Hydrogen Pipeline Market Report Scope & Overview:

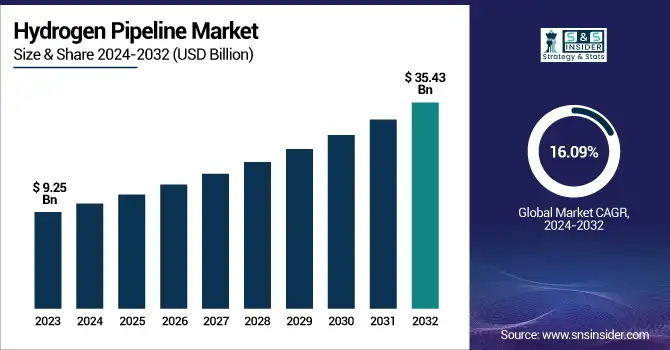

The Hydrogen Pipeline Market was valued at USD 9.25 billion in 2023 and is expected to reach USD 35.43 billion by 2032, with a growing CAGR of 16.09% over the forecast period 2024-2032.

To Get more information on Hydrogen Pipeline Market - Request Free Sample Report

This report uniquely captures the evolution of the hydrogen pipeline market by presenting regional trends in pipeline installation and utilization rates, highlighting shifts in infrastructure deployment and operational efficiency. It tracks the rise of smart pipeline monitoring systems as part of increasing technological adoption. A focus on safety reveals a steady decline in incident rates driven by AI-based leak detection systems. Additionally, the report explores emerging trends such as blended hydrogen transport with natural gas and the repurposing of existing gas pipelines, signaling a transformative shift in energy infrastructure.

The U.S. hydrogen pipeline market is projected to grow from USD 1.01 billion in 2023 to USD 3.88 billion by 2032, expanding at a robust CAGR of 16.14%. This growth is driven by rising investments in clean energy infrastructure and increasing demand for low-emission fuel alternatives. The market is witnessing steady year-over-year gains, reflecting strong momentum in hydrogen transportation development across the country.

Hydrogen Pipeline Market Dynamics

Drivers

-

Growing concerns over climate change and carbon emissions are accelerating the adoption of hydrogen as a clean fuel, driving demand for dedicated pipeline infrastructure.

The rising demand for clean energy sources is a major driver of growth in the hydrogen pipeline market. With climate change and carbon emissions on the rise, hydrogen is becoming a viable alternative to fossil fuels, and governments and industries around the world are jumping on the bandwagon. Future green hydrogen produced through renewable energy sources provides a carbon-free solution to decarbonizing transportation, power generation, and other heavy industry sectors. As energy producers switch to hydrogen, the need for effective and scalable hydrogen transport systems becomes critical, with pipelines the best option for long-distance, high-volume transport. Leading net-zero goals in addition to clean energy roadmaps supported strong investments in hydrogen infrastructure across Europe, Asia-Pacific, and North America in the latest market trends. This growth story will be further complemented by technological innovations in the segment, declining production costs, and increasing integration with renewable energy sources to fulfill the world’s emerging energy needs sustainably.

Restraint

-

High capital and infrastructure costs hinder the scalability of hydrogen pipelines due to expensive construction, material requirements, and retrofitting challenges.

Developing hydrogen pipeline infrastructure requires substantial capital investment, which poses a significant restraint to market growth. The construction of new hydrogen-specific pipelines must overcome significant engineering and material selection costs and safety measures, all attributed to hydrogen having unique properties, such as small molecular size and high diffusivity. Furthermore, retrofitting existing natural gas pipelines to convey hydrogen is not a straightforward process, as upgrading or replacing large sections is often needed to ensure that materials are compatible with hydrogen and to avoid phenomena like hydrogen embrittlement. All of these changes raise capital and operating costs. Furthermore, hydrogen demand is much smaller than that for fossil fuels, and thus economies of scale in the near term will be hard to achieve. Investors can be incentivized to take their chances on mammoth projects but struggle in regions without supportive regulatory frameworks or long-term offtake contracts. Consequently, the advanced pipeline investment is still a prominent obstacle to the proliferation and growth of hydrogen pipeline networks.

Opportunities

-

Private sector investments and PPPs are accelerating hydrogen pipeline development by combining government support with industry expertise and capital.

Private sector investment and Public-Private Partnerships (PPP) are playing a crucial role in accelerating the development of hydrogen pipeline infrastructure. As global interest in clean energy intensifies, numerous energy giants, industrial conglomerates, and infrastructure developers are entering the hydrogen value chain. This has led many stakeholders to invest in and further develop production, storage, and distribution networks with the longer-term aim of seeing hydrogen emerge as a viable sustainable fuel source. Through PPP models, governments and private players are able to share financial risks, technical know-how, and regulatory support, paving the way for large-scale hydrogen projects to be economically viable. Governments help by means of policy incentives, subsidies and strategic planning, while the private sector offers the innovation, capital and operational efficiencies. The future collaboration is essential for the development of extensive pipeline network to move hydrogen from production centers to industrial sites, fuelling stations or export terminals. Hydrogen infrastructure in 2030 Finally, PPP growth is likely to provide a major lift to hydrogen infrastructure scalability and reliability globally.

Challenges

-

Alternative transport methods like liquefied hydrogen tankers and ammonia carriers pose competition to pipelines due to their flexibility and suitability for long-distance and export applications.

One of the key challenges facing the hydrogen pipeline market is competition from alternative hydrogen transport modes. Liquefied hydrogen tankers and hydrogen carriers like ammonia or liquid organic hydrogen carriers (LOHCs) are flexible and scalable technologies that can be used for long-distance and cross-border hydrogen transport. These new alternatives may be more cost such in regions with no current pipeline in place or territories where piping is not viable due to terrain, urban development or geopolitical borders. Moreover, such carriers, like ammonia, are easier to store and convert into hydrogen, which makes these carriers more attractive options to move hydrogen through international supply chains. Such methods may prove more cost-effective than designing new pipelines, countries and companies that have stated an interest in hydrogen exports. This competitive pressure may hinder investment in pipeline infrastructure, particularly in nascent markets, unless economic or strategic benefits of pipelines within certain regions or applications are demonstrated.

Hydrogen Pipeline Market Segmentation Analysis

By Type

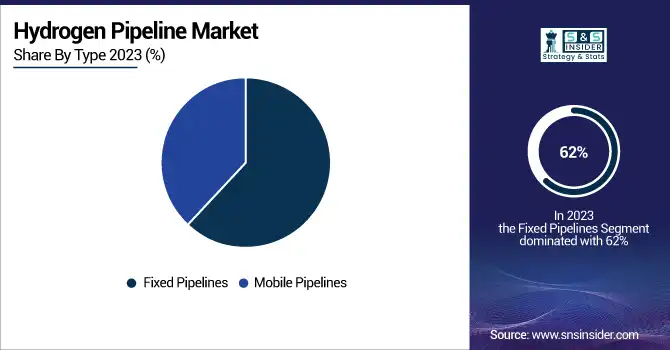

The fixed pipelines emerged as the dominant and fastest-growing segment, accounting for approximately 62% of the market share in 2023. The pipelines are permanently laid down, usually underground, and often constructed from some robust material such as steel or plastic. They can transport hydrogen in a safe and long-term process. Fixed pipelines are particularly cost-effective for those sectors that use hydrogen continuously as a high-volume feedstock, including chemical manufacturing, refining and energy generation. Increasing global demand for clean energy means raising the presence of robust hydrogen infrastructure, too and stimulating the fast-growing global market for hydrogen pipelines. We drive demand for hydrogen, and the reliability, scalability, and capacity necessary to serve a large-scale hydrogen economy make them a key piece of the future.

By Distance

The Upto 300 km segment dominated with a market share of over 38% in 2023. Long cross-country pipelines have a key role to play in delivering hydrogen from centralized production sites typically positioned in proximity to renewable and industrial hubs to the major consumption centers that exist throughout the regions. Their high scale capacity and long range contribute to the development of a connected hydrogen infrastructure that is essential in scaling hydrogen applications in power generation, mobility and heavy industry. Moreover, such pipelines facilitate the export of hydrogen across borders, contributing to energy diversification and security. The demand for long-distance hydrogen pipelines will remain strong as nations invest in decarbonization and transition to clean energy, cementing their place as the market-leading segment in the hydrogen pipeline market.

By Hydrogen

The gas segment dominated with a 58% share in 2023 and continues to hold the largest market position. This is largely attributed to the relative energy efficiency and low operational costs associated with transporting hydrogen in its gaseous state via dedicated pipelines. Gaseous hydrogen piping is a well-understood, robust molecular infrastructure because piping prevents hydrogen explosions since it has similar flow properties to combustible gases. Moreover, unlike hydrogen, transporting it as a gas avoids energy-intensive liquefaction processes, which can lower operational expenses. These elements also extend the firm grip of gas segment in the market. If gas is the king, the liquid sector is something of a young prince, with rapid growth due to its long-distance transport and increasing use in energy and industrial applications.

By Pipeline Structure

The metal pipelines dominated with a 72% share in 2023 and currently hold the largest market share. This dominance is due to the availability of extant metal pipeline infrastructure and their established strength and durability in transporting hydrogen over long distances. For example, the materials with high-pressure tolerance and structural integrity for large-scale hydrogen transmission networks are mostly steel and other types of metals. Moreover, due processes and the ongoing preference of industry actors for metal pipeline technology are expected to support their familiarity. The market is, however, gradually changing as plastics and composites is the fastest growing segment due to innovative lightweight corrosion-resistant materials which are now being considered as an available alternative to metals for potential future hydrogen transport systems.

Hydrogen Pipeline Market Regional Outlook

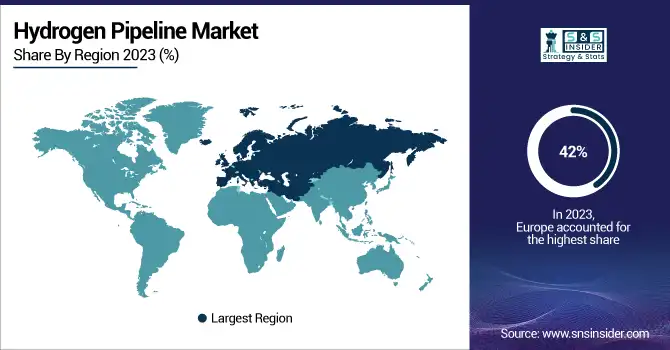

The Europe region dominated with a market share of over 42% in 2023, driven by robust government regulations and high investments aimed at reducing carbon emissions. This vision of the region focuses on building renewable hydrogen infrastructure and long-distance pipelines to enable reliable distribution. Various initiatives in several countries seek to establish hydrogen production hubs near points of demand, contributing to regional integration and the security of energy supply. Joint ventures across European countries and private sector players are also speeding up the hydrogen projects. This unified approach underlines Europe’s will to be the world leader in clean energy, especially hydrogen, placing it at the leading edge of constructing a greener energy future with advanced pipelines and cross-border collaboration.

The Middle East and Africa are rapidly emerging as the fastest-growing regions in the hydrogen pipeline market. This expansion is fueled by a surplus of renewable power, increasing need for clean H2, and beneficial government policies that promote domestic green energy production. There’s also well-established oil and gas infrastructure in the region that provides a solid foundation for the transition to hydrogen transport. Hydrogen infrastructure is receiving a clear commitment from countries such as Oman that are embarking on large-scale pipeline projects to connect production hubs to export points. With an accelerating global push for clean energy, the Middle East and Africa are discovering themselves as strategic players in the hydrogen economy, utilising their natural resources and prime geographical location to contribute to wider energy transitions around the world.

Get Customized Report as per Your Business Requirement - Enquiry Now

Hydrogen Pipeline Market Key Players are:

-

Cenergy Holdings (composite and steel pipeline systems for hydrogen transport)

-

SoluForce B.V. (flexible reinforced thermoplastic hydrogen pipelines)

-

Salzgitter AG (hydrogen-ready steel pipes and tubes)

-

Gruppo Sarplast S.r.l (GRP and thermoplastic piping systems for hydrogen applications)

-

Tenaris (high-pressure hydrogen transmission pipes)

-

Hexagon Purus (hydrogen distribution pipe systems and Type 4 composite pressure vessels)

-

Pipelife International GmbH (plastic hydrogen pipeline solutions)

-

Europe Technologies (pipeline welding and inspection technologies for hydrogen infrastructure)

-

H2 Clipper, Inc. (long-distance hydrogen transport systems including pipelines and airships)

-

NPROXX (high-pressure hydrogen storage and pipeline components)

-

GF Piping Systems (polymer-based pipeline systems suitable for hydrogen transport)

-

ArcelorMittal (hydrogen-compatible steel pipeline products)

-

Jindal Saw Limited (welded and seamless pipes for hydrogen infrastructure)

-

Vallourec (seamless pipes for hydrogen transport and storage)

-

Tata Steel (hydrogen-ready pipeline steel solutions)

-

Liberty Steel Group (pipeline products for hydrogen energy systems)

-

ILJIN Steel (specialized steel pipelines for hydrogen applications)

-

Butting Group (corrosion-resistant stainless steel pipelines for hydrogen)

-

Welspun Corp (large-diameter hydrogen pipeline manufacturing)

-

Tubacex Group (high-alloy and stainless-steel piping for hydrogen transport)

Suppliers for (Strong in hydrogen production, liquefaction, and an extensive hydrogen pipeline network globally) on the Hydrogen Pipeline Market

-

Air Liquide

-

Linde plc

-

Air Products and Chemicals, Inc.

-

NEL ASA

-

Plug Power Inc.

-

Cummins Inc.

-

McDermott International, Ltd.

-

Tenaris S.A.

-

Enbridge Inc.

-

Kinder Morgan, Inc.

Recent Development

-

In November 19, 2024: Cenergy Holdings’ subsidiary, Corinth Pipeworks, enhanced its production facility by installing a new finishing line to address the growing demand for steel pipes. This upgrade has increased efficiency by enabling the LSAW and HSAW mills to operate independently.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.25 Billion |

| Market Size by 2032 | USD 35.43 Billion |

| CAGR | CAGR of 16.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Mobile Pipelines, Fixed Pipelines) •By Distance (Upto 300 Km, More than 300 Km) •By Hydrogen (Gas, Liquid) •By Pipeline Structure (Metal, Plastics & Composites) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cenergy Holdings, SoluForce B.V., Salzgitter AG, Gruppo Sarplast S.r.l, Tenaris, Hexagon Purus, Pipelife International GmbH, Europe Technologies, H2 Clipper, Inc., NPROXX, GF Piping Systems, ArcelorMittal, Jindal Saw Limited, Vallourec, Tata Steel, Liberty Steel Group, ILJIN Steel, Butting Group, Welspun Corp, Tubacex Group. |