Heat-Assisted Magnetic Recording (HAMR) Device Market Size:

Get more information on Heat-Assisted Magnetic Recording (HAMR) Device Market - Request Sample Report

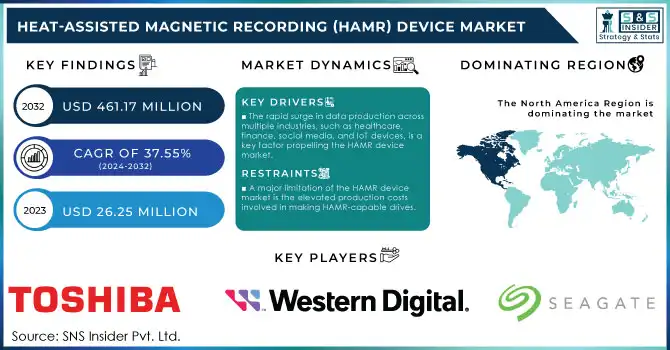

The Heat-Assisted Magnetic Recording (HAMR) Device Market size was valued at USD 26.25 Million in 2023 and is expected to reach USD 461.17 Million by 2032 and grow at a CAGR of 37.55% over the forecast period 2024-2032.

The heat-assisted magnetic recording (HAMR) device market is rapidly evolving within the data storage industry, offering cutting-edge solutions to significantly boost storage capacity in hard disk drives (HDDs). One of the most pivotal industry applications of HAMR technology is within cloud storage and data centers, which play a crucial role in the growing demand for high-capacity storage. In 2023, there were approximately 10,978 data center locations globally, and cloud data centers consume around 3% of the world's energy. As the exponential growth of digital data continues, there is a critical need for more efficient and scalable storage solutions. Currently, 60% of the world’s corporate data is stored in the cloud, highlighting the increasing reliance on data centers for secure, reliable storage. Cloud service providers and data centers depend on high-capacity HDDs to manage vast amounts of data, and HAMR technology allows them to maximize storage density without increasing the physical footprint or cost of their infrastructure. This advantage is essential in meeting the surging demand for data storage while maintaining cost-effective operations.

The HAMR device market growth is also being driven by the increasing need for data storage in the enterprise sector, where businesses in industries like healthcare, finance, and telecommunications generate and store immense amounts of data. The demand for efficient data management solutions in these sectors is substantial, as they require high storage capacity, performance, and reliability. With HAMR-enabled devices, businesses can achieve better storage capabilities, improved performance, and reduced operational costs, particularly where data integrity and storage reliability are paramount. As a result, the continued advancement of HAMR technology is poised to significantly enhance data management efficiency and contribute to the robust growth of the HAMR device market, which is expected to play a crucial role in meeting future storage demands across multiple industries.

Heat-Assisted Magnetic Recording Device Market Dynamics

Drivers

-

The rapid surge in data production across multiple industries, such as healthcare, finance, social media, and IoT devices, is a key factor propelling the HAMR device market.

With the rapid expansion of digital data, the need for more efficient and compact storage options is increasing. Conventional hard disk drives (HDDs) have encountered restrictions in storage capacity because of the limitations set by the physical characteristics of magnetic recording media. These constraints are especially evident as sectors advance the limits of data storage needs. HAMR technology tackles this issue by enhancing the storage density on magnetic disks, enabling a significantly greater amount of data to be stored in the same physical area. This is accomplished by employing a laser to raise the disk material's temperature to a level that makes the magnetic material more receptive to the recording procedure. This enables the utilization of smaller magnetic particles, thus enhancing the areal density. With organizations and industries requiring the storage of large volumes of data, the need for HAMR-enabled drives is anticipated to rise.

-

The competition in the storage market, particularly in the enterprise and consumer segments, is another driver for the HAMR device market.

As competitors work to offer higher capacity drives with better performance, technologies like HAMR provide a competitive edge. Companies that can offer higher-capacity, faster storage devices can secure their positions in the market, especially in sectors like cloud storage, data centers, and backup solutions. With the ongoing need for storage devices that deliver high performance, reliability, and scalability, companies are incentivized to innovate and adopt next-generation storage technologies like HAMR. In this competitive environment, the technology's ability to offer substantial improvements over existing HDD technologies makes it an attractive solution for companies looking to stay ahead in the rapidly evolving storage market.

Restraints

-

A major limitation of the HAMR device market is the elevated production costs involved in making HAMR-capable drives.

The technology necessitates complex parts, such as high-accuracy lasers, unique magnetic substances, and cutting-edge recording heads, all of which add to the total expense of the drives. Moreover, the integration of the laser with the magnetic recording process requires more sophisticated manufacturing methods, consequently increasing production expenses. This price premium renders HAMR devices less appealing to price-sensitive markets, particularly in comparison to conventional HDDs or even SSDs, which provide cheaper costs per gigabyte. Although HAMR technology offers increased storage densities and enhanced performance, the cost disparity can pose a major obstacle to its widespread acceptance, especially in price-sensitive sectors or scenarios where the advantages of HAMR are not urgently needed.

HAMR Device Market Segmentation Analysis

by Type

The 50TB HAMR drive segment dominated in 2023 with over 55% market share in the heat-assisted magnetic recording (HAMR) device market. This capacity is a natural evolution for organizations transitioning from conventional HDDs to high-capacity drives, offering significantly higher storage density without drastic cost implications. It is particularly attractive to companies with growing data needs, such as content delivery networks (CDNs), e-commerce platforms, and streaming services. For example, companies like Amazon Web Services (AWS) and Netflix could utilize 50TB drives to optimize large-scale data storage and retrieval efficiently.

The 100TB HAMR drive segment is expected to be the fastest-growing segment during 2024-2032, fueled by the increasing demand for ultra-high-capacity storage solutions in cutting-edge applications. This segment caters to industries like genomics, artificial intelligence (AI), and large-scale research where data generation is exceptionally high. Its exponential growth is driven by advancements in HAMR technology, which ensures higher areal density and extended lifecycle. Companies like DeepMind and OpenAI, operating in machine learning and AI model training, are examples of potential adopters of 100TB drives. These organizations require immense storage for datasets and simulations.

by Sales Channel

The distributor sales segment dominated the HAMR device market, accounting for 58% of the market share in 2023. This channel involves manufacturers partnering with distributors to supply HAMR devices to a broader customer base, including small-to-medium businesses, resellers, and regional markets. Distributors act as intermediaries, helping manufacturers reach multiple geographies and customer segments efficiently. Companies like Toshiba and Hitachi leverage distributors to expand their market footprint and address regional storage demands in industries like media, healthcare, and logistics.

The direct sales segment is anticipated to witness the fastest CAGR during 2024-2032 in the heat-assisted magnetic recording (HAMR). This channel is ideal for businesses seeking customized solutions and direct technical support, as it enables closer collaboration between the manufacturer and the client. Companies like Western Digital and Seagate Technology often utilize direct sales to cater to enterprise-level customers, offering tailor-made solutions for hyperscale data centers and critical storage requirements.

HAMR Device Market Regional Outlook

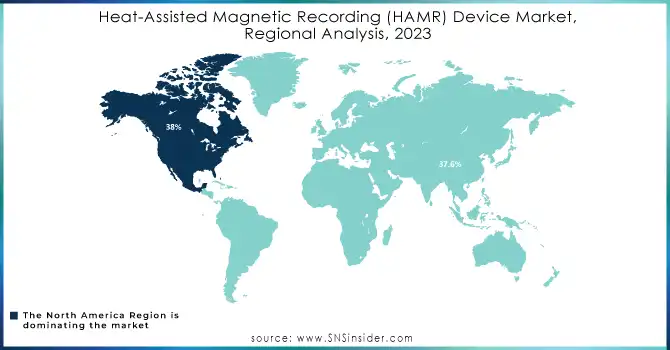

North America dominated in 2023 with a 38% market share due to several factors, including the strong presence of key players like Western Digital, Seagate Technology, and Hewlett Packard Enterprises in the region. North America is known for its advanced technological infrastructure, substantial R&D investments, and leading-edge developments in storage technologies. Companies like Seagate and Western Digital are heavily involved in the development and deployment of HAMR devices to meet the growing demand for high-capacity, high-performance storage solutions, particularly in sectors like cloud computing, big data analytics, and AI applications.

Asia-Pacific is projected to become the fastest-growing region during the forecast period from 2024 to 2032, attributed to rapid industrialization, technological advancements, and increasing demand for data storage solutions in countries like China, Japan, and South Korea. The presence of major semiconductor manufacturers, such as Samsung Electronics and Toshiba, and the rapid expansion of cloud data centers in this region are key drivers of the market. Companies in the region are adopting HAMR technology to meet the growing storage needs for consumer electronics, cloud computing, and AI-based applications.

Need Any Customization Research On Heat-Assisted Magnetic Recording (HAMR) Device Market - Inquiry Now

Key Players

The major key players in the Heat-Assisted Magnetic Recording (HAMR) Device Market are:

-

Seagate Technology (Exos HAMR HDD, IronWolf Pro HAMR HDD)

-

Western Digital Corporation (Ultrastar HAMR HDD, Gold Series HAMR HDD)

-

Toshiba Corporation (MG Series HAMR HDD, Canvio HAMR HDD)

-

Fujitsu (Eternus HAMR Storage, Lifebook HAMR Drive)

-

HGST (Hitachi Global Storage Technologies) (Deskstar HAMR, Ultrastar HAMR DC)

-

Samsung Electronics (HAMR SSD Series, T7 HAMR Portable Drive)

-

Intel Corporation (HAMR Optane Drive, HAMR SSD Family)

-

Sony Corporation (HAMR Data Archival Unit, CineAlta HAMR Drive)

-

Micron Technology (HAMR SSD Enterprise, HAMR Flash Storage)

-

IBM Corporation (HAMR Storwize System, Spectrum Scale HAMR Drive)

-

Quantum Corporation (Scalar HAMR Libraries, DXi HAMR Backup Appliance)

-

Lenovo (ThinkSystem HAMR Drive, ThinkPad HAMR Expansion Storage)

-

Dell Technologies (PowerEdge HAMR Storage, EMC HAMR Data Protection)

-

Hewlett Packard Enterprise (HPE) (ProLiant HAMR Storage, Nimble HAMR Drive)

-

Apple Inc. (MacBook HAMR Expansion, iCloud HAMR Backup Drives)

-

Sandisk (Western Digital Subsidiary) (HAMR Ultra USB, HAMR Secure Pro SSD)

-

Panasonic Corporation (Blu-Ray HAMR Data, Toughbook HAMR Drive)

-

ADATA Technology (XPG GAMMIX HAMR SSD, HAMR External Drive)

-

Transcend Information (HAMR JetDrive SSD, HAMR StoreJet Portable Drive)

-

Kingston Technology (HAMR NVMe Drive, DataTraveler HAMR USB Drive)

Suppliers Providing Software/Platforms to Manufacturers

-

ANSYS

-

Autodesk

-

COMSOL Multiphysics

-

Siemens Digital Industries Software

-

Altair Engineering

-

Dassault Systèmes (SOLIDWORKS)

-

Mentor Graphics (a Siemens Business)

-

Cadence Design Systems

-

PTC Inc.

-

Synopsys

Recent Development

-

May 2024: Toshiba Electronics Europe GmbH announced that Toshiba Electronic Devices & Storage Corporation (Toshiba) has successfully achieved storage capacities of over 30TB with two next-generation large-capacity magnetic recording technologies for hard disk drives (HDDs): Heat Assisted Magnetic Recording (HAMR) and Microwave Assisted Magnetic Recording (MAMR).

-

May 2024: Fujitsu revealed the creation of the FUJITSU Network 1FINITY T250, a disaggregation-based optical transmission solution aimed at realizing the IOWN (Innovative Optical and Wireless Network) initiative and began its sales.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 26.25 Million |

| Market Size by 2032 | USD 461.17 Million |

| CAGR | CAGR of 37.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (50TB HAMR Drive, 100TB HAMR Drive) • By Sales Channel (Direct Sales, Distributor Sales) • By Application (Laptop/Notebook, Desktops, Servers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Seagate Technology, Western Digital Corporation, Toshiba Corporation, Fujitsu, HGST (Hitachi Global Storage Technologies), Samsung Electronics, Intel Corporation, Sony Corporation, Micron Technology, IBM Corporation, Quantum Corporation, Lenovo, Dell Technologies, Hewlett Packard Enterprise (HPE), Apple Inc., Sandisk (Western Digital Subsidiary), Panasonic Corporation, ADATA Technology, Transcend Information, Kingston Technology |

| Key Drivers | • The rapid surge in data production across multiple industries, such as healthcare, finance, social media, and IoT devices, is a key factor propelling the HAMR device market. • The competition in the storage market, particularly in the enterprise and consumer segments, is another driver for the HAMR device market. |

| RESTRAINTS | • A major limitation of the HAMR device market is the elevated production costs involved in making HAMR-capable drives. |