Healthcare Digital Signage Market Report Scope & Overview:

Get More Information on Healthcare Digital Signage Market - Request Sample Report

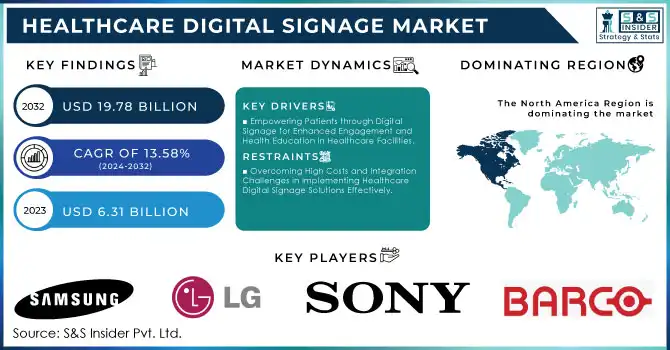

The Healthcare Digital Signage Market Size was valued at USD 6.31 Billion in 2023 and is expected to reach USD 19.78 Billion by 2032 and grow at a CAGR of 13.58% over the forecast period 2024-2032.

The Healthcare Digital Signage market is experiencing growth due to various advancements and improvements in healthcare communication and patient engagement. Hospitals and clinics increasingly adopt digital signage to enhance the delivery of critical information, streamline operations, and improve the general patient experience. These systems allow for updating health care services in real-time, such as schedules of appointments, patient wait times, and statuses in the emergency room. Besides, digital signage increases patient education by displaying health-related information like recommendations on treatment, healthy living, and disease prevention. This is to improve health outcomes through informed patients regarding their diseases and management. Moreover, it's used as a tool for internal communication among care providers smooth workflows, and coordination. Further propelling this integration are emerging technologies, including touchscreens, interactive displays, and mobile connectivity, to name a few. This allows healthcare facilities to provide targeted and easily accessible information to patients.

A total of about 64% of physicians believe that IoT can be used to reduce the workload for healthcare professionals, whereas 52% of patients use digital signage as a tool for health information. More fascinating is the fact that 83% of patients interact so actively with the digital content offered by the hospitals. In addition, 75% of both the patients and staff believe that digital signage improves their experience in the hospitals. Almost 40% of patients report that digital communication plays an important role in their healthcare decisions and experiences. These statistics are the underpinning factors behind why digital signage is significant in healthcare institutions to improve communication and work productivity.

Healthcare Digital Signage Market Dynamics

Key Drivers:

-

Empowering Patients through Digital Signage for Enhanced Engagement and Health Education in Healthcare Facilities.

In the healthcare sector, facilities use digital signage to provide patients with real-time and accessible information so they can be aware of their treatments, manage their appointments, and know everything related to their health. Interactive digital screens encourage patients to be more participative in receiving personalized content, such as healthcare tips, wellness programs, and post-treatment care instructions. Such advanced communication results in an informed patient community that, in turn, ensures improved health and satisfaction outcomes. As the value of educating patients continues to increase, it is not a wonder that the demand for digital signage solutions in healthcare environments is rising.

-

Enhancing Hospital Efficiency with Digital Signage for Seamless Patient Navigation and Communication Solutions.

Another main growth driver of the Healthcare Digital Signage market is the pursuit of greater operating efficiency in hospitals and clinics. In digital signage, the processes relating to wayfinding can be made simple to avoid confusion between patients and waiting times by promptly showing and announcing schedule schedules and room availability. Moreover, due to the addition of the use of mobile devices, touchscreens, and cloud-based systems, further flexibility and tailored approaches have been promoted for specific needs in healthcare applications thereby ensuring that the technology allows smooth communication between patients, healthcare providers, and administrative staff, all incorporating principles of workflow and resource management. With these superior functionalities and efficiencies, digital signage is quickly gaining momentum in medical environments.

Restrain:

-

Overcoming High Costs and Integration Challenges in Implementing Healthcare Digital Signage Solutions Effectively.

Most hospitals operate on lean budgets, making it hard to justify the upfront investment in new-generation digital signage systems. In the long run, the costs relating to upgrading the systems, technical support, and periodic hardware maintenance may pose pressure on the wallet, especially for smaller clinics.

Integrating with existing healthcare IT systems also poses a challenge. Ensuring compatibility of the digital signage solutions with the electronic health records and other systems that administer patients will be time-consuming and technically demanding. For instance, this will involve providing secure and seamless communication among the various software platforms allowing for real-time information about the patient, to be made available on the digital signage to update schedules or change room assignments. There are also additional complexities in the form of data security and patient confidentiality healthcare institutions must comply with very stringent regulations, such as HIPAA in the U.S. before they can implement a digital signage solution.

Healthcare Digital Signage Market Segmentation Overview

By Component

The hardware segment dominated the Healthcare Digital Signage market in 2023 with a significant 45% revenue share. The deployment of digital signage solutions required the setup of physical infrastructure like display screens, kiosks, and interactive panels. High-quality hardware investments are imperative for reliable and clear communication in healthcare facility investments, as this technology proves to be fundamental to displaying real-time information to patients, visitors, and staff.

The service segment is likely to grow with a very healthy CAGR of 15.5% in the forecast period, as the requirements for system integration, software upgrade, and maintenance services are increasing. With the advancement of digital signage solutions among healthcare organizations, the need for technical support for the uninterrupted, customized, and optimized availability of those systems will increase. Services are on the rise, driven mainly by the fast shift of platforms to cloud-based ones and the increasing desire for secure data handling.

By Display Type

In 2023, LCD dominated the largest share of 45% in the market, primarily due to its high adoption rate across healthcare facilities around the globe, its cost-effectiveness and reliability along its ability to be versatile. LCDs come in a wide size and resolution range, from small-to-medium size displays used in waiting rooms to large, information-based displays. The other aspect is that they are mainly bright in well-illuminated environments, and power consumption is relatively low compared with other display technologies.

The OLED segment will grow at the highest CAGR of 14.2% during the forecast period. Growth in sales is also attributed to the superior visual quality of OLED displays, which include more vivid colors, deeper blacks, and wider viewing angles, enhancing the overall aesthetic appeal of digital signage. In addition, with the growing focus of healthcare facilities on patient engagement and experience, the demand for high-quality visual communication tools also grows. Moreover, OLED technology often goes hand-in-hand with thinner and lighter designs that open up more flexible installation options, ideal for innovative signage solutions.

By Type

The video walls segment accounted for the largest share of 24% in revenue of the Healthcare Digital Signage market in 2023. Such growth may be a result of a greater sense of desire for high-impact and high-definition displays that enhance communication and visibility in healthcare environments. Video walls are especially useful in heavily trafficked locations such as lobbies and waiting rooms, for they can display vital information, educational content, and promotional materials simultaneously.

The transparent LED screen segment is likely to witness growth at the fastest CAGR of 14.6% over the forecast period. This growth is based on the increasing demand for innovative display solutions that blend functionality with aesthetics. Transparent LED screens help healthcare facilities provide a view and insights while maintaining their modern and open environment. They can be mounted on windows or partitions to create an integrated look without compromising light or visibility.

By Location

Indoor dominated the market in Healthcare Digital Signage, accounting for a remarkable 73% in 2023. The importance of indoor signage for maximizing patient communication and navigation within healthcare premises explains this prominence. Mainly, indoor digital signage is used across waiting rooms, reception areas, and hallways to broadcast real-time information regarding appointment schedules, directional guidance, and health education messages. Indoor digital signage is very relevant in fast-paced environments such as hospitals, in terms of the ability to display dynamic content and real-time updates, thus being a more important part of patient engagement and operational efficiency.

The outdoor location segment is expected to grow at the fastest CAGR of 14% during the forecast period. The growing popularity of outdoor digital signage can be attributed to the growing recognition of its potential to attract and inform patients and visitors outside healthcare facilities. In addition, through outdoor displays, information about service offerings, health campaigns, and notices about various events could be communicated effectively. Demand for innovations like this leads to the overall trend of enhancing hospital visibility and branding. Outdoor displays continue to become sturdier, weather-resistant, and energy-efficient as technology advances, making them more feasible for healthcare applications.

By Display Size

In 2023, the below-32-inch segment dominated the market, making up a revenue share of 45%. This can be attributed to the fact that smaller display sizes are widely versatile and cost-effective, making them common in many healthcare environments, such as waiting rooms, consultation areas, and patient rooms. Below-32-inch displays are ideal for presenting certain information, such as appointments, health recommendations, and navigating, not to overwhelm the patients or visitors. In addition, they are not too big and fit easily in small areas.

The segment above 52 inches is expected to grow with the fastest CAGR of 14.1% for the respective forecast period. This growth can largely be attributed to the high demand for bigger, impactful displays that enhance visibility and engagement in areas such as hospital lobbies and large waiting rooms. Dynamic content, health campaigns, and educational videos are best displayed on larger screens and capture the attention of patients and visitors.

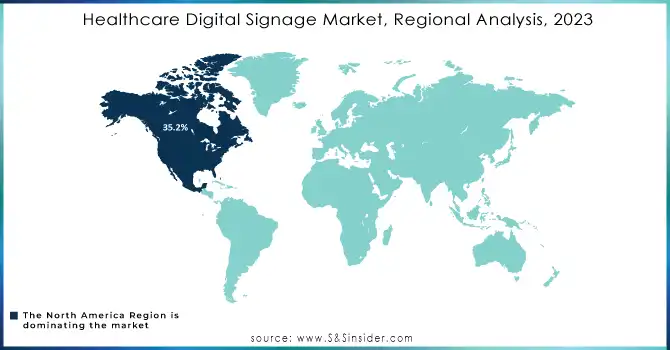

Healthcare Digital Signage Market Regional Analysis

In 2023, North America held the largest revenue share at 35.2%. The main reasons for this were the developed health structure and the early readiness of the region to adapt to digital solutions. The U.S. and Canada led in the implementation of new solutions for patient engagement, improved operational efficiency, and communication within health organizations. This region's hospitals and clinics increasingly realize the importance of digital signage to deliver real-time information, to better educate patients, and to facilitate better wayfinding. Strong investments in healthcare technology with favorable government policies and funding have further consolidated the North American lead in the market.

Asia-Pacific is the most rapidly expanding market with 8.01% CAGR during the forecast period. The drivers in this region include the heavy investment going into the telecommunication infrastructure, especially in the emerging economies that are also typically the countries of India and China where the demand for wireless communication continues to grow. The expansion of IoT applications and smart city initiatives in this region also underlines the increasing demand for advanced spectrum analysis tools. As the business and governmental authorities focus on technological advancements, the market in the Asia-Pacific region is expected to witness tremendous growth for the adoption of Healthcare Digital Signages. For example, Fortis Healthcare (India) utilizes digital signage throughout its facilities to enhance patient engagement and streamline operations. Digital displays in waiting areas share health education content, while screens in administrative zones improve internal communication among staff.

Need Any Customization Research On Healthcare Digital Signage Market - Inquiry Now

Key Players in Healthcare Digital Signage Market

Some of the major players in the Healthcare Digital Signage Market are:

-

Samsung Electronics (SMART Signage, Medical Displays)

-

LG Electronics (LG OLED Displays, Digital Signage Solutions)

-

NEC Display Solutions (NEC MultiSync, NEC Digital Signage Software)

-

Sony Corporation (BRAVIA Professional Displays, Digital Signage Solutions)

-

Barco (Barco TransForm N, ClickShare)

-

BrightSign (BrightSign XT, BrightSign LS)

-

Scala (Scala Digital Signage, Scala Cloud)

-

Visix (AxisTV Signage Suite, Visix Digital Signage)

-

Hallmark (Hallmark Interactive Patient Solutions, Hallmark Digital Signage)

-

Planar Systems (Planar UltraRes, Planar DirectLight)

-

Mitsubishi Electric (Mitsubishi LCD Displays, DisplayWall Systems)

-

Sharp Corporation (Sharp Professional LCD Displays, Sharp Digital Signage)

-

Peerless-AV (Peerless-AV Kiosk Solutions, Peerless-AV Digital Signage)

-

Aerva (Aerva Digital Signage Platform, Aerva Cloud)

-

X2O Media (X2O Platform, X2O Collaboration)

-

RMG Networks (RMG Digital Signage Solutions, RMG Network Management)

-

Cenareo (Cenareo Digital Signage, Cenareo Player)

-

Omnivex (Omnivex Moxie, Omnivex Display)

-

Nanonation (Nanonation Software, Nanonation Kiosks)

-

Mediacast (Mediacast Digital Signage, Mediacast Interactive Displays)

Suppliers for Raw Material players in the Healthcare Digital Signage Market are:

-

Sharp Corporation

-

LG Display

-

Japan Display Inc.

-

Corning

-

NVIDIA

-

Intel

-

Broadcom

-

NXP Semiconductors

-

Texas Instruments

-

Innolux

Recent Trends

-

In October 2024, LG introduced its 2MP IPS Diagnostic Monitor, designed to enhance medical digital signage with superior image clarity and color accuracy, crucial for effective diagnosis and clinical workflows. This launch underscores LG's commitment to innovative healthcare solutions.

-

In October 2024, Amino announced a partnership with Signaux as a value-added distributor for the Middle East and North Africa (MENA) regions. This collaboration aims to enhance Amino’s market presence, providing advanced digital signage and IPTV solutions powered by its H200 Series media players

-

In March 2024, LG is enhancing its healthcare digital signage offerings with the launch of the 24-inch All-in-One Thin Client (model 24CR661).

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.31 Billion |

| Market Size by 2032 | USD 19.78 Billion |

| CAGR | CAGR of 13.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Display Type (LCD, LED, OLED) • By TYPE (Video Walls, Video Screen, Transparent LED Screen, Digital Poster, Kiosks, Others) • By Location (Indoor, Outdoor) • By Display Size (Below 32 Inches, 32 to 52 Inches, more than 52 Inches) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics, LG Electronics, NEC Display Solutions, Sony Corporation, Barco, BrightSign, Scala, Visix, Hallmark, Planar Systems, Mitsubishi Electric, Sharp Corporation, Peerless-AV, Aerva, X2O Media, RMG Networks, Cenareo, Omnivex, Nanonation, Mediacast |

| Key Drivers | • Empowering Patients through Digital Signage for Enhanced Engagement and Health Education in Healthcare Facilities. • Enhancing Hospital Efficiency with Digital Signage for Seamless Patient Navigation and Communication Solutions. |

| RESTRAINTS | • Overcoming High Costs and Integration Challenges in Implementing Healthcare Digital Signage Solutions Effectively. |