Pipeline Monitoring System Market Report Scope & Overview:

Get More Information on Pipeline Monitoring System Market - Request Sample Report

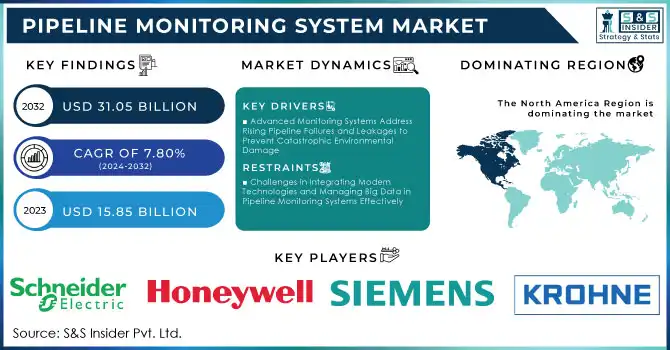

The Pipeline Monitoring System Market Size was valued at USD 15.85 Billion in 2023 and is expected to reach USD 31.05 Billion by 2032 and grow at a CAGR of 7.80% over the forecast period 2024-2032.

The Pipeline Monitoring System market is experiencing growth driven by increasing safety and environmental regulations. The oil and gas, water supply, and chemicals sectors' increased vigilance has compelled a need to have sophisticated monitoring tools that can detect leaks and anomalies in real-time. The global length of oil and gas pipelines is projected to reach 2.17 million kilometers by 2025, growing from 2.08 million kilometers in 2021, which represents a 4.5% increase. North America leads with 962,023 kilometers, while the Former Soviet Union follows with 417,905 kilometers. The United States holds the highest total globally at 2,225,032 kilometers of pipelines, with Russia and Canada at 259,913 kilometers and 100,000 kilometers, respectively. The significant mileage underscores the importance of advanced monitoring systems to ensure safety and compliance with regulatory standards.

To mitigate this risk, pipeline monitoring systems must be adopted to assure process efficiency improvement and adherence to regulatory requirements. These systems provide critical data to prevent expensive spills, protect ecosystems, and safeguard public health. Technological advancements in monitoring solutions, including IoT devices and artificial intelligence incorporation, are also contributing to market growth. This means uninterrupted collection and analysis of data for operators to react promptly in case something goes wrong. Fiber-optic and acoustic monitoring technologies allow better accuracy and reliability to be obtained during the inspection of pipelines. As the demands for smart infrastructure are ever-increasing, companies continue their investments in monitoring and complex pipeline systems to have better safety, lower maintenance costs, and resource management. Consequently, one of the major driving forces behind the pipeline monitoring system market growth is this vast trend for more intelligent and responsive monitoring solutions.

Pipeline Monitoring System Market Dynamics

Key Drivers:

-

Advanced Monitoring Systems Address Rising Pipeline Failures and Leakages to Prevent Catastrophic Environmental Damage

The increasing pipeline failures and leakages in the pipelines represent a significant driving force for the Pipeline Monitoring System market. Leaks and rupture incidents rise as the aging infrastructure and operational demands increase. These have caused significant damage to environmental elements and financial losses. Catastrophic consequences, such as wildlife damage, contamination of natural resources, and interruption of service might also be reported because of these failures. Companies instead focus their efforts on installing advanced monitoring systems that offer real-time insight into pipeline integrity. This ensures that any potential issues are detected beforehand, thereby cutting down the risks involved in catastrophic failures and material transportation safety concerns.

-

Automation and Digital Transformation Drive Growth in Pipeline Monitoring for Enhanced Efficiency and Safety

An additional significant reason is that energy and utility organizations increasingly face a surge in the demand for automation and digital transformation. With the increasing help of technology, organizations are fast turning towards digital solutions to improve operational efficiency as well as decision-making. Advances in technologies such as machine learning and data analytics in pipeline monitoring systems enable operators to pick up numerous data points without causing any glitches in the pipeline. Automated systems enable better predictive maintenance to reduce occurrences of downtime and operational costs. The pipeline monitoring systems can be integrated into the existing structures and infrastructure, which helps to make the working process more efficient, and well-managed, and allows companies to be more agile in their response to possible threats, hence encouraging more investment in pipeline monitoring technologies.

Restrain:

-

Challenges in Integrating Modern Technologies and Managing Big Data in Pipeline Monitoring Systems Effectively

Primarily, operators are using legacy systems that do not support modern solutions; this makes the upgrade quite complex. For example, in the case where an organization has a relatively older pipeline, the integration of advanced monitoring sensors may require comprehensive modification that would interfere with the operations, making it more costly. Some of these constraints can influence the timely introduction of efficient monitoring solutions that then have a ripple effect on pipeline management concerning safety and efficiency. Data management issues relate to the management of information delivered by monitoring systems. The emergence of big data has added complexity in processing large amounts of information collected from pipeline monitoring in organizations. For example, a gas company might receive terabytes every day from fiber optic sensors, and this is an impossible amount of information to understand actionable insights from.

Pipeline Monitoring System Market Segmentation Overview

By Technology

The acoustic/ultrasonic segment accounted for the largest share of 25% in 2023 on account of the effectiveness and reliability in leak detection and monitoring pipeline integrity. Acoustic and ultrasonic technologies have been well established in the industry with excellent capability in the determination of pressure variations and sound wave generation by leaks, thus, allowing operators to detect such potential failures before they become major issues. This segment is highly penetrated in all segments, such as oil and gas, water, and chemicals where pipeline safety is vital

The LiDAR segment is anticipated to grow at a CAGR of 8.4% over the forecast period due to their advanced capabilities in providing high-resolution three-dimensional mapping of pipeline infrastructure. The rise of LiDAR technology in the monitoring of large and complex pipeline networks is mainly because of its capacity to make detailed assessments of terrain and environmental conditions around pipelines. With improved accuracy in the identification of possible threats such as soil erosion or vegetation encroachment, adoption is thereby compelled by the operators.

By Type

The metallic pipeline monitoring system market dominated with market share of 74% in 2023, due to the heavy use of metallic materials in pipeline construction as compared to others such as oil and gas, water, and chemical sectors. Metallic pipelines, including steel, are strong and resistant to extreme temperatures and pressures. Since these industries are particularly concerned about safety and reliability issues, leakage detection, corrosion, and other integrity issues in metallic pipelines become essential.

The metallic pipeline monitoring systems market is expected to grow at the fastest CAGR of over 7.9% during the forecast period due to advancements in monitoring technologies. Advances like smart sensors and integrated monitoring solutions are further enlarging the possibilities for metallic pipeline systems. With these, real-time data collection and analysis help in the identification of possible issues and the making of proactive decisions through actionable insights for predictive maintenance and operational optimization.

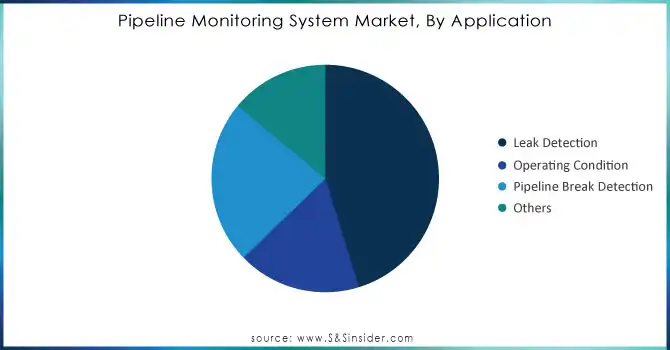

By Application

The leakage detection segment accounted for the highest market share of 45% in 2023 as pipelines-based industries in oil and gas, water supply, and chemicals are a matter of great concern for safety and environmental protection. Leak detection systems are imperative to offer leak leakage preventing real-time identification so that unmitigated failure of pipes, environmental degradation, and loss of money may be averted. Companies are investing in advanced leak detection technologies with intensifying regulatory frameworks across the world to maintain their operations and compliance.

The pipeline break detection segment is likely to gain significantly with an estimated CAGR of approximately 8.23% during the forecast period, due to the increasing awareness of the severe implications of pipeline breaks. Such occurrences may lead to catastrophic spills, severe damage to infrastructure, and heavy financial responsibilities. As industries are investing in making their safety measures better, the focus on implementing reliable break detection systems that can identify sudden failures and send alerts immediately is increasing.

Need Any Customization Research On Pipeline Monitoring System Market - Inquiry Now

By Industry

The oil and gas segment dominated the market, holding a 65% revenue share in 2023, as primarily the industry depends heavily on pipeline infrastructure for the transport of crude oil, natural gas, and refined products. The oil and gas sector utilizes extensive network pipelines, which need to be monitored vigilantly so that they can stay safe and operational. These operations are critical, and thus advanced pipeline monitoring systems need to be implemented to recognize leaks, corrosion, and other integrity issues, thus reducing the environmental risks and saving expensive shutdowns or accidents

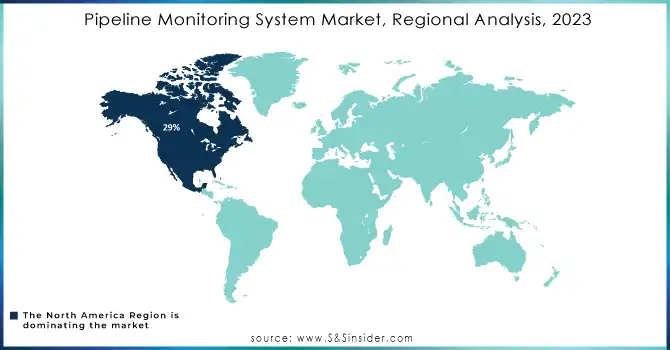

Pipeline Monitoring System Market Regional Analysis

North America dominated the market in 2023, capturing nearly 29% of revenue, helped by the large pipeline network and stringent regulatory requirements that require high safety and environmental standards. These regions are dominated by oil and gas majors, and huge investments have been made in pipeline monitoring technologies, given the strict safety standards there. For example, the United States. Pipeline and Hazardous Materials Safety Administration is very strict with its norms that mandate pipeline integrity to be frequently monitored and reported. The regulatory context brought about as a result of this leads to an increase in demand for advanced solutions in monitoring, thus making North America the leader in the market of pipeline monitoring systems.

The Asia Pacific region is expected to develop substantially by the projection period at an 8.1% CAGR. Growth can be attributed to the rapid pace of industrialization and urbanization of countries such as China and India, with increased energy consumption coupled with a concurrent rise in the development of pipeline infrastructure. For instance, China invests heavily in the laying and extension of its natural gas pipeline networks in its cities because energy demand is increasing. Now, the challenge is to sustain these, promote energy security and environmental sustainability, and avoid pipelines leaking or malfunctioning. This modernization and safety focus is anticipated to drive the Asia Pacific market at a higher growth rate during the given forecast period.

Key Players in Pipeline Monitoring System Market

Some of the major players in the Pipeline Monitoring System Market are:

-

Honeywell (Pipeline Monitoring Solutions, Smart Pressure Sensors)

-

Emerson (DeltaV Pipeline Management, SmartSignal Pipeline Monitoring)

-

Siemens (SITRANS, COMOS)

-

Schneider Electric (EcoStruxure, Modicon)

-

IBM (IBM Maximo, IBM Watson IoT)

-

KROHNE (OPTIMASS, H250 MFC)

-

TE Connectivity (FLEXIM, OPTI-TEK)

-

Xylem (Flygt, Wedeco)

-

Aegion Corporation (Corrpro, Insituform)

-

Perma-pipe (Pre-Insulated Piping Systems, SmartPigs)

-

Propipe (Pipe Inspection, Pipeline Integrity Management)

-

MISTRAS Group (Pipeline Integrity Management, Condition Monitoring)

-

Pipelines Integrity Services (PIS) (Data Analytics, Risk Assessment)

-

Keller Group plc (Geotechnical Monitoring, Environmental Monitoring)

-

Intergraph (SmartPlant, Smart 3D)

-

Sensus (FlexNet, Sensus Analytics)

-

NDT Global (Ultrasonic Inspection, Pipeline Integrity Management)

-

Aquatech (Integrated Water Management, Wastewater Treatment)

-

Altus Intervention (Well Intervention Services, Pipeline Inspection)

-

H2O Innovation (Water Treatment Solutions, Integrated Monitoring Systems)

Recent Trends

-

In October 2024, Trans Mountain announced a partnership with Hifi Engineering to establish a state-of-the-art fiber optic network designed for comprehensive monitoring and advanced leak detection on its expansion project. This initiative will enhance pipeline safety and integrity over the next ten years.

-

In February 2024, Houston-based PipeSense acquired ProFlex Technologies, an advanced leak detection company, bringing together over a century of combined expertise in integrity management technologies for both onshore and offshore pipelines. Leveraging advanced artificial intelligence (AI) analysis techniques.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15.85 Billion |

| Market Size by 2032 | USD 31.05 Billion |

| CAGR | CAGR of 7.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Technology (PIGs, Smart Ball, Acoustic/Ultrasonic, Magnetic Flux Leakage Technology, Fiber Optic Technology, Mass Volume/Balance, LIDAR, Vapor Sensing, Others) • by Type (Metallic, Non-metallic, Others) • by Application (Leak Detection, Operating Condition, Pipeline Break Detection, Others) • by Industry (Oil & Gas, Water & Wastewater, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell, Emerson, Siemens, Schneider Electric, IBM, KROHNE, TE Connectivity, Xylem, Aegion Corporation, Perma-Pipe, Propipe, MISTRAS Group, Pipelines Integrity Services (PIS), Keller Group plc, Intergraph, Sensus, NDT Global, Aquatech, Altus Intervention, H2O Innovation |

| Key Drivers | • Advanced Monitoring Systems Address Rising Pipeline Failures and Leakages to Prevent Catastrophic Environmental Damage • Automation and Digital Transformation Drive Growth in Pipeline Monitoring for Enhanced Efficiency and Safety |

| RESTRAINTS | • Challenges in Integrating Modern Technologies and Managing Big Data in Pipeline Monitoring Systems Effectively |