Interactive Kiosk Market Size:

Get more Information on Interactive Kiosk Market - Request Sample Report

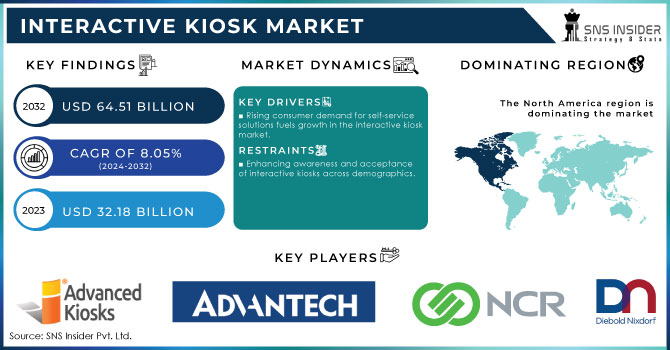

The Interactive Kiosk Market Size was valued at USD 32.18 Billion in 2023 and is expected to reach USD 64.51 Billion by 2032, growing at a CAGR of 8.05% over the forecast period 2024-2032.

The interactive kiosk market has seen substantial growth in recent years, driven by advancements in technology and the increasing demand for self-service solutions across various sectors. For Example, Pizza Hut and KFC leverage interactive kiosks to enhance customer experience and streamline operations. These self-service kiosks allow customers to browse menus, customize orders, and make payments, reducing wait times and minimizing human error. At Pizza Hut, kiosks enable diners to design their pizzas with various toppings and crust options, fostering engagement. KFC utilizes kiosks to promote combo meals and exclusive offers, facilitating upselling opportunities. by integrating these digital solutions, both brands not only improve order accuracy and efficiency but also cater to the growing demand for contactless service, ultimately enhancing customer satisfaction and loyalty.

In the retail sector, about 54% of consumers prefer self-service options, leading many retailers to integrate kiosks for tasks like order placement and product inquiries. The healthcare industry is also adopting kiosks rapidly, with over 75% of hospitals in the U.S. implementing self-service solutions to streamline patient check-ins and information access. Additionally, reports indicate that 65% of consumers are more likely to use a kiosk than wait in line, especially post-pandemic, as businesses shift towards contactless solutions to enhance safety. As companies leverage kiosks to reduce wait times and improve customer experience, the market for these technologies is set to expand further, supported by advancements in AI and data analytics that allow for personalized interactions.

Interactive Kiosk Market Dynamics

Drivers

-

Rising consumer demand for self-service solutions fuels growth in the interactive kiosk market.

Increasing consumer inclination for self-service solutions is one of the main factors driving the Interactive Kiosk Market. In this age of technology and internet consumers, it is used to getting information and services easily wherever they can. Interactive kiosks are also becoming more popular in retail, hospitality, healthcare, and transportation for improving operations and customer experience. Improved Service Efficiency: Self-service kiosks enable customers to order, check in, pay, and access information without the direct human interface in general resulting in shorter waiting times and increased service efficiency. Self-service kiosks result in enhanced client satisfaction as businesses can serve their customers quicker by offering fewer errors and increased transactional accuracy. In fast food, for instance, kiosks provide a way for customers to add custom touches to their orders without holding up the entire line. In addition to a better customer experience, this flexibility creates a greater volume of sales as customers typically upsell themselves when they can control everything.

-

Enhancing business efficiency and cost savings through interactive kiosks.

Interactive kiosks offer substantial cost reductions and improved operational effectiveness, making them a compelling investment for companies. Kiosks decrease labor costs by automating tasks like customer check-ins, order placements, and payments, eliminating the need for extra staff. In the retail industry, kiosks can process transactions that usually need a cashier, freeing up employees to focus on more intricate customer service tasks. This doesn't just reduce labor expenses but also enhances customer service by allowing employees to concentrate on offering individualized help instead of handling simple transactions. Additionally, kiosks can function around the clock, offering services beyond typical operating hours. The constant availability can result in more chances to make money, particularly for businesses in the hospitality and entertainment industries, as customers may want services during late night or early morning hours.

Restraints

-

Enhancing awareness and acceptance of interactive kiosks across demographics.

Some demographics have limited awareness and acceptance of interactive kiosks, which hinders the market. While some tech-savvy consumers may be quick to adopt self-service kiosks, others like older adults or those unfamiliar with technology may be more hesitant to use them. Consumers sometimes do not grasp the full utility and advantages of kiosks, which can result in hesitancy to use them. If people do not know how to operate a kiosk or find it too difficult, they might decide to stick with traditional service choices instead.

Moreover, the acceptance of kiosks in various areas can be influenced by cultural factors. In certain societies, service interactions are valued over self-service kiosks, reducing their popularity. When implementing kiosks, businesses need to take into account cultural nuances to ensure optimal effectiveness and usage rates. Dealing with a lack of knowledge and approval necessitates active promotion and teaching initiatives. Businesses need to invest in promoting the advantages of interactive kiosks, showcasing their convenience, effectiveness, and potential to improve customer interactions. Offering clear guidance and assistance on how to use kiosks can also reduce worries and promote acceptance.

Interactive Kiosk Market - Segmentation Outlook

by Component

The hardware segment led the market in 2023 with a 50% market share, holding the largest portion as a result of the rising need for physical kiosks across different industries. These kiosks have modern features like touch screens, interactive displays, and payment systems to improve customer involvement and operational effectiveness. For instance, businesses such as KIOSK Information Systems offer personalized kiosks designed for different uses, such as ticketing and check-in services at airports and transportation centers.

The software segment is accounted to experience a faster growth rate during 2024-2032, driven by the growing demand for customized user interactions and data analytics features. Software solutions improve kiosk functionality by allowing for functions such as collecting customer feedback, analyzing data in real time, and managing interactive content. Businesses can enhance the engagement and effectiveness of their kiosks by using interactive content software, like that offered by companies such as Intuiface.

by Type

Automated Teller Machines (ATMs) remained the dominant segment in 2023 with a 53% market share in the interactive kiosk market. They provide essential banking services, enabling users to perform various transactions, including cash withdrawals, deposits, fund transfers, and account inquiries. The widespread adoption of ATMs can be attributed to their convenience, operational efficiency, and 24/7 availability. Financial institutions like Bank of America and Wells Fargo have invested heavily in ATM technology, enhancing user experience through features such as touchscreen interfaces, multilingual support, and advanced security measures.

Vending kiosks are going to become the fastest-growing segment during 2024-2032, driven by advancements in technology and changing consumer preferences. These kiosks offer a wide range of products, from snacks and beverages to electronics and personal care items, making them versatile and appealing to consumers. Companies like Nayax and Cantaloupe Systems are revolutionizing the vending industry by incorporating cashless payment systems, real-time inventory tracking, and interactive touchscreens, significantly enhancing the user experience.

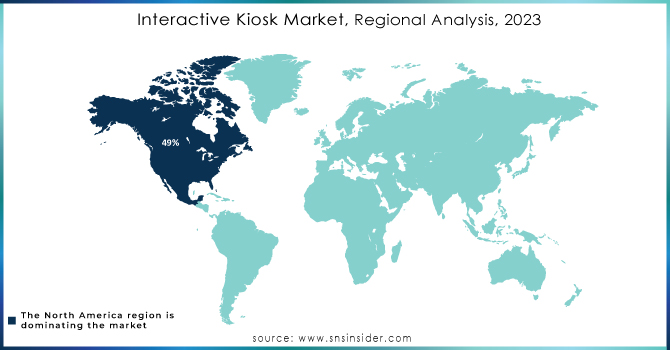

Interactive Kiosk Market - Regional Analysis

North America led the interactive kiosk market in 2023 with a 49% market share, driven by the robust adoption of technology and increasing demand for self-service solutions across various sectors. The region's advanced infrastructure supports the deployment of kiosks in retail, healthcare, and hospitality, enhancing customer engagement and operational efficiency. For example, NCR's self-checkout kiosks are widely used in grocery stores, facilitating quick and efficient customer service.

Europe is emerging as the fastest-growing region in the interactive kiosk market during 2024-2032, fueled by the increasing digitalization across various industries and a shift towards self-service technology. The adoption of kiosks in public transport, retail, and healthcare sectors is gaining momentum as organizations strive to enhance user experience and reduce wait times. Countries like the UK, Germany, and France are at the forefront, with companies such as KIOSK Information Systems and Azkoyen Group leading the charge. For instance, the Azkoyen Group provides innovative vending and kiosk solutions that cater to consumer needs in public spaces.

Need any customization research on Interactive Kiosk Market - Enquiry Now

Key Players

The major key players in the Interactive Kiosk Market are:

-

Advanced Kiosks (Kiosk Management Software, Self-Service Kiosks)

-

Advantech Co., Ltd. (UTK Series Kiosks, ADAM-60K Series I/O Module)

-

NCR Corporation (Self-Checkout Solutions, Digital Signage Kiosks)

-

Diebold Nixdorf (VN Series ATMs, Interactive Teller Machines)

-

Glory Ltd (Cash Recycling Kiosk, Automated Teller Machines)

-

Embross (Self-Check-In Kiosks, Passenger Processing Solutions)

-

Kiosk Information Systems (Outdoor Kiosks, Custom Kiosk Solutions)

-

Meridian Kiosks (Meridian Tablet Kiosk, Self-Service Kiosk)

-

Olea Kiosks Inc. (Custom Kiosk Solutions, Interactive Kiosk Displays)

-

Redyref (Redyref Digital Signage Kiosks, Custom Interactive Kiosks)

-

Source Technologies (Secure Printing Kiosks, Document Management Kiosks)

-

Touchscreen Solutions (Touchscreen Kiosks, Interactive Displays)

-

Zivebox (Parcel Delivery Kiosks, Smart Locker Systems)

-

Kiosks4Business (Retail Kiosks, Payment Kiosks)

-

KIOSK Information Systems (Check-In Kiosks, Ticketing Kiosks)

-

Smart Kiosks (Smart Vending Kiosks, Interactive Information Kiosks)

-

Toshiba (Self-Service Checkout Kiosks, Digital Signage Kiosks)

-

Xiphos Technologies (Xiphos Self-Service Kiosks, Digital Signage Solutions)

-

Screencraft (Interactive Digital Kiosks, Wayfinding Kiosks)

-

Apex Kiosks (Self-Service Kiosks, Bill Payment Kiosks)

Recent Development

-

January 2024: TouchMate expanded its product line to include interactive kiosks specifically designed for EV charging stations. These kiosks feature programmatic advertising capabilities, positioning them as a significant product for the company's growth in this sector.

-

March 2023: Olea Kiosks introduced advanced self-service kiosks that integrate AI for enhanced customer interaction. These kiosks are designed to improve user experiences in various industries, including retail and healthcare.

-

September 2023: Samsung developed an innovative check-in solution for hotels that uses facial recognition technology. This kiosk allows guests to receive room keys quickly, improving check-in efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 32.18 Billion |

| Market Size by 2032 | USD 64.51 Billion |

| CAGR | CAGR of 8.05% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Type (Automated Teller Machines (ATMs), Retail Self-Checkout Kiosks, Self-Service Kiosks, Vending Kiosks) • By End User (BFSI, Retail, Food & Beverage, Healthcare, Government, Travel & Tourism, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Advanced Kiosks, Advantech Co., Ltd., NCR Corporation, Diebold Nixdorf, Glory Ltd, Embross, Kiosk Information Systems, Meridian Kiosks, Olea Kiosks Inc, Redyref, Source Technologies, Touchscreen Solutions, Zivebox, Kiosks4Business, Smart Kiosks, Toshiba, Xiphos Technologies, Screencraft, Apex Kiosks |

| Key Drivers | • Rising consumer demand for self-service solutions fuels growth in the interactive kiosk market. • Enhancing business efficiency and cost savings through interactive kiosks. |

| RESTRAINTS | • Enhancing awareness and acceptance of interactive kiosks across demographics. |