Butane Market Report Scope & Overview:

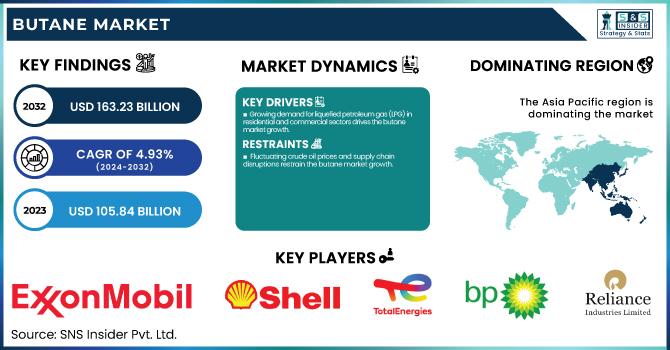

The Butane Market size was USD 105.84 billion in 2023 and is expected to reach USD 163.23 billion by 2032 and grow at a CAGR of 4.93% over the forecast period of 2024-2032.

To Get more information on Butane Market - Request Free Sample Report

This report provides in-depth insights into the butane market, covering key trends and industry dynamics. It analyzes production capacity and utilization by country and type in 2023, highlighting supply- demand balance. The report also examines feedstock prices across regions, offering a comparative cost analysis. Additionally, it evaluates the regulatory impact by country and type, detailing compliance requirements and industry policies. Environmental metrics, including emissions data, waste management practices, and sustainability initiatives, are assessed to understand the market’s ecological footprint. Furthermore, the study explores innovation and R&D activities by type in 2023, showcasing advancements in butane production and applications. These insights help stakeholders navigate the evolving landscape, optimize operations, and align with regulatory and sustainability goals.

The United States held the largest market share in the Butane Market, valued at USD 16.76 billion, accounting for 72% of the global market, primarily due to its strong refining capacity, abundant natural gas reserves, and high demand across industrial and commercial sectors. The U.S. is a leading producer of liquefied petroleum gas (LPG), including butane, with major refining hubs in Texas, Louisiana, and California contributing to large-scale production. Additionally, the country's expanding petrochemical industry, which utilizes butane as a key feedstock, has further driven market dominance. The growing adoption of butane in industrial, residential, and auto fuel applications, along with increasing exports to Asia and Europe, strengthens its market leadership. Moreover, favorable regulatory frameworks, infrastructure investments, and technological advancements in refining and storage facilities have bolstered the U.S. butane market growth.

Butane Market Dynamics

Drivers

-

Growing demand for liquefied petroleum gas (LPG) in residential and commercial sectors drives the butane market growth.

The increasing adoption of liquefied petroleum gas (LPG) as a clean and efficient fuel source in residential and commercial sectors is a key driver of the butane market. Governments worldwide are promoting LPG as a household and commercial fuel through subsidies and initiatives aimed at reducing reliance on traditional fuels like coal and wood. Butane, a primary component of LPG, plays a crucial role in meeting this rising demand. Additionally, the expansion of urbanization, improvements in energy infrastructure, and the shift toward clean cooking fuels in emerging economies are further propelling market growth. Countries like India, China, and Brazil are witnessing a surge in LPG consumption, supported by government policies and increasing disposable incomes. These factors are expected to drive the demand for butane-based LPG, strengthening its market position in the coming years.

Restrain

-

Fluctuating crude oil prices and supply chain disruptions restrain the butane market growth.

The butane market is highly dependent on crude oil and natural gas production, making it vulnerable to price volatility and supply chain disruptions. Fluctuations in global crude oil prices directly impact the production cost and pricing of butane, affecting market stability. Geopolitical tensions, trade restrictions, and unexpected supply chain disruptions, such as those seen during the COVID-19 pandemic, have further constrained the availability of raw materials. Additionally, the shift toward renewable energy sources and increasing environmental regulations targeting fossil fuel consumption have put pressure on butane production and usage. These uncertainties create pricing challenges for manufacturers and end-users, potentially limiting market expansion. Consequently, the industry must navigate volatile pricing trends and geopolitical risks to ensure a stable and sustainable supply of butane.

Opportunity

-

Advancements in butane-based petrochemical applications create growth opportunities for the butane market.

The rising demand for butane as a feedstock in petrochemical industries presents a significant growth opportunity for the butane market. Butane is extensively used in the production of ethylene, butadiene, and other petrochemicals, which are key components in the manufacturing of plastics, rubber, and synthetic materials. With the increasing focus on petrochemical expansion, especially in Asia-Pacific and the Middle East, the demand for butane as a raw material is expected to surge. Additionally, advancements in butane cracking technologies and investment in large-scale petrochemical projects by key players such as ExxonMobil, Saudi Aramco, and Sinopec are further driving market growth. This growing utilization of butane in high-value chemical applications is expected to create long-term revenue opportunities for market participants.

Challenge

-

Stringent environmental regulations and carbon emission concerns pose a major challenge to the butane market.

The butane market faces increasing regulatory scrutiny due to growing environmental concerns and carbon emissions associated with fossil fuel consumption. Governments and environmental agencies are imposing strict emissions regulations, which could limit the production and use of butane in various applications. The Paris Agreement and national-level decarbonization policies are encouraging industries to shift toward renewable and low-carbon alternatives, posing a significant challenge for the butane market. Additionally, concerns over LPG-related carbon footprints and air pollution risks have led to rising investments in biofuels and green energy alternatives. As countries strengthen their commitment to reducing greenhouse gas emissions, the butane industry must adapt by investing in cleaner production technologies, carbon capture solutions, and sustainable energy transitions to remain competitive in the evolving energy landscape.

Butane Market Segmentation Analysis

By Application

Residential/Commercial segment held the largest market share at around 42% in 2023. This is attributed to the fact that a large part of liquefied petroleum gas (LPG) is used in residential cooking and heating applications, which drives the growth of this segment. Being one of the fractions of LPG, it is widely used in domestic kitchens, restaurants, hotels, and commercial enterprises due to its high thermal efficiency, economical, and clean combustion. Various governments in emerging economies like India, China, and Brazil have introduced subsidies and policies that encourage LPG use, which will continue to support increased levels of butane. Moreover, growth in an urban population, better accessibility to the gas distribution network, and higher household and commercial disposable income were also contributing factors to the growth of LPG in residential and commercial sectors. Butane corresponds with the residential and commercial sectors in particular, and so it holds the fort more firmly due to the stemming exodus of conventional biomass and coal in favor of environmental and low-carbon alternative fuels.

Butane Market Regional Outlook

Asia Pacific held the largest market share, around 38%, in 2023. Growth in LPG consumption in countries such as China, India, and Japan is attributed to government subsidies, high urbanization, and the expanding energy infrastructure. For example, India has introduced the Pradhan Mantri Ujjwala Yojana (PMUY), a program that gives away subsidized LPG connections to households and boosts butane requirements. With the development of several petrochemical plants in the region, particularly in China and South Korea, butane has also become an important feedstock for the petrochemical industry, particularly for ethylene and butadiene production and other chemicals. Asia Pacific is expected to continue, therefore, holding dominance in the global butane market due to the presence of a large number of refineries and rising industrial activities, along with growing consumer demand for LPG as an alternate fuel in automotive use.

North America held a significant market share. The extraction and refining facilities for butane-related resources are extensive in the U.S. as it figures to be a leading producer of natural gas liquids. Market growth is driven by the increasing petrochemical production, especially in the U.S. and Canada, where butane is employed as an important feedstock to manufacture ethylene, butadiene, and synthetic rubber. Owing to increasing LPG demand for being a less polluting and greener fuel relative to the traditionally used fuels and a growing trend of consuming butane in automotive as an alternative fuel, the region is anticipated to boost incessantly in the years to come. North America is also a considerably important market owing to the presence of major industry players, export potential, and developing shale gas extraction.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

ExxonMobil Corporation

-

Royal Dutch Shell plc

-

TotalEnergies SE

-

Chevron Corporation

-

British Petroleum (BP) plc

-

China Petroleum & Chemical Corporation (Sinopec)

-

Indian Oil Corporation Limited

-

Reliance Industries Limited

-

Saudi Arabian Oil Company (Saudi Aramco)

-

Gazprom PJSC

-

Phillips 66

-

PetroChina Company Limited

-

ConocoPhillips

-

Ecopetrol S.A.

-

Petróleos de Venezuela, S.A. (PDVSA)

-

Repsol S.A.

-

Lukoil PJSC

-

Marathon Petroleum Corporation

Recent Development

-

In April, 2025, Sinopec partnered with CATL to establish 10,000 battery swap stations by the end of 2025, aiming to strengthen China's electric vehicle infrastructure.

-

In December 2024, IOC revealed its plan to invest over ₹21,000 crore in expanding the Barauni refinery and advancing city gas distribution projects in Bihar, focusing on boosting refining capacity and promoting cleaner fuel adoption.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 105.84 Billion |

| Market Size by 2032 | USD 163.23 Billion |

| CAGR | CAGR of 4.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Residential/Commercial, Industrial, Auto Fuel, Refinery, Chemical Feedstock, Petrochemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ExxonMobil Corporation, Royal Dutch Shell plc, TotalEnergies SE, Chevron Corporation, British Petroleum (BP) plc, China Petroleum & Chemical Corporation (Sinopec), Indian Oil Corporation Limited, Reliance Industries Limited, Saudi Arabian Oil Company (Saudi Aramco), QatarEnergy, Gazprom PJSC, Phillips 66, PetroChina Company Limited, ConocoPhillips, Ecopetrol S.A., Petróleos de Venezuela, S.A. (PDVSA), Petrobras, Repsol S.A., Lukoil PJSC, Marathon Petroleum Corporation |