Hermetic Packaging Market Size & Industry Analysis:

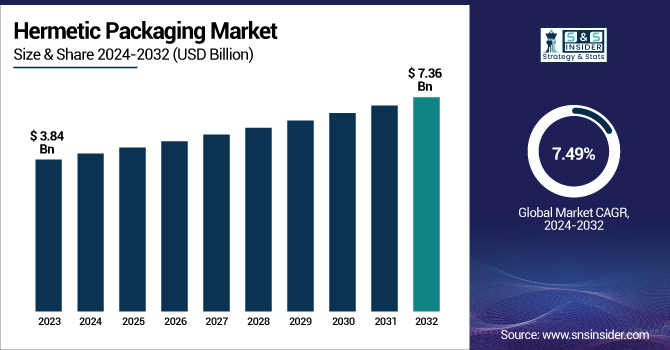

The Hermetic Packaging Market was valued at USD 3.84 billion in 2023 and is projected to reach USD 7.36 billion by 2032, growing at a CAGR of 7.49% from 2024 to 2032.

To Get more information on Hermetic Packaging Market - Request Free Sample Report

The key drivers for this market are growing demand for high-reliability electronic components in aerospace, defense, automotive, and healthcare industries, where protection from moisture, radiation, and extreme temperatures are critical. Escalating demand is also fueled by the increasing deployment of advanced sensor technologies, electric vehicles, and implantable medical devices.

The U.S. has specific and strict regulatory requirements to comply with defense and space industries' regulations to optimize the ever-growing market. In the U.S., the market was valued at USD 0.61 billion in 2023 and is expected to reach USD 1.36 billion by 2032, with a CAGR of 9.31%. Moreover, (patent innovations and intellectual property updates) (failure rate and reliability analysis) directly affects the competition of this market. The constant innovation has inspired companies to concentrate on new material innovations and miniaturization, enabling better performance, as well as keeping U.S. regulatory frameworks devoted to improved safety, reliability, and environmental compliance.

Hermetic Packaging Market Dynamics:

Drivers:

-

Ensuring Reliability The Growing Role of Hermetic Packaging in High-Performance Electronics

The rising demand for high-reliability electronics is a key driver of the Hermetic Packaging Market, particularly in aerospace, defense, and automotive industries, where electronic components must withstand extreme conditions. Hermetic packaging provides superior protection against moisture, pressure variations, radiation, and temperature extremes, ensuring the longevity and performance of mission-critical systems. In the aerospace and defense sectors, satellites, military-grade sensors, and radar systems require hermetically sealed enclosures to prevent environmental degradation. The automotive industry, especially with the rise of electric vehicles (EVs) and autonomous driving systems, relies on hermetic packaging for power modules, LiDAR sensors, and battery protection to enhance safety and reliability. Additionally, the increasing adoption of 5G infrastructure and advanced semiconductor technologies further accelerates the demand for high-performance sealed components.

Restraints:

-

Cost Sensitivity Limiting Hermetic Packaging Adoption in Budget-Constrained Industries

Limited adoption in cost-sensitive industries remains a key restraint for the Hermetic Packaging Market, as sectors like consumer electronics, industrial sensors, and commercial telecommunications prioritize affordability over high-reliability sealing. Traditional hermetic packaging, involving glass-to-metal or ceramic-to-metal seals, is expensive due to precision engineering, material costs, and stringent testing requirements. In contrast, lower-cost alternatives such as plastic encapsulation, conformal coatings, and epoxy-based seals offer sufficient protection for many applications at a fraction of the cost. While hermetic sealing is indispensable in aerospace, defense, and medical devices, industries operating on tight profit margins and mass production models often find it economically unfeasible. Additionally, the high initial investment in specialized manufacturing equipment further discourages widespread adoption. As a result, companies are exploring hybrid packaging solutions that balance cost-efficiency with moderate environmental protection, aiming to bridge the gap between affordability and reliability.

Opportunities:

-

Increasing medical implants drive demand for biocompatible, moisture-resistant hermetic seals.

The increasing use of implantable medical devices and wearable health technologies is fueling demand for biocompatible hermetic packaging. As advancements in minimally invasive treatments and long-term implants progress, the need for reliable, contamination-free enclosures becomes crucial. Devices like pacemakers, cochlear implants, neuro stimulators, insulin pumps, and artificial retina implants require airtight, corrosion-resistant packaging to prevent bodily fluid ingress, which could cause malfunctions or infections. Hermetic seals made from ceramic-to-metal, titanium, and specialized glass materials provide long-term protection against moisture, oxidation, and electromagnetic interference (EMI). In applications such as neuro modulation and brain-machine interfaces, where precision and durability are critical, biocompatible hermetic packaging enhances device longevity and improves patient outcomes. Additionally, the growing adoption of smart wearable health monitors, including continuous glucose monitors (CGMs) and cardiac sensors, is driving innovation in miniaturized and lightweight hermetic sealing technologies, ensuring reliability and efficiency in next-generation medical devices.

Challenges:

-

Regulatory compliance remains a major challenge in the hermetic packaging market, especially for medical, aerospace, and defense applications.

Industries must adhere to stringent certification standards such as FDA (for medical devices), MIL-STD (for military electronics), and ISO 13485 (for medical manufacturing quality systems). These regulations ensure that hermetically sealed components can withstand extreme environmental conditions, including pressure fluctuations, radiation exposure, and moisture ingress. However, meeting these compliance requirements involves rigorous testing, prolonged approval timelines, and substantial costs for manufacturers. In the medical sector, implantable devices like pacemakers and neuro stimulators must pass biocompatibility tests and long-term reliability assessments before they reach the market. Similarly, aerospace and defense applications demand high-reliability packaging for avionics, satellites, and radar systems, requiring shock resistance, EMI shielding, and prolonged durability. The need for continuous design validation, certification renewals, and compliance audits further adds to the time and expense, making it challenging for new market entrants and increasing overall production costs.

Hermetic Packaging Industry Segmentation Outlook:

By Product

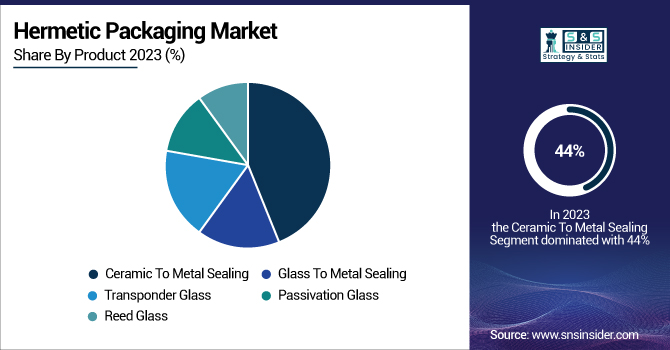

Ceramic-to-metal sealing dominated the hermetic packaging market with approximately 44% revenue share in 2023, driven by its superior durability, thermal stability, and resistance to extreme environments. Widely used in aerospace, defense, medical implants, and power electronics, this segment ensures airtight protection against moisture, pressure variations, and radiation exposure. The increasing adoption of high-reliability electronics, growth in satellite deployments, and rising demand for advanced medical implants further boost market expansion. Ceramic-to-metal seals, made from materials like alumina and titanium, offer excellent electrical insulation and mechanical strength, making them ideal for harsh operating conditions. With the rise of electric vehicles (EVs), 5G infrastructure, and industrial automation, the demand for high-performance hermetic sealing solutions continues to grow, solidifying ceramic-to-metal sealing as the leading segment in the market.

The Transponder Glass segment is projected to be the fastest-growing in the hermetic packaging market from 2024 to 2032, owing to the growing utilization in RFID technology, automotive security systems, and industrial automation. Hermetic seal, durability on the edge, and a significant sensitivity to environmental factors make transponder glass best suited in contactless data transmission applications. Moreover, rising adoption of biometrics authentication, smart manufacturing, and IoT-enabled tracking systems also augment the growth of the market." As automated toll collection, asset tracking, and Near-Field Communication (NFC)-enabled payment technologies become more widely adopted, so does the demand for miniaturized, high-reliability transponder glass solutions. This segment is anticipated to witness considerable CAGR and will stand out as one of the most proffering market in hermetic packaging market, as industries emphasize on security, efficiency and automation.

By Application

The Military & Defense segment dominated the hermetic packaging market in 2023, accounting for approximately 41% of total revenue, driven by the growing need for high-reliability electronic components in mission-critical applications. Hermetic packaging ensures protection against moisture, radiation, extreme temperatures, and pressure variations, making it essential for military-grade sensors, radar systems, satellite communication devices, avionics, and missile guidance systems. The rising investments in defense modernization programs, electronic warfare systems, and space exploration have further propelled demand. With the increasing adoption of autonomous military vehicles, unmanned aerial systems (UAS), and next-generation communication networks, the need for rugged and long-lasting hermetically sealed components is expanding. Governments worldwide are emphasizing enhanced battlefield communication, secure data transmission, and advanced surveillance technologies, all of which rely on high-performance, failure-resistant electronics.

The Aeronautics & Space segment is expected to be the fastest-growing in the hermetic packaging market from 2024 to 2032, owing to the swift growth of satellite deployments and space exploration initiatives, in addition to advances in commercial aerospace technologies. As more low-Earth orbit (LEO) satellites are launched for communication, earth observation, and navigation, the need for high-reliability, radiation-hardened electronics component keeps growing. In space, hermetic packaging is critical to shielding avionics, sensors and microelectronics from extremes of temperature and vacuum, as well as cosmic radiation. Advanced hermetic sealing solutions are being increasingly adopted in next-generation aircraft, supersonic jets, and reusable spacecraft. Beyond that, private space companies along with government agencies are investing heavily in deep-space missions, lunar exploration and Mars colonization, driving demand for rugged, fail-safe electronic enclosures.

Hermetic Packaging Market Regional Analysis:

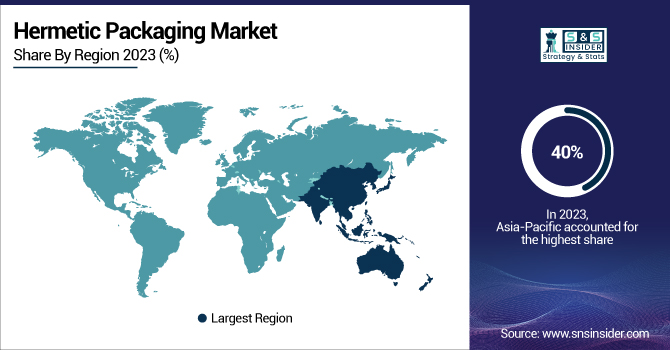

The Asia-Pacific region dominated the hermetic packaging market in 2023, accounting for approximately 40% of total revenue, driven by rapid industrialization, strong growth in aerospace, defense, automotive, and electronics sectors, and increasing government investments in semiconductor manufacturing. Countries like China, Japan, South Korea, and India are at the forefront of technological advancements, particularly in 5G infrastructure, electric vehicles (EVs), and space exploration, all of which require high-reliability hermetically sealed components. The rising production of military-grade electronics, satellite systems, and advanced medical implants has further fueled market expansion. Additionally, Asia-Pacific serves as a global hub for semiconductor and electronics manufacturing, with companies investing heavily in miniaturized and high-performance packaging solutions. The region’s strong emphasis on indigenous defense programs, smart cities, and next-generation transportation systems continues to boost demand for hermetic packaging technologies.

North America is expected to remain a leading region in the hermetic packaging market from 2024 to 2032, owing to its strong aerospace, defense, and medical industries. The area is home to many of the world’s top aerospace and defense companies that require high-reliability, durable and moisture-resistant components for military-grade electronics, satellites and communication systems. The advancement of next-gen airframes, defense systems, and spaceflight missions — amongst others — is driving the need for more advanced hermetic packages. Furthermore, increasing use of implantable medical devices like peace makers and neuro stimulators has enhanced the demand of biocompatible hermetic seals. A robust semiconductor industry also exists in North America, which requires hermetic packaging for high-performing chips used in telecommunications (5G infrastructure) and automotive electronics.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Hermetic Packaging Market are:

-

NGK Spark Plug Co., Ltd. (Japan) – Specializes in ceramic-to-metal seals for automotive and industrial applications.

-

Schott AG (Germany) – Offers glass-to-metal seals and packaging solutions for pharmaceuticals, aerospace, and electronics.

-

AMETEK, Inc. (U.S.) – Provides hermetic seals and packaging solutions for defense, aerospace, and medical devices.

-

Amkor Technology (U.S.) – Known for advanced semiconductor packaging, including hermetically sealed components for electronics.

-

Texas Instruments Incorporated (U.S.) – Manufactures high-performance hermetic packaging for semiconductors and electronics.

-

Teledyne Microelectronic Technology (U.S.) – Specializes in hermetic packaging for space, military, and industrial sectors.

-

Kyocera Corporation (Japan) – Offers ceramic-to-metal seals for electronics and automotive applications.

-

Materion Corporation (U.S.) – Provides precious metal alloys and hermetic packaging solutions for electronics and medical devices.

-

Egide S.A. (France) – Manufactures hermetic packaging for high-performance electronic systems, including aerospace and defense applications.

-

Micross Components, Inc. (U.S.) – Specializes in hermetic sealing solutions for medical, aerospace, and defense industries.

-

SGA Technologies (U.K.) – Provides high-reliability hermetic sealing for aerospace, defense, and industrial sectors.

-

Complete Hermetics (U.S.) – Offers glass-to-metal sealing for electronic components, automotive sensors, and medical devices.

-

Willow Technologies Ltd. (U.K.) – Specializes in hermetic packaging for medical implants and high-reliability electronic components.

-

Mackin Technologies (Japan) – Known for ceramic-to-metal seals in automotive and industrial electronics.

List of companies that provide raw materials and components for the Hermetic Packaging Market:

-

Materion Corporation (U.S.)

-

CoorsTek Inc. (U.S.)

-

Schott AG (Germany)

-

CeramTec (Germany)

-

Teledyne Microelectronic Technology (U.S.)

-

Heraeus Holding GmbH (Germany)

-

Kyocera Corporation (Japan)

-

Amkor Technology (U.S.)

-

EGIDE S.A. (France)

-

Mitsubishi Materials Corporation (Japan)

-

Umicore (Belgium)

-

Micross Components, Inc. (U.S.)

Recent Development:

-

4th February 2025, SGA Technologies offers end-to-end support from design conception to full manufacturing, specializing in high-reliability hermetic components and packages with over 50 years of industry experience.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.84 Billion |

| Market Size by 2032 | USD 7.36 Billion |

| CAGR | CAGR of 7.49% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Refrigeration Systems, Air Conditioning Systems, Heat Pumps) • By Application (Domestic, Commercial, Transportation, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NGK Spark Plug Co., Ltd. (Japan), Schott AG (Germany), AMETEK, Inc. (U.S.), Amkor Technology (U.S.), Texas Instruments Incorporated (U.S.), Teledyne Microelectronic Technology (U.S.), Kyocera Corporation (Japan), Materion Corporation (U.S.), Egide S.A. (France), Micross Components, Inc. (U.S.), SGA Technologies (U.K.), Complete Hermetics (U.S.), Willow Technologies Ltd. (U.K.), and Mackin Technologies (Japan) |