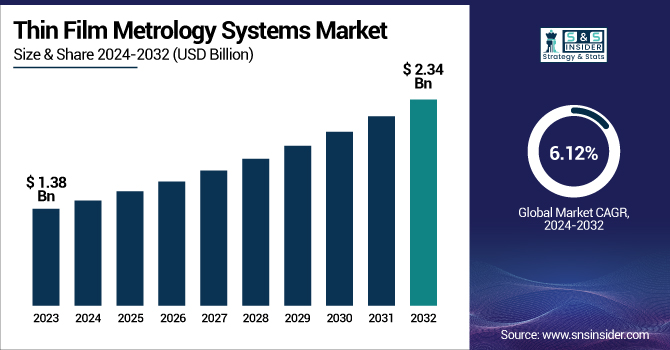

Thin Film Metrology Systems Market Size & Growth:

The Thin Film Metrology Systems Market Size was valued at USD 1.38 Billion in 2023 and is expected to reach USD 2.34 Billion by 2032 and grow at a CAGR of 6.12% over the forecast period 2024-2032.

To Get more information on Thin Film Metrology Systems Market - Request Free Sample Report

One of the thin film metrology systems market trends is automation and integration, with the most important being the entirely automated tools from users for real-time monitoring and process control. The demand for these advanced metrology systems mainly comes from the growth, especially in renewable energy, flexible electronics, and healthcare. Software and data analytics integration are besides sensor fusion technologies, and multiple sensor combinations that make measurements better are another trend in thin film metrology. Furthermore, beyond new solution introduction, software and data analytics integration have impacts on the productivity of the overall system, including predictive maintenance and defect detection functionalities for better performance. The U.S. Department of Energy has taken the first step in the development of advanced measuring technologies as it starts with projects that aim at the introduction of energy systems smart enough to let the user know their condition and feed back the data to them, thus simultaneously reducing the production time and cost of the semiconductor industry. FCC also has not left the semiconductor industry, sanding research is being conducted with increased applications like 5G, which has made them work in projects that ensure semiconductor manufacturing gains substantial momentum, and they have also cited new devices such as 5G for applications of advanced metrology systems.

The U.S. Thin Film Metrology Systems Market was 0.26 Billion in 2023 and is likely to grow at a CAGR of 7.01%. The increase in demand for precision and accuracy in the next-generation technologies, such as 5G and AI, the growth of the renewable energy sector, and the influx of investment in the automotive and electronics industries are some of the factors that drive the growth of the US Thin Film Metrology market. In these industries, thin film metrology is an imperative aspect to ensure the performance and quality of the equipment.

Thin Film Metrology Systems Market Dynamics

Key Drivers:

-

Rising Demand for Precision Thin Film Measurement Drives Market Growth in Semiconductors, Electronics, and Beyond

One of the key factors boosting the global Thin Film Metrology Systems market is the rising need for high-precision measurement tools in sectors like semiconductors, electronics, and coatings. The rising demand for high-performance thin films used in electronics such as displays or integrated circuits, semiconductor devices, or renewable energy (solar panels, artificial leaves) stems from a long list of electronic and energy-related advances. This growth is driven by the increasing complexity of devices and the need for precise control of thin film properties like thickness and uniformity. In addition, growing applications of EVs and advanced optical coatings development, especially in the automotive and aerospace sectors, are also expected to positively impact the need for metrology systems. Nanotechnology is another key aspect augmenting the market growth as it increases the scope of thin films in other industries such as healthcare, where accurate measurement plays a crucial role in diagnostics and medical devices.

Restrain:

-

High Cost of Advanced Metrology Equipment Restricts Adoption in Smaller Enterprises and Emerging Markets

The high cost of advanced metrology equipment in the Thin Film Metrology Systems market would act as a major restraint. These systems are complex, and their flexibility and versatility make them capital-intensive, especially in industries such as semiconductor manufacturing and aerospace. Such high-end equipment may not be affordable to smaller enterprises and emerging markets, limiting the adoption of the latest metrology technologies. Specialized experience is also necessary for the upkeep and calibration of these systems, which drives up operational expenses. Consequently, cost-based restrictions lead to a delayed penetration of thin film metrology systems in the regions as well as industries where cost is of high concern.

Opportunity:

-

Emerging Technologies and Materials Science Drive Opportunities for Growth in Thin Film Metrology Systems Market

Thin film metrology is an offering that is attractive to both energy and power sectors because of the burgeoning market for solar energy and photo-voltaic cells, the efficiency of these cells relies on the accurate application of material. Moreover, the development of quantum computing, photonic devices, and flexible electronics opens up a new segment in the market and will drive demand for next-generation metrology solutions. R&D activities across the new regions will account for expansion as key companies intend to drive forward emerging sector demands.

Challenges:

-

Integration Challenges and Skill Gaps Hinder Growth of Thin Film Metrology Systems in Advanced Manufacturing

The complexity of integrating with existing manufacturing processes is another challenge. Advanced production lines rolled out into the industry place great demands on thin film metrology systems that need to be integrated almost seamlessly and, in many situations, tailored to the specific needs of the facility. It can be complicated and costly to integrate, which might require retooling or upgrading of existing infrastructure. In addition, firms face the challenge of keeping up with the rapidly evolving thin film measurement technology. Many industries are also facing a shortage of skilled professionals who can operate and maintain these high-tech systems, which increases both operational and training costs. This skill gap, along with the complexities and expenses, tends to create barriers for the growth of the market.

Thin Film Metrology Systems Market Segmentation Overview

By Type

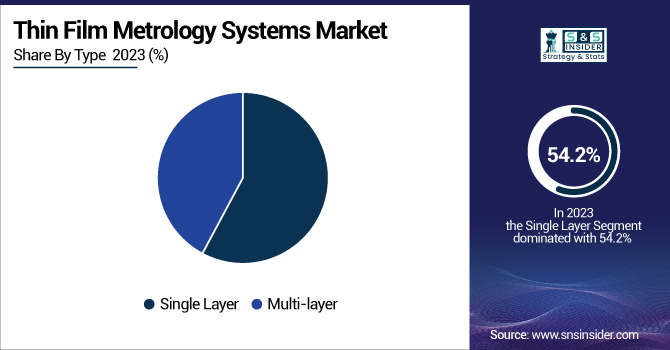

The single-layer thin film metrology segment accounted for the largest revenue share of 54.2% in 2023. This supremacy is due to its simplicity, affordable, and broad applications in the semiconductor device fabrication and coating industries by tri-layer or bi-layer single films. Due to their importance in accurately measuring the films, single-layer films are most commonly used for quality control and routine manufacture, as all standard processes are based on their properties.

From 2024 to 2032, the multi-layer thin film segment is anticipated to witness the highest increase in CAGR. The need for multi-layer thin films is increasing as different industry sectors, especially electronics and semiconductors, demand complex and performance thin film materials. The increasing demand for high-performance coatings, photovoltaic cells, and display technologies is expected to promote the use of multi-layer films. Due to superior control over optical properties, electrical characteristics, and durability, they would account for considerable market growth in the coming years.

By Technology

The Thin Film Metrology Systems market was dominated by Ellipsometry at 34.2% in 2023. The reason for its dominance is essentially its accuracy, and thin-film thickness and refractive index, and absorption coefficients measurement by this technique are used across diverse applications such as semiconductor manufacturing, coatings, and optics. Ellipsometry is a highly popular method due to its non-destructive feature and capability to study complex structures of the film, making it essential for advanced manufacturing processes.

The increase in fastest CAGR during the forecast years from 2024 to 2032 is seen in spectroscopy. Optical and Raman spectroscopy give information about the composition and structure of thin films. Spectroscopy is one of the methods that shows promise for the increasing demand for higher-grade materials, particularly in fields such as photovoltaics, biotechnology, and electronics, due to its capabilities of providing a rich set of high-resolution, multi-dimensional data. The combination of this increasing versatility and the improvements in spectroscopy technology means we can expect to see the rapid growth of this market in the coming 10 years.

By Application

The Thin Film Metrology Systems market was primarily driven by Film Thickness Measurement, which accounted for a major share of 54.2% in 2023. The high usage is related to the demand for accurate and reliable thickness measurements in semiconductor manufacturing, coatings, and many industries where tight material properties control is required. Among these segments, thin film measurement is considered an essential segment as it plays a vital role in ensuring the quality and consistency of various products, especially electronics, optics, and materials science.

Anti-Reflective Coatings are estimated to grow at the highest CAGR from 2024-2032. The rising need for anti-reflective coatings in various sectors such as solar energy, optics, and displays fuels the growth of this market. These coatings are important for the efficiency of solar panels, as well as for reducing glare in optical devices and improving the performance of displays. Factors such as increasing penetration of solar energy technologies, along with continual development of specific display and lens technologies, seem poised for rapid growth in this segment during the next decade.

By End Use

The Electronics & Semiconductor sector accounted for the majority of the market share in 2023, with an overall share of 43.2%. This dominance is primarily due to the complexity of semiconductor devices and the requirements for accurate thin film measurements within chip manufacturing and electronic components. With the continuing trend toward smaller, cheaper electronics, it is critical that the properties of thin films, including their thickness and uniformity, are controlled accurately. Thin film metrology system finds its major application in the electronics industry as it plays a critical role in the fabrication of integrated circuits, displays, and other high-end technologies.

The automotive industry, on the other hand, is predicted to have the highest CAGR from 2024 to 2032. As the automotive industry embraces electric vehicles (EVs) and implements more sophisticated electronics in automobiles, including sensors, displays, and battery technologies, the demand for high-precision thin film measurements is on the rise. The real reason behind this exponential growth is due to the movement of the automotive industry towards advanced, interconnected, and sustainable technologies.

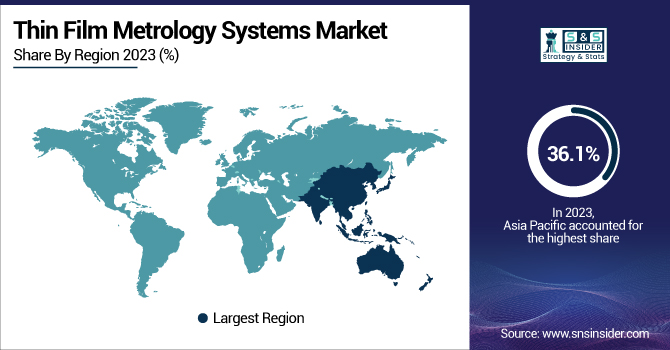

Thin Film Measurement System Market Regional Analysis

Asia Pacific led the Thin Film Metrology Systems market with takes 36.1% share in 2023 as it has a significant share of semiconductor manufacturing and consumer electronics Major semiconductor foundries and electronics giants such as TSMC (Taiwan), Samsung (S. Korea), Sony (Japan), and SMIC (China) invest massively in these thin film technologies to stay competitive. A strong supply chain, a skilled labor workforce, and government programs that support high-tech manufacturing also contribute to the region. APAC continues to invest in advanced metrology tools spurred by the K-Semiconductor Strategy of South Korea and the Made in China 2025 plan of China, which further increases the demand for thin film measurement systems in R&D and mass production environments.

North America is expected to show the largest growth during the expected period from 2024 to 2032 due to other new advances in semiconductor innovations, such as in renewable energy and many other health applications. Increased investments by domestic semiconductor manufacturers (e.g., the CHIPS and Science Act in the U.S.), combined with the presence of major players such as Intel, Lam Research, and Applied Materials, are driving market growth. Further, the rising scope of R&D in nanotechnology and photonics in several research institutes in the U.S. and Canada has been helping the emerging sectors to adopt the thin film metrology system.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players Listed in the Thin Film Metrology Systems Market are:

-

KLA Corporation (Filmetrics F20)

-

Onto Innovation (NanoSpec 6100)

-

Nova Measuring Instruments (Nova T600i)

-

HORIBA (UVISEL Plus)

-

SCREEN Holdings (SSM3000)

-

Tokyo Electron Limited (Prober Metrology System)

-

Rudolph Technologies (now Onto Innovation) (MetaPULSE G)

-

Semilab (SE2000)

-

Park Systems (NX10)

-

Bruker Corporation (DektakXT)

-

Zygo Corporation (NewView 9000)

-

Nanometrics (merged with Rudolph to form Onto Innovation) (RPMBlue)

-

Accretech / Tokyo Seimitsu (UF200SA)

-

Otsuka Electronics (Optical Multilayer Film Thickness Meter FE-3000)

-

J.A. Woollam Co. (M-2000 Ellipsometer)

Thin Film Metrology Systems Market Trends

-

In October 2024, HORIBA STEC launched the Xtrology system, a fully automated thin film inspection tool combining spectroscopic ellipsometry, Raman spectroscopy, and photoluminescence.

-

In December 2024, Semilab acquired two advanced metrology solutions, QCM and OWLS, from MicroVacuum. The move strengthens Semilab’s capabilities in thin film and surface characterization across industries like life sciences and battery research.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.38 Billion |

| Market Size by 2032 | USD 2.34 Billion |

| CAGR | CAGR of 6.12% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Single Layer, Multi-layer) • By Technology (Ellipsometry, Reflectometry, Spectroscopy, X-ray Metrology, Others) • By Application (Film Thickness Measurement, Film Coatings on Fiber Optics, Anti-reflective Coatings, Photovoltaic Cell Layers, Decorative Coatings, Others) • By End Use (Electronics & Semiconductor, Automotive, Aerospace & Defense, Healthcare, Energy & Power, Research & Development Institutes, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | KLA Corporation, Onto Innovation, Nova Measuring Instruments, HORIBA, SCREEN Holdings, Tokyo Electron Limited, Rudolph Technologies, Semilab, Park Systems, Bruker Corporation, Zygo Corporation, Nanometrics, Accretech / Tokyo Seimitsu, Otsuka Electronics, J.A. Woollam Co. |