Gas Turbine MRO Market Report Scope & Overview:

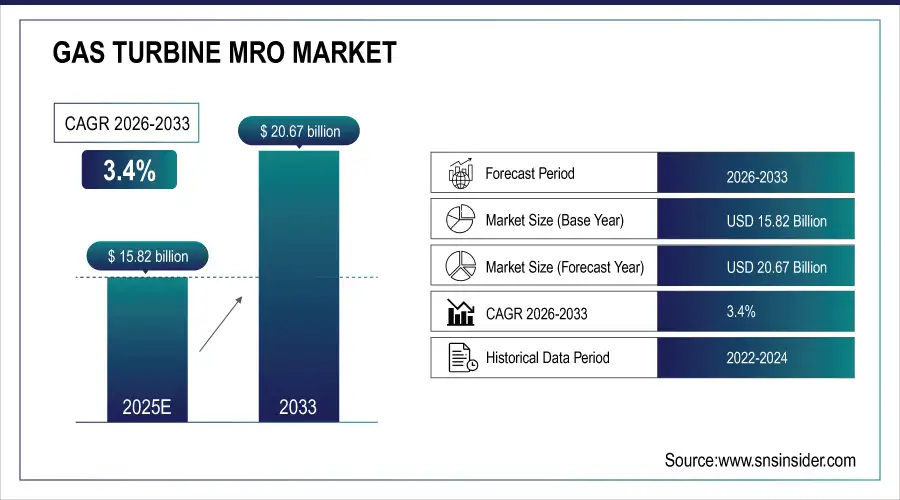

The Gas Turbine MRO Market size was valued at USD 15.82 billion in 2025E and is expected to grow to USD 20.67 billion by 2033 with an emerging CAGR of 3.4% over the forecast period of 2026-2033.

Gas turbine maintenance, repair, and overhaul (MRO) is a critical aspect of ensuring the efficient and safe operation of gas turbines. MRO involves a range of activities, including inspections, repairs, and replacements of components, as well as testing and monitoring of performance. Gas turbines are used in a variety of applications, including power generation, aviation, and industrial processes.

As such, the MRO requirements for gas turbines can vary depending on the specific application and operating conditions. Effective gas turbine MRO requires a combination of technical expertise, specialized equipment, and rigorous quality control processes. This ensures that gas turbines are maintained to the highest standards of safety and reliability, while also maximizing their operational efficiency and lifespan.

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 15.82 Billion

-

Market Size by 2033 USD 20.67 Billion

-

CAGR of 3.4% From 2026 to 2033

-

Base Year 2025

-

Forecast Period 2026-2033

-

Historical Data 2022-2024

To Get More Information on Gas Turbine MRO Market - Request Sample Report

Gas Turbine MRO Market Trends:

• Rising global energy consumption is driving higher operational hours of gas turbines, increasing the need for frequent MRO interventions.

• Power producers are accelerating investments in predictive maintenance powered by AI, IoT sensors, and digital twins to reduce downtime and optimize turbine performance.

• Advanced repair methods such as additive manufacturing, laser cladding, and automated component restoration are becoming more mainstream to extend turbine life.

• Operators are shifting toward long-term service agreements (LTSAs) and performance-based contracts to ensure cost predictability and improved reliability.

• Gas turbine fleets are being upgraded for higher efficiency and reduced emissions, creating demand for component retrofits, modernization programs, and technology-enhanced overhauls.

The U.S. Gas Turbine MRO market size was valued at an estimated USD 5.95 billion in 2025 and is projected to reach USD 7.75 billion by 2033, growing at a CAGR of 3.1% over the forecast period 2026–2033. Market growth is driven by the large installed base of gas turbines across power generation, oil & gas, and industrial applications, along with the need to extend equipment lifespan and improve operational efficiency. Increasing demand for reliable power supply, particularly from combined-cycle power plants, is supporting steady MRO activities. Additionally, advancements in digital maintenance solutions, predictive analytics, and condition-based monitoring, coupled with long-term service agreements and strong participation from OEMs and independent service providers, further reinforce the growth outlook of the U.S. gas turbine MRO market during the forecast period.

Gas Turbine MRO Market Growth Drivers:

-

Growing need for efficient and reliable power generation

-

Rise in industrialization across the globe

-

Growing demand for energy due to the rise in the population

The demand for energy is on the rise, and this is directly linked to the growing global population. As a result, the market for gas turbine MRO is experiencing a surge. According to the International Energy Agency, global energy consumption is expected to grow by 1.3% in 2023, despite a slowing economy and high energy prices. This demand has created a need for maintenance, repair, and overhaul services for gas turbines. Gas turbines are a crucial component of power generation, and they require regular maintenance to ensure they operate efficiently and effectively. As the demand for energy continues to rise, the need for gas turbine MRO services will only increase.

Gas Turbine MRO Market Restraints:

-

High cost associated with the maintenance and repair services

-

Complexity of gas turbine technology

The complexity of gas turbine technology poses a significant challenge for the gas turbine MRO market. This complexity can be attributed to the intricate design and operation of gas turbines, which require specialized knowledge and expertise to maintain and repair. Gas turbines are highly sophisticated machines that consist of numerous intricate components, including blades, rotors, and combustion chambers. These components must work together seamlessly to ensure optimal performance and efficiency. However, even minor issues with one component can have a significant impact on the overall performance of the turbine. Furthermore, gas turbines operate under extreme conditions, including high temperatures and pressures, which can cause wear and tear on the components over time. As a result, the maintenance and repair of gas turbines require specialized skills and knowledge, as well as access to advanced equipment and technology.

Gas Turbine MRO Market Segment Analysis:

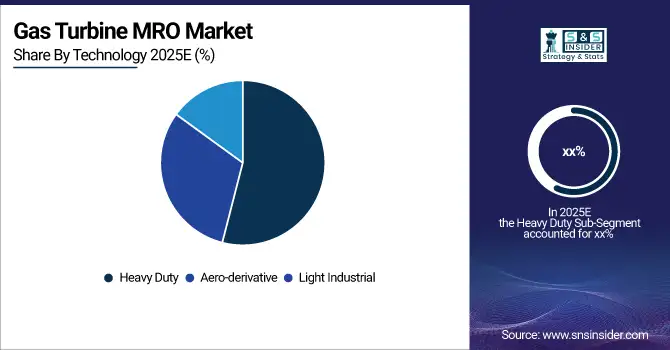

By Technology

The Gas Turbine MRO Market by technology type Heavy Duty, Aero-derivative, and Light Industrial is evolving rapidly as power producers focus on reliability, efficiency, and operational flexibility. Heavy-duty turbines dominate due to their widespread use in large power plants, resulting in strong demand for major overhauls and part refurbishment. Aero-derivative turbines are seeing rising adoption in oil & gas and distributed power applications, driving the need for faster, mobility-focused maintenance solutions. Light industrial turbines require frequent servicing due to their use in smaller industrial settings with variable load conditions. Across all categories, digital monitoring, predictive maintenance, and component upgrades are shaping future MRO demand.

By End-User

The Gas Turbine MRO Market by end user Oil & Gas, Manufacturing, Aviation, Power Utilities, and Others is expanding as industries prioritize efficiency, uptime, and operational continuity. Power utilities remain the largest segment, driven by the need to maintain aging turbine fleets and ensure stable electricity supply. Oil & gas companies demand frequent MRO services due to heavy turbine usage in upstream and midstream operations. Aviation relies on specialized turbine maintenance to meet strict safety and performance standards. Manufacturing facilities utilize turbines for onsite power and process needs, increasing routine servicing. Other sectors, including marine and commercial facilities, also contribute to steady MRO demand.

Gas Turbine MRO Market Regional Analysis:

North America Gas Turbine MRO Market Insights

In 2025, North America is a leading region in the gas turbine MRO market with the U.S. as the major contributing country to this dominance. Advanced technological infrastructure, skilled workforce, and favorable government policies. The United States, in particular, has a robust gas turbine MRO industry, with a significant number of companies specializing in this field. For Example, GE, Baker Hughes, Solar Turbines, etc. These companies have access to cutting-edge technology and equipment, allowing them to provide high-quality services to clients. Additionally, the country's favorable business environment and regulatory framework have created a conducive atmosphere for the growth of the gas turbine MRO market. Furthermore, North America's strategic location and well-developed transportation infrastructure make it an ideal hub for the gas turbine MRO industry. This has enabled companies in the region to efficiently serve clients across the globe, further contributing to the region's dominance in the market.

Do You Need any Customization Research on Gas Turbine MRO Market - Enquire Now

Asia Pacific Gas Turbine MRO Market Insights

Asia Pacific is expected to grow with the highest CAGR during the forecast period 2026-2033 in the gas turbine MRO market owing to the increasing demand for energy and the growing number of gas turbine installations in the region. Gas turbine MRO, or maintenance, repair, and overhaul, is a critical aspect of ensuring the longevity and efficiency of gas turbines. As the demand for energy continues to rise in the Asia Pacific region due to the increasing population in the emerging countries of the Asia Pacific like India, the need for reliable and efficient gas turbines becomes increasingly important. This has led to a surge in gas turbine installations, which in turn has created a significant demand for MRO services. Furthermore, the Asia Pacific region is home to several emerging economies, such as China and India, which are experiencing rapid industrialization and urbanization. This has resulted in a growing demand for energy to power factories, buildings, and transportation systems. As a result, the gas turbine MRO market in the region is expected to experience substantial growth in the coming years.

Europe Gas Turbine MRO Market Insights

Europe’s Gas Turbine MRO market is driven by the region’s shift toward cleaner power generation, modernization of gas-fired plants, and the integration of renewable energy systems. Many European countries operate aging turbine fleets that require frequent overhaul and component upgrades to maintain efficiency and meet strict emission regulations. The adoption of digital solutions such as predictive maintenance and remote diagnostics is strengthening MRO demand across utilities and industrial sectors. Additionally, increased focus on energy security, especially after regional geopolitical disruptions, has accelerated investments in maintaining and optimizing existing gas turbine assets. Industrial sectors, including manufacturing and chemicals, further support steady MRO growth.

Latin America (LATAM) and Middle East & Africa (MEA) Gas Turbine MRO Market Insights

The LATAM and MEA Gas Turbine MRO markets are expanding due to rising power demand, aging gas turbine infrastructure, and increasing reliance on gas-based generation to support industrialization and urban growth. In LATAM, countries like Brazil and Mexico are investing in refurbishing gas-fired plants to improve fuel efficiency and grid reliability. MEA remains a major market, driven by large-scale gas turbine deployments in oil & gas operations, power utilities, and desalination facilities. Harsh operating environments and high load factors further elevate maintenance needs. Strong government spending on energy infrastructure and industrial projects continues to boost long-term MRO demand across both regions.

Gas Turbine MRO Market Key Players:

The major players are Baker Hughes, Siemens, GE, Mitsubishi Heavy Industries, Solar Turbines, Bharat Heavy Electrical Ltd., OPRA Turbines, Kawasaki Heavy Industries, Ansaldo Energia, Sulzer Ltd, and other key players mentioned in the final report.

Competitive Landscape for Gas Turbine MRO Market:

Baker Hughes is a global energy technology company providing advanced solutions for oil & gas, power generation, and industrial sectors. The company delivers a broad portfolio of products and services, including gas turbines, compressors, digital monitoring systems, and maintenance and repair solutions. With a strong focus on efficiency, emissions reduction, and reliability, Baker Hughes supports customers in optimizing asset performance. Its global service network and technological expertise make it a key player in the Gas Turbine MRO market.

-

In April of 2024, Baker Hughes, a leading energy technology company, announced that it had been awarded a lucrative order to be booked in the first quarter of the same year. The order was granted by Black & Veatch, a subcontractor to the JGC and Samsung Heavy Industries consortium, and it was for the delivery of two LM9000-driven compressor trains. These compressor trains were to be used for the PETRONAS nearshore liquefied natural gas facility in Sabah, Malaysia.

Mitsubishi Power, a subsidiary of Mitsubishi Heavy Industries, is a leading provider of power generation technologies and energy solutions worldwide. The company specializes in gas turbines, steam turbines, boilers, and integrated power systems, supported by advanced digital and predictive maintenance tools. Mitsubishi Power is known for its high-efficiency turbine designs, low-emission technologies, and strong global service capabilities. Its comprehensive MRO offerings help utilities and industrial clients enhance reliability, performance, and lifecycle management of power assets.

-

Mitsubishi Power, a power solution brand of Mitsubishi Heavy Industries, Ltd. (MHI), has been making waves in the global gas turbine market. According to McCoy Power Reports data, the company captured the top market share by megawatts in 2022, with a global gas turbine market share of 33%. Additionally, Mitsubishi Power has secured an impressive 49% market share in the Advanced Class gas turbine market, thanks to the success of its latest model JAC (J-Series Air-Cooled) gas turbines.

| Report Attributes | Details |

| Market Size in 2025E | USD 15.82 Billion |

| Market Size by 2033 | USD 20.67 Billion |

| CAGR | CAGR of 3.4% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Heavy Duty, Aero-derivative, and Light Industrial) • By End-user (Oil & Gas, Manufacturing, Aviation, Power Utilities, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Baker Hughes, Siemens, GE, Mitsubishi Heavy Industries, Solar Turbines, Bharat Heavy Electrical Ltd., OPRA Turbines, Kawasaki Heavy Industries, Ansaldo Energia, Sulzer Ltd. |