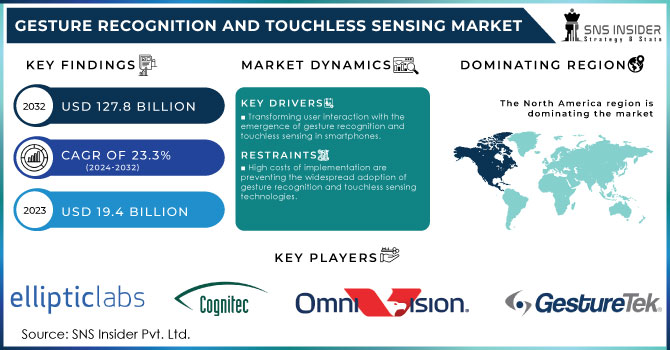

Gesture Recognition And Touchless Sensing Market Size:

Get more Information on Gesture Recognition and Touchless Sensing Market - Request Sample Report

The Gesture Recognition and Touchless Sensing Market Size was valued at USD 19.4 billion in 2023 and is expected to reach USD 127.78 billion by 2032 and grow at a CAGR of 23.3 % over the forecast period 2024-2032.

Gesture Recognition and Touchless Sensing Market has seen an increase in popularity among humans due to the decreased costs of components. Support from different governments worldwide is also aiding in the continuous expansion. Therefore, touchless sensing is capable of detecting movements or commands without the need for physical contact, whereas gesture recognition involves a device's capability to recognize human gestures through mathematical algorithms. This market has gained significant popularity in the consumer electronics, automotive, and healthcare sectors, as well as in gaming. In the consumer electronics sector, there is an increasing use of gesture recognition in smartphones, tablets, and smart TVs, allowing for a more intuitive interaction with your devices. This technology is also making its way into the automotive industry, which is enhancing driving safety by allowing hands-free control of infotainment systems and other vehicle features. Touchless technology in healthcare is on the rise, allowing for more hygienic interaction with medical devices and reducing the risk of contamination through virtual engagement. Besides these, the gaming industry has also implemented gesture recognition technology to enhance the overall gaming experience, such as the use of motion controllers in various console generations. The market is expanding more broadly due to increased demand for gesture recognition systems incorporating AI and ML, making the technology more precise, effective, and providing growth forecasts.

The emphasis on safety in the automotive sector and incorporation of advanced driver assistance systems (ADAS) is a major factor fueling growth in the Gesture Recognition and touchless Sensing Market. Automakers, especially in the high-end and luxury markets, are integrating gesture recognition systems into vehicles more and more. This allows drivers to use hand gestures to control important functions like infotainment systems, climate control, and navigation. This minimizes distractions and improves road safety by decreasing the requirement for physical interaction with the vehicle's controls. As an example, BMW's Gesture Control feature in vehicles such as the 7 Series enables drivers to change volume, answer or decline calls, and operate the infotainment system without removing their hands from the steering wheel, supporting the U.S. National Highway Traffic Safety Administration's (NHTSA) push for ADAS technologies to improve safety regulations in vehicles. The federal viewpoint on safety technology implementation focuses on making design choices that reduce risks, including software glitches, sensor malfunctions, and ineffective control measures, which are crucial in creating highly autonomous vehicles. The importance of gesture recognition in this scenario is highlighted as it ensures that the driver can still interact with the vehicle in an intuitive and safe manner despite the increasing automation. The inclusion of backup plans like halting safely and moving to low-risk states during malfunctions emphasizes the significance of dependable gesture recognition systems in upholding safety.

Gesture Recognition and Touchless Sensing Market Dynamics:

Drivers

- Transforming user interaction with the emergence of gesture recognition and touchless sensing in smartphones.

Transformative growth in the Gesture Recognition and touchless Sensing Market is being fueled by the ingenious incorporation of touchless technologies into top smartphone models by major companies such as Apple, Samsung, and Google. In 2019, Google's Pixel 4 series debuted the "Motion Sense" feature, incorporating Soli radar technology for hands-free control of music, calls, and app navigation without touching the screen. This feature is especially advantageous in situations where it is difficult to touch the device, like when cooking or exercising. In the same way, Apple's Face ID and swipe gestures have improved user interaction with a smooth and intuitive interface, while Samsung's gesture recognition capabilities allow for tasks such as scrolling and capturing screenshots using hand movements. Google Meet now includes hand gesture recognition, which lets users raise a virtual hand by raising their physical hand during video calls, showing how technology is improving meeting efficiency and user experience. This feature, powered by AI, is offered in most Google Meet Workspace plans and showcases how gesture recognition is now extending from smartphones to various digital interfaces. The increasing need for touchless, intuitive interactions in the current technological environment is driving this expansion. Driven by advancements in AI and machine learning, the market for gesture recognition and touchless sensing technologies is expected to grow as consumers look for more sanitary and effective ways to use their devices.

- Increase in Gesture Detection and touchless Sensing Technologies Boosts Market Expansion across Industries

The growth of Gesture Recognition and touchless Sensing technologies is fueling market expansion across commercial, healthcare, and research sectors due to increased innovation and flexibility. The use of gesture recognition technology is growing as it is being applied in various areas like translating sign language, interacting with robots, and communicating with machines. Recent developments show how technology has the potential to improve human-computer interaction (HCI) through practical Touchless Sensing sector. Gesture recognition in the medical field is becoming essential for creating prosthetic hand controllers that can respond naturally to the movements of users, providing a more intuitive interface for individuals who use prosthetics. Moreover, advancements in acquisition tools such as electromyography (EMG) and vision-based technologies are expanding the abilities of gesture recognition systems. Some advanced systems have notably achieved a recognition accuracy of around 97%, even in difficult conditions like limited lighting. These developments demonstrate how gesture recognition is increasingly able to enhance communication with virtual and physical objects. The growing attention and financial support from research institutions and corporations underscore the increasing importance and influence of gesture recognition technology in different sectors.

Restraints

- High costs of implementation are preventing the widespread adoption of gesture recognition and touchless sensing technologies.

The significant obstacle to the widespread adoption of advanced gesture recognition and touchless sensing technologies is the high costs of implementing and integrating them. The use of advanced hardware like high-resolution cameras, specialized sensors, and powerful processing units is required for these technologies, leading to higher expenses. For example, incorporating gesture detection into popular devices like smartphones, tablets, and smart TVs necessitates a substantial investment in research and development (R&D) to guarantee precise and quick responsiveness. Likewise, in the automotive industry, implementing gesture-based controls for entertainment systems and driver assistance features requires significant investment in technology development and manufacturing. The expenses linked to these technologies may be too high for certain manufacturers, which could restrict their availability and affordability for a wider range of consumers. In addition, the continuous need for upkeep and software upgrades contribute to the overall expense of owning a product, impacting its future sustainability for individuals and companies alike. The adoption rate of gesture recognition systems in different Touchless Sensing sectors, such as healthcare, is also affected by the expensive cost structure, particularly due to the need for specialized sensors and systems for precise control of medical devices and prosthetics using gestures. It is essential to tackle these cost-related challenges in order to speed up the implementation of gesture recognition and touchless sensing technologies.

Gesture Recognition and Touchless Sensing Market Segment Analysis

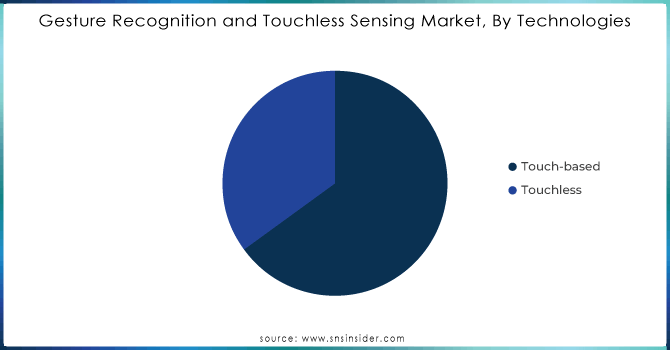

By Technologies

Touch-based Technologies dominated the revenue share in the Gesture Recognition and touchless Sensing market with a 71% share in 2023. The reason for this dominance is the broad acceptance and incorporation of touch-based systems in a range of consumer electronics, automotive, and healthcare sectors. Touch-based interfaces are common in smartphones, tablets, and interactive displays, providing users with natural and quick interactions. The technology uses capacitive, resistive, or optical sensors to identify and understand touch inputs, playing a crucial role in user interface design. Top companies are spearheading innovation in touch-based gesture recognition through state-of-the-art products and progress. As an example, Apple is still ahead in innovation with its cutting-edge touch-based technologies. The iPhones and iPads produced by the company utilize capacitive touchscreens which enable multi-touch gestures, improving user interaction and experience. Apple's rollout of 3D touch technology, although it was later discontinued, showcased the possibilities of touch inputs that respond to pressure, emphasizing the continuous advancements in touch-based technologies. Samsung has also made substantial progress in developing its touch-based technology. The high-resolution AMOLED displays on the Galaxy series smartphones from the company enable users to perform various gestures such as swiping and pinching on the advanced touchscreens. Samsung's innovation in touch-based interactions is demonstrated by their Edge Screen technology, enabling users to access Touchless Sensing sectors and notifications from the screen's edges. In the automotive industry, Continental AG has incorporated touch-based gesture controls into their vehicle interfaces. The ProViu camera-based systems allow drivers to control in-car infotainment systems using touch gestures, improving convenience and reducing distractions. The dominance of touch-based technology highlights its crucial function in improving user experience and interaction on different devices. As technology progresses, the ongoing development and usage of touch-based systems are expected to fuel expansion in the Gesture Recognition and touchless Sensing market.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Touchless Sensing Product

Based on Touchless Sensing Product, touchless biometric devices became the top segment in the Gesture Recognition and touchless Sensing market, accounting for 46% of the revenue in 2023. This increase highlights the growing dependence on touchless biometric systems for secure and convenient user authentication and identification. Contactless biometric technology, such as facial recognition, iris scanning, and palm vein authentication, is quickly becoming popular because of its non-intrusive qualities and improved security measures. For example, Face++, a major competitor in the biometric industry, has created cutting-edge facial recognition technology that is utilized in a range of Touchless Sensing sectors including mobile devices and public security systems. Their technology is created to function with precision and quickness, adapting to various lighting situations and user situations.NEC Corporation has also achieved notable progress in touchless biometric technology through its Neoface facial recognition system. NEC's technology is well-known for its precision and dependability, and is used in various Touchless Sensing sectors such as access control and surveillance. The company's products can identify faces in crowded or dimly lit settings, showing the increasing need for advanced touchless biometric technology.Fujitsu, a significant player, has brought out new palm vein authentication systems that offer a good balance of security and user convenience. Fujitsu's Palm Secure technology utilizes infrared light to record and examine distinct vein patterns in the palm, providing a touchless and extremely secure authentication method that is growing in popularity in banking and corporate environments. The importance of touchless biometric equipment is emphasized in the ever-changing field of gesture recognition and touchless sensing technologies. The touchless biometric systems market is expected to keep growing due to innovations by top companies, as the demand for improved security and user convenience in different industries continues to drive the market.

Gesture Recognition and Touchless Sensing Market Regional Analysis:

North America dominated the Gesture Recognition and touchless Sensing market in 2023, capturing a significant 36% of the revenue. The region's strong technological foundation, widespread use of cutting-edge consumer electronics, and substantial funding for research and development contribute to this dominance. The forefront of innovation in this sector is dominated by the United States and Canada, with significant input from major technology companies and a welcoming atmosphere for technological progress. Microsoft and Apple, two American companies, are at the forefront of developing gesture recognition and touchless sensing technologies. For example, Microsoft's HoloLens uses cutting-edge gesture recognition to engage with mixed reality settings, demonstrating its effectiveness in business use and improving user involvement with easy-to-use control methods. Apple's ongoing integration of touchless technology in their devices, such as the iPhone and iPad, demonstrates their dedication to improving user interfaces and staying ahead in the market. Google is a major player as well, as it has implemented Motion Sense in the Pixel 4 series, utilizing radar technology for hands-free control of device features. This technology demonstrates Google's commitment to incorporating cutting-edge touchless solutions into everyday consumer devices. In Canada, Research In Motion (RIM), the previous creator of BlackBerry devices, has been investigating touchless technologies to improve user engagement with mobile devices and business solutions. Canadian businesses are also engaged in creating new uses and enhancing current touchless systems to keep up with the increasing need.

In 2023, Asia Pacific was identified as the second most rapidly developing region in the Gesture Recognition and touchless Sensing market, showing a notable increase in the use of these technologies. Growing investments in advanced technologies and innovations are pushing the region to adopt them more quickly. There is a noticeable trend in the healthcare industry towards incorporating gesture recognition to improve remote patient monitoring. This involves virtual physical therapy apps that help with taking medication on time, identifying lack of movement, tracking sleep habits, and giving reminders for skipped meals and low fluid intake. Gesture recognition is also crucial in promoting lifestyle improvements such as quitting smoking and monitoring neurological well-being. An example is the development of a virtual rehabilitation system by Duke University's Clinical Research Institute in the US, aimed at helping patients recovering from knee replacement surgery. This showcases how technology has the potential to provide supervised therapy at home. China is especially concentrating on improving its security measures by implementing touchless biometric solutions at border checkpoints. The gaming industry is rapidly growing, leading to a higher need for gesture recognition technology, as stated by the Chinese Ministry of Industry and Information Technology. The increase in usage of consumer devices like smartphones, laptops, tablets, and smart TVs is predicted to fuel the growth of the gesture recognition market in China. The swift growth and integration of these technologies in different industries in Asia Pacific underline the region's important position in the expansion of the gesture recognition and touchless sensing market. The area's forward-thinking strategy and strong consumer interest highlight its great influence on the worldwide market.

KEY PLAYERS

The major key players IN Gesture Recognition and touchless Sensing Market and are Intel Corporation ,Jabil Inc., Microchip Technology Inc. , Sony Corporation ,Elliptic Laboratories ASA , GestureTek ,Microsoft Corporation , Google LLC , Cipia Vision Ltd., Ultraleap ,Apple Inc. & Others

RECENT DEVELOPMENT

-

In December 2023, NXP Semiconductors released the Trimension NCJ29D6 automotive UWB solution which incorporates ultra-precise location awareness and security with radars, gesture recognition.

-

In September 2023, Meta and EssilorLuxottica announced the release of the Ray-Ban Meta smart glasses which includes advanced cameras that support map content, audio features with AI interface controls through gestures.

-

In May 2023, SAP and Accenture used AR/AI technologies including gesture recognition in order to capture a USD 1T revenue opportunity by 2025.

-

In May 2023, Infineon Technologies purchased Imagibob in order to improve its TinyML edge AI capabilities. This purchase allowed Infineon to enhance its products for embedded designs, such as voice control, gesture recognition, predictive maintenance, and signal classification.

-

April 2023 saw the release of IMOU SENSE by IMOU, an in-house AI algorithm matrix designed for smart IoT solutions, providing enhanced smart detection and accuracy. The matrix contained smart algorithms for video AI, perception algorithms for sensor calibration, and navigation algorithms for cleaning robots and home services, such as gesture recognition, to improve user experience.

-

In April 2023, Elmos introduced sensor IC solutions at Sensor+Test, demonstrating creative ideas for intelligent switches with advanced gesture control. This technology allows for natural gestures to enhance interactions between humans and machines in automotive and industrial settings.

-

In January 2023, PreAct Technologies, a company that offers flash LIDAR technology, bought Gestos, a software company based in Barcelona. This purchase allows PreAct to incorporate Gestoos’ sophisticated computer vision and gesture recognition technology into its extensive system for monitoring activities, controlling devices, and understanding spatial awareness.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 19.4 Billion |

| Market Size by 2032 | USD 127.8 Bnillion |

| CAGR | CAGR of 23.3% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Technologies (Touch-based, Touchless) • By Gesture Recognition Industry(Automotive ,Consumer electronics ,Healthcare , Advertisement and communication,Defense ,Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Intel Corporation ,Jabil Inc., Microchip Technology Inc. , Sony Corporation ,Elliptic Laboratories ASA , GestureTek ,Microsoft Corporation , Google LLC , Cipia Vision Ltd., Ultraleap ,Apple Inc. & Others |

| Key Drivers |

• Transforming user interaction with the emergence of gesture recognition and touchless sensing in smartphones. |

| Restraints |

• High costs of implementation are preventing the widespread adoption of gesture recognition and touchless sensing technologies. |