Greenhouse Film Market Report Scope & Overview:

The Greenhouse Film Market Size was valued at USD 6.76 Billion in 2023 and is expected to reach USD 16.55 Billion by 2032, growing at a CAGR of 10.47% over the forecast period of 2024-2032.

Get More Information on Greenhouse Film Market - Request Sample Report

The greenhouse film market is shaped by several pivotal factors. A comprehensive supply chain analysis provides insights into production and distribution processes. Understanding consumer preferences reveals a demand for films that enhance crop yield and sustainability. Increased investment and funding are driving innovation in this sector, while pricing strategies reflect a balance between cost and quality. Additionally, the environmental impact of greenhouse films is increasingly prioritized, with a focus on sustainability. These elements are explored in depth in our report, offering a clear picture of the market landscape.

Greenhouse Film Market Dynamics

Drivers

-

Government Initiatives and Support for Agricultural Innovation Fuel Greenhouse Film Market Growth

Food security and sustainability have become all the more vital and various governments around the world are acknowledging a changing of the guard in these sectors. Demand in the market is on the rise due to the subsidies and policies. These include grants for adopting sustainable farming techniques, tax incentives for using energy-efficient materials for greenhouses and other support for farmers transitioning to high-tech agricultural systems. Further rising applications of advanced materials such as inhibitors and coatings for maximizing the efficiency of greenhouse films are bolstering the growth of the global greenhouse films market. There is a particularly strong level of support in large agricultural countries, and increasing food production with less environmental impact has grown in importance. The five mentioned elements play a fair way to market acceptance and growth of greenhouse films in agriculture.

Restraints

-

Lack of Awareness and Expertise in Greenhouse Film Technology Hinder Market Growth

In, most areas also in developing economies, there is a lack of awareness & knowledge in using greenhouse films which also is a major barrier. Practitioners have limited insight on benefits of applying greenhouse films which includes increased crop yield, energy savings as well as supporting sustainable agriculture movements. Additionally, advanced greenhouse films may be difficult to install and maintain, requiring farmers to have the appropriate technical expertise. Limited knowledge of the applications and benefits of greenhouse films can lead to hesitance toward investment, thereby impeding market growth in certain regions. Thus, education and training programs should be developed that highlight the advantages and best practices of greenhouse film technologies.

Opportunities

-

Increasing Adoption of Greenhouse Films in Emerging Markets Presents New Growth Avenues

Greenhouse films are also widely used in developed countries, providing good scope for their penetration in emerging markets as agriculture continues to modernize in these regions. Agricultural innovations are a high priority in many developing countries to ensure food security and efficient resource use. These requirements can be efficiently solved with Greenhouse films which act as a barrier offering better crop protection, yield quality improvement and water management. Furthermore, the growing population and increasing consumer demand for high-quality produce in these regions make greenhouse films an attractive market opportunity. These markets remain largely untapped by manufacturers; providing affordable and localized greenhouse film solutions will create huge opportunities.

Challenge

-

Challenges in Recycling and Disposal of Greenhouse Films Affect Market Sustainability

Greenhouse film recycling and disposal still pose a huge challenge for the environment. Some greenhouse films have been developed from recyclable material, although there is little implementation of their collection, recycling and reuse in many regions. As a result, used films go to landfills and contribute to plastic waste. Such a problem could potentially harm the green sustainability of agricultural greenhouse films, if farmers and producers fail to dispose of them properly and are criticized by the environmentalists. Furthermore, there is no universal recycling infrastructure available for greenhouse films, so that circular economy cannot be established. Of course, addressing these issues will entail advancements in film design, recycling technology, and waste-management systems.

Greenhouse Film Market Segmental Analysis

By Type

The multi-layer greenhouse films segment dominated the greenhouse film market with the largest share of about 36.2% in 2023. This is because they better improve the crop yield, energy efficiency and practical durability than single- and double-layer films. Opting for multi-layer films can enhance insulation and UV protection, ensuring optimal greenhouse conditions and extending the growing season even in unpredictable weather regions. Moreover, demand for multi-layer films has increased due to the encouragement from governments in areas such as Europe to embrace technological advancement to support sustainable agriculture.

By Material

In 2023, low-density polyethylene (LDPE) dominated and accounted with a market share of 42.5%, dominated the material segment of the greenhouse film market. Due to, flexibility, cost-effective, and light transmission properties, LDPE is widely used. These characteristics make it perfect for greenhouses, optimizing crop growing conditions. In addition, the adoption is further fortified by global agriculture associations endorsing its application for improved crop productivity with low environmental impact as in the case of other regions such as North America and Europe.

By Thickness

In 2023, the 80 to 150 micron thickness segment dominated and accounted for more than 50.3% of the market share in the greenhouse film market. This thickness range is a compromise between cost vs durability vs utility. These types of films provide good protection from outside weather without significantly decreasing light for plants. They have found broad utility through government programs in some regions to promote efficient and sustainable growing practices and serve to help maximize resource allocation.

By Application

In 2023, the vegetable application segment dominated the market, with 40.2% market share. Greenhouse films are widely employed for vegetable production due to their ability to create an environment conducive to high yield and quality. Being staple crops in food systems across the world, vegetables are particularly well-suited to greenhouse environments, which minimize pesticide use and allow for longer growing periods. Consumer demand for high-quality, pesticide-free horti-products, coupled with government initiatives that motivate sustainable agricultural practices contributes to the growth of this segment.

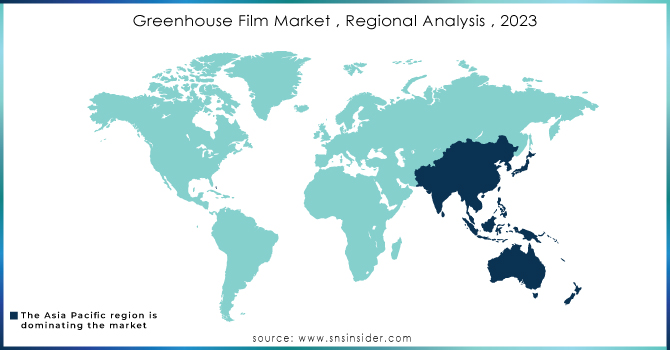

Greenhouse Film Market Regional Outlook

The Asia Pacific region held the largest share of the greenhouse film market in 2023, constituting around 42.1% of the total market share. This superiority can be traced back to fast-growing agricultural technologies and the rising need for food as the population expands. With countries like China and India leading, for example, China’s utilization of high-tech greenhouses has greatly improved crop yields, aided by government legislation that encourages sustainable agriculture. In India, the National Mission on Sustainable Agriculture has encouraged use of greenhouse films, resulting in significant increase in protected cultivation. In addition, greenhouse films are increasingly used because of the favorable climate that allows year-round crop production for the region. According to statistical data, China alone accounts for more than 1.6 million hectares of land covered with greenhouses, making an influential contribution to the growth of the market.

On the other hand, in 2023, the North America region emerged as the fastest growing region in the greenhouse film market with a significant CAGR in the forecast period. The large expansion of this area is mainly dependent on the augmented investment in agro-technology and strong focus on home-grown food production. To enhance growing conditions, high-tech greenhouses that incorporate advanced films are becoming more popular, especially in the United States. For instance, the usage of greenhouse film solutions is surging in states such as California, which emphasizes implemented initiatives to improve sustainable agriculture. In Canada, growth is also seen, supported by government policymaking encouraging innovative agricultural practices. The North America greenhouse film market may continue to grow as consumers increasingly demand fresh, locally grown fruits, vegetables, and flowers throughout the year, encouraging farmers to invest in greenhouse technologies increasingly using advanced films for improved crop protection and increased yield.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Recent Highlights

-

October 2024: SABIC collaborated with iyris and Napco National to reveal circular polyethylene greenhouse roofing for Saudi Arabia’s National Food Production Initiative. The collaboration promotes sustainable farming practices and increasing food security through eco-friendly materials.

-

December 2024: Berry Global and VOID Technologies introduced a high-performance, sustainable film that reduces environmental impact while improving strength in packaging. This partnership meets the increasing need for sustainable packaging options in all sectors.

Key Players

-

Agriplast (Greenhouse Films, Anti-Dust Greenhouse Film)

-

Agriplast Tech India Pvt. Ltd. (Greenhouse Plastic Film, UV Stabilized Greenhouse Film)

-

Agripolyane (Multi-Layer Greenhouse Film, Anti-Condensation Film)

-

A. A. Politiv Ltd. (Greenhouse Film, Anti-Drip Greenhouse Film)

-

Armando Alvarez Group (Polyethylene Greenhouse Film, Multi-Layer Film)

-

Beijing Kingpeng International Hi-Tech Corporation (Greenhouse Covering Film, UV-Resistant Film)

-

Berry Global Inc. (Greenhouse Film, Agriculture Film)

-

Central Worldwide Co. Ltd. (Greenhouse Cover Film, Plastic Film for Agriculture)

-

Coveris (Agricultural Films, Greenhouse Plastic)

-

Essen Multipack (Greenhouse Plastic Film, UV Stabilized Film)

-

Ginegar Plastic Products Ltd. (Greenhouse Cover Film, Thermal Screen Film)

-

Groupe Barbier (Greenhouse Films, Sun Control Films)

-

Lumite Inc. (Agricultural Film, Greenhouse Covering Film)

-

POLIFILM Group (Greenhouse Film, UV Stabilized Films)

-

RKW Group (Greenhouse Film, Polyethylene Film)

-

SABIC (Agricultural Films, Greenhouse Film)

-

Tuflex India (Greenhouse Film, UV-Resistant Greenhouse Film)

-

Vis and Son Company Limited (VSC) (Greenhouse Film, Agricultural Plastic Film)

-

Thai Charoen Thong Karntor Co. Ltd. (Greenhouse Plastic Film, Polyethylene Greenhouse Film)

-

Plastika Kritis S.A. (Greenhouse Films, UV Stabilized Cover Films)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.76 Billion |

| Market Size by 2032 | USD 16.55 Billion |

| CAGR | CAGR of 10.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Single Layer, Double Layer, Multi-layer) •By Material (Low-density polyethylene (LDPE), Linear low-density polyethylene (LLDPE), Ethylene-vinyl acetate (EVA), Polyvinyl Chloride (PVC), Others) •By Thickness (80 to 150 Micron, 150 to 200 Micron, More than 200 Micron) •By Application (Vegetables, Fruits, Flowers and Ornamentals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Berry Global Inc., Ginegar Plastic Products Ltd., Amcor plc, BASF SE, SABIC, The Dow Chemical Company, POLIFILM Group, RKW Group, Essen Multipack, Armando Alvarez Group and other key players |