Glass-reinforced Substrate Market Report Scope & Overview:

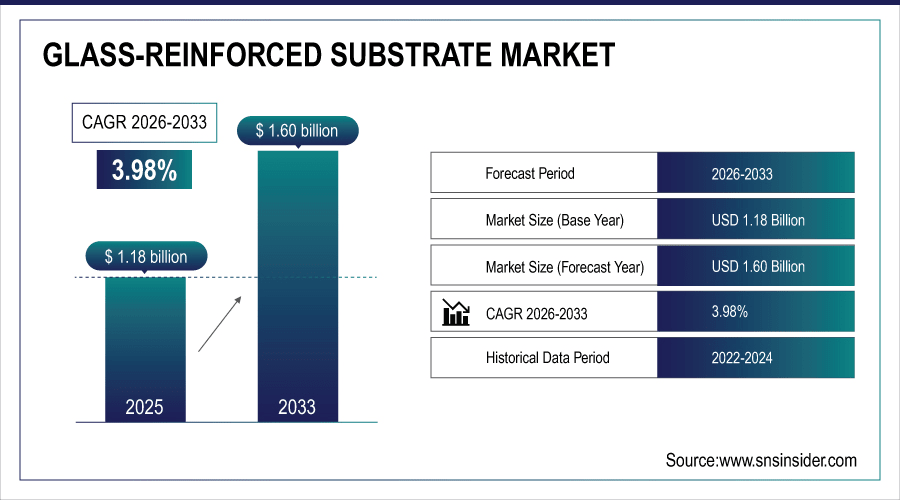

The Glass-reinforced Substrate Market size was valued at USD 1.18 Billion in 2025E and is projected to reach USD 1.60 Billion by 2033, growing at a CAGR of 3.98% during 2026-2033.

The Glass-reinforced Substrate Market is expanding due to the increasing demand for lightweight, strong, and high performance materials in various industries including to electronics, automotive, aerospace and building. With the growing popularity in printed circuit (PC), boards and sophisticated electronic systems, the market continues to grow steadily. Innovations in high strength and environment-friendly substrates are improving product efficiency and attractiveness. Increasing R&D and Production Capacity expansion by major manufacturers further contribute to market growth.

Global PCB substrate production capacity (mainly glass-reinforced epoxy like FR-4) exceeded 7.2 billion square meters in 2024, with ~85% utilization rate

To Get More Information On Glass-reinforced Substrate Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 1.18 Billion

-

Market Size by 2033: USD 1.60 Billion

-

CAGR: 3.98% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Glass-reinforced Substrate Market Trends

-

In automotive, aerospace and electronics, components are getting lighter while becoming stronger so that manufacturers lean on GRS for better performing products, greater fuel savings and durability.

-

Increasing GRS application in printed circuit boards, such as semiconductor packaging and consumer electronics is augmenting the market growth, supported by miniaturization & enhanced performance requirements in devices.

-

Increasing demand for sustainable, recyclable and low-emission GRS products in compliance with regulations on sustainability and corporate responsibility across various industries is a key driving factor for market growth.

-

Material performance advancement Continuous innovations such as high-temperature resistant, flame retardant, lightweight substrates are driving extensions of fusions for investment and more applications.

-

Growing manufacturing and commerce in developing regions, especially Asia Pacific, are also stimulating the demand for GRS further with plantation expansion as well as industrialization.

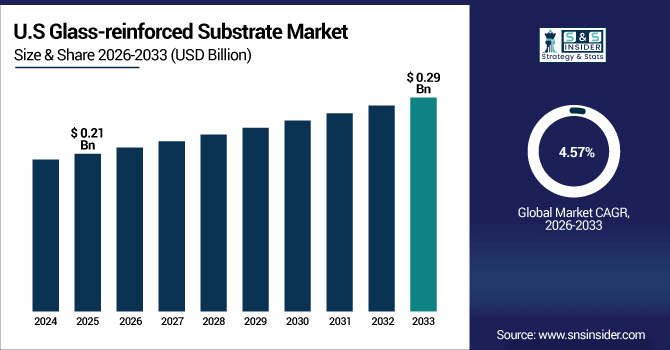

The U.S. Glass-reinforced Substrate Market size was valued at USD 0.21 Billion in 2025E and is projected to reach USD 0.29 Billion by 2033, growing at a CAGR of 4.57% during 2026-2033. Glass-reinforced Substrate Market growth is driven by rising demand for lightweight and sturdy materials from the electronic and automotive industries will stimulate U.S. Glass-Reinforced Substrate (GRS) Market growth. Increasing utilization of high level printed circuit boards and semiconductor applications are driving the market growth. Innovations in high-strength and flame-retardant materials are improving product performance. Investment in domestic manufacturing and R&D is fortifying supply chains and competitiveness.

Glass-reinforced Substrate Market Growth Drivers:

-

Increasing Adoption of Lightweight, High-Performance Glass-Reinforced Substrates Across Multiple Industries.

The global GRS market is primarily influenced by increasing requirement for lightweight, high-strength, and durable materials from electronics, automotive, construction and aerospace industries. Material adoption is being aided by advanced PCB and semiconductor applications. The supply chain is developing alternative flame retardant, high temperature substrates. Increasing emphasis on decreasing component weight and enhancing fuel economy drives the market. Local production for R&D investments support supply chains and product availability. Sustainable efforts also promote eco-friendly and recyclable GRS material use.

Automotive GRS demand surged 18% YoY in 2024, driven by EV power electronics and ADAS systems. Each EV now uses 1.5–2.2x more substrate area than ICE vehicles, directly boosting range efficiency and lightweighting goals.

Glass-reinforced Substrate Market Restraints:

-

High Production Costs and Complex Manufacturing Processes Limiting Market Expansion

The high cost of raw materials, such as glass fiber and proprietary resins, affect total production costs. Complicated production phase lead to longer time, labor and energy. Challenges in small scale production house for cost and competitive productiveness. Cost-conscious consumers may opt for other, more-affordable materials in lieu of GRS. Regulations compliance and quality certifications adds to cost of operation. These are all factors that cumulatively limit the global market from growing quickly.

Glass-reinforced Substrate Market Opportunities:

-

Growing Demand for Eco-Friendly and Technologically Advanced Glass-Reinforced Substrates

Growing emphasis on environment friendly and recyclable materials opens new avenues for ecofriendly GRS products. Advances in technology allow for production of fast, light, flame-resistant substrates. Growth in developing economies increases the penetration of the regional market. New applications, for aerospace, medical devices and 5G electronics in particular, are being adopted. Strategic alliances are beneficial and R&D investments improve the product portfolio. The market players can achieve growth by providing new, cost-effective and sustainable GRS solutions.

Over 60% of top GRS suppliers formed at least one strategic R&D alliance in 2024 — with universities, chipmakers, or recyclers — to co-develop sustainable, low-cost solutions. These partnerships accelerated time-to-market by 40% for next-gen halogen-free, high-thermal laminates.

Glass-reinforced Substrate Market Segment Analysis

-

By Thickness: The 0.1 mm - 0.5 mm segment led the Glass-Reinforced Substrate Market with a 45.78% share in 2025E, while the 0.5 mm - 1 mm segment is the fastest growing with a CAGR of 4.56%.

-

By Application: Printed Circuit Boards (PCBs) dominated the market with a 46.21% share in 2025E, whereas IC Packaging Substrates are the fastest growing segment with a CAGR of 4.13%.

-

By Type: Glass-Reinforced Epoxy Laminates led the market with 51.67% share in 2025E, while Glass-Reinforced BT (Bismaleimide Triazine) Resin is the fastest growing segment with a CAGR of 4.50%.

-

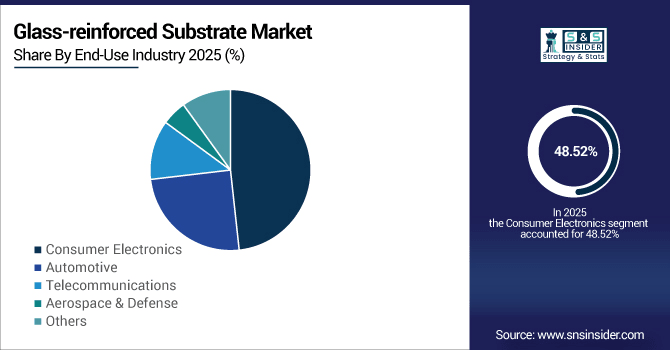

By End-Use Industry: Consumer Electronics held 48.52% of the market in 2025E, while Automotive is the fastest growing segment with a CAGR of 4.61%.

By End-Use Industry, Consumer Electronics Lead While Automotive Grow Fastest

Consumer Electronics lead the market because smartphones, tablets, wearables, and other devices rely heavily on glass-reinforced substrates for durability, light weight, and high-performance circuit support. Meanwhile, the Automotive sector is growing fastest due to the increasing integration of electronics in vehicles, including EV battery management systems, infotainment modules, ADAS, and powertrain control units. Demand for thermally stable, reliable, and high-durability substrates in automotive applications, combined with the shift toward electric and connected vehicles, is accelerating market growth, driving investments and technological innovation in glass-reinforced substrates.

By Thickness, 0.1 mm - 0.5 mm Leads Market While 0.5 mm - 1 mm Registers Fastest Growth

In 2025, the 0.1 mm – 0.5 mm thickness segment is already ruling the Glass-Reinforced Substrate Market and is likely to lead in terms of consumption as it offers an optimal balance between mechanical strength, electrical insulation, and cost efficiency. It is extensively utilized in PCBs, electronic modules and display panels, now the most used types for ordinary electronic applications. The 0.5 mm – 1 mm segment line, however, is experiencing the fastest increase in demand due to greater uptake within high-performance applications including IC packaging, automotive electronics and RF components, among other new and existing ones that require higher durability, thermal resistance and stability for next-generation devices and industrial electronics.

By Application, Printed Circuit Boards (PCBs) Dominate While IC Packaging Substrates Shows Rapid Growth

In 2025, PCBs dominate the market as they are fundamental for nearly all electronic devices and use glass-reinforced laminates to enable high numbers of transistors they house and high performance of the equipment. The IC Packaging Substrates have the fastest growth of this ten-year period, as such electronic solutions as high-performance computing, miniaturized technologies, and semiconductor devices gain considerable popularity. The automotive electronics, 5G telecommunications, advanced industrial solutions, high-frequency operations, thermal management, and compact designs are among the factors driving their rapid growth, contributing to the expanding applicability of IC packaging in the world.

By Type, Glass-Reinforced Epoxy Laminates Lead While Glass-Reinforced BT (Bismaleimide Triazine) Resin Registers Fastest Growth

In 2025, Glass-Reinforced Epoxy Laminates (FR-4) are popular because of their flexibility, ease of use, and economical cost making it largely used in consumer electronics goods, PCBs, automotive and industrial equipment. HS Sub Categories and Applications: They provide great insulation, mechanical strength and flame resistance, so they are the most commonly used material. And Glass Reinforced BT (Bismaleimide Triazine) Resin segment is growing even faster, especially for high-performance IC packaging, 5G devices and aerospace electronics. Because of its fantastic thermal stability, lower dielectric loss and small supporting for miniaturization and high frequency circuit design, advanced electronic application had favored it in the world.

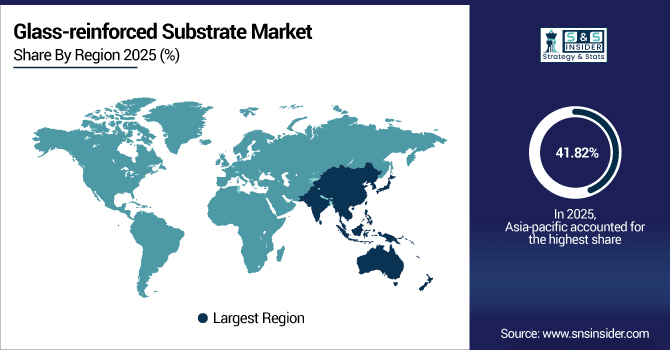

Glass-reinforced Substrate Market Regional Analysis:

Asia-pacific Glass-reinforced Substrate Market Insights

In 2025E Asia-Pacific dominated the Glass-reinforced Substrate Market and accounted for 41.82% of revenue share, this leadership is due to the area is supported by excellent PCB and semiconductor manufacturing, quick uptake of consumer electronics, increasing use of automotive electronics. Rising industrial uses, 5G infrastructure build out and government push on smart manufacturing also drive the market. China dominates this region that acts as the production and exports node for glass-reinforced substrates to countries worldwide.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Glass-reinforced Substrate Market Insights

China has a majority of electronics and PCBs are being manufactured; making it the largest market for glass-reinforced substrates in Asia-Pacific. While strong domestic demand, particularly for consumer electronics, telecom equipment and automotive electronics, is driving the sector.

North America Glass-reinforced Substrate Market Insights

North America is expected to witness the fastest growth in the Glass-reinforced Substrate Market over 2026-2033, with a projected CAGR of 4.70% due to high demand from aerospace, defense, automotive and telecommunication industries. The region is experiencing increasing use of advanced IC packaging, high-frequency RF parts and 5G networks. Market growth is propelled by robust silicon fabrication process and R&D, and high performance, dependable substrates.

U.S. Glass-reinforced Substrate Market Insights

U.S., is a key market for high-performance glass-reinforced substrates, particularly in aerospace, defense, telecommunications, and automotive sectors. Demand for advanced IC packaging and high-frequency electronic components is rising due to 5G, AI, and IoT applications.

Europe Glass-reinforced Substrate Market Insights

In 2025, Europe maintains a constant share in the glass-reinforced substrate market, driven primarily by Germany. Growth comes from automotive electronics, industrial automation and aerospace & defense (high performance substrates). Demand for epoxy laminates and BT resin substrates is driven by investment in R&D, 5G infrastructure and advanced manufacturing technologies.

Germany Glass-reinforced Substrate Market Insights

Germany as a major contributor, shows stable growth in the glass-reinforced substrate market. Key drivers include automotive electronics, industrial automation, and aerospace & defense applications. Germany’s strong automotive and electronics industries require high-performance, thermally stable substrates.

Latin America (LATAM) and Middle East & Africa (MEA) Glass-reinforced Substrate Market Insights

The Glass-reinforced Substrate Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the moderate consumption in consumer electronics, automotive and industrial applications. Brazil and Mexico are major contributors, as is South Africa. Growth is being fueled by rising electronics production, telecom infrastructure expansion and industrial automation. The market is on the rise, driven by foreign funding and government moves to strengthen electronics abilities.

Glass-reinforced Substrate Market Competitive Landscape:

AGC Inc., the world-leading glass manufacturer supplies high-quality glass for reinforced substrates and other various types of electronics and automotive applications. The business specializes in epoxy and BT resin materials for PCBs, IC packaging, and display applications. AGC’s robust R&D strengths enable it to develop high performance, heat resistant substrates that meet the needs of 5G, automotive and industrial electronics applications.

-

In November 2024, AGC's M100/200 series glass substrates for AR/MR glasses were selected as an 'Honoree' in the CES 2025 Innovation Awards program.

SKC is a leading producer of special glass substrates and high performance film laminates. The firm aims consumer electronics, automotive modules and industrial with its glass-reinforced offering. Manufacturing excellenceSKC is committed to manufacturing state-of-the-art technology for thick and credit card clear, durable, heat- and electrically-stable substrates.

-

In July 2025, SKC's subsidiary, Absolics, began prototype production of glass substrates at its Georgia facility, aiming for mass production by the end of 2025.

Corning Incorporated is a worldwide well-known manufacturer of the specialty glass and reinforced substrates for PCB, IC packaging, and RF microwave. Its troubled materials are used in consumer electronics, telecom and automotive products for their superior thermal and electrical qualities. Corning Highlights Innovation in Ultrathin Lightweight, and Damage-Resistant Glass for Next-Gen Electronics.

-

In March 2025, Corning launched GlassWorks AI™ Solutions, a comprehensive portfolio designed to support AI data center infrastructure needs.

Samtec is the service leader in the electronic interconnect industry and a global manufacturer of Connectors, Cables, Optics and RF Systems. Its parts are widely used in telecommunications, industrial and computer equipment. The company specializes on high speed, high frequency and thermally stable substrates for 5G and next generation electronic devices.

-

In March 2025, Samtec introduced its Glass Core Technology (GCT), a proprietary process leveraging the performance benefits of glass to enable performance-optimized, ultra-miniaturized substrates for next-generation designs.

Glass-reinforced Substrate Market Key Players:

Some of the Glass-reinforced Substrate Market Companies are:

-

AGC Inc.

-

SKC

-

Corning Incorporated

-

Samtec

-

Nippon Electric Glass Co., Ltd.

-

PLANOPTIK AG

-

Schott AG

-

Ohara Inc.

-

Dai Nippon Printing Co., Ltd.

-

Absolics

-

LG Innotek

-

Toppan Inc.

-

Kyocera Corporation

-

Murata Manufacturing Co., Ltd.

-

Sumitomo Bakelite Co., Ltd.

-

Toray Industries, Inc.

-

DuPont de Nemours, Inc.

-

Hitachi Chemical Co., Ltd.

-

Taiwan Glass Ind. Corp.

-

Nitto Denko Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.18 Billion |

| Market Size by 2033 | USD 1.60 Billion |

| CAGR | CAGR of 3.98% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Thickness (≤ 0.1 mm, mm - 0.5 mm, 0.5 mm - 1 mm and 1 mm) • By Application (Printed Circuit Boards (PCBs), IC Packaging Substrates, RF & Microwave Components, Automotive Electronic Modules, Display Panels and Others) • By Type (Glass-Reinforced Epoxy Laminates, Glass-Reinforced BT (Bismaleimide Triazine) Resin, Glass-Reinforced Polyimide, Glass-Reinforced Cyanate Ester, Glass-Reinforced PTFE and Others) • By End-Use Industry (Consumer Electronics, Automotive, Telecommunications, Aerospace & Defense and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | AGC Inc., SKC, Corning Incorporated, Samtec, Nippon Electric Glass Co., Ltd., PLANOPTIK AG, Schott AG, Ohara Inc., Dai Nippon Printing Co., Ltd., Absolics, LG Innotek, Toppan Inc., Kyocera Corporation, Murata Manufacturing Co., Ltd., Sumitomo Bakelite Co., Ltd., Toray Industries, Inc., DuPont de Nemours, Inc., Hitachi Chemical Co., Ltd., Taiwan Glass Ind. Corp., Nitto Denko Corporation |