt operations already established and be particularly relevant in industries where the infrastructure is less modern and flexible. Furthermore, connected solenoids present a significant challenge as they are more likely to be the target of a cyber-attack, putting sensitive data and operational control at risk. For businesses utilizing intelligent monitoring solutions, implementing strong cybersecurity standards is essential.

Opportunity:

-

AI Analytics and Cloud Solutions Drive Growth in Advanced Refrigeration Monitoring Market Opportunities

With plenty of market opportunities, especially towards AI-based analytics and cloud-based platforms which now allow data to be accessed freely and decisions accelerating accordingly. There is a great opportunity for growth in the adoption of wireless sensors for remote monitoring, particularly in the pharmaceuticals sector where even slight variations in temperature control can greatly impact the outcome. Novel trends like blockchain for traceability and sustainable cooling solutions are also opening up avenues to expand in the market. With businesses focusing on operational efficiency and compliance, advanced refrigeration monitoring systems are expected to experience significant growth in the next few years.

Challenges:

-

Workforce Shortage and Environmental Challenges Hinder Growth in Refrigeration Monitoring System Adoption

Another critical challenge is the absence of experts who need to work on sophisticated monitoring systems. While refrigeration monitoring technology continues to add features like predictive analytics, it can be difficult for businesses to locate skilled workers who can utilize the plethora of data these tools provide. In addition to this, environment-related issues associated with refrigerants and their possible contribution to global warming compel manufacturers to design eco-friendly alternatives, which demands constant technological up-gradation and regulations compliance. These obstacles can be overcome, however, as it would necessitate an expansion of industry-wide efforts towards better system compatibility, stronger cybersecurity frameworks, and workforce training for the refrigeration monitoring market to be successfully adopted and sustainably developed.

Refrigeration Monitoring Market Segments Overview

By Offering

The hardware segment dominated the refrigeration monitoring market and accounted for 62.8% of the total market share in 2023. Hardware components include sensors, controllers, data loggers, etc. They are essential for freezing systems to monitor and control efficiently. This is why it has a substantial market share. In industries such as food & beverages, pharmaceuticals, and chemicals, hardware solutions are extensively adopted since maintaining the right temperature conditions is essential.

The software segment is projected to witness the fastest CAGR from 2024 to 2032. This rapid growth is due to the growing need for cloud-based platforms, AI-based analytics, and IOT-based solutions which enable improved remote monitoring, predictive maintenance, and real-time data insights. The need for enhanced refrigeration monitoring software is projected to significantly increase, as businesses (e.g., butcheries, pharmacies, supermarkets, etc.) may want to use it to improve operational efficiency, compliance, and control.

By Sensor

In 2023, temperature sensors led the refrigeration monitoring market with a 31.7% market share, and the segment is anticipated to witness the fastest CAGR during the forecast years of 2024 to 2032. The supremacy is particularly attributed to the fact that temperature sensors are vital in ensuring optimum temperature conditions are maintained across industries that require such controls including food & beverages, pharmaceuticals, and chemicals. Indispensable in cold storage units, warehouses, and transportation systems, these sensors provide crucial data relating to product safety, product quality, and regulatory compliance. These smart sensors that provide real-time monitoring and alerting capability are being increasingly demanded and they are being increasingly adopted with their ability to provide remote access as part of their cloud solution. Furthermore, the growing demand for energy-efficient refrigeration systems, along with the need for IoT and AI-powered analytical systems to monitor, evaluate, diagnose, and address refrigeration issues is also expected to have a positive impact on the growth of the global temperature sensing solutions market during the forecast period to achieve optimal performance and higher operational efficiency.

By Application

The storage segment took up the largest market share in 2023 of the refrigerating monitoring market up 71.6%. Such dominance is mainly attributed to the high preference for refrigeration systems in warehouses, cold storage, supermarkets, and retail outlets to protect perishable items. Storage-based refrigeration solutions have high demand in industries like food & beverages, pharmaceuticals, and chemicals, which need to maintain product quality and stay compliant with safety regulations.

The transportation segment is anticipated to have the largest CAGR from 2024 to 2032. This growth is driven by rising demand for cold chain logistics in industries such as pharmaceuticals and frozen foods. The implementation of GPS-based tracking systems, constant monitoring, and temperature control solutions is improving the efficiency of transportation. The need to maintain the integrity of products being transported across the globe will be a key driver for the additional use of sophisticated refrigeration monitoring solutions.

By Industry

The refrigeration monitoring market by food & beverages segment accounted for the largest share of 42.6% in 2023. The dominance is due to the high utilization of refrigeration systems for food processing units, cold storage, supermarkets, and retail chains to store perishable products. Alternatively, the requirement for ideal temperature conditions for food and beverage in the supply chain, consumer safety, and regulatory compliance fuels the demand for monitoring technology in the food and beverage industry.

The pharmaceuticals segment expects the fastest car from the 2024-2032 period This expansion is driven by rising demand for temperature-sensitive drugs, vaccines, and biopharmaceuticals that need specific storage conditions. The growth in this segment, alongside regulatory compliance and product integrity, is further fueled by increasing investments in pharmaceutical cold chain logistics, and the adoption of automated alerts and IoT-enabled monitoring systems.

Refrigeration Monitoring Market Regional Analysis

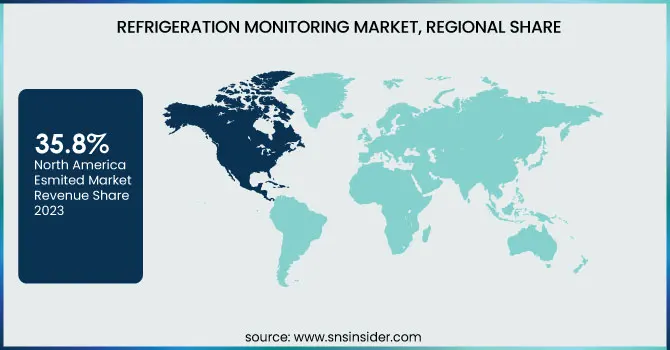

The refrigeration monitoring market in North America held the largest share with 35.8% in 2023. The high presence of core industries such as food & beverages, pharmaceuticals, and retail chains depending on significantly advanced refrigeration solutions drives the dominance. Strict regulatory standards such as FDA and USDA also drive regions to adopt monitoring systems to ensure product safety and compliance. Investments have also been made by supermarket chains, such as Walmart and Costco, to utilize smart refrigeration systems to improve food storage. Apart from these, pharmaceutical giants like Pfizer and Moderna are also using advanced temperature monitoring solutions to preserve the efficacy of temperature-sensitive vaccines and medications.

The Asia Pacific region is expected to witness the fastest CAGR from 2024 to 2032. The growing demand for cold chain logistics is positive, especially in major markets such as China, India and Japan where changes in food exports and drug production over the years have increased. Companies like Alibaba’s Freshippo, in China, are using smart refrigeration systems to optimize their fresh food supply chain. Likewise, India-based pharmaceutical companies are also working towards real-time monitoring technology to secure the safety of vaccines while being shipped and stored.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Refrigeration Monitoring Market are:

-

Frostrol (Controls)

-

Swift Sensors (Wireless Temperature Sensors)

-

SQUAIR (IoT Platform for Refrigeration Monitoring)

-

Endress+Hauser (Instrumentation and Process Automation Solutions)

-

Resource Data Management (RDM) (DMTouch Front-End Control & Monitoring System)

-

Atsuya Technologies (AI-Powered Refrigeration Monitoring Platform)

-

GlacierGrid (Real-Time Refrigeration Monitoring System)

-

AKCP (Wireless Temperature and Humidity Monitoring Solutions)

-

Emerson Electric Co. (X-Web Monitoring System)

-

Danfoss (Danfoss AK-SM 800A)

-

Honeywell International Inc. (ThermoRebellion Monitoring System)

-

ABB Ltd. (ABB Ability Refrigeration Monitoring)

-

Johnson Controls (Verasys Controls)

-

Sensaphone (Sentinel Monitoring System)

-

Rittal GmbH & Co. KG (Blue e+ Cooling Units)

Recent Trends

-

In January 2025, Emerson Electric introduced a new Dewpoint Sensor that provides real-time monitoring of humidity and air quality, enhancing reliability in gas processes for improved safety and efficiency.

-

In October 2024, Danfoss launched NeoCharge, an advanced solution designed to optimize industrial refrigeration systems, enhancing energy efficiency, performance, and system reliability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.38 Billion |

| Market Size by 2032 | USD 16.46 Billion |

| CAGR | CAGR of 7.84% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software, Services) • By Sensor (Temperature Sensors, Defrost Sensors, Touch Sensors, Liquid Level Sensors, Gas Detectors, Contact Sensors, Motion Detectors, Pressure Sensors, AC Current Meters, Water Detection Sensors) • By Application (Storage, Transportation) • By Industry (Food & Beverages, Pharmaceuticals, Chemicals, Hospitals, Residential, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Frostrol, Swift Sensors, SQUAIR, Endress+Hauser, Resource Data Management (RDM), Atsuya Technologies, GlacierGrid, AKCP, Emerson Electric Co., Danfoss, Honeywell International Inc., ABB Ltd., Johnson Controls, Sensaphone, Rittal GmbH & Co. KG. |