Gate Openers Market Report Analysis & Overview:

The Gate Openers Market Size was estimated at USD 2.49 billion in 2023 and is expected to reach USD 4.31 billion by 2032, growing at a CAGR of 6.29% over the forecast period of 2024-2032. This report provides unique insights into the Gate Openers Market by offering detailed data on manufacturing output, utilization rates, and installation and maintenance costs across different regions. It highlights technological adoption trends, illustrating the pace at which smart and automated gate opener systems are being embraced globally. Furthermore, it includes an analysis of export/import data, revealing key trade movements and regional market dynamics. New trends such as the rise in sustainable materials and energy-efficient solutions for gate openers are also highlighted, positioning the market for future growth in a more eco-conscious landscape.

The U.S. gate openers market is expected to grow from USD 0.33 billion in 2023 to USD 0.60 billion by 2032, reflecting a compound annual growth rate (CAGR) of 6.78%. This expansion is fueled by the rising adoption of automated security systems in both residential and commercial properties. As technological advancements continue, the demand for efficient, secure, and convenient gate opening solutions is set to increase across various sectors.

Market Dynamics

Drivers

-

The rising adoption of smart home automation and IoT-enabled security systems is driving demand for advanced, remote-access gate openers.

The growing demand for smart home automation is significantly driving the gate openers market. As IoT (Internet of Things)-enabled systems become more common, the automated gate openers are seeing rising popularity as homeowners and businesses integrate them with smart security solutions. Characteristics such as remote access through smartphones, voice control using virtual assistants, and real-time monitoring have made these systems extremely appealing. And the growth of AI-powered facial recognition and geofencing tech is also driving adoption. The market is shifting towards wireless and solar-powered gate openers that are less reliant on traditional power sources, ensuring better energy efficiency. Smart cities and connected infrastructure are growing, Specialists predict a rise in demand for intelligent access control solutions. Emerging economies are quickly closing in on North America and Europe, the leaders in adoption. The global push for touchless and automated security systems after the pandemic further fuels this trend, making smart home compatibility one of the key growth factors for the gate openers market.

Restraint

-

The high initial cost and maintenance expenses of automated gate openers limit adoption, but advancements in energy-efficient and smart technologies are driving market growth.

Automated gate openers involve high initial costs, including the purchase, installation, and integration with smart security systems. These costs can present a hurdle, especially for residential customers and small enterprises working within financial constraints. Moreover, maintenance costs, including repairs, part replacements, and software updates for smart-enabled gate openers, contribute to the overall expenditure. While the technological developments are paving the way for cost-effective solutions, premium features such as remote access, biometric authentication, and solar-powered options also add to the cost. Still, the market is experiencing steady growth amid rising security concerns and higher adoption in residential, commercial, and industrial sectors. Manufacturers are working on energy-efficient and low-maintenance models to target a wider range of consumers. Furthermore, the advancing trend of smart automation and integration with IoT-based security systems is anticipated to open up new possibilities, which will cumulatively offset cost-related concerns and drive the demand for convenience and security.

Opportunities

-

The rising demand for solar-powered and energy-efficient gate openers is driving innovations that reduce electricity dependence, lower costs, and promote sustainability.

The growing demand for eco-friendly and energy-efficient solutions is driving innovation in the gate openers market, particularly with the rise of solar-powered models. With consumers and enterprises prioritizing sustainability and energy conservation, manufacturers are introducing gate openers that function on renewable power sources, minimizing dependence on traditional electricity. Solar-powered gate openers can significantly reduce carbon footprints and are also cost-effective as they do not require long wiring and grid power. He said such solutions would be able to reach areas that don't have access to electricity easily.

Furthermore, factors such as battery storage and low-power consumption technologies are improving these devices' efficiency and reliability. The growth in adoption via incentive schemes and policies put in place by governments/ environmental agencies driving green energies is further driving the market. With the growing focus on sustainability, manufacturers will likely launch more durable, smart, and self-sufficient gate opener systems in accordance with universal energy efficiency goals.

Challenges

-

Limited awareness, high costs, and lack of infrastructure in underdeveloped regions hinder the adoption of automated gate openers.

Limited awareness and affordability in underdeveloped regions pose significant challenges to the adoption of gate openers. Consumers and businesses in these areas do not yet understand the potential benefits of automated gates and may not have converted from manual gates despite them being inexpensive and easy to use. This is compounded by the economic pressures on individuals and small businesses, making it difficult to invest in automated solutions, especially without basic infrastructure such as stable electricity and internet connectivity. This, along with limited access to information about modern gate opener technologies, leads to lower market penetration as compared to costly marketing and distribution networks.

Additionally, in lower-income economies, costs of installation and maintenance may prove prohibitive. Manufacturers face certain challenges, the primary one being cost-effective solutions, localized marketing strategies, and dissemination via partnership with local distributors for product accessibility and awareness, which would boost adoption in underdeveloped markets.

Segmentation Analysis

By Product Type

The Linear Ram segment dominated with a market share of over 32% in 2023, This growth is attributed to increased usage in residential and commercial applications. This is a popular one because it is easy to install, cost-effective, and reliable in maintaining a smooth operation of your gate. Linear style Ram gate openers are a popular choice for swing gates since they use a simple, effective mechanism that can be easily maintained. Moreover, the capability of sliding gate openers to accommodate heavy-duty gates makes them a practical option for both residents and companies looking to improve security. Moreover, the rising trend of deployment of automated entry systems and smart home technologies is also propelling the segment growth. The Linear Ram segment still dominates the market due to its cost-effectiveness and ease of use.

By Application

The Commercial segment dominated with a market share of over 48% in 2023, owing to the extensive deployment of automated gate systems across office buildings, shopping malls, hotels, and business complexes. With the growing number of commercial premises being built, gate openers are becoming an essential investment for such establishments that also prioritize security, controlled access, and convenience. Rising demand for high-tech solutions, including remote-controlled and sensor-based opener systems, also propels the growth of this segment. Moreover, increasing concerns regarding unauthorized access and property safety are also a key factor behind the widespread adoption in the commercial sector. Adoption of advanced technologies such as IoT and AI-based gate openers improves effectiveness of security measures, which in turn supports market prominence. The commercial industry is still on top of the world's gate opener market, with the emphasis shifting to automation and security improvement by businesses.

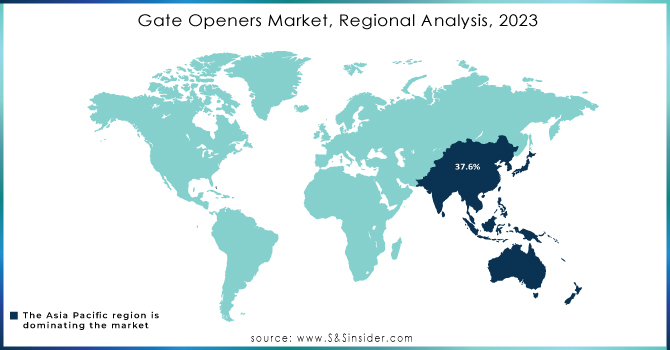

Regional Analysis

The Asia-Pacific region, dominated with a market share of over 48% in 2023, is leading the global gate openers market, both in terms of size and growth rate. Such dominance can be due to various reasons, such as rapid urbanization, increasing disposable income, and continued development of infrastructure, but largely in emerging economies such as China and India. With the new and commercial properties in particular being built, as well as the current existence of cities, these gated systems are growing in demand. Due to the convenience, security, and energy efficiency they provide, an increasing number of homeowners and businesses prefer automated solutions. Government projects for smart infrastructure and advanced technology adoption also accelerate the market. It is also the rise of the smart home and the infusion of automation into our daily lives. Asia-Pacific is projected to witness lucrative growth opportunities in the gate openers market due to the growing middle class and the growth of the economy.

Ask For Customized Report as per Your Business Requirement - Enquiry Now

Key players in the Gate Openers Market

-

Chamberlain Group (LiftMaster, MyQ Smart Gate Openers)

-

CAME BPT UK Ltd (BPT Intercoms, CAME Automations)

-

Ken Wan (Automatic Sliding and Swing Gate Openers)

-

BENINCA Group (Beninca Automation, Myone Gate Systems)

-

Katers Automation (Automatic Gate Openers, Remote Controls)

-

King Gates SRL (Dynamos Sliding Gate Motors, Jet Swing Gate Motors)

-

Homelife Integration (Smart Home Gate Automation Systems)

-

Ditec Entrematic (Ditec PWR Swing Gate Motors, Ditec NeoS Sliding Gate Operators)

-

Roteco SRL (Automatic Gate and Barrier Systems)

-

Aleko Products (Aleko Sliding and Swing Gate Openers)

-

FAAC Group (FAAC 746 Sliding Gate Operator, FAAC 415 Swing Gate Motor)

-

Nice S.p.A. (Robus Sliding Gate Openers, Toona Swing Gate Motors)

-

BFT S.p.A. (Deimos BT A600 Sliding Gate Operator, Phobos Swing Gate Motor)

-

GTO Access Systems (Mighty Mule) (Mighty Mule MM371W, MM572W)

-

HySecurity (SlideDriver, StrongArm Barrier Gate)

-

Somfy Systems (Elixo 500 Sliding Gate Motor, Axovia Swing Gate Motor)

-

Ghost Controls (TDS2XP Swing Gate Opener, Heavy-Duty Automatic Gate Openers)

-

US Automatic (Patriot Swing Gate Operator, Ranger HD)

-

TAU Srl (TAU 2500 Sliding Gate Motors, TAU R40 Swing Gate Operators)

-

LiftMaster (a part of Chamberlain Group) (RSL12UL, LA400PKGU Swing Gate Openers)

Suppliers for (Reliable gate automation, turnstiles, and smart home integration) Gate Openers Market

-

ASSA ABLOY

-

CAME

-

Chamberlain Group

-

FAAC Group

-

Marantec Group

-

Nice

-

Somfy Group

-

Overhead Door Corporation

-

Nortek Security & Control

-

DoorKing

Recent Development

- In February 2023, Nice introduced the SlideDriver II hydraulic gate operator from HySecurity, featuring its most advanced technology yet with the SmartTouch 725 control board, reaffirming its commitment to secure perimeter solutions.

- In March 2024, LiftMaster launched the Elite Strength Heavy-Duty Wall Mount Garage Door Opener HD RJO 98032, the only UL-certified residential opener designed for heavy lift doors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.49 Billion |

| Market Size by 2032 | USD 4.31 Billion |

| CAGR | CAGR of 6.29% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Function (Double-Acting, Single-Acting) • By Product (Welded, Tie Rod, Telescopic, Mill Type) • By Application (Mobile, Industrial, Energy & Power, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Actuant Corporation, Caterpillar Inc., Eaton Corporation Plc, JARP Industries Inc., Hengli Hydraulic, Kawasaki Heavy Industries Limited, Parker Hannifin Corporation, Robert Bosch GmbH (Bosch Rexroth AG), Texas Hydraulics Inc., Wipro Limited, Komatsu Ltd., Danfoss Power Solutions, SPX Flow Inc., Hawe Hydraulik, Yuken Kogyo Co., Ltd., Daikin Industries Ltd., Bailey International LLC, Linde Hydraulics, Hydac International, KYB Corporation |