Healthcare Digital Content Creation Market Report Scope & Overview:

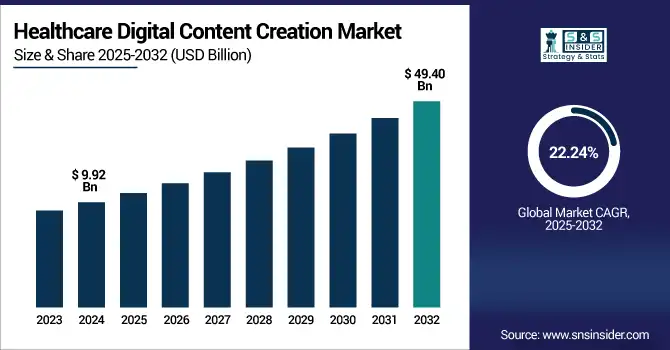

The healthcare digital content creation market size was valued at USD 9.92 billion in 2024 and is expected to reach USD 49.40 billion by 2032, growing at a CAGR of 22.24% over 2025-2032.

To Get more information on Healthcare Digital Content Creation Market - Request Free Sample Report

The healthcare digital content creation market will experience a radical growth trajectory mainly because of the rapidly digitalizing healthcare systems and increasing preference for remotely provided care. Over 60% of countries now have telehealth policies in place, which, according to the World Health Organization, has established a solid platform for digital content demand. Hospitals, pharma, and clinics are increasingly adopting omnichannel content strategies to educate patients with credible content assets that break down complex health topics into easy-to-understand formats, such as explainer videos, digital brochures, interactive apps, and symptom checkers.

As the global internet users continues to skyrocket to over 5.6 billion active internet users while mobile health app use increases by more than 30% YoY, demand for 24/7, on-demand health content is a trend that shows no sign of slowing. Low-priced smartphones, better 4G/5G networks, and evolving government-health literacy programs have fueled increased consumption in developing markets as well. In this new landscape, the life science professionals and the marketing agencies that support them are seeking automated solutions and adopting cloud-based platforms to rapidly scale output while upholding the highest quality, compliance, and brand content requirements.

At the same time, the evolution of the regulatory landscape and increasing R&D initiatives continue to support the growth of the market. For establishments such as the U.S. FDA have issued revised guidelines on digital communication and advertising for QPharma and larger pharmaceutical, medical device, and biotechnology companies, leaving little room for content fidelity and placing a heavy emphasis on ethical patient interaction. This has resulted in an explosion in evidence-based, multilingual, and demographically focused digital health campaigns.

Furthermore, major healthcare players are now investing between 10-15% of their annual marketing budget in digitally-centric content (including AI, chatbots, and localised media) targeting personal communities. As of 2024, 70% the marketing organizations surveyed will enable the education of the buyer for the patient journey by leveraging data analytics and content automation 2024. Investments are increasing as well in the natural language generation, real-time content updates, and AI-based editorial review system areas. These plugins and add-ons not only enhance user engagement but are also in alignment with the changing local and international digital health communication regulations, which will heighten the global healthcare digital content creation market growth and healthcare digital content creation market share.

Market Dynamics:

Drivers:

-

Rising Demand for Digital Engagement, AI Integration, and Regulatory Push Fuels Market Growth

The healthcare digital content creation market is fueled by an intersection of technology, policy support, and user demand. The advent of AI-enabling technology, tools, and cloud platforms has evolved the development, personalization, and delivery of healthcare content. Top health systems and pharma companies are using machine learning to auto-generate educational content, do SEO experiments, and personalize based on patient demographics.

For instance, Microsoft Cloud for Healthcare added enhanced content personalization capabilities in late 2023 that increased patient engagement by more than 40% in pilot health networks.

Regulation-wise, the European Medicines Agency (EMA) is enforcing digital information standards for transparency and evidence-based medical claims, which has been driving the demand for compliant content. And digital health marketing spending has exploded, with an average 22% year-over-year increase in spending on healthcare content initiatives, according to a Deloitte report. This has created a demand explosion of content across patient portals, wearables integration platforms, and virtual assistants. Rapid growth of content creation capabilities is the emergence of artificial intelligence (AI) and data analytics tools, which allow healthcare providers to produce real-time, evidence-based digital content that reinforces the growth of, healthcare digital content creation market share.

Restraints:

-

Data Privacy Risks, Content Regulation Complexity, and Skill Gaps Hamper the Market Expansion

One of the main concerns is data privacy and cybersecurity, especially in countries with strict rules such as HIPAA in the U.S.and GDPR in Europe. These rules even prohibit content referring to patient data, further complicating the legal requirements of personalized content types.

For instance, in early 2024, one major digital health company was slapped with a USD 2 million fine after the company used AI-generated patient testimonials without clear permission, causing shockwaves across the industry.

Additionally, regulations disparate with different rules and regulations from regulators, including the FDA, EMA, and local health ministries. This presents difficulties for compliance, in particular where a marketing campaign is conducted on an international scale. In addition, there is a dearth of talent in healthcare content writing, regulatory editing, and ethical AI practice, so the demand-supply is unbalanced. Only 30% of health care providers have digital content teams in-house, and many must outsource to a 3rd party vendor that may lack domain knowledge. Slow reprogramming of legacy applications and a lack of integration with new content management environments are other barriers to efficiency. These inhibitors restrict the healthcare digital content creation market size and impede the potential of other emerging market trends to reach maximum profitability, despite strong technological potential and underlying demand.

Segmentation Analysis:

By Content Type

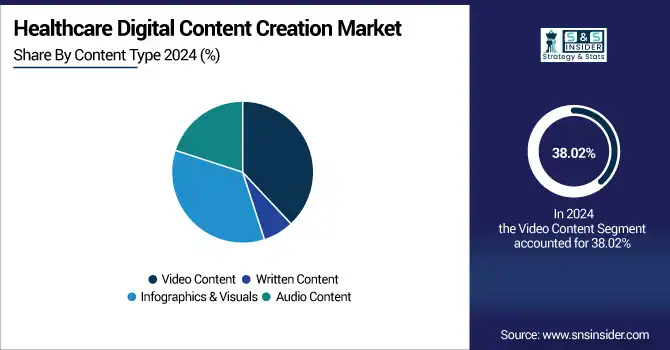

The video content segment was the highest contributor to the healthcare digital content creation market in 2024, accounting for 38.02% share of the market. This dominance is ascribed to the increasing preference for visual learning and improved patient engagement, along with the ability of video to describe complicated medical terminology. Healthcare providers are now utilizing explainer videos, 3D animation, and virtual consultation recordings to educate and enhance compliance among patients and digital outreach strategies. There is also high utilization of videos, including on outlets such as YouTube, patient portals, and social media for public health monitoring, which has made videos a preferred format.

In contrast, the infographics & visuals category was the fastest-growing type of content, reflecting the growing demand for fast, snackable, and visually appealing health content. Infographics are becoming more and more popular in chronic disease management programs and public health campaigns, as well as social media content strategies, when attention is scarce. They are gaining popularity for being able to distill statistics, symptoms, and treatment plans into one convenient visual.

By End Use

Based on end-users, the healthcare providers segment held a revenue share of 46.03% in 2024 in the global healthcare digital content creation market. This supremacy is part of a trend towards widespread use of digital content tools in the hospital, clinic, and physician office settings for patient education, compliance communication, and digital marketing. Providers have begun to include content creation platforms inside their EHRs to send personalized care messages, treatment plans, and health reminders, giving Patients a 'one-stop shopping' and better outcomes.

However, the patient segment is expected to be the fastest-growing end-user category owing to the emergence of health-conscious consumers and an increase in direct-to-patient digital content. Patients are seeking education on symptoms, treatments, and preventive measures. This pressure is compounded by the increasing consumption of mobile apps, wearables, and health communities, in which users need tailored and bite-sized content. At the same time, user-generated content, interactive formats are picking up, and that is also driving the fast growth of this segment.

Regional Analysis:

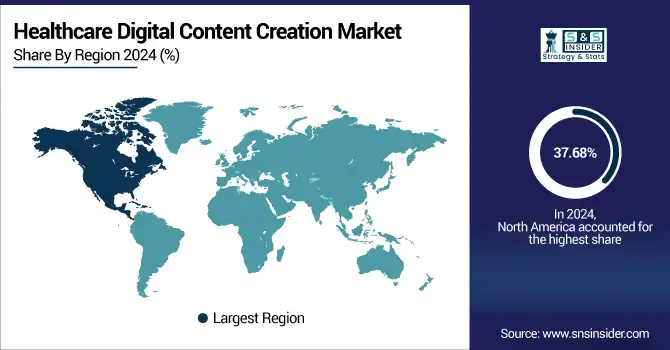

The healthcare digital content creation market in North America held a significant share in 2024, capturing 37.68% of the revenue share due to well-established healthcare infrastructure, greater digital literacy, and a surge in the usage of telehealth services.

The U.S. healthcare digital content creation market size was valued at USD 2.82 billion in 2024 and is expected to reach USD 12.64 billion by 2032, growing at a CAGR of 20.67% over 2025-2032. The US was the most prepared country in the region, due to its high healthcare IT spending, high proportion of top digital health companies, and robust regulatory infrastructure for digital communications (eg, HIPAA, FDA guidance). By 2024, more than 89% of U.S. healthcare marketers had incorporated digital channels for patient experience. Canada, similarly, is making substantial investments in the development of AI-based patient education content in various governmental programs. Mobile-first healthcare content in Mexico is largely in favour of rural outreaches as the market widens.

In Europe, significant growth in the healthcare digital content creation market is supported by robust public-led health campaigns and EU regulatory harmonization. Germany leads the region, led by previously announced DiGA coverage and integration of content platforms into telemedicine applications. France and the UK are also clearly visible, guided by national initiatives on digital health literacy and NHS digital outreach, respectively. An Umbraco international project in Poland, Italy, and Spain has seen the development of multilingual content and further helped facilitate healthcare cross-border communication. The country enjoys robust communication guidelines from EMA in respect of the content, which has also made it a center for compliant digital healthcare marketing.

The fastest growth is expected to be observed in Asia Pacific owing to increasing digitalization, penetration of smartphones, and increasing healthcare awareness. China is a regional leader, buoyed by the growth of AI-based health content platforms on apps like WeChat and high levels of government investment in digital health. In India, more than 72% of urban mobile consumers search for health-related content, fueled by a health and wellness boom and growing demand for vernacular content. Japan and Korea are spending millions on medical visualization and teleconsultation content. These companies are forced to localize the content to increase the level of engagement as well.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Leading healthcare digital content creation companies in the market include Medical Digitals, Textuar Communications LLP, WebMD Ignite, Healthcare Success LLC, Amnet, Right Source Marketing, Aha Media Group, Big Sea, Brenton Way Inc., Wallace HCL Ltd., and One Vision Health.

Recent Developments:

-

In April 2025, WebMD Ignite upgraded its Coach care-management solution by integrating SMS text-messaging and population-wide campaign delivery. This improvement enables more efficient, real-time outreach pushing health education messages via text to improve member engagement and reduce costs, capitalizing on the fact that 99% of texts are opened and 90% read within three minutes.

-

In February 2025, SingHealth’s largest public healthcare cluster partnered with Philips to co-design and implement AI-driven imaging workflows, predictive ICU management tools, and integrated data architectures. The multi-year agreement aims to “future-proof” clinical operations and elevate patient care efficiency via digital-first strategies.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 9.92 billion |

| Market Size by 2032 | USD 49.40 billion |

| CAGR | CAGR of 22.24% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Content Type (Video Content, Written Content, Infographics & Visuals, and Audio Content) • By End Use (Healthcare Providers, Patients, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Medical Digitals, Textuar Communications LLP, WebMD Ignite, Healthcare Success LLC, Amnet, Right Source Marketing, Aha Media Group, Big Sea, Brenton Way Inc., Wallace HCL Ltd., and One Vision Health. |