Radiation Hardened Electronics Market Size:

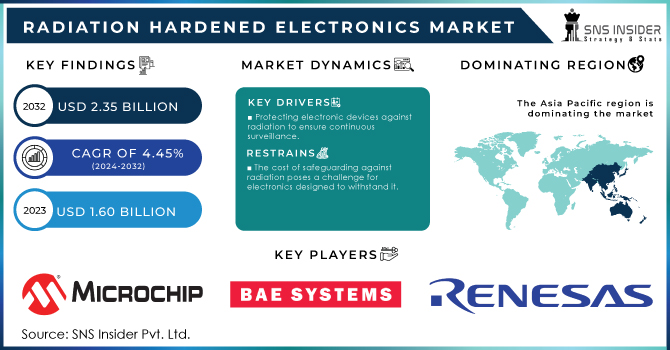

The Radiation Hardened Electronics Market Size was valued at USD 1.60 billion in 2023 and is expected to reach USD 2.35 billion by 2032, growing at a CAGR of 4.45% over the forecast period 2024-2032.

Increasing need for reliable technology in challenging environments like space is fueling growth in Radiation Hardened Electronics Market. These specialized parts guarantee flawless performance in high radiation environments, playing a crucial role in security applications (such as ISR systems) and space exploration. The remarkable expansion of the space industry, which has grown to a $384 billion global economy in 2022 and tripled its active satellites in only five years, continues to drive demand for these components. Spacecrafts are always being bombarded by energetic particles and radiation, making radiation-resistant electronics crucial for their ongoing functioning.

Get More Information on Radiation Hardened Electronics Market - Request Sample Report

For Instance, NASA's innovative Habitable Worlds Observatory (HWO) mission idea, aims to find evidence of life outside our solar system, needs a cutting-edge telescope with unmatched stability. Additionally, BAE Systems is spearheading a group to create the highly stable optical systems crucial for HWO's accomplishment. These systems are designed to achieve stability at the picometer scale, which is much smaller than what current technology can achieve. This high level of stability is necessary for directly capturing images of exoplanets and potentially finding indications of life. HWO's main difficulty lies in suppressing starlight. Exoplanets are significantly dimmer compared to their host stars, requiring a remarkable 10 billion to 1 contrast ratio for successful imaging by the High Contrast Imaging techniques.

Nuclear power plants, impressive feats of modern technology, utilize atomic energy but are at risk from radiation which can damage their electronics and lead to potential malfunctions or safety risks. Radiation-tolerant electronics are becoming essential safeguards, enhancing signal quality, enhancing reactor safety and efficiency, and minimizing radiation-induced damage. The demand for these specific parts is increasing due to a rise in the worldwide count of functioning nuclear reactors from 411 units in 2022 to 436 units by May 2023, boosted by investments in emerging areas. These electronics play a crucial role in tasks such as nuclear detection and measurement, ultimately leading to safer and more efficient energy generation. They allow for wireless monitoring in nuclear facilities, which is especially important in emergencies or high-radiation zones where conventional communication systems may not work.

Radiation Hardened Electronics Market Dynamics

Drivers

-

Protecting electronic devices against radiation to ensure continuous surveillance.

The constant requirement for strong security systems drives the market for radiation-resistant electronics. These specific parts are crucial in Intelligence, Surveillance, and Reconnaissance (ISR) systems, which are essential for border control and data gathering.

ISR systems work in various settings, some of which could present radiation dangers. From guarding border security outposts in isolated deserts to supervising sensitive facilities, these systems need constant functionality. Conventional electronics may be vulnerable to the negative impacts of radiation, which can jeopardize mission reliability and present safety hazards. This is when radiation-resistant electronics come into play as the quiet protectors. Designed to endure extreme conditions with radiation exposure, they guarantee flawless operation of ISR systems. Their steady performance offers security personnel the dependable information and thorough understanding required to make crucial decisions. Essentially, durable electronics resistant to radiation are crucial for reliable surveillance, protecting security initiatives worldwide.

-

Innovation Introduces a New Age for Electronics that are Resistant to Radiation

The world of electronics that can withstand radiation is changing due to constant technological progress. These advancements cover three main areas materials science, design techniques, and testing methodologies. The collaboration among these sectors is fueling a transformation - better efficiency, increased dependability, and a more appealing cost for electronics that can withstand radiation. Materials science is leading the way in developing novel materials that have inherent radiation resistance. For example, Gallium Nitride (GaN) has outstanding radiation resistance, which makes it perfect for use in nuclear power plants. This enhances the safety and durability of crucial systems while also creating opportunities for smaller, more efficient electronics in challenging conditions. Design strategies are also changing. Experts are using new tactics to reduce the impact of radiation on electronic parts. This could include using specific designs, integrating protection measures, or even embracing fresh circuit structures. These design improvements not only enhance the durability of electronics but also facilitate the development of completely new features suited for environments with high levels of radiation.

Restraints

-

The cost of safeguarding against radiation poses a challenge for electronics designed to withstand it.

Specialized materials, as opposed to easily accessible ones, are required to endure the severe effects of radiation. Moreover, it is essential to employ meticulous design methods and thorough testing protocols to guarantee seamless functionality in such challenging settings. Regrettably, this results in a high cost, acting as a major obstacle for potential users. This cost factor is particularly detrimental for emerging markets and applications with constrained budgets, impeding broader utilization of this essential technology.

-

The difficulty lies in developing a testing environment that replicates the diverse and high levels of radiation found in space.

Accurately simulating real-world environments is a critical challenge in the development of radiation-hardened electronics. Picture the electronics facing the brutal radiation in outer space, the powerful bursts of a nuclear explosion, or the tough environments on a military field. These settings subject electronics to a diverse mix of radiation - various kinds, different energy levels, and changing intensities. Creating a controlled testing lab environment to mimic this disorderly combination is a major obstacle.

Testing centers commonly use a mix of different radiation sources and methods to simulate a somewhat accurate setting. This could include the utilization of particle accelerators, gamma-ray sources, and neutron generators. Although these tools offer a solid foundation, replicating the real-world situation accurately is still difficult to achieve. The issue stems from the possibility of inconsistencies between the artificial setting in a lab and the real-life exposure of electronic parts to radiation. This unpredictability may lead to doubts regarding the actual durability of the electronics in practical scenarios.

Radiation Hardened Electronics Market Segment Analysis

by Product Type

Commercial-off-the-Shelf (COTS) components hold the majority of the market share in 2023 with 55% in the radiation-hardened electronics market. Several factors can be credited for this dominance. To start with, Commercial Off-The-Shelf (COTS) products provide a noticeable cost benefit in contrast to tailor-made options. Secondly, they cut down project timelines by getting rid of long design and development processes. Ultimately, current COTS components may be ideal for specific radiation conditions, offering a convenient and budget-friendly option for numerous uses.

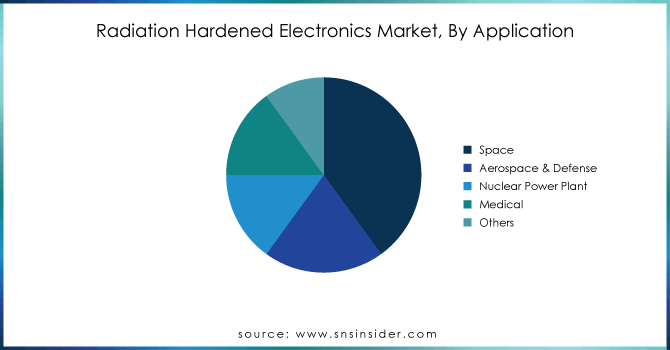

by Application

In the radiation-hardened electronics market, Space dominates with a 40% market share in 2023, based on application. Space exploration is expected to be the main application for electronics that can withstand radiation. Cosmic rays and solar radiation are always bombarding space vehicles, satellites, and planetary explorers. This is where radiation-resistant electronics come in as the protectors of the galaxies. These unique parts guarantee the ongoing functionality of these incredible spacecraft, protecting both data reliability and mission security. The growing investment by the government in space exploration, along with the emergence of commercial space companies, is also driving the need for radiation-resistant electronics. As space exploration goes further and requires extended durations, these durable electronics will be essential for unraveling the secrets of the universe.

Need any Customized Research Report on Flexible Display Market - Enquiry Now

Radiation Hardened Electronics Market Regional Outlook

In 2023, the Asia Pacific region is rapidly advancing towards a dominant position in the radiation-hardened electronics market, commanding a solid 35% market share and expected to continue growing. This increase is driven by a combination of different elements. China's successful space programs, overseen by CASC, and India's space advancements under ISRO's leadership are expanding the horizons of space exploration, requiring dependable electronics for satellite launches and space missions.

The growing defense and aerospace sectors in the area, led by major companies such as Mitsubishi Heavy Industries (Japan) and Hindustan Aeronautics Limited (India), need radiation-resistant parts for advanced defense purposes and future aircraft. Moreover, government efforts such as China's National Integrated Circuit Industry Investment Fund and India's "Make in India" program are actively promoting local manufacturing and technological progress in this field. South Korea and Taiwan lead the way in the region's semiconductor industry, establishing a strong base for producing these specialized electronics. The combination of these elements establishes Asia Pacific as a potential center for radiation-resistant electronics, with advantages reaching beyond space and defense to support nuclear power plants, medical devices, and other industries in need of reliable electronics in challenging conditions.

North America, is a growing force in the market for radiation-hardened electronics, possessing a significant 30% market share in 2023. This expansion is a result of its extensive background in space research and military protection. Big companies such as Lockheed Martin and Raytheon Technologies heavily depend on these specialized components for their advanced spacecraft, missiles, and defense systems. Nuclear power, a well-established sector in North America, also drives the need for electronics that can withstand radiation to guarantee the safe functioning of nuclear facilities.

Westinghouse Electric and GE Hitachi Nuclear Energy are heavily engaged in the development of these essential components. North America's dedication to technological progress further enhances its strength. Universities and private institutions are always advancing radiation-resistant electronics, helping to keep regional companies at the forefront of this changing field. Prominent companies producing these unique electronics in North America are Texas Instruments, Analog Devices, and Airbus Defence and Space. They create circuits and components that are resistant to radiation, designed for use in space on satellites, spaceships, and other equipment. Airbus Defence and Space has a strong presence in North America, where they create and produce radiation-resistant electronics for satellites and space systems. North America's past in space discovery, defense technology, nuclear energy, and dedication to advancement solidify its role in the expanding market for radiation-resistant electronics.

Key Players

Some of the major key players in the Radiation Hardened Electronics market with their respective products:

-

Microchip Technology Inc. (US) (Radiation-hardened microcontrollers and field-programmable gate arrays (FPGAs))

-

BAE Systems (UK) (Radiation-hardened power systems, sensors, and communication systems)

-

Renesas Electronics Corporation (Japan) (Radiation-hardened microcontrollers and semiconductors)

-

Infineon Technologies AG (Germany) (Radiation-hardened power semiconductors and ICs)

-

STMicroelectronics (Switzerland) (Radiation-hardened diodes, transistors, and memory components)

-

AMD (US) (Radiation-hardened processors and FPGAs)

-

Texas Instruments (US) (Radiation-hardened analog and mixed-signal ICs)

-

Honeywell International Inc. (US) (Radiation-hardened sensors and control systems)

-

Teledyne Technologies (US) (Radiation-hardened cameras and imaging sensors)

-

TTM Technologies, Inc. (US) (Radiation-hardened printed circuit boards (PCBs))

-

Cobham (UK) (Radiation-hardened communication systems and equipment)

-

Analog Devices, Inc. (US) (Radiation-hardened analog-to-digital converters (ADCs) and signal processors)

-

Data Device Corporation (DDC) (US) (Radiation-hardened power supplies and data buses)

-

3D Plus (France) (Radiation-hardened memory and storage devices)

-

Mercury Systems Inc. (US) (Radiation-hardened integrated circuits and systems)

-

PCB Piezotronics (US) (Radiation-hardened sensors for pressure and vibration measurements)

-

Vorago Technologies (US) (Radiation-hardened microcontrollers and ASICs)

-

Micropac Industries (US) (Radiation-hardened semiconductors and components)

-

GSI Technology (US) (Radiation-hardened memory devices)

-

Everspin Technologies (US) (Radiation-hardened magnetoresistive random-access memory (MRAM))

-

Semiconductor Components Industries (US) (Radiation-hardened transistors and diodes)

-

Aitech (US) (Radiation-hardened embedded systems and FPGAs)

-

Microelectronics Research Development Corporation (US) (Radiation-hardened semiconductor devices)

-

Space Micro (US) (Radiation-hardened communications and data processing systems)

-

Triad Semiconductor (US) (Radiation-hardened analog and digital ICs)

List of suppliers that provide raw materials and components for the radiation-hardened electronics market:

-

Materion Corporation (US)

-

L3Harris Technologies (US)

-

Ametek, Inc. (US)

-

Kryoflux (US)

-

Teledyne Microelectronics (US)

-

Advanced Cryogenics (US)

-

IMT (Integrated Microwave Technologies) (US)

-

Semiconductor Technologies and Instruments (STI) (US)

-

Global Semiconductor (US)

-

Planar Systems (US)

-

VPT, Inc. (US)

-

Tata Steel (India)

-

Mitsubishi Materials Corporation (Japan)

Recent Development

-

In January 2024, Infineon Technologies AG unveiled radiation-hardened asynchronous static random-access memory (SRAM) chips for space applications. Using RADSTOP technology, these chips are designed with proprietary methods for enhanced radiation hardness, ensuring high reliability and performance in harsh environments.

-

In October 2023, Teledyne e2v collaborated with Microchip Technology to develop a pioneering space computing reference design, featuring Microchip's Radiation-Tolerant Gigabit Ethernet PHYs. The innovative design focuses on high-speed data routing in space applications, presented at the EDHPC 2023.

-

In September 2023, Microchip Technology Inc. launched the MPLAB Machine Learning Development Suite, a comprehensive solution supporting 8-bit, 16-bit, and 32-bit MCUs, and 32-MPUs for efficient ML at the edge. The integrated workflow streamlines ML model development across Microchip's product portfolio.

-

In September 2023, Infineon Technologies collaborated with Chinese firm Infypower in the new energy vehicle charger market, providing industry-leading 1200 V CoolSiC MOSFET power semiconductors. This partnership aimed to enhance efficiency in electric vehicle charging stations, offering wide constant power range, high density, minimal interference, and high reliability for Infypower's 30 kW DC charging module.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.60 billion |

| Market Size by 2032 | USD 2.35 Billion |

| CAGR | CAGR of 4.45 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Commercial-off-the-Shelf (COTS), Custom Made) • By Component (Mixed Signal ICs, Processors & Controllers, Memory, Power Management) • By Manufacturing Technique (Radiation-Hardening by Design, Radiation-Hardening by Process) • By Application (Space, Aerospace & Defense, Nuclear Power Plant, Medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microchip Technology Inc.(US), BAE Systems (UK), Infineon Technologies AG (Germany), STMicroelectronics (Switzerland), Renesas Electronics Corporation (Japan), AMD (US), Texas Instruments (US), Honeywell International Inc. (US), TTM Technologies, Inc. (US), Cobham (UK), Analog Devices, Inc.(US), Teledyne Technologies (US), Data Device Corporation (DDC) (US), 3D Plus (France), Mercury Systems Inc (US), Vorago Technologies (US), Micropac Industries (US), GSI Technology (US), PCB Piezotronics (US), Everspin Technologies (US), Semiconductor Components Industries (US), Microelectronics Research Development Corporation (US), Aitech (US), Space Micro (US), Triad Semiconductor (US) |

| Key Drivers | • Protecting electronic devices against radiation to ensure continuous surveillance. • Innovation Introduces a New Age for Electronics that are Resistant to Radiation. |

| RESTRAINTS | • The cost of safeguarding against radiation poses a challenge for electronics designed to withstand it. • The difficulty lies in developing a testing environment that replicates the diverse and high levels of radiation found in space. |