Embedded Antenna Systems Market Size Analysis:

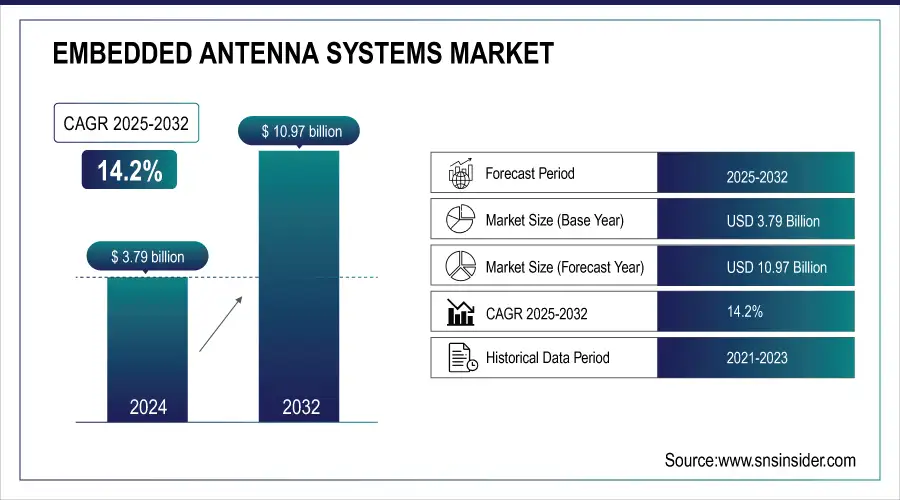

The Embedded Antenna Systems Market Size was valued at USD 3.79 billion in 2024 and is expected to reach USD 10.97 billion by 2032, growing at a CAGR of 14.2% over the forecast period 2025-2032.

Embedded antennas are a type of antenna that uses meta-materials to maximize the performance of small antenna systems These antennas, like any other electromagnetic antenna, are designed to transmit energy into space. In addition, meta-materials are substances created with different patterns, often invisible to give strange physical properties, which are used in this type of antenna. meta-materials in the construction of the antenna can increase the radiation power of the antenna.

Embedded Antenna Systems Market Size and Forecast:

-

Market Size in 2024: USD 3.79 Billion

-

Market Size by 2032: USD 10.97 Billion

-

CAGR: 14.2% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Get more information on Embedded Antenna Systems Market - Request Sample Report

Key trends in the Embedded Antenna Systems Market:

-

Rising demand for miniaturized, high-performance antennas in compact connected devices.

-

Growing penetration of 5G and IoT driving multi-band embedded antenna integration.

-

Increasing adoption of smart consumer electronics and wearable technologies.

-

Expansion of connected automotive applications including telematics and V2X systems.

-

Accelerated deployment of industrial IoT and smart factory wireless ecosystems.

-

Higher demand for low-power wide-area networks (LPWAN) and NB-IoT connectivity.

-

Advancements in flexible and PCB-based antenna designs for space-efficient integration.

-

Strategic collaborations between OEMs, telecom providers, and antenna solution developers.

Embedded Antenna Systems Market Driver:

-

Rising Proliferation of IoT-Enabled Devices Across Smart Infrastructure Stimulates Embedded Antenna Systems Market Expansion

The rapidly increasing adoption of IoT-enabled devices in sectors such as smart homes, manufacturing, transportation, and healthcare has become a primary catalyst for the embedded antenna systems market growth. As connected environments become pervasive, demand for compact, power-efficient, and high-performance embedded antennas is surging. These antenna systems ensure seamless connectivity and enhanced device reliability, empowering massive machine-to-machine (M2M) communications fundamental to smart infrastructure projects. Technological advancements, including miniaturization and multiband capabilities, further fuel their uptake, enabling integration into a wide range of products without compromising performance. In August 2025, leading manufacturers introduced chip-scale antennas designed for ultra-compact consumer and industrial electronics, accelerating market expansion by addressing both performance and scale requirements.

For example, in August 2025, a prominent global electronics manufacturer integrated advanced embedded antennas into its new line of smart home devices, resulting in improved Wi-Fi and Bluetooth performance. This development allowed more reliable real-time communications and contributed to strong commercial success in the smart appliance segment, cementing the antenna's key role in next-generation connected platforms.

Embedded Antenna Systems Market Restraint:

-

High Integration Complexity and Cost Constraints Complicate Embedded Antenna Systems Deployment in Legacy Devices

The deployment of embedded antenna systems in legacy and existing devices is significantly restrained by complex integration requirements and high costs associated with retrofitting. Many older products were not designed with the spatial, electrical, or design allowances necessary for integrated antennas, making redesigns essential. Additional engineering is required to ensure minimal signal interference and optimal performance, while costs rise due to specialized materials, expertise, and regulatory compliance needs. This creates a financial and operational burden for OEMs, especially in cost-sensitive sectors, ultimately reducing the feasibility of wide-scale upgrades and hindering market growth in these applications.

For instance, a mid-sized medical equipment provider evaluated retrofitting its established product line with embedded antennas to capitalize on IoT connectivity. However, the prohibitive redesign costs, complications with electromagnetic compatibility, and extended certification timelines led the company to delay or abandon such upgrades, illustrating how integration challenges deter market adoption in established equipment lines.

Embedded Antenna Systems Market Opportunities:

-

Expanding 5G Infrastructure Presents New Growth Avenues for Embedded Antenna Systems Market

The accelerated global rollout of 5G networks presents a significant opportunity for the embedded antenna systems market, enabling ultra-low latency and high-speed data transmissions for next-generation devices. Embedded antennas are crucial in smartphones, IoT sensors, automotive telematics, and industrial automation solutions that require multi-band, high-frequency performance. In September 2025, several countries launched large-scale 5G expansion programs, driving manufacturers to innovate antenna technologies compatible with 5G millimeter-wave and sub-6 GHz bands. This encourages partnerships between telecom firms and device makers, spurring demand for high-performance embedded antennas designed for dense, fast-evolving network environments.

For example, in September 2025, a leading telecom operator collaborated with a major automotive electronics supplier to integrate advanced 5G-compatible embedded antennas in connected vehicles. This initiative improved vehicle-to-everything (V2X) communication reliability.

Embedded Antenna Systems Market Segmentation Analysis:

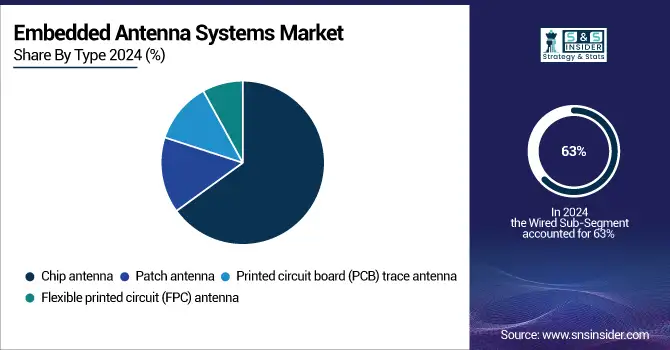

By Type, Chip Antennas Dominate Market While FPC Antennas Register Fastest Growth

The chip antenna segment commands the largest share of the embedded antenna systems market, estimated at around 63% of total revenue in 2025, due to its compact size, high reliability, and compatibility with a wide range of wireless protocols. The surge in demand for miniaturized electronics, especially in smartphones, wearables, and IoT devices, has driven manufacturers to adopt chip antennas for their space-saving and high-performance characteristics. Product development has focused on multi-band and dual-band chip antennas, enabling seamless integration into system-in-package (SiP) modules and supporting advanced wireless standards such as Wi-Fi 6E and Bluetooth 5. This trend is closely correlated with the broader embedded antenna systems market, as chip antennas are essential for enabling compact, high-speed connectivity in next-generation devices.

The FPC antenna segment is projected to grow at the highest CAGR of approximately 7.3% over the forecast period, driven by the increasing demand for flexible, lightweight, and easily integrable antennas in consumer electronics, automotive, and industrial IoT applications. FPC antennas offer superior bendability and spatial efficiency, making them ideal for devices with complex form factors and limited internal space. Product development has focused on enhancing signal integrity and supporting multiple wireless protocols, including 5G and Wi-Fi 6. This growth is directly correlated with the embedded antenna systems market, as FPC antennas enable manufacturers to meet evolving design requirements for compact, high-performance wireless devices.

By Connectivity, Wi-Fi/Bluetooth Segment Dominates Market While MNWAVE 5G Registers Fastest Growth

The Wi-Fi/Bluetooth segment holds the largest share of revenue, estimated at around 39% in 2025, due to the widespread adoption of wireless connectivity in consumer electronics, smart home devices, and industrial automation. The proliferation of IoT devices and the need for reliable, low-latency communication have driven demand for embedded antennas supporting Wi-Fi and Bluetooth protocols. Product development has focused on multi-protocol antennas and advanced MIMO configurations to improve throughput and reliability. This segment's dominance is closely correlated with the embedded antenna systems market, as Wi-Fi/Bluetooth antennas are critical for enabling seamless connectivity in a broad range of applications.

The MNWAVE 5G segment is projected to grow at the highest CAGR of approximately 5.8% over the forecast period, driven by the rapid deployment of 5G networks and the increasing demand for high-speed, low-latency wireless communication. The expansion of 5G infrastructure, especially in smart cities and industrial IoT, has created a strong demand for advanced embedded antennas capable of supporting millimeter-wave frequencies. Product development has focused on beamforming and massive MIMO technologies to enhance signal quality and coverage.

By End-User, Consumer Electronics Segment Dominates Market While Industrial Segment Registers Fastest Growth

The consumer electronics segment accounts for the largest share of revenue, estimated at around 49% in 2025, due to the widespread adoption of wireless connectivity in smartphones, tablets, wearables, and smart home devices. The demand for compact, high-performance embedded antennas has driven manufacturers to integrate advanced antenna solutions into consumer electronics. Product development has focused on miniaturization and multi-band support to meet the evolving needs of consumers.

The industrial segment is projected to grow at the highest CAGR over the forecast period, driven by the increasing adoption of IoT and automation technologies in manufacturing, logistics, and energy management. The need for reliable, high-performance wireless communication in industrial environments has created a strong demand for embedded antennas capable of supporting advanced protocols and operating in challenging conditions. Product development has focused on ruggedized designs and enhanced signal integrity to meet the requirements of industrial applications. This growth is directly correlated with the embedded antenna systems market, as industrial IoT is a key driver of demand for advanced embedded antenna solutions.

By Application, Smart Meters Segment Dominates Market While Gateway Routers Register Fastest Growth

The smart meters segment holds the largest share of revenue, estimated at around 33% in 2025, due to the global expansion of smart grid infrastructure and the increasing demand for efficient energy management. The integration of advanced communication technologies, such as 5G and IoT, into smart meters has driven demand for sophisticated embedded antennas capable of supporting reliable data transmission. Product development has focused on antennas for cellular and wireless protocols, such as NB-IoT and LoRaWAN, to meet the requirements of smart metering applications.

The gateway routers segment is projected to grow at the highest CAGR over the forecast period, driven by the increasing demand for high-speed, reliable wireless connectivity in smart homes, offices, and industrial environments. The expansion of IoT and the need for seamless integration of multiple devices have created a strong demand for advanced embedded antennas in gateway routers. Product development has focused on multi-band support and enhanced signal integrity to meet the evolving needs of consumers and businesses.

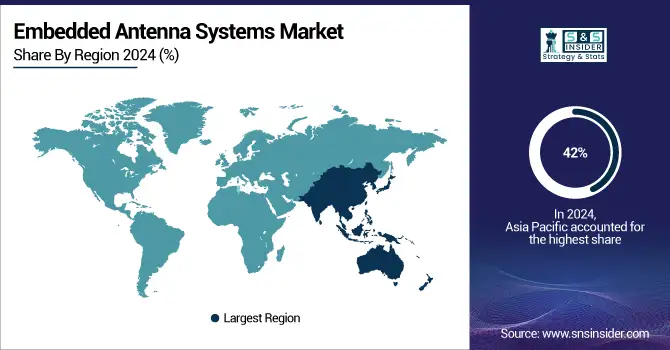

Asia-Pacific Dominates Embedded Antenna Systems Market in 2024

In 2024, Asia-Pacific holds an estimated 42% share of the Embedded Antenna Systems Market, securing its position as the leading region. The region’s dominance is driven by high-volume consumer electronics manufacturing, rapid 5G network rollouts, and expanding smart city and IoT ecosystems. Government support for digital infrastructure, coupled with strong supply chain networks and mass production capabilities, accelerates the adoption of embedded antennas across smart devices, connected appliances, and industrial automation. With continuous innovation in connectivity solutions and large-scale device deployment, Asia-Pacific continues to define the growth trajectory of the global embedded antenna systems market.

Need any customization research on Embedded Antenna Systems Market - Enquiry Now

China Leads Asia-Pacific’s Embedded Antenna Systems Market

China leads the regional market owing to its massive electronics manufacturing sector, resilient supply chain ecosystem, and global leadership in 5G commercialization. Government investments in smart city initiatives, IoT expansion, and digital infrastructure significantly boost demand for embedded antenna integration across consumer, industrial, and telecom applications. Strong collaboration between domestic manufacturers and global technology brands further strengthens product innovation and scalability. Supported by high domestic device consumption and rapid wireless deployment, China emerges as the leading country in Asia-Pacific’s Embedded Antenna Systems Market in 2024.

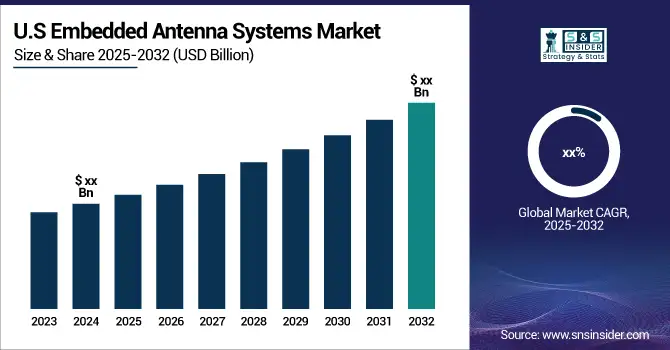

North America is the Fastest-Growing Region in Embedded Antenna Systems Market in 2024

North America is projected to register the fastest CAGR of over 15% in 2024, driven by accelerated adoption of next-generation wireless technologies and strong investments in connected ecosystems. The growth surge is propelled by increasing IoT penetration, early 5G implementation, rising smart device integration, and strong R&D for advanced antenna miniaturization. Expansion of edge connectivity, smart infrastructure, automotive connectivity, and industrial automation also contributes to the region’s rapid growth momentum, positioning North America as a core innovation hub for embedded antenna technologies.

United States Leads North America’s Embedded Antenna Systems Market

The United States dominates due to its strong innovation landscape, high capital influx into wireless R&D, and rapid commercialization of connected technologies. Large-scale IoT deployments, smart mobility advancements, and industry adoption of embedded connectivity solutions further stimulate demand. The country’s regulatory environment encourages next-generation technology deployment, while domestic manufacturers rapidly scale 5G-enabled and IoT-optimized antenna solutions across consumer, automotive, and industrial segments. These factors underscore the U.S. as the key growth engine of North America’s Embedded Antenna Systems Market in 2025.

Europe Embedded Antenna Systems Market Insights, 2024

In 2024, Europe accounted for approximately 26% of global market revenue, supported by stringent IoT device standards, increased 5G infrastructure investments, connected automotive expansion, and rising smart home adoption. Technological alignment with regulatory frameworks and strong collaboration between telecom providers and OEMs further accelerates embedded antenna innovation and deployment across the region.

Germany Leads Europe’s Embedded Antenna Systems Market

Germany leads the region due to its advanced automotive connectivity landscape, industrial automation ecosystem, and rigorous wireless performance standards. Strong partnerships between manufacturers and telecom operators enhance antenna optimization for connected vehicles, industrial IoT, and consumer electronics. With continuous investments in next-generation communication technologies, Germany stands at the forefront of Europe’s Embedded Antenna Systems Market in 2024.

Middle East & Africa and Latin America Embedded Antenna Systems Market Insights, 2024

In 2024, the Middle East & Africa experienced notable market growth, driven by rapid urbanization, expansion of mobile data networks, and increasing deployment of smart city and industrial connectivity solutions. South Africa emerged as the regional leader, supported by strong investments in digital infrastructure and growing antenna integration across urban and industrial networks.

Latin America demonstrated steady growth, fueled by telecom modernization, IoT device adoption, and expanding smart home and industrial connectivity. Brazil leads the region, backed by nationwide network enhancement initiatives and increasing penetration of embedded antenna systems across consumer and enterprise applications. Together, these regions contribute to sustained global market expansion and connectivity enablement.

Embedded Antenna Systems Companies are:

-

Molex LLC

-

Kyocera AVX (AVX Corporation)

-

Yageo Corporation

-

TE Connectivity Ltd

-

Amphenol Corporation

-

Mobile Mark, Inc.

-

Abracon LLC

-

Aethercomm, Inc.

-

Pulse Electronics Corporation

-

Antenova Ltd

-

Fractus Antennas

-

Laird Technologies

-

Johanson Technology, Inc.

-

U-BUCK Antennas (U-BUCK Semiconductor)

-

Linx Technologies Inc.

-

HUBER+SUHNER AG

-

Huawei Technologies Co., Ltd.

-

Murata Manufacturing Co., Ltd.

Competitive Landscape for the Embedded Antenna Systems Market:

Molex LLC

Molex LLC is a U.S.-based global connectivity and electronics leader, offering high-performance embedded antenna solutions across automotive, industrial, consumer, healthcare, and telecommunication applications. The company specializes in integrated antenna modules supporting 5G, Wi-Fi 6/6E, GNSS, Bluetooth, and ultra-wideband connectivity. Its role in the Embedded Antenna Systems Market is essential, combining advanced engineering, global manufacturing scale, and custom antenna integration capabilities to support high-speed, space-optimized wireless communication. Molex focuses on innovation in multi-band, miniaturized antenna designs that enable seamless connectivity across next-generation smart devices and IoT ecosystems.

-

In 2025, Molex LLC introduced a compact multi-protocol embedded antenna module supporting 5G, Wi-Fi 6E, and GNSS for next-generation IoT and automotive telematics platforms.

Taoglas Ltd

Taoglas Ltd is an Ireland-based global provider of IoT antenna and RF solutions, recognized for its advanced embedded antenna systems engineered for 5G, Wi-Fi, Bluetooth, GNSS, LPWAN, and UWB applications. The company specializes in high-efficiency miniaturized antenna integrations for IoT, automotive telematics, smart cities, wearables, and industrial connectivity markets. Its role in the Embedded Antenna Systems Market is significant, offering optimized RF performance, rapid design customization, and pre-certified embedded antenna platforms that accelerate product deployment. Taoglas continues to push antenna innovation with solutions that enhance connectivity reliability, device miniaturization, and global network compatibility.

-

In 2025, Taoglas Ltd launched a next-generation 5G embedded antenna platform optimized for ultra-low-power IoT devices and global multi-regional connectivity.

Kyocera AVX (AVX Corporation)

Kyocera AVX (AVX Corporation), headquartered in the U.S., is a leading manufacturer of RF components and miniaturized embedded antennas designed for use in automotive, industrial, consumer electronics, and medical connectivity systems. The company specializes in compact chip antennas, surface-mount embedded antennas, and high-frequency connectivity modules supporting 5G, Wi-Fi, GNSS, and Bluetooth. Its role in the Embedded Antenna Systems Market is vital, delivering space-efficient, high-performance antenna solutions that enable reliable wireless functionality in highly integrated electronic devices. Kyocera AVX drives connectivity innovation through precision-engineered antenna designs that support high-density, high-frequency signal environments.

-

In 2025, Kyocera AVX revealed a new ultra-compact 5G embedded chip antenna series designed to support high-density smart devices and scalable IoT modules.

Yageo Corporation

Yageo Corporation, based in Taiwan, is a global electronic components leader providing embedded antennas and wireless connectivity solutions across telecom, automotive, industrial IoT, and consumer markets. The company delivers integrated 4G/5G, Wi-Fi, GNSS, and Bluetooth embedded antenna systems built for high performance, signal stability, and mass-production scalability. Its role in the Embedded Antenna Systems Market is prominent, supporting OEMs with high-volume manufacturing, global supply chain capabilities, and advanced antenna miniaturization technologies. Yageo continues to enhance multi-band antenna efficiency to meet the growing connectivity demands of next-generation smart and industrial devices.

-

In 2025, Yageo Corporation expanded its embedded antenna portfolio with multi-band 5G connectivity solutions engineered for industrial IoT and smart consumer hardware.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.79 Billion |

| Market Size by 2032 | USD 10.97 Billion |

| CAGR | CAGR of 14.2% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Flexible Printed Circuit (FPC) Antenna, Printed Circuit Board (PCB) Trace Antenna, Chip Antenna, Patch Antenna) • By Connectivity (4G/LTE, NB-IoT, Cellular, MNWAVE 5G, GNSS/GPS, Wi-Fi/Bluetooth, Low-Power Wide-Area Network (LPWAN), Radiofrequency Identification (RFI), Ultra-Wideband (UWB)) • By End-User (Consumer Electronics, Automotive, Transportation, Industrial, Communication (Datacom & Telecom), Healthcare, Aerospace & Defense, Other) • By Application (Airplanes, Gateway Routers, Satellites, Payment Terminals, Smart Meters, Infotainment And Navigations, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Molex LLC, Taoglas Ltd, Kyocera AVX (AVX Corporation), Yageo Corporation, TE Connectivity Ltd, Amphenol Corporation, Maxtena Inc., Mobile Mark, Inc., Abracon LLC, Aethercomm, Inc., Pulse Electronics Corporation, Antenova Ltd, Fractus Antennas, Laird Technologies, Johanson Technology, Inc., U-BUCK Antennas (U-BUCK Semiconductor), Linx Technologies Inc., HUBER+SUHNER AG, Huawei Technologies Co., Ltd., and Murata Manufacturing Co., Ltd. |