Bioactive Wound Care Market Size & Overview:

To get more information on Bioactive Wound Care Market - Request Free Sample Report

The Bioactive Wound Care Market was valued at USD 11.06 billion in 2023 and is expected to reach USD 21.18 billion by 2032, growing at a CAGR of 7.52% from 2024-2032.

The bioactive wound care market is growing rapidly, led by increased awareness of advanced wound management solutions along with the increasing incidence of chronic wounds including diabetic foot ulcers, venous leg ulcers, and pressure ulcers in recent years. With growing knowledge of the wound healing process, bioactive wound care products such as antimicrobial dressings, moist wound care products, and active dressings are seeing adoption due to their ability to improve wound healing, infection reduction, and improved patient outcomes.

The market is also influenced by recent technological advancements and product innovations. For example, in May 2024, ConvaTec released results from a large international RCT showing that AQUACEL Ag+ Extra had a significantly higher venous leg ulcer healing rate compared to standard dressing care. This indicates the increasing use of antimicrobial dressings in clinical practice.

In addition, the development of product portfolios is maximizing in the market. Integra LifeSciences Holdings Corporation in March 2024 debuted MicroMatrix Flex in the U.S. — a dual-syringe system designed to improve accessibility to complicated wound areas and streamline wound preparation. These features are making bioactive wound care more efficient and effective.

The rising prevalence of surgical wounds and trauma cases globally is also driving the market growth. Technological innovations like smart dressings capable of real-time tracking will further drive adoption. During AAOS 2024, Smith+Nephew revealed its latest innovation in robotic-assisted surgery, a new solution integrated with the CORI Surgical System, introduced in February 2024. This development underlines growing convergence of advanced surgical technologies and wound care solutions reflecting Smith+Nephew's commitment to enhancing surgical precision and patient outcomes.

Based on region, North America and Europe are prospective leaders in the adoption of bioactive wound plunging given the vast and mature healthcare infrastructure, whereas developing countries in Asia-Pacific are its fastest growing markets, primarily attributed to rising healthcare funding and awareness initiatives.

Bioactive Wound Care Market Dynamics

Drivers

-

The bioactive wound care market is primarily driven by the increasing global burden of chronic wounds, including diabetic foot ulcers, venous leg ulcers, and pressure ulcers.

According to the International Diabetes Federation, 537 million people worldwide are suffering from diabetes in the year 2023. It is estimated that, by 2045, this figure will reach approximately 783 million. Of these patients, about 15% suffer from diabetic foot ulcers at some point in their lifetime. This requires a higher demand for advanced wound care products with enhanced healing and minimum complication. Such wound care solutions, such as bioactive antimicrobial and moist wound dressings, have become so widely accepted mainly because they are particularly effective in managing such conditions.

| Type of Chronic Wound | Key Statistics |

|---|---|

| Diabetic Foot Ulcers (DFUs) | Affects approximately 15% of people with diabetes globally. |

| 2 million people in the U.S. are affected annually. | |

| DFUs account for 50-70% of non-traumatic lower-limb amputations. | |

| 1 in 5 diabetic patients experience an amputation due to DFUs. | |

| Over 537 million adults globally have diabetes (2023), projected to reach 783 million by 2045. | |

| Venous Leg Ulcers (VLUs) | Affects approximately 1-3% of the global population. |

| 70% of VLUs are recurrent, increasing the healthcare burden. | |

| Annual treatment costs for VLUs in the U.S. exceed USD3 billion. | |

| Pressure Ulcers (Bedsores) | Affects up to 10% of hospitalized patients. |

| Patients with pressure ulcers stay 2 to 3 times longer in the hospital. | |

| Pressure ulcers affect up to 15% of people in long-term care facilities. | |

| Economic Impact | The annual cost of treating chronic wounds in the U.S. is around USD 25 billion. |

| The global economic burden is rising due to the aging population, diabetes, and obesity. |

-

Rise in Surgical Wound and Trauma Cases Another major cause of increased demand for bioactive wound care products is the rise in surgical procedures and trauma cases.

WHO estimates about 310 million major surgeries carried out yearly across the world. However, in low- and middle-income countries, these cases experience surgical site infections by up to 20%. In addition, trauma cases are also increasing with rising cases of road traffic accidents. The WHO has estimated 1.3 million deaths and 20-50 million injuries caused due to road traffic incidents every year. Bioactive wound care products, including active dressings and innovative wound matrices, minimize the infection risk and enhance recovery rates in surgical and traumatic wounds.

Restraint

-

One of the key restraints for the bioactive wound care market is the high cost associated with advanced wound care products.

Bioactive dressings for managing wounds, particularly antimicrobial dressings, hydrocolloids, and active larger dressings are much more expensive than traditional wound care products. New materials of silver, collagen, and other bioactive agents are used, making the production price much higher, thus the retailer's price will also be slightly higher.

Many health systems, particularly in low- and middle-income countries, continue to find bioactive wound care products too expensive. In public health systems, budgetary constraints apply, so that only low-cost, effective treatments are widely available, and reimbursement for advanced wound care is difficult, resulting in delay of treatment or use of ineffective alternatives.

Furthermore, for patients with inadequate health insurance coverage, also in cases where the care takes place in resource-challenged settings, this renders the price of the advanced products above their ability to pay, which can limit the expansion of markets in certain areas. Affordability and cost-effectiveness of bioactive wound care products is effectively a challenge that generally sustains market penetration on the grassroots level where price-sensitive buyers are pronounced.

Bioactive Wound Care Market Segmentation Analysis

By Product

Moist wound care dominated the market in 2023 with a revenue share of 58%. Moist wound dressings allow an optimal healing environment to form; they keep the ideal moisture conditions nearby, preventing drying out and allowing cell migration for the wound to close faster. Such approach spares pain and minimizes scarring, while also reducing infection risk compared to dry dressings. Growing number of chronic wound patients reflects the need for effective moist wound care products in the global market.

The antimicrobial facet of wound care is expected to be the fastest growing at a CAGR of 9.71% throughout the forecast period. This segment is also sub-segmented as silver-based & non-silver antimicrobial products that provide several benefits including ease of use, high availability, and cost-effectiveness over antibiotics. Furthermore, these products are typically sold without a prescription and carry a low risk of antimicrobial resistance, thus propelling the growth of the segment within the market.

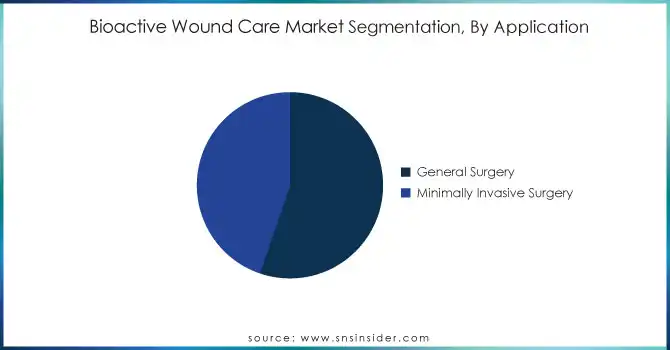

By Application

In 2023, the general surgery segment dominated the market with a market share of 62%. This segment is then further divided into plastic, dermatological, pediatric, and other applications. Factors such as an increasing population, an aging population, and enhanced access to healthcare services contribute to the increasing demand for general surgery.

Based on the method of surgery, the minimally invasive surgery segment is expected to grow fastest at a CAGR of 8.16% during the forecast period. It includes procedures that do less damage to the body than open surgery. Less invasive procedures generally mean less pain, shorter hospital stays, and fewer complications. A common method, laparoscopy, surgically accesses the abdomen through small incisions using tiny tubes, cameras, and specialized surgical instruments.

Bioactive Wound Care Market Regional Outlook

In 2023, North America dominated the bioactive wound care market with a market share of 43% of total revenue. The dominance is mainly ascribed to the high prevalence of diabetes and the immediate adoption of advanced wound care practices in the region. One of the prime movers of the market leadership is the increasing number of people suffering from acute and chronic infections, which highly resembles the growth in revenues for the global bioactive wound care market.

The bioactive wound care market in the Asia Pacific region is anticipated to grow at the fastest pace, recording a CAGR of 7.23% over the forecast period. Several reasons have contributed to this growth, including the region's large and aging population, in addition to the growing prevalence of chronic diseases such as diabetes. Government drives to reduce hospital stays and lower healthcare expenditure fuelled higher consumption of bioactive dressings since they assist the wound in healing rapidly. Although treatments of the infection/wound management process have given rise to advanced outpatient options (i.e., negative-pressure therapy and/or antimicrobial dressings), further developments are key to the growth of the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Smith & Nephew (ALLEVYN Life Foam Dressing, ACTICOAT Flex Antimicrobial Barrier Dressing)

-

Mölnlycke Health Care (Mepilex Border Foam Dressing, Mepitel One Contact Layer)

-

ConvaTec Group (AQUACEL Ag+ Extra Hydrofiber Dressing, DuoDERM Signal Hydrocolloid Dressing)

-

3M Healthcare (Tegaderm High-Performance Foam Dressing, V.A.C. Therapy)

-

Coloplast (Biatain Silicone Foam Dressing, Comfeel Plus Hydrocolloid Dressing)

-

Medtronic (Proximel Silicone Foam Dressing, Kendall Hydrogel Wound Dressing)

-

Medline Industries (Optifoam Gentle Dressings, Silver Alginate Antimicrobial Dressing)

-

Integra LifeSciences (Integra Meshed Bilayer Wound Matrix, PriMatrix Dermal Repair Scaffold)

-

Organogenesis (Apligraf Bioengineered Skin Substitute, PuraPly Antimicrobial Wound Matrix)

-

BSN Medical (Cutimed Sorbion Sachet Dressing, Cutimed Siltec B Foam Dressing)

-

Advanced Tissue (Hydrofera Blue Ready Foam Dressing, Endoform Natural Dermal Template)

-

Hartmann Group (HydroTac Foam Dressing, Sorbalgon Calcium Alginate Dressing)

-

Derma Sciences (MediHoney Wound Gel, Xtrasorb Super Absorbent Dressing)

-

MiMedx Group (EpiFix Amniotic Membrane Allograft, AmnioFix Injectable Allograft)

-

Alliqua BioMedical (Biovance Collagen Wound Cover, Interfyl Injectable Human Connective Tissue Matrix)

-

Hollister Incorporated (Restore Foam Dressing with Silver, TRIACT Advanced Foam Dressing)

-

Health (Hydrocolloid Wound Dressing, Transparent Film Dressing)

-

B. Braun Melsungen (Askina Calgitrol Ag Silver Alginate Dressing, Askina Foam Border Dressing)

-

Acelity (PROMOGRAN Prisma Matrix, TIELLE Plus Hydropolymer Dressing)

-

Systagenix Wound Management (Adaptic Touch Non-Adherent Dressing, Silvercel Antimicrobial Alginate Dressing)

Key suppliers

These suppliers play a vital role in ensuring the production of high-quality bioactive wound care products by providing essential materials for foam, hydrocolloid, alginate, and antimicrobial technologies.

-

Dow Chemical Company Suppliers

-

3M Industrial Adhesives and Tapes Division Suppliers

-

Henkel AG & Co. KGaA Suppliers

-

BASF SE Suppliers

-

Evonik Industries Suppliers

-

Celanese Corporation Suppliers

-

Freudenberg Performance Materials Suppliers

-

DSM Biomedical Suppliers

-

Kuraray Co., Ltd. Suppliers

-

Ashland Global Holdings Inc. Suppliers

Recent Developments

-

May 2024: ConvaTec announced the results of a recent multinational randomized controlled trial (RCT), highlighting significant advancements in the healing of venous leg ulcers using AQUACEL Ag+ Extra compared to standard dressing care. The findings emphasize the product's superior efficacy in promoting wound healing.

-

February 2024: Smith+Nephew a global leader in medical technology, unveiled plans to showcase the future of surgical innovation at AAOS 2024. Attendees will get an exclusive first look at a new feature of the CORI◊ Surgical System, a cutting-edge, image-agnostic, robotic-assisted surgical solution. This innovation aims to enhance personalization in surgery, streamline efficiencies, and optimize performance within Smith+Nephew’s orthopedic reconstruction portfolio.

-

March 2024: Integra LifeSciences Holdings Corporation introduced MicroMatrix Flex in the U.S. market. This advanced dual-syringe system is designed for seamless blending and precise application of MicroMatrix paste. It offers enhanced accessibility to hard-to-reach areas and facilitates the preparation of smooth wound surfaces, making it ideal for managing complex wound sites.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.06 Billion |

| Market Size by 2032 | US$ 21.18 Billion |

| CAGR | CAGR of 7.52% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Moist Wound Care, Antimicrobial Wound Care, Active Dressing) •By Application (General Surgery, Minimally Invasive Surgery) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Smith & Nephew, Mölnlycke Health Care, ConvaTec Group, 3M Healthcare, Coloplast, Medtronic, Medline Industries, Integra LifeSciences, Organogenesis, BSN Medical, Advanced Tissue, Hartmann Group, Derma Sciences, MiMedx Group, Alliqua BioMedical, Hollister Incorporated, B. Braun Melsungen, Acelity, Systagenix Wound Management, and other players. |

| Key Drivers | •The bioactive wound care market is primarily driven by the increasing global burden of chronic wounds, including diabetic foot ulcers, venous leg ulcers, and pressure ulcers •Rise in Surgical Wound and Trauma Cases Another major cause of increased demand for bioactive wound care products is the rise in surgical procedures and trauma cases. |

| Restraints | •One of the key restraints for the bioactive wound care market is the high cost associated with advanced wound care products. |