Healthcare Fraud Detection Market Analysis:

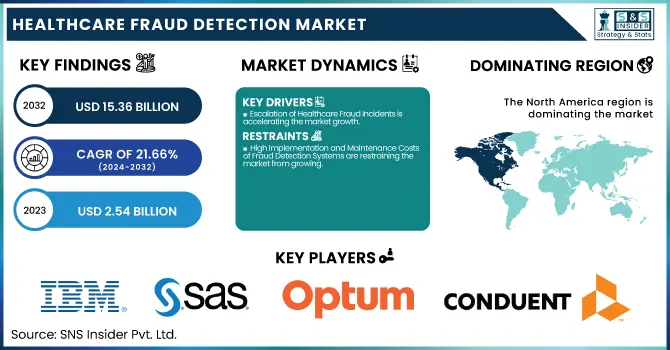

The Healthcare Fraud Detection Market was valued at USD 2.54 billion in 2023 and is projected to reach USD 15.36 billion by 2032, growing at a CAGR of 21.66% during the forecast period 2024-2032.

To Get more information on Healthcare Fraud Detection Market - Request Free Sample Report

This report provides distinctive value by delivering detailed statistical insights, including regional volumes of fraudulent healthcare claims and their economic impact by payer types like government, private insurers, and employers. It also analyzes detection accuracy and false positive rates of fraud analytics systems, presenting a performance-based view of technological effectiveness. Trends in adoption by delivery mode—cloud-based and on-premises—are discussed, as well as the compliance enforcement environment via monitored compliance measures and penalties. Such data points supply a solid and useful basis upon which to frame existing trends, threats, and the changing efficiency of fraud protection systems within global healthcare systems.

U.S. Healthcare Fraud Detection Market Overview

The U.S. Healthcare Fraud Detection Market was valued at USD 0.76 billion in 2023 and is expected to reach USD 4.45 billion by 2032, growing at a CAGR of 21.29% from 2024-2032. The United States is at the forefront of the North American market for detecting healthcare fraud due to the country's sophisticated healthcare infrastructure and high healthcare spending. The nation has shown a high level of commitment towards curbing fraud through the extensive use of sophisticated analytics, AI-powered detection tools, and stringent regulatory policies. These measures have established the U.S. as the leader in the North American healthcare fraud detection market.

Healthcare Fraud Detection Market Dynamics

Drivers

-

Escalation of Healthcare Fraud Incidents is accelerating the market growth.

The growing rate of fraudulent practices in the healthcare industry is the key momentum booster for fraud detection tools' adoption. In 2021, the United States Department of Justice opened 831 new criminal health care fraud investigations and 805 new civil investigations. Additionally, the United States Sentencing Commission indicated that healthcare fraud criminals accounted for 8% of all fraud, theft, and property damage cases in fiscal year 2021. These statistics raise red flags concerning the need for effective fraud detection systems to secure financial resources and ensure the integrity of healthcare systems. As a result, healthcare organizations have been investing more in advanced analytics and monitoring solutions to detect and prevent fraudulent behavior proactively, thus fueling market growth.

-

Integration of Advanced Technologies in Fraud Detection is propelling the growth of the market.

The use of innovative technologies like artificial intelligence (AI), machine learning (ML), and blockchain has transformed the detection of healthcare fraud. These technologies allow for the processing of large datasets to recognize patterns and anomalies, which point towards fraudulent behavior. For example, in January 2022, Premier, Inc. unveiled "INSights," a vendor-agnostic analytics platform that will automate data preparation and improve clinical, quality, and financial results. Such technology enables real-time monitoring and predictive analysis, drastically enhancing the precision and effectiveness of fraud detection systems. As healthcare organizations seek to counter more complex fraud schemes, the use of these advanced technologies continues to grow, driving market growth.

Restraint

-

High Implementation and Maintenance Costs of Fraud Detection Systems are restraining the market from growing.

One of the key limitations inhibiting the growth of the healthcare fraud detection market is the exorbitant cost of deploying, integrating, and maintaining fraud analytics solutions. Such systems typically demand huge investments in sophisticated software, infrastructure overhauls, and trained staff to manage and analyze intricate healthcare data. Also, small and medium-sized healthcare providers and payers might not be able to afford such technologies because of limited budgets, particularly in developing or resource-constrained areas. Not only are the costs initial, but they are also recurring since systems need to be updated constantly to keep up with changing patterns of fraud and regulatory demands. The high cost of these advanced solutions may discourage adoption, especially among providers with weaker IT capabilities, thus hindering universal roll-out throughout the global healthcare sector.

Opportunities

-

Integration of AI and Predictive Analytics in Fraud Detection Systems presents an opportunity to the market.

The greater adoption of artificial intelligence (AI), machine learning (ML), and predictive analytics in healthcare fraud detection systems poses a large market opportunity. Such technologies are capable of detecting sophisticated fraud schemes in advance, processing enormous sets of data in real time, and flagging irregularities that other systems may miss. As healthcare fraud schemes evolve to become highly sophisticated, predictive models can improve early detection and prevention, saving billions in fraudulent claims in the long run. Recent trends, including SAS Institute's focus on generative AI in fraud detection (2024), reflect the sector's move towards smart solutions. With insurers and healthcare providers looking to reduce losses and enhance compliance, AI-based platforms provide a scalable, effective, and responsive solution to fighting fraud, thus creating new opportunities for technology providers and solution vendors in the market.

Challenges

-

Data Privacy and Regulatory Compliance Constraints are challenging the market progress.

One of the biggest challenges to the healthcare fraud detection industry is ensuring data privacy and adhering to strict regulatory environments such as HIPAA (Health Insurance Portability and Accountability Act) within the U.S. and GDPR (General Data Protection Regulation) in the European Union. Detection of healthcare fraud involves access to large volumes of sensitive patient information, claims data, and provider information, raising serious confidentiality and data security concerns. Firms need to employ strong encryption and access controls, which make it harder to design a system and drive up the cost. Moreover, dealing with local compliance regulations creates complexity for multinational players. Any mistake in the management of sensitive health information can lead to legal sanctions, damage to reputation, and loss of customer trust. These regulatory and ethical limitations create operational complexities, hindering innovation and deployment, particularly in cross-border anti-fraud schemes.

Healthcare Fraud Detection Market Segmentation Analysis

By Solution Type

The Descriptive Analytics segment dominated the healthcare fraud detection market with a 40.12% market share in 2023 because of its foundational purpose in discovering fraud patterns through comparing historical data. This method allows the healthcare providers, insurers, and government organizations to identify abnormal billing practices, aberrant claim patterns, and system-wide inefficiencies. Descriptive analytics is a key starting point in the fraud detection cycle, providing transparent visualizations and dashboards that enable stakeholders to easily see where fraud could be taking place. Its large adoption rate is also due to its cost and ease of integration with current healthcare IT systems. With the expansion of healthcare data availability and high demand for clear reporting, descriptive analytics continues to be a reliable choice for creating fraud detection solutions, thus retaining its market supremacy in 2023.

By Delivery Mode

The On-Premises segment dominated the healthcare fraud detection market with a 56.20% market share in 2023 because it found greater appeal with large healthcare organizations and government agencies that put a high value on data security and compliance. These organizations handle highly sensitive patient and claims information, which requires more control of data storage, access, and processing environments. On-premises solutions can be deployed customized, comply better with internal IT policies, and integrate more effortlessly with legacy environments, making them the best choice for complicated organizational frameworks. In addition, many health providers consider on-premises infrastructure to be safer and more stable, particularly in areas that have strict data security regulations, such as HIPAA in the U.S. This preference for greater control and privacy resulted in the on-premises segment still controlling the market in 2023, even as cloud-based options attracted increasing interest.

By Component

The Software segment dominated the healthcare fraud detection market with a 70.20% market share in 2023 because of the growing demand for sophisticated analytics platforms, machine learning models, and real-time fraud detection systems. Payors and healthcare providers increasingly use sophisticated software tools to detect patterns of fraud, waste, and abuse in claims data. These software tools provide automation, scalability, and integration with hospital information systems, electronic health records, and insurance platforms. The use of AI-based analytics and predictive modeling further enhances the validity of software in fraud prevention methodologies. Furthermore, with the growth of sophisticated fraud schemes and the amount of healthcare data expanding exponentially, software solutions offered a scalable and efficient solution to reducing risk. Their ongoing improvements and flexibility positioned them as the most wanted component in 2023 in both public and private healthcare facilities.

By Application

The Insurance Claims Review segment dominated the healthcare fraud detection market with a 38.15% market share in 2023 because of the rising number of health insurance claims and the growing complexity of the reimbursement process. Payors and healthcare providers are under increased pressure to detect anomalies, stop fraudulent billing, and maintain compliance. This phase consists of both prepayment and postpayment reviews, which are critical in identifying upcoding, duplicate billing, phantom claims, and undue procedures. Given that claim-based fraud accounts for a major part of healthcare fraud worldwide, players invested significantly in AI-powered data analytics-driven automated claims review systems. Moreover, the integration of fraud detection solutions with claim management platforms facilitated streamlining of the review process, minimizing manual errors, and speeding up adjudication timelines, positioning it as the most used and essential application space in 2023.

By End-User

In 2023, the Public & Government Agencies segment dominated the healthcare fraud detection market with a 43.22% market share, because of its central role in administering national healthcare programs like Medicare and Medicaid. Such programs are often targeted by instances of fraudulent claims, which leads government agencies to implement sophisticated fraud analytics solutions for protecting public funds. As regulatory requirements and compliance structures toughen, agencies are deeply committed to technologies that facilitate early detection, investigation, and prevention of healthcare fraud. Such initiatives as the U.S. Centers for Medicare & Medicaid Services' (CMS) Fraud Prevention System have exemplified the usefulness of real-time analytics in anomaly detection. Furthermore, public sector organizations tend to partner with private vendors to establish strong fraud detection ecosystems, bolstering their efforts. Their mass operations and obligation to remain transparent and accountable add further fuel to their dominance in this space.

Healthcare Fraud Detection Market Regional Analysis

North America dominated the healthcare fraud detection market with a 42.36% market share in 2023 because of the advanced healthcare infrastructure of the region, good regulation, and high rates of healthcare fraud cases. The United States itself has seen countless cases of insurance and Medicaid fraud, leading to heavy investment in fraud analytics technology by public and private entities. Availability of market leaders, including IBM, SAS, and Optum, has even boosted the take-up of advanced fraud detection platforms throughout the region. Moreover, positive government activities—such as the Health Care Fraud and Abuse Control Program (HCFAC)—also help further the advancement of holistic fraud prevention models, adding to the region's lead in the marketplace.

The Asia Pacific is experiencing the fastest growth in the healthcare fraud detection market with 22.72% CAGR, with the increasing digitization of healthcare systems, growing insurance penetration, and heightened fraud loss awareness. India, China, and Japan are experiencing exponential growth in healthcare data volumes, which has created a need for analytics-driven solutions to prevent fraudulent operations. Regional governments are also working to enhance healthcare regulations and data protection laws, favorable for the implementation of fraud detection systems. Further, the growing use of cloud-based and AI-powered analytics by insurers and third-party administrators (TPAs) is driving the need for effective, scalable fraud management solutions in the emerging economies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Healthcare Fraud Detection Market

-

IBM Corporation (IBM Watson Health, IBM SPSS Modeler)

-

SAS Institute Inc. (SAS Fraud Framework for Healthcare, SAS Visual Analytics)

-

Optum, Inc. (Optum Payment Integrity, Optum Claims Manager)

-

Conduent Inc. (Fraud Detection Suite, PI Gateway)

-

Change Healthcare (ClaimsXten, Payment Accuracy)

-

EXL Service Holdings, Inc. (EXL Healthcare Analytics, EXL Payment Integrity)

-

LexisNexis Risk Solutions (LexisNexis FraudPoint, LexisNexis ThreatMetrix)

-

Northrop Grumman Corporation (Fraud Prevention System, Data Fusion Platform)

-

Wipro Limited (Fraud Analytics Solution, Wipro Holmes)

-

HCL Technologies (FRAUDWATCH, HealthEdge)

-

Fair Isaac Corporation (FICO) (FICO Insurance Fraud Manager, FICO Falcon Platform)

-

SCIO Health Analytics (an EXL Company) (SCIO Fraud Waste and Abuse, SCIO Claims Analytics)

-

CTG (Computer Task Group) (Healthcare Fraud Analytics, CTG Health Solutions)

-

DXC Technology (DXC Fraud Detection System, DXC Payment Integrity Solutions)

-

Oracle Corporation (Oracle Healthcare Analytics, Oracle Enterprise Health Analytics)

-

Cerner Corporation (Cerner HealtheIntent, Cerner Claims Analytics)

-

COTIVITI, Inc. (Payment Accuracy, Risk Adjustment Solutions)

-

Inovalon Holdings, Inc. (Inovalon ONE Platform, Risk Adjustment Analytics)

-

McKesson Corporation (InterQual, Clear Coverage)

-

Allscripts Healthcare Solutions, Inc. (CareInMotion, Practice Management Analytics)

Essential Suppliers in the Healthcare Fraud Detection Ecosystem

(These suppliers commonly provide cloud computing infrastructure, data analytics platforms, AI/ML tools, and cybersecurity technologies, all of which are essential for powering, securing, and scaling healthcare fraud detection solutions.)

-

Intel Corporation

-

Amazon Web Services (AWS)

-

Microsoft Azure

-

NVIDIA Corporation

-

SAP SE

-

VMware, Inc.

-

Dell Technologies

-

Red Hat, Inc.

-

Broadcom Inc. (Symantec Enterprise Division)

-

Oracle Corporation

Recent Developments in Healthcare Fraud Detection

-

July 2023: IBM was named as one of the top contributors to the global healthcare fraud analytics market. The company's advanced analytics solutions were touted for their central position in preventing and detecting fraud, solidifying its position in a market expected to grow to USD 5.03 billion by 2028.

-

November 2024: SAS Institute highlighted the increasing use of artificial intelligence (AI) and generative AI for healthcare fraud detection. The organization highlighted how such technologies are increasingly becoming essential to effectively detect and respond to fraud, greatly enhancing the accuracy and speed of investigations.

-

May 2023: Conduent Inc. was recognized as a key contributor to the global healthcare fraud detection market. Its expanding influence is attributed to the rising need for strong and effective fraud detection solutions in the healthcare sector.

Healthcare Fraud Detection Market Report Scope:

Report Attributes Details Market Size in 2023 US$ 2.54 Billion Market Size by 2032 US$ 15.36 Billion CAGR CAGR of 21.66 % From 2024 to 2032 Base Year 2023 Forecast Period 2024-2032 Historical Data 2020-2022 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Solution Type (Descriptive Analytics, Prescriptive Analytics, Predictive Analytics)

• By Delivery Mode (On-Premises, Cloud-Based)

• By Component (Services, Software)

• By Application (Insurance Claims Review [Postpayment Review, Prepayment Review], Pharmacy Billing Issue, Payment Integrity, Others)

• By End-User (Public & Government Agencies, Private Insurance Payers, Third-Party Service Providers, Employers)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Company Profiles IBM Corporation, SAS Institute Inc., Optum, Inc., Conduent Inc., Change Healthcare, EXL Service Holdings, Inc., LexisNexis Risk Solutions, Northrop Grumman Corporation, Wipro Limited, HCL Technologies, Fair Isaac Corporation (FICO), SCIO Health Analytics (an EXL Company), CTG (Computer Task Group), DXC Technology, Oracle Corporation, Cerner Corporation, COTIVITI, Inc., Inovalon Holdings, Inc., McKesson Corporation, Allscripts Healthcare Solutions, Inc., and other players.