Wi-Fi Chipset Market Size & Overview:

Get more Information on Wi-Fi Chipset Market - Request Sample Report

The Wi-Fi Chipset Market size was Valued at USD 23.78 Billion in 2023. It is Estimated to Reach USD 37.16 Billion by 2032, Growing at a CAGR of 5.11% During 2024-2032.

The Wi-Fi chipset market has experienced considerable expansion due to the rising need for wireless connectivity in different devices and sectors. Wi-Fi chipsets play a vital role in enabling wireless communication in devices and are essential for the smooth transmission of data across wireless networks. Industrial automation and Industry 4.0 efforts are more and more integrating wireless communication to simplify operations, boost productivity, and lower costs. The significant investments made by the U.S. government in industrial automation and Industry 4.0 in 2023 demonstrate their key role in boosting economic growth, improving manufacturing efficiency, and sustaining global competitiveness. Major federal organizations like the Department of Energy (DOE) and the National Institute of Standards and Technology (NIST) are leading the charge in these initiatives. Moreover, it is anticipated that industrial automation will increase productivity in U.S. manufacturing by 30% in the next five years, playing a key role in economic growth and operational effectiveness. Wi-Fi chipsets allow for real-time monitoring and controlling of machinery, making predictive maintenance easier and reducing downtime. This is especially important in extensive manufacturing plants, as the capacity to link machines without wires can greatly enhance efficiency and scalability.

Furthermore, the healthcare sector is using Wi-Fi chipsets to enhance patient care and make operations more efficient. The National Institutes of Health (NIH) is a significant provider of financial support for healthcare research and the advancement of technology. In 2023, NIH funded over USD 50 billion, with a significant amount allocated toward technological research. Likewise, the Biomedical Advanced Research and Development Authority (BARDA) allocated about USD 2.7 billion in 2023 for the advancement of medical countermeasures and technologies, specifically emphasizing vaccines and diagnostics. Wireless communication makes it possible to combine different medical devices, facilitating immediate monitoring of patient vital signs, conducting diagnostics from a distance, and providing telemedicine services. Hospitals and healthcare centers are more and more using Wi-Fi-enabled devices to improve patient results and streamline operations, leading to a greater need for advanced Wi-Fi chipsets that can handle these essential functions.

MARKET DYNAMICS

Drivers

-

Smart Homes and IoT Drive the Surging Demand for Wi-Fi Chipsets.

The growth of smart homes and the Internet of Things (IoT) is a major catalyst for the Wi-Fi chipset market. Smart homes heavily depend on connected devices like smart thermostats, lighting systems, security cameras, and household appliances, all needing strong and uninterrupted wireless connections. Wi-Fi chipsets are essential to these devices, allowing them to connect and the central hub or smartphone that oversees their operations. The rising popularity of smart home devices is creating a greater demand for Wi-Fi chipsets that provide reliable connectivity, minimal power usage, and fast data transfer speeds. Additionally, the wider IoT industry, including healthcare, manufacturing, and transportation sectors, relies on Wi-Fi for instant data transmission, monitoring, and control. In healthcare, Wi-Fi chipsets in wearable devices track patient vital signs and send information to healthcare providers, leading to prompt interventions. IoT-empowered machines in the manufacturing industry utilize Wi-Fi to connect with central systems to predict maintenance, ultimately minimizing downtime and enhancing productivity.

-

Miniaturization and Energy Efficiency Driving Innovation in the Wi-Fi Chipset Market.

The Wi-Fi chipset market is driven with particular significance to miniaturization as well as power efficiency. This reflects broader trends in the industry referring to the need for smaller and, at the same time, more energy-efficient devices. As the demand for smaller, more lightweight, and portable devices grows among consumers, including various types of mobile technology and wearables, manufacturers have to design Wi-Fi chipsets that could fit smaller spaces while not losing in connectivity. The relevance of miniaturization is critical to the smartphone and, particularly, wearable tech sectors. For instance, due to miniaturization, chipsets can be used in smartwatch models without compromising their design in terms of size and weight. Hence, the right size featuring connectivity properties is achieved in such a case on the one hand. At the same time, energy efficiency is also critical for ensuring the proposed miniaturized device would have a reasonable battery life facilitating the syncing of data and providing the connectivity function. As smart devices become an increasingly central part of modern societies, from smartphones and tablets to home systems and wearables, energy-efficient devices can run for days on a single charge. This can be reasonably explained by the application of safer low-power modes and protocols in the system-on-chip design, structurally preserving low-transistor-based components.

Restraints

-

Dealing with Spectrum Overload and Interference Issues in the Evolving Wi-Fi Chipset Industry.

Spectrum congestion and interference greatly limit growth in the Wi-Fi chipset market, especially with the increasing need for wireless connections. Wi-Fi networks function in designated frequency ranges, mainly in the 2.4 GHz and 5 GHz bands, that are utilized by a variety of devices such as smartphones, laptops, smart home gadgets, and industrial IoT systems. As the number of devices joining Wi-Fi networks grows, the bands become more crowded, causing congestion in the spectrum. Additionally, the competition for available bandwidth is heightened by the implementation of new technologies like 5G and the Internet of Things (IoT) that also depend on wireless spectrum. Consequently, Wi-Fi networks may experience a decrease in performance and reliability, posing a challenge for chipset makers to create solutions to address these problems. To tackle spectrum congestion and interference, new technologies like Wi-Fi 6 and Wi-Fi 6E have been developed, providing access to less congested frequency bands and improved tools for handling interference. Nonetheless, continuous advancements in spectrum management and chipset design are still vital to guarantee the continued expansion of the Wi-Fi chipset market despite these obstacles.

KEY MARKET SEGMENTATION:

By MIMO Configuration

The SU-MIMO segment held a market share of 54% in 2023. This dominance is because it enables a single device to use multiple antennas at the same time to improve data transfer speeds. It works best in areas with few users, where one device needs a reliable, strong connection. SU-MIMO technology is commonly used in consumer electronics such as smartphones, tablets, and laptops, as well as in enterprise-grade routers for applications needing strong and reliable performance in the Wi-Fi chipset market. Qualcomm and other companies have incorporated SU-MIMO into their chipsets, allowing devices to provide faster data rates and better signal quality.

The MU-MIMO segment is expected to grow at a faster CAGR during the forecast period, as it allows numerous devices to simultaneously connect to a Wi-Fi network, each receiving multiple data streams for improved performance. This technology greatly enhances network efficiency and is perfect for densely populated areas such as offices, stadiums, and homes with multiple connected devices. With the rapid increase of IoT devices and smart homes, MU-MIMO is quickly becoming the most rapidly expanding sector in the Wi-Fi chipset market. Broadcom and Intel are at the forefront, integrating MU-MIMO into their newest chipsets to improve user experience by decreasing latency and boosting network throughput.

By IEEE Standard

The 802.11ax, also recognized as Wi-Fi 6 and Wi-Fi 6E captured a market share of over 36% in 2023 and dominated the market. Wi-Fi 6 was introduced to improve network efficiency, speed, and capacity, offering speeds of up to 9.6 Gbps and working well in crowded areas. The most recent version, Wi-Fi 6E, expands on these features to include the 6 GHz band, providing more spectrum for less interference and improved performance. For example, Intel's incorporation of Wi-Fi 6E chipsets in various laptops and desktops improves connectivity and performance in crowded network settings.

The 802.11be, recognized as Wi-Fi 7, is the most rapidly expanding segment during 2024-2032 within the Wi-Fi chipset market. It symbolizes the upcoming era of Wi-Fi innovation, offering unparalleled speeds of up to 30 Gbps and better latency than previous versions. Wi-Fi 7 includes functions like Multi-Link Operation (MLO) and Enhanced Spatial Reuse (ESR), which greatly enhance network effectiveness and velocity. Enterprises like Broadcom, for instance, develop Wi-Fi 7 chipsets to back upcoming high-performance consumer electronics and business applications, establishing fresh standards for connectivity and speed.

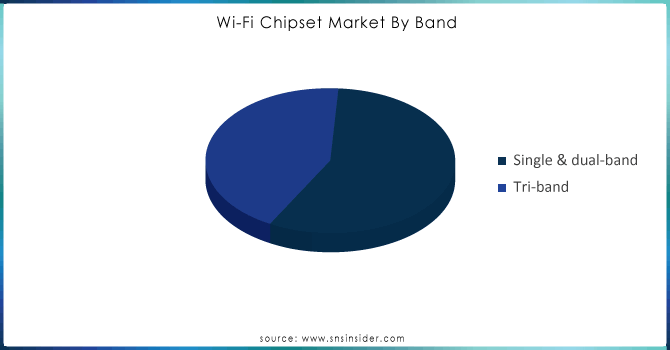

By Band

Single and dual-band Wi-Fi chipsets dominated with 55% revenue share in 2023 because of their extensive compatibility and common usage in various consumer electronics. These chipsets function on either the 2.4 GHz or 5 GHz frequency ranges, with dual-band devices providing both bands for better efficiency and decreased interference. Broadcom, a key player in the chipset industry, supplies dual-band Wi-Fi chipsets that are incorporated in numerous home routers and smartphones. Their chipsets are utilized in devices that need consistent and trustworthy wireless connectivity in various settings, like the Broadcom BCM43684, which enables dual-band Wi-Fi for improved speed and coverage.

The tri-band sector is accounted to have a quick growth rate during 2023-2032, because of the rising need for efficient networking solutions that can support multiple devices at once with minimal disruption. Tri-band chipsets function on an extra 5 GHz band alongside the usual 2.4 GHz and 5 GHz bands, offering more channels and lessening congestion. Advanced routers and high-end consumer electronics utilize Qualcomm's tri-band chipsets such as the Snapdragon X65 5G modem. These chipsets are created to provide top-notch performance and capacity, enabling fast internet and connection for multiple devices in smart homes and corporate offices.

Need any customization research on Wi-Fi Chipset Market - Enquiry Now

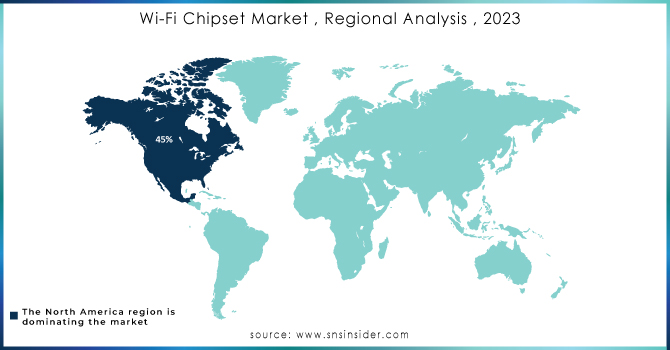

REGIONAL ANALYSIS:

North America led the Wi-Fi chipset market in 2023 with a 45% market share because of its advanced technology, widespread use of smart devices, and high IoT application penetration. In the United States, strong research and development efforts in the region contribute to advancements in Wi-Fi technology, positioning it as a top player in the market. The inclusion of top tech firms such as Qualcomm, Broadcom, and Intel enhances North America's superiority even more. Moreover, the increasing need for fast internet in multiple industries such as healthcare, education, and government is driving the growth of the market. Qualcomm's Wi-Fi chipsets are commonly utilized in smartphones, routers, and IoT devices, whereas Intel's solutions are found in laptops and enterprise-level networking gear.

Asia-Pacific is to experience a rapid growth rate during the forecast period 2024-2032, due to the widespread adoption of smart devices, higher internet usage, and the growth of the IoT environment. Nations such as China, Japan, and South Korea are at the forefront by making substantial investments in 5G technology, which supports the expansion of Wi-Fi chipsets. MediaTek's Wi-Fi chipsets are commonly utilized in budget-friendly smartphones and smart home gadgets, meeting the needs of the expanding middle class in the area. Moreover, the Wi-Fi chipset market is anticipated to experience additional growth due to the region's concentration on smart city projects and industrial automation.

KEY PLAYERS:

Some of the major key players in Wi-Fi chipset market are Broadcom Inc, MediaTek Inc, Texas Instruments Incorporated, STMicroelectronics N.V, On Semiconductor Co, Cisco Systems Inc, Cypress Semiconductor Corporation, Extreme Networks, D-Link, Intel Corporation, and Other players.

RECENT DEVELOPMENT

-

February 22, 2023: Qualcomm announced the Wi-Fi 7 Networking Pro Series chipsets to provide high-speed, low-latency connectivity for both enterprise and home networks. The chipset supports UP to 33 Gbps quad-band connectivity to meet a wide range of devices from routers to premium consumer gadgets.

-

January 4, 2023: MediaTek announced its Filogic 380 Wi-Fi 7 and Filogic 880 Wi-Fi 7 chipsets integrated with high-speed internet at CES 2023. Both chipsets are designed to deliver seamless multi-gigabit speed and robust connectivity to meet high-end smartphones and PCs, smart home devices, and automotive use.

-

April 20, 2023: Broadcom announced a new series of Wi-Fi chipsets ensuring over 40Gbps performance. The chipset will be installed on resident gateways, enterprise access, and mobile, facilitating ultra-performance quick connectivity and network performance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 23.78 Billion |

| Market Size by 2032 | USD 37.16 Billion |

| CAGR | CAGR of 5.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By MIMO Configuration (SU-MIMO, MU-MIMO) • By IEEE Standard (802.11be, 802.11ax, 802.11 Ac, 802.11ad, 802.11b/G/N.) • By Band (Single & Dual Band, Tri-Band) • By Industry (Healthcare, Automotive, Consumer Electronics, Enterprise, Industrial, Retail, BFSI, Others) • By Application (Mobile Robots, Drones, Networking Devices [Routers & Gateways, Access Points], mPos, In-Vehicle Infotainment, Consumer Devices [Smartphones, Laptops & PC, Tablets], Cameras, Smart Home Devices [Appliances, Smart Speakers], Gaming Devices, AR/VR Devices, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Broadcom Inc., MediaTek Inc., Texas Instruments Incorporated, STMicroelectronics N.V, On Semiconductor Co, Cisco Systems Inc, Cypress Semiconductor Corporation, Extreme Networks, D-Link, Intel Corporation |

| Key Drivers | • Smart Homes and IoT Drive the Surging Demand for Wi-Fi Chipsets. • Miniaturization and Energy Efficiency Driving Innovation in the Wi-Fi Chipset Market. |

| RESTRAINTS | • Dealing with Spectrum Overload and Interference Issues in the Evolving Wi-Fi Chipset Industry. |