Glutaraldehyde Market Report Scope & Overview:

Get E-PDF Sample Report on Glutaraldehyde Market - Request Sample Report

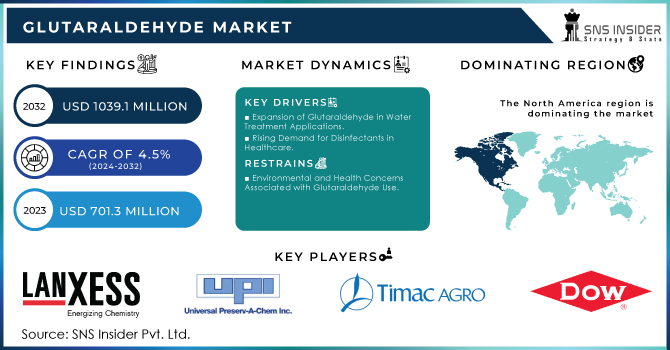

The Glutaraldehyde Market Size was valued at USD 701.3 million in 2023, and is expected to reach USD 1039.1 million by 2032, and grow at a CAGR of 4.5% over the forecast period 2024-2032.

Glutaraldehyde has recently been in high demand due to some of the versatile properties that it exhibits, including being a strong biocide and disinfectant. Major usage areas include healthcare facilities, water treatment, and many other industries. Glutaraldehyde is usually the main ingredient in the sterilization process and generally acts as a fixative in the lab. Much of the demand has been fueled by the healthcare industry itself, due to the common application of glutaraldehyde in the high-level disinfection of medical devices. It is further tethered to very stringent regulations and guidelines and reinforced with stipulated measures that call for adequate sterilization procedures at medical institutions against HAIs, especially where endoscopes and surgical instruments are concerned. Growing concerns and emphasis on hygiene conditions in medical settings also boosted glutaraldehyde applications; it is now considered an essential chemical in the healthcare sector. Other important applications of glutaraldehyde include industry, more specifically in the oil and gas and pulp and paper industries. Glutaraldehyde is used as a biocide in the oil and gas industries to control microbial growth in pipelines and bottom-hole reservoirs, thus avoiding further biofouling and corrosion that might consequently bring about operational inefficiencies and very expensive repairs. Glutaraldehyde also applies in the pulp and paper industries as slimicide to inhibit the growth of slime-forming bacteria and algae in paper mills, ensuring smooth running of production processes. The value and versatility of it are further epitomized by its effectiveness in controlling microorganisms in demanding industrial setups, further fueling its adoption within a host of industries.

Moreover, the glutaraldehyde market is the growing demand for personal care and cosmetic products. Glutaraldehyde finds application in personal care products since it is this chemical that provides the necessary cross-linking of proteins, giving more durability and effectiveness to hair conditioners and nail hardeners. As such, owing to the increasing awareness of consumers about grooming and hygiene, demand for glutaraldehyde from the personal care segment has remained steady. Furthermore, its ability to be an effective preservative for cosmetics ensures product stability and helps to extend shelf life, hence making the chemical quite important to this end-user industry. Moving forward, the demand for glutaraldehyde will still be high when consumers continue looking for premium and durable personal care products.

Additionally, the regulatory environment on the use of glutaraldehyde is a factor that very strongly affects the market dynamics. The use of glutaraldehyde is regulated by very stringent controls over use, exposure, and environmental effect in most regions of the world, with institutions such as the US Environmental Protection Agency and the European Chemicals Agency. Manufacturers and end-users should, therefore, ensure that they adhere to these regulations to avoid penalty, product withdrawal, or bans. These shifting regulatory requirements spur innovation in the formulation of products and safety processes and push companies to come up with safer, more environmentally friendly alternatives or improved formulations of glutaraldehyde. Such interactions between regulatory pressures and market demand further set the growth trajectory of the glutaraldehyde market, keeping it dynamic and evolving.

Market Dynamics:

Drivers:

-

Expansion of Glutaraldehyde in Water Treatment Applications

One of the major drivers in the Glutaraldehyde Market is its increasing application in water treatment. Keeping in view the global concern for assured pure and safe water supplies, especially in the industrial treatment process, the need for efficient biocides like glutaraldehyde has naturally grown. Hence, companies are looking to expand their capacities to cater to this rising demand. For example, in June 2023, Solenis LLC, one of the largest specialty chemicals manufacturers in the world, announced a plan to hike its glutaraldehyde production capacity in the United States. Growing investments in production capacity were responding to the rising demand in microbial control in cooling towers and other industrial water systems. For such aspects, glutaraldehyde has built a solid reputation for its effectiveness in controlling the formation of biofilm and bacterial growth and become one of the more popular products within the water treatment industry, especially so in areas with tight regulations concerning the environment.

-

Rising Demand for Disinfectants in Healthcare

Rising demand from the healthcare sector for potent disinfectants has been the major growth driver for the Glutaraldehyde Market. With the rising cases of nosocomial or hospital-acquired infections and the concern over antibiotic-resistant bacteria, demand for potent disinfectants is raised. Glutaraldehyde is actually a broad-spectrum antimicrobial used comprehensively in medical institutions for sterilization and disinfection purposes. Steris Corporation introduced a new glutaraldehyde-based disinfectant for use in hospitals in September 2023, offering better microbial control and faster kill times. Rising demands in more advanced solutions for disinfection rise to the exacting standards of the healthcare industry. Glutaraldehyde forms an important factor in health care disinfection since it kills a large number of viruses, bacteria, and fungi.

Restraint:

-

Environmental and Health Concerns Associated with Glutaraldehyde Use

Glutaraldehyde is a largely applied disinfectant that enormously suffers from environmental and health concerns it raises. Being cytotoxic at higher concentration, it creates serious health and environmental risks. Regulations are being introduced that limit its use in view of the above-mentioned issues. For example, in December 2023, the European Chemicals Agency tightened the control over glutaraldehyde in consumer products because of its sensitizing and respiratory sensitizer potential. This pressured manufacturers to find substitute biocides or safer formulations for glutaraldehyde, impacting market growth. Balancing efficacy with safety is a challenge the industry will have to encounter in view of stringent regulatory frameworks across regions.

Opportunity:

-

Development of Eco-friendly Glutaraldehyde Alternatives

Environmental concerns and related regulatory pressures are escalating, hence an opportunity for developers of eco-friendly glutaraldehyde alternatives. The focus of companies is shifting to developing biocides with similar efficacy to glutaraldehyde but less environmental impact. Clariant AG introduced new biodegradable biocide product lines in April 2024 for uses such as water treatment and healthcare, which could replace glutaraldehyde. These new products are designed to meet demands for sustainable solutions without sacrificing effective microbial control. The launch of these alternatives could just be the very beginning of new growth opportunities in the Glutaraldehyde Market, especially among environmentally conscious consumers and industries. In such a shifting market, companies capable of innovating and delivering greener solutions are likely to gain an edge.

Challenge:

-

Balancing Efficacy and Safety in Glutaraldehyde Formulations

One major challenge in the Glutaraldehyde Market is to establish formulations that balance efficacy with safety. Glutaraldehyde is an extremely effective biocide; however, on the negative side, it is hugely toxic and associated with certain risks that have to be dealt with carefully. This challenge is especially acute in healthcare, where the use of disinfectants should not result in an appreciable risk to patient safety. This, in turn, exerts a heavy pressure on the companies to come up with formulations which retain the high antimicrobial efficacy for glutaraldehyde while reducing its toxic impact. For example, in August 2023, Johnson & Johnson announced the development of a new glutaraldehyde-based disinfectant with reduced toxicity levels for use in health settings more safely. This product forms just part of a wider trend toward safer biocide formulations that underlines the pertinacious efforts the industry is making to master this critical challenge. The ability to innovate in this area will be of prime importance to any company aiming to hold its prevailing position in the respective market.

KEY MARKET SEGMENTS

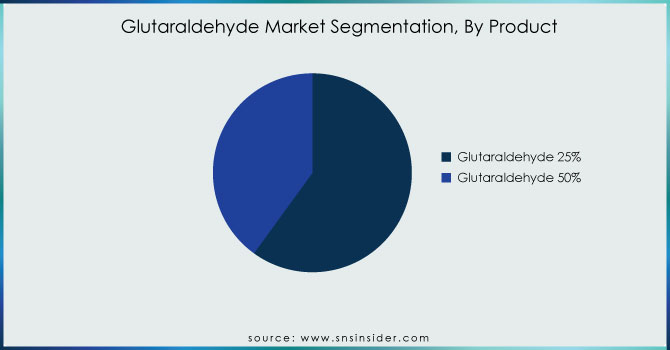

By Product

The Glutaraldehyde 50% segment dominated the glutaraldehyde market, accounting for a share of approximately 60% in 2023. This product in this concentration is of enhanced effectiveness for biocide and disinfectant applications in multiple industries, especially the healthcare and industrial sectors. For instance, Glutaraldehyde 50% is being applied on a large scale for high-level disinfection of surgical instruments and endoscope devices in a healthcare set-up. Again, in the oil and gas industry, this higher concentration is needed for effective application to control microbial growth in pipelines and reservoirs. Lower concentrations could be ineffective in these applications. The need for robust and reliable disinfection and microbial control drives Glutaraldehyde 50% to the top of the market and makes it very dominant in those situations where maximum potency is required.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

The disinfectant segment dominated the glutaraldehyde market in 2023 and is anticipated to hold a share of approximately 45% in the same market. The broad application as a strong disinfectant, particularly within healthcare facilities for the sterilization of various medical instruments like endoscopes and surgical tools, drives this domination. Glutaraldehyde exerts activity against a broad spectrum of microorganisms, ranging from bacteria to viruses and fungi. It forms one of the important constituents in the fight against HAIs and it derives strength from stringent hygiene regulations in hospitals and clinics. All these factors firmly establish disinfectants as the lead application segment for glutaraldehyde in the market.

By End-User

The Healthcare segment dominated the glutaraldehyde market in 2023 by capturing about a 50% share. This has been largely due to the fact that glutaraldehyde finds major application in hospitals and medical centers for sterilizing surgical instruments and medical devices such as endoscopes and dialysis machines to high-level disinfectants. Glutaraldehyde finds application in the protection of patients due to rising demand for sterilization in healthcare sectors, resulting from protection against healthcare-associated infections. Moreover, strict regulations by regulatory agencies for high hygiene standards in healthcare settings further increase its demand, making the healthcare sector the largest end-use industry for glutaraldehyde.

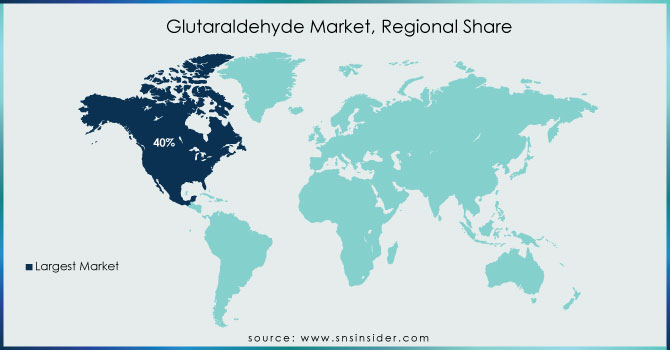

Regional Analysis

In 2023, North America dominated the glutaraldehyde market and held an estimated share of approximately 40%. This domination is majorly fueled by the strong demand coming from the healthcare sector, in which glutaraldehyde finds extensive application for the sterilization of medical instruments and equipment. The United States, because of its rigid healthcare legislations and high infection control standards in healthcare, acts as the prime driver. For example, glutaraldehyde finds extensive application in hospitals and clinics for disinfection purposes of critical medical devices such as endoscopes. Developed healthcare infrastructure with continuous evolution in medical technology is boosting the regional market in North America and further re-establishing its lead in the global glutaraldehyde market.

Moreover, in 2023, Asia-Pacific emerged as the fastest-growing region in the glutaraldehyde market, accounting for about a 30% share. Growth in this region is fast because of the increasing infrastructure in health care, increasing investments being made for medical and industrial applications, and enhanced awareness of infection control standards—especially in emerging countries such as China and India. For example, in China, increasing healthcare infrastructure and stringent sterilization measures in hospitals result in growing demand for glutaraldehyde. On the other hand, growth in the medical sector of India and technological progress in water treatments accelerate the use of glutaraldehyde. Accelerating industrial base within the region and the rising need for proper hygiene in the healthcare and water treatment applications segments spur market growth.

Key Players

The major key players are LANXESS, UPI Chem, TIMAC AGRO International, DOW, Finoric LLC, Whiteley Corporation, Neogen Corporation, Grassland Agro, Surfachem Group Ltd, Tianxin Chemical Enterprise, and other key players mentioned in the final report.

Recent Developments

-

June 2024: US glutaraldehyde prices dropped on oversupply, while prices gained in Asia on tighter supply and rising demand.

-

April 2023: The European Chemicals Agency (ECHA) proposed including eight substances on Annex XIV of REACH Regulation 1907/2006, which requires authorization. Among these is Glutaral, a preservative in cosmetics.

| Report Attributes | Details |

| Market Size in 2023 | US$ 701.3 Mn |

| Market Size by 2032 | US$ 1039.1 Mn |

| CAGR | CAGR of 4.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Glutaraldehyde 25% and Glutaraldehyde 50%) • By Application (Water Treatment, Disinfectant, Tanning, Animal Husbandry, Electron & Light Microscopy) • By End-user (HealthCare, Cosmetics, R&D Laboratories, Agriculture, Oil & Gas, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | LANXESS, UPI Chem, TIMAC AGRO International, DOW, Finoric LLC, Whiteley Corporation, Neogen Corporation, Grassland Agro, Surfachem Group Ltd, Tianxin Chemical Enterprise |

| Key Drivers | • Expansion of Glutaraldehyde in Water Treatment Applications • Rising Demand for Disinfectants in Healthcare |

| Market Restraints | • Environmental and Health Concerns Associated with Glutaraldehyde Use |