IT Operations Management Software Market Report Scope & Overview:

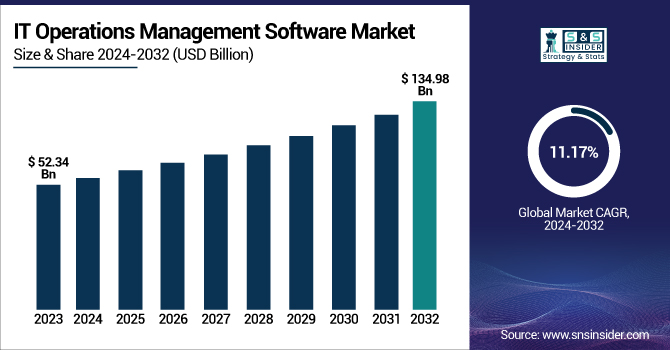

The IT Operations Management Software Market was valued at USD 52.34 billion in 2023 and is expected to reach USD 134.98 billion by 2032, growing at a CAGR of 11.17% from 2024-2032.

To Get more information on Aviation Crew Management Systems Market - Request Free Sample Report

This growth is driven by increasing demand for automation, cost-saving strategies, and enhanced security. The market is witnessing advancements in IT operations automation, significantly improving efficiency and reducing operational costs. Additionally, the need for robust security and compliance measures continues to rise, especially with evolving regulations. Time-to-value metrics are crucial for measuring the effectiveness of IT solutions, while Service-Level Agreement (SLA) compliance remains a priority for ensuring service reliability. Overall, the market is experiencing significant expansion, with organizations investing in innovative software solutions to optimize IT operations and improve service delivery.

U.S. IT Operations Management Software Market was valued at USD 15.36 billion in 2023 and is expected to reach USD 39.81 billion by 2032, growing at a CAGR of 11.16% from 2024-2032.

The growth of the U.S. IT Operations Management Software Market is primarily driven by the increasing adoption of automation in IT operations, which helps businesses optimize their processes and reduce costs. Additionally, the rising demand for enhanced security and compliance measures in response to growing cyber threats and regulatory requirements is fueling market expansion. Companies are also focusing on improving service delivery and operational efficiency, which boosts the adoption of advanced IT solutions. Furthermore, the need for better time-to-value metrics and SLA compliance is pushing organizations to invest in IT operations management software, driving sustained market growth.

IT Operations Management Software Market Dynamics

Drivers

-

Managing Complex Multi-Cloud and Hybrid IT Environments Drives Demand for Advanced Operations Management Solutions.

The growing adoption of multi-cloud, hybrid, and distributed IT systems, the management of current IT infrastructures has become much more complex. As organizations extend their digital realms to multiple platforms and locations, it becomes tougher to maintain continuity of operations. Without adequate management tools, the likelihood of system failures, inefficiency, and performance problems escalates. In order to mitigate this complexity, companies need advanced IT operations management software that is capable of effective monitoring, automation, and optimization of operations in varied environments. Such tools offer increased visibility, control, and automation to allow organizations to manage their infrastructure without interruption. With the dynamic nature of IT environments, companies are embracing advanced ITOM solutions to ensure operational continuity, optimize performance, and enable their digital transformation initiatives.

Restraints

-

High Implementation Costs of ITOM Software Limit Adoption, Especially for Small and Mid-Sized Businesses.

The upfront costs associated with the deployment of ITOM software may be high, such as in licensing, infrastructure, and integrating systems. Small to mid-sized businesses may find these financial impediments challenging in adopting such solutions. Whereas large organizations might have the financial resources to invest in such extensive systems, smaller businesses frequently struggle with justifying the return on investment due to budget restrictions. Besides, having to employ qualified personnel to set up and keep the software in place adds further to the expense, and hence it becomes an even greater obstacle. This cost restricts the capacity of most organizations to fully benefit from the advantages provided by ITOM software, slowing down market growth and hindering the rapid adoption of these sophisticated solutions.

Opportunities

-

AI and Automation Integration in ITOM Software Enhances Predictive Analytics, Efficiency, and Proactive Issue Resolution.

The combination of artificial intelligence (AI) and machine learning (ML) in ITOM software allows for predictive analytics and proactive problem resolution, which has a major positive impact on IT operations. With the use of AI, organizations can predict potential system failures or performance bottlenecks before they affect operations, minimizing downtime and maximizing overall efficiency. Automation is also important to automate repetitive tasks like monitoring, troubleshooting, and reporting so that IT teams can devote more time to strategic activities. This smart automation not only increases productivity but also maximizes the use of resources, with greater control over the IT infrastructure. As companies in today's world more and more look for means to enhance IT efficiency and lower operational expenses, the use of AI and automation in ITOM software is a major growth driver in the market.

Challenges

-

Data Security and Privacy Concerns Grow as ITOM Software Manages Sensitive Data and Faces Regulatory Compliance Challenges.

With more organizations depending on ITOM software to handle sensitive and critical business information, the threat of data breaches and security threats is a major issue. Such solutions tend to handle enormous amounts of data, making them vulnerable targets for cyberattacks. With data protection laws like GDPR and CCPA, organizations need to make sure that their ITOM systems are in line with strict privacy and security regulations. Failing to comply with these regulations will lead to huge fines, loss of reputation, and eroded customer confidence. With increasing sophistication in cyber threats, it becomes increasingly difficult to protect IT environments, creating even more concerns. Therefore, companies need to spend in proper security and ensure their ITOM software vendors focus on data protection to effectively counter such risks.

IT Operations Management Software Market Segment Analysis

By Enterprise Size

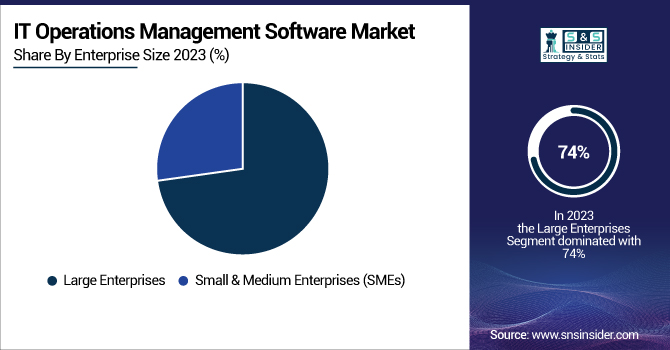

Large enterprises accounted for approximately 74% of the revenue share in the IT Operations Management Software Market in 2023. Their dominance stems from extensive IT infrastructures requiring robust, scalable solutions for system monitoring, automation, and security. These organizations prioritize advanced analytics, AI-driven automation, and cloud-based integrations to optimize operations and reduce downtime. Additionally, high compliance requirements and the need for seamless workflow management drive significant investments in sophisticated IT operations management tools, ensuring optimal performance, cybersecurity, and regulatory adherence across multiple global locations.

Small & Medium Enterprises (SMEs) are projected to grow at the fastest CAGR of approximately 12.66% from 2024 to 2032 in the IT Operations Management Software Market. This growth is fueled by the increasing adoption of cloud-based solutions that offer cost-effective, scalable, and automated IT management tools. SMEs are embracing digital transformation, AI-powered automation, and remote work environments, leading to greater demand for simplified IT operations solutions. The availability of subscription-based, flexible pricing models also enables these businesses to integrate advanced IT management capabilities efficiently.

By Deployment

The cloud segment held the largest revenue share of around 70% in the IT Operations Management Software Market in 2023. Its dominance is driven by the growing adoption of cloud computing, offering enhanced scalability, real-time monitoring, and cost efficiency. Organizations prefer cloud-based solutions for their flexibility, automatic updates, and remote accessibility, ensuring seamless IT operations. The integration of AI-driven automation and predictive analytics further enhances cloud-based IT management, enabling proactive issue resolution and operational efficiency across various industries, reducing dependency on legacy on-premises systems.

The on-premises segment is expected to grow at the fastest CAGR of approximately 12.33% from 2024 to 2032 in the IT Operations Management Software Market. This growth is primarily driven by industries with strict regulatory and security requirements, such as finance and healthcare, where data privacy concerns necessitate localized IT management. Enterprises with legacy infrastructure prefer on-premises solutions to maintain full control over data and security. Additionally, businesses in regions with limited cloud infrastructure are increasingly investing in on-premises IT management systems.

By Vertical

The IT & Telecom segment captured the largest revenue share of around 24% in the IT Operations Management Software Market in 2023. The dominance of this sector is attributed to the industry's heavy reliance on complex IT infrastructures requiring advanced monitoring, automation, and performance management tools. With the rise of 5G, cloud computing, and IoT technologies, telecom operators demand sophisticated IT operations management software to ensure network uptime, manage large-scale data traffic, and enhance service reliability, making it a crucial segment in the market.

The Retail & E-Commerce segment is expected to grow at the fastest CAGR of approximately 13.36% from 2024 to 2032 in the IT Operations Management Software Market. This growth is driven by the rapid digitalization of retail operations, the increasing adoption of omnichannel strategies, and the need for real-time IT infrastructure monitoring. E-commerce platforms require robust IT management solutions to handle high website traffic, secure transactions, and streamline logistics. The integration of AI-driven automation and cloud-based IT operations further accelerates the segment’s expansion.

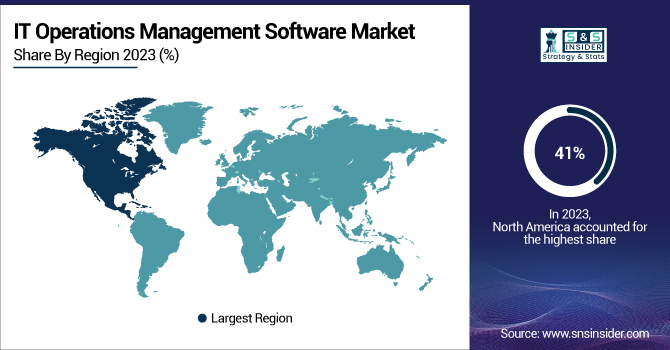

Regional Analysis

North America dominated the IT Operations Management Software Market with the highest revenue share of approximately 41% in 2023. The region's leadership is driven by the strong presence of major IT software providers, high adoption of AI-driven automation, and early digital transformation initiatives. Enterprises across industries prioritize IT operations management for cybersecurity, cloud integration, and compliance. Additionally, North America’s advanced technological infrastructure and significant investments in IT modernization contribute to its dominant market position, with organizations consistently seeking enhanced efficiency and system reliability.

The Asia Pacific region is projected to grow at the fastest CAGR of approximately 13.39% from 2024 to 2032 in the IT Operations Management Software Market. This growth is fueled by rapid digital transformation, increasing cloud adoption, and expanding IT infrastructures in emerging economies. The rising demand for automation, cybersecurity solutions, and cost-effective IT management tools among SMEs and large enterprises further accelerates market expansion. Government initiatives supporting digitalization, along with the growth of e-commerce and telecom industries, create strong opportunities for IT operations software adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BMC Software, Inc. (BMC Helix, TrueSight)

-

Cisco Systems, Inc. (Cisco Prime Infrastructure, Cisco DNA Center)

-

Elasticsearch B.V. (Elastic Stack, Elastic Cloud)

-

Freshworks Inc. (Freshservice, Freshdesk)

-

IBM Corporation (IBM Tivoli, IBM Netcool)

-

Microsoft (System Center, Azure Monitor)

-

ServiceNow (ServiceNow ITOM, ServiceNow ITSM)

-

SolarWinds Worldwide, LLC. (SolarWinds Network Performance Monitor, SolarWinds Server & Application Monitor)

-

Splunk Inc. (Splunk Enterprise, Splunk IT Service Intelligence)

-

Zoho Corporation Pvt. Ltd. (Zoho Creator, Zoho Analytics)

-

Broadcom (CA Unified Infrastructure Management, CA APM)

-

Open Text Corporation (OpenText Content Suite, OpenText Magellan)

-

Dynatrace LLC (Dynatrace Software, Dynatrace Real User Monitoring)

-

New Relic, Inc. (New Relic One, New Relic APM)

-

Datadog (Datadog Infrastructure Monitoring, Datadog APM)

-

Hewlett Packard Enterprise Development LP (HPE OneView, HPE Operations Orchestration)

-

Dell Inc. (Dell EMC OpenManage, Dell Technologies Cloud)

-

PagerDuty, Inc. (PagerDuty Incident Response, PagerDuty Event Intelligence)

-

ScienceLogic (ScienceLogic SL1, ScienceLogic AIOps)

Recent Developments:

-

In 2024, ServiceNow and NVIDIA launched telco-specific GenAI solutions to enhance telecom service management. The collaboration introduces Now Assist for Telecommunications Service Management, leveraging NVIDIA AI to boost productivity, speed issue resolution, and improve customer experiences.

-

In June 2024, Freshworks completed the acquisition of Device42, a provider of IT asset management and network mapping solutions, enhancing its ability to offer comprehensive IT operations management capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 52.34 Billion |

| Market Size by 2032 | US$ 134.98 Billion |

| CAGR | CAGR of 11.17% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Enterprise Size (Large Enterprises, Small & Medium Enterprises) • By Vertical (BFSI, Healthcare, Retail & E-Commerce, IT & Telecom, Energy & Utilities, Government & Public Sector, Others) • By Deployment (Cloud, On-Premises) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BMC Software, Inc., Cisco Systems, Inc., Elasticsearch B.V., Freshworks Inc., IBM Corporation, Microsoft, ServiceNow, SolarWinds Worldwide, LLC., Splunk Inc., Zoho Corporation Pvt. Ltd., Broadcom, Open Text Corporation, Dynatrace LLC, New Relic, Inc., Datadog, Hewlett Packard Enterprise Development LP, Dell Inc., PagerDuty, Inc., ScienceLogic |