Gradient Power Amplifier Market Report Scope & Overview:

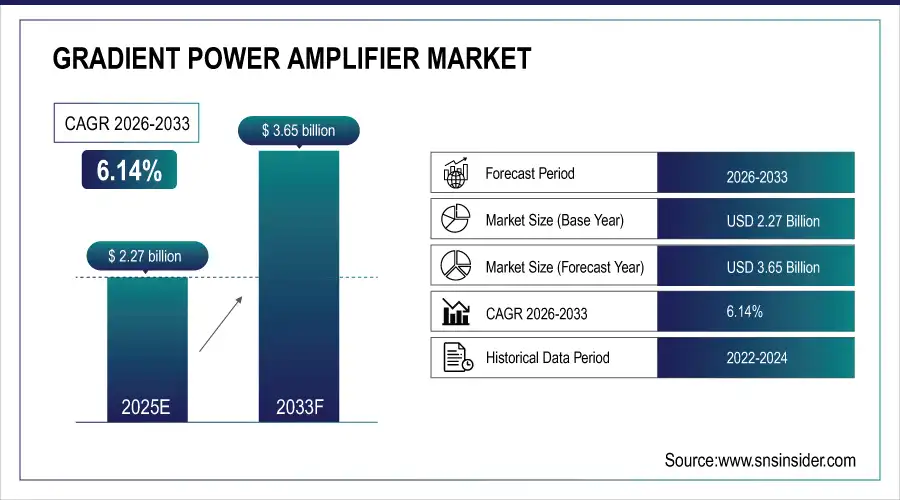

The Gradient Power Amplifier Market Size was valued at USD 2.27 Billion in 2025E and is expected to reach USD 3.65 Billion by 2033, growing at a CAGR of 6.14% over the forecast period of 2026-2033.

The Gradient Power Amplifier Market is expanding steadily, driven by rising adoption of MRI and NMR systems across healthcare, research, and industrial sectors. Growing demand for high-precision imaging, faster scan cycles, and advanced diagnostic capabilities is accelerating amplifier upgrades. Technological advances in power efficiency, multi-channel configurations, and thermal stability further support market growth.

Market Size and Forecast:

-

Gradient Power Amplifier Market Size in 2025E: USD 2.27 Billion

-

Gradient Power Amplifier Market Size by 2033: USD 3.65 Billion

-

CAGR: 6.14% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Gradient Power Amplifier Market - Request Free Sample Report

Key Gradient Power Amplifier Market Trends

-

Rising demand for high-precision MRI imaging is driving upgrades to advanced gradient amplifiers with improved linearity and low noise performance.

-

Increasing adoption of multi-channel and high-power amplifiers enables faster scan times, higher resolution, and enhanced patient throughput.

-

Integration of digital control, real-time monitoring, and thermal management technologies is improving amplifier reliability and system longevity.

-

Growing use of MRI and NMR systems in research institutions is creating strong demand for customizable and programmable gradient amplifiers.

-

Expansion of industrial imaging and non-destructive testing applications is supporting the need for robust, high-stability power amplifiers.

-

Advancements in semiconductor components and power electronics are enabling compact amplifier designs with higher efficiency and reduced heat generation.

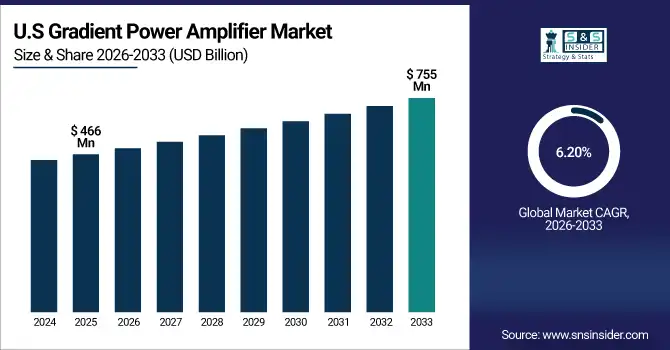

U.S. Gradient Power Amplifier Market Insights

The U.S. Gradient Power Amplifier Market size was USD 466 million in 2025 and is expected to reach USD 755 million by 2033 growing at a CAGR of 6.20% over the forecast period of 2026-2033. The rise in high-precision MRI installations is causing a surge in demand for advanced gradient amplifiers, which in turn is boosting adoption of multi-channel and high-power systems. This growing need for faster imaging, improved resolution, and enhanced diagnostic accuracy is driving hospitals and research centers to upgrade to next-generation gradient amplification technologies.

Gradient Power Amplifier Market Growth Driver

-

Rising Global MRI Installations and Shift Toward High-Performance Imaging Drives Demand for Advanced Gradient Power Amplifiers

The rapid rise in global MRI system installations is significantly driving demand for Gradient Power Amplifiers, as hospitals and diagnostic centers increasingly require faster imaging speeds, higher resolution, and improved scan accuracy. This growing need has created a direct push toward adopting high-power, multi-channel gradient amplifiers capable of supporting advanced MRI sequences, high-throughput workflows, and improved patient handling. The expansion of specialized radiology centers, combined with a surge in chronic disease diagnostics, is further amplifying market momentum. Additionally, technological advancements such as thermal stabilization systems, ultra-low noise circuitry, and real-time current monitoring are improving amplifier reliability and lifecycle performance.

In May 2024, when a leading MRI OEM introduced an upgraded gradient subsystem designed for ultra-fast cardiac and neurological imaging, prompting higher adoption among premium MRI manufacturers. As a result, the increasing dependence on precision imaging has become a primary factor stimulating market expansion.

Gradient Power Amplifier Market Restraint

-

High System Costs and Complex Integration Challenges Limit Gradient Power Amplifier Adoption Across Emerging MRI Markets

The high cost of Gradient Power Amplifiers, combined with complex system integration requirements, continues to restrain their widespread adoption, especially in price-sensitive regions. These amplifiers require specialized cooling, advanced shielding, and compatibility with high-field MRI architectures, making total system deployment substantially expensive. This results in budget constraints for smaller hospitals, standalone imaging centers, and research labs, ultimately slowing down installations. Additionally, integration challenges with legacy MRI models particularly those operating on outdated control software create added engineering costs and lengthier procurement cycles. The shortage of skilled technicians who can manage configuration, calibration, and maintenance further intensifies adoption hurdles. These factors collectively limit the pace at which healthcare facilities can modernize imaging infrastructures, reducing market penetration opportunities for amplifier manufacturers and slowing innovation scaling. As a consequence, cost-driven procurement barriers continue to pose significant resistance to long-term market acceleration.

Gradient Power Amplifier Market Opportunity

-

Growing Adoption of AI-Enabled MRI Workflows Creates Demand for Smart Gradient Power Amplifiers

The rapid integration of AI-enabled MRI workflows presents a major opportunity for Gradient Power Amplifier manufacturers, as AI-driven reconstruction, motion-correction, and automation systems require amplifiers with improved stability, precision, and responsiveness. This shift is driving demand for smart amplifiers equipped with enhanced monitoring capabilities, predictive diagnostics, and optimized power delivery for accelerated scan sequences. As AI reduces scan times, amplifiers must support faster switching speeds and high-frequency gradient pulses without compromising image quality. Growing investment in AI-based radiology platforms across the U.S., Europe, and Japan further accelerates this shift.

A key development occurred in July 2024, when a global imaging technology company introduced an AI-assisted MRI platform featuring an intelligent gradient subsystem designed to reduce scan energy consumption by 18%. This alignment of AI automation with next-generation gradient control is creating significant opportunities for amplifier vendors to position themselves as essential components in the future of precision imaging.

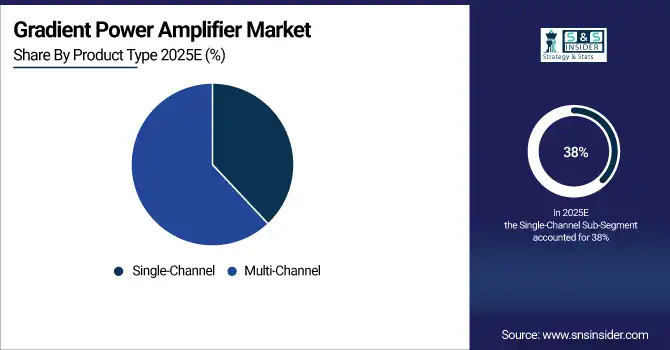

Gradient Power Amplifier Market Segment Highlights:

-

By Product Type Single-Channel – 38% (largest), multi-channel – 62%

-

By Power Rating Low-Power Gradient Amplifiers – 35%, Medium-Power Gradient Amplifiers – 42% (largest), High-Power Gradient Amplifiers – 23%

-

By Application MRI Systems – 46% (largest), Nuclear Magnetic Resonance (NMR) Instruments – 22%, Scientific Research & Laboratories – 19%, Industrial Imaging Systems – 13%

-

By End User Hospitals & Diagnostic Centers – 48% (largest), Research Institutes & Universities – 27%, Industrial Facilities – 15%, OEM Medical Equipment Manufacturers – 10%

Gradient Power Amplifier Market Segment Analysis

By Product Type

The Multi-Channel Gradient Power Amplifiers segment dominates the market with a 62% share, driven by rising adoption in advanced MRI systems, multi-coil NMR instruments, and scientific research setups requiring synchronized and high-precision magnetic field control. Their ability to support complex imaging sequences, faster gradient switching, and improved diagnostic clarity significantly accelerates demand. The Single-Channel segment holds 38%, supported by applications in compact MRI units, basic research labs, and industrial imaging systems. Increasing preference for cost-effective configurations in small-scale facilities continues to strengthen segment growth.

By Power Rating

Medium-Power Gradient Amplifiers lead the market with a 42% share, largely due to their extensive use in mid- to high-end MRI systems where balanced performance, thermal stability, and efficient pulsing capabilities are essential. These amplifiers offer optimal gradient strength for clinical imaging without excessive power consumption, driving widespread adoption. Low-Power amplifiers account for 35%, supported by portable MRI units, laboratory-scale NMR systems, and industrial scanners. High-Power amplifiers hold 23%, primarily serving advanced research, high-resolution MRI, and specialized scientific imaging applications requiring strong gradient fields.

By Application

MRI Systems dominate the market with a 46% share, fueled by growing global demand for diagnostic imaging, expansion of hospital radiology departments, and continuous upgrades to high-field MRI systems. Increasing preference for faster image acquisition and improved clarity is boosting the need for advanced gradient amplifiers. NMR Instruments follow with 22%, driven by material analysis, chemical characterization, and pharmaceutical R&D. Scientific Research & Laboratories stand at 19%, supported by physics and biomedical research. Industrial Imaging Systems hold 13%, as non-destructive testing and material inspection gain traction.

By End User

Hospitals & Diagnostic Centers lead with a 48% share, driven by the rising volume of MRI scans, increasing installation of advanced imaging systems, and continuous demand for reliable, high-performance gradient amplifiers. Growing emphasis on early diagnosis and precision imaging further strengthens adoption. Research Institutes & Universities capture 27%, supported by expanding scientific programs in physics, medical research, and biomolecular studies. Industrial Facilities account for 15%, driven by quality control and material inspection applications. OEM Medical Equipment Manufacturers represent 10%, with demand linked to new MRI system production and technological advancements.

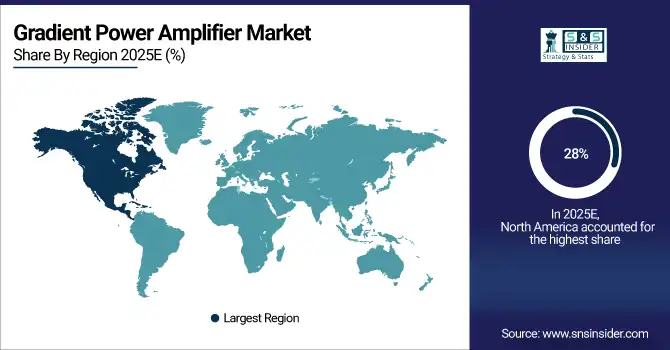

Gradient Power Amplifier Market Regional Analysis

North America Gradient Power Amplifier Market Insights

North America leads the Gradient Power Amplifier Market with a 28% share in 2025, driven by strong concentration of RF component manufacturers, advanced communication infrastructure, and high investment in aerospace, defense, and MRI systems. The U.S. continues to drive adoption through large-scale R&D programs in signal processing and semiconductor innovation. Growing deployment of next-generation wireless networks and precision imaging technologies enhances demand for high-power, low-distortion gradient amplifiers. Strategic collaborations between OEMs, research labs, and defense agencies further accelerate market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Gradient Power Amplifier Market Insights

Europe holds a 20% share in 2025, supported by advancements in industrial automation, medical imaging equipment, and high-precision electronic systems across Germany, France, and the U.K. Increasing adoption of advanced MRI machines, along with strong automotive electronics development, fuels demand for high-accuracy gradient amplifiers. The region’s emphasis on innovation, safety standards, and sustainable engineering strengthens market penetration. Investments in 5G, robotics, and scientific instrumentation continue to push the need for reliable, high-performance power amplification solutions.

Asia-Pacific Gradient Power Amplifier Market Insights

Asia-Pacific dominates the global market with a 38% share in 2025, anchored by rapid expansion in semiconductor manufacturing, telecom infrastructure, and medical imaging production. China, Japan, South Korea, and India are accelerating investments in 5G base stations, EV electronics, and MRI system development. High-volume production of consumer electronics and industrial equipment boosts demand for cost-efficient gradient amplifiers with superior precision and thermal stability. Government-backed semiconductor initiatives and strong OEM ecosystems position Asia-Pacific as the fastest-growing hub for Gradient Power Amplifier technologies.

Middle East & Africa Gradient Power Amplifier Market Insights

The Middle East & Africa region accounts for 8% of the market in 2025, driven by increasing adoption of advanced healthcare imaging, expanding telecom networks, and defense modernization programs. Countries such as the UAE, Saudi Arabia, and South Africa are integrating high-power amplifier systems in MRI installations, security systems, and smart infrastructure. Growing partnerships with global OEMs improve technology availability. Ongoing digital transformation and diversification efforts are expected to create sustained opportunities for gradient amplification applications across healthcare and industrial sectors.

Latin America Gradient Power Amplifier Market Insights

Latin America represents 6% of the market in 2025, supported by rising investments in medical imaging centers, telecom modernization, and industrial testing applications across Brazil, Mexico, and Argentina. Increasing use of gradient amplifiers in MRI diagnostics, electronics testing, and research laboratories drives regional adoption. Government initiatives to strengthen healthcare infrastructure and attract electronics manufacturing contribute to steady market growth. Collaborations with global amplifier and semiconductor suppliers are enhancing local technical capabilities and supporting broader implementation of high-performance signal amplification technologies.

Competitive Landscape for Gradient Power Amplifier Market:

Analog Devices, Inc.

Analog Devices is a leading provider of high-performance analog, mixed-signal, and RF solutions powering advanced medical imaging, industrial automation, and communication systems.

-

In March 2025, Analog Devices introduced its GPA-9000 High-Precision Gradient Power Amplifier Platform, designed for next-generation MRI scanners and industrial magnetic field control systems. The platform features enhanced linearity, improved current delivery, and integrated thermal management to support high-resolution, high-speed imaging performance.

Texas Instruments Incorporated

Texas Instruments delivers robust analog and embedded processing technologies used across healthcare imaging, automotive electronics, and industrial equipment.

-

In January 2025, TI launched the TI-GPA3200 Series Gradient Power Amplifiers, offering improved current stability, reduced distortion, and compact form factors tailored for portable MRI units and advanced semiconductor test equipment.

MaxLinear, Inc.

MaxLinear specializes in high-speed analog, RF, and mixed-signal semiconductor solutions supporting communication, industrial, and sensing applications.

-

In February 2025, MaxLinear announced the MX-GPA Multichannel Gradient Amplifier Module, featuring synchronized current modulation, low-noise operation, and optimized control algorithms for medical imaging manufacturers and precision scanning systems.

Qorvo, Inc.

Qorvo provides cutting-edge RF, power, and semiconductor technologies widely used in aerospace, defense, and industrial electronics.

-

In April 2025, Qorvo introduced the Q-GPA Ultra-Dynamic Gradient Amplifier, engineered to deliver high-bandwidth output, superior heat dissipation, and enhanced electromagnetic performance for advanced MRI platforms and high-precision magnetic actuation systems.

Gradient Power Amplifier Market Key Players

Some of the Gradient Power Amplifier Companies

-

Analog Devices

-

Texas Instruments

-

NXP Semiconductors

-

Broadcom

-

Infineon Technologies

-

STMicroelectronics

-

Qualcomm

-

Mitsubishi Electric Corporation

-

General Electric

-

Siemens

-

Qorvo

-

Toshiba Corporation

-

Skyworks Solutions

-

Maxim Integrated

-

Microchip Technology

-

ON Semiconductor

-

Renesas Electronics

-

Prodrive Technologies

-

Pure Devices GmbH

-

Ae Techron Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD2.27 Billion |

| Market Size by 2033 | USD 3.65 Billion |

| CAGR | CAGR of6.14% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Single-Channel, Multi-Channel) • By Power Rating (Low-Power Gradient Amplifiers, Medium-Power Gradient Amplifiers, High-Power Gradient Amplifiers) • By Application (MRI Systems, Nuclear Magnetic Resonance (NMR) Instruments, Scientific Research & Laboratories, Industrial Imaging Systems) • By End User (Hospitals & Diagnostic Centers, Research Institutes & Universities, Industrial Facilities, OEM Medical Equipment Manufacturers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Analog Devices, Texas Instruments, NXP Semiconductors, Broadcom, Infineon Technologies, STMicroelectronics, Qualcomm, Mitsubishi Electric Corporation, General Electric, Siemens, Qorvo, Toshiba Corporation, Skyworks Solutions, Maxim Integrated, Microchip Technology, ON Semiconductor, Renesas Electronics, Prodrive Technologies, Pure Devices GmbH, Ae Techron Inc. |