Lignin Derivatives Market Report Scope & Overview:

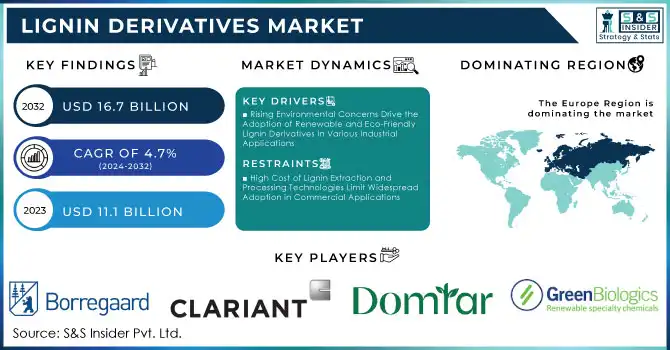

The Lignin Derivatives Market Size was valued at USD 11.1 Billion in 2023 and is expected to reach USD 16.7 Billion by 2032 and grow at a CAGR of 4.7% over the forecast period 2024-2032. The Lignin Derivatives Market is expanding rapidly, driven by increasing demand for sustainable and eco-friendly alternatives to traditional petroleum-based chemicals. Companies like Green Biologics Ltd. are exploring lignin as a raw material for biofuels and other renewable chemicals, pushing the boundaries of sustainable energy production. In January 2024, a breakthrough by Green Biologics Ltd. introduced a more efficient lignin-based catalyst, which could enhance the production of biofuels and fine chemicals. This innovation highlights the growing importance of lignin in the renewable energy sector, as it offers an environmentally friendly alternative to conventional chemical processes.

Get More Information on Lignin Derivatives Market - Request Sample Report

Moreover, Sappi Lanxess has advanced lignin’s potential in material science. In September 2023, the company reported on its progress in developing lignin-based composites for use in automotive and aerospace industries, which offer higher performance and lower environmental impact than traditional materials. These developments indicate lignin’s growing role not only as a feedstock for chemicals but also in manufacturing lightweight, durable products. In June 2024, Sappi Lanxess also focused on lignin-derived surfactants, which have been shown to replace harmful synthetic surfactants in detergents and personal care products, contributing to greener consumer products. These advancements emphasize the versatility and eco-friendly potential of lignin, positioning it as a key material in various industrial applications.

Lignin Derivatives Market Dynamics:

Drivers:

-

Rising Environmental Concerns Drive the Adoption of Renewable and Eco-Friendly Lignin Derivatives in Various Industrial Applications

-

Expanding Applications of Lignin Derivatives in Biofuels and Green Chemicals Spur Market Growth

-

Government Regulations and Policies Supporting Sustainable and Green Alternatives Foster Lignin Derivatives Demand

-

Growing Demand for Lignin-Based Bio-based Products in the Consumer Goods Industry Enhances Market Expansion

-

Technological Advancements in Lignin Extraction and Conversion Techniques Enhance Market Opportunities

Technological innovations in lignin extraction and conversion processes have greatly improved the economic feasibility of lignin derivatives. Advances in biorefinery technologies have made it easier and more cost-effective to extract lignin from biomass and convert it into high-value products like adhesives, resins, and biofuels. Moreover, new catalytic processes are being developed to convert lignin into a wider range of valuable chemicals. These breakthroughs in processing technologies are opening new doors for the lignin derivatives market, as they enable manufacturers to produce high-quality products at competitive prices, thus attracting a broader range of industries.

Restraint:

-

High Cost of Lignin Extraction and Processing Technologies Limit Widespread Adoption in Commercial Applications

Despite its potential, the high cost associated with extracting and processing lignin from biomass remains a significant challenge. The complex processes required to isolate lignin, such as pretreatment and enzymatic hydrolysis, can be expensive and energy-intensive. Additionally, converting lignin into valuable derivatives often involves costly chemical treatments or catalytic processes. These high costs can limit the competitiveness of lignin derivatives compared to traditional petrochemical-based products. For many companies, the initial investment required for lignin-based production facilities or technology adoption may be a deterrent, particularly in industries where cost-efficiency is crucial.

Opportunity:

-

Increased Research into Lignin-Based Carbon Nanomaterials and Composites Offers Untapped Market Potential

-

Expanding Use of Lignin Derivatives in the Agricultural Sector Opens New Revenue Streams

-

Lignin Derivatives as a Key Material for Biodegradable Plastics Creates Opportunities in the Packaging Industry

Challenge:

-

Lack of Standardization and Scale-Up Challenges in Lignin Processing Technology Hinders Market Growth

One of the major challenges facing the lignin derivatives market is the lack of standardized processing techniques and difficulties associated with scaling up production. While lignin extraction and conversion technologies have seen advancements, there is still no universally accepted method for lignin extraction and processing that is both cost-effective and efficient. As a result, scaling up these technologies to industrial levels remains challenging, especially for small and medium-sized companies. The lack of consistency in product quality and supply chain infrastructure further complicates efforts to commercialize lignin derivatives on a large scale, thus limiting their widespread adoption.

Lignin Derivatives Market Segmentation Overview

By Source

The softwood segment dominated the lignin derivatives market in 2023, holding a market share of around 60%. This is primarily due to the higher availability and lower cost of softwood as a feedstock for lignin extraction compared to hardwood. Softwood-derived lignin is widely used in applications such as concrete additives and as a binder in various industrial processes. Major suppliers like Borregaard have capitalized on this advantage by using softwood to produce high-quality lignin products for diverse industries.

By Type

Lignosulfonates emerged as the dominating type in the lignin derivatives market in 2023, with a market share of approximately 45%. Lignosulfonates are used extensively in applications such as concrete, and ceramics, and as a dispersant in detergents due to their superior binding and water-retention properties. Companies like Borregaard and Domtar are major players producing lignosulfonates for these sectors, driving the segment’s growth.

By Application

Concrete & Cement dominated the application segment in the lignin derivatives market in 2023, with a market share of about 35%. The demand for lignin-based additives in concrete has surged due to their ability to improve water retention, workability, and environmental sustainability. This segment is further driven by increased construction activities and the need for green building materials, with companies like Borregaard offering lignin-based concrete additives as part of their product portfolios.

By End Use Industry

Agriculture dominated the end-use industry segment in the lignin derivatives market in 2023, holding a market share of approximately 30%. Lignin derivatives are widely used in animal feed as a natural binder and for soil conditioning, which enhances plant growth and crop yield. Companies are increasingly focusing on providing lignin-based products for the agricultural sector, as they are seen as sustainable and eco-friendly alternatives to synthetic chemicals.

Lignin Derivatives Market Regional Analysis

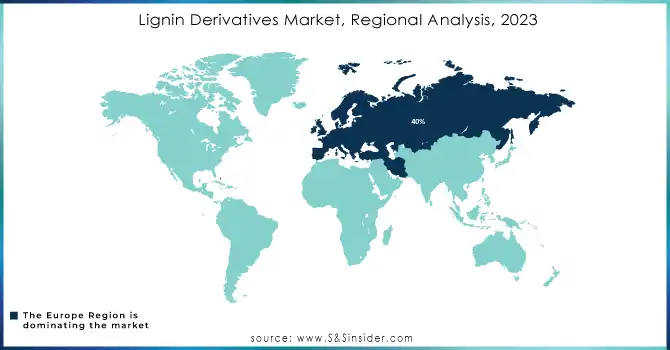

In 2023, Europe dominated the lignin derivatives market, accounting for a market share of around 40%. The region's dominance can be attributed to the extensive presence of lignin-based product manufacturers, robust industrial infrastructure, and strong demand for sustainable materials, particularly in sectors like construction and animal feed. Countries such as Germany, Sweden, and Finland are leading contributors due to their abundant wood-based biomass resources. Sweden’s Borregaard, for example, produces high-quality lignin products used in concrete and agricultural applications, bolstering the region's market position. Additionally, the European Union’s emphasis on sustainability and eco-friendly products further propels the adoption of lignin derivatives, as evidenced by the growing demand for bio-based concrete additives and animal feed supplements.

Moreover, the Asia Pacific region emerged as the fastest-growing market for lignin derivatives, with a CAGR of 8.6% in 2023. This growth is primarily driven by increasing industrialization, rising demand for sustainable materials, and the growing presence of key players in the region. China and India are leading countries in this expansion, with both nations showing increasing interest in bio-based chemicals as part of their green initiatives. China is particularly focused on lignin-based resins and adhesives for use in the automotive and construction industries. Companies like Jiangsu Yuxing and Suwon Lignin are capitalizing on these opportunities, with China’s focus on reducing carbon emissions fueling the demand for eco-friendly alternatives in industrial processes. Additionally, India’s booming construction sector is driving the use of lignin in concrete and cement applications. The increasing investments in sustainable agricultural practices further contribute to the fast growth of lignin derivatives in this region.

Recent Developments

October 2024: Researchers developed a new green strategy using lignin to produce eco-friendly sunscreen. By utilizing lignin’s antioxidant properties, the innovation not only contributes to sustainable beauty products but also reduces the reliance on synthetic ingredients. This breakthrough aligns with the growing demand for natural alternatives in cosmetics.

April 2024: Nippon Paper Industries received a grant to advance a liquid composition involving lignin sulfonic acid-based compounds and aromatic compounds. The project aims to enhance packaging materials, boosting sustainability and offering a potential alternative to conventional plastics in the packaging industry.

Need Any Customization Research On Lignin Derivatives Market - Inquiry Now

Key Players in Lignin Derivatives Market

-

Borregaard (Lignosulfonates, Vanillin, Lignin-based resins)

-

CLARIANT (Lignin-based surfactants, Lignosulfonates, Phenolic resins)

-

Domtar Corporation (Lignosulfonates, Lignin products for concrete, Paper & pulp chemicals)

-

Green Biologics Ltd. (Bio-based butanol, Lignin-based biofuels, Renewable chemicals)

-

Kraton Polymers (Lignin-based resins, Lignin derivatives for adhesives, Lignin-based surfactants)

-

Lignol Energy Corporation (Lignin products, Biofuels, Bio-based chemicals)

-

Nippon Paper Industries Co., Ltd. (Lignosulfonates, Phenolic resins, Lignin-based surfactants)

-

RISE Research Institutes of Sweden (Lignin-based composites, Lignin-derived materials, Bio-based chemicals)

-

Sappi Lanxess (Lignosulfonates, Vanillin, Lignin-based resins)

-

Segetis (Lignin derivatives for chemicals, Bio-based solvents, Lignin-based surfactants)

-

Stora Enso (Lignin-based resins, Lignosulfonates, Bio-based chemicals)

-

Suwon Lignin Co., Ltd. (Lignosulfonates, Lignin for agriculture, Lignin-based resins)

-

Tembec (Acquired by Rayonier Advanced Materials) (Lignosulfonates, Lignin-based products, Pulp and paper chemicals)

-

TransFurans Chemicals (Lignin-based surfactants, Lignin products for energy, Lignosulfonates)

-

Valmet (Lignin-based products for energy, Lignosulfonates, Lignin for biofuels)

-

WestRock (Lignin products for paper, Lignosulfonates, Bio-based chemicals)

-

Woodbridge (Lignin-based polyurethane foams, Lignin for composites, Lignosulfonates)

-

Xylem (Lignin-based chemicals for water treatment, Lignosulfonates, Lignin-derived energy solutions)

-

Zeachem (Bio-based chemicals, Lignin-based biofuels, Renewable solvents)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.1 Billion |

| Market Size by 2032 | US$ 16.7 Billion |

| CAGR | CAGR of 4.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Softwood, Hardwood, Others) •By Type (Lignosulfonates, Phenolic Resins, Vanillin, Others) •By Application (Concrete & Cement, Feed & Animal Nutrition, Adhesives & Binders, Chemical Intermediates, Others) •By End-use Industry (Agriculture, Construction, Automotive, Chemical & Materials, Food & Beverages, Cosmetics & Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Borregaard, Domtar Corporation, UPM-Kymmene Corporation, Nippon Paper Industries Co., Ltd., Kraton Polymers, Sappi Lanxess, Kraton Polymers, Suwon Lignin Co., Ltd., Tembec (Acquired by Rayonier Advanced Materials), The Green Biologics Ltd. and other key players |

| Key Drivers | • Rising Environmental Concerns Drive the Adoption of Renewable and Eco-Friendly Lignin Derivatives in Various Industrial Applications • Expanding Applications of Lignin Derivatives in Biofuels and Green Chemicals Spur Market Growth |

| RESTRAINTS | • High Cost of Lignin Extraction and Processing Technologies Limit Widespread Adoption in Commercial Applications |