High Availability Server Market Size:

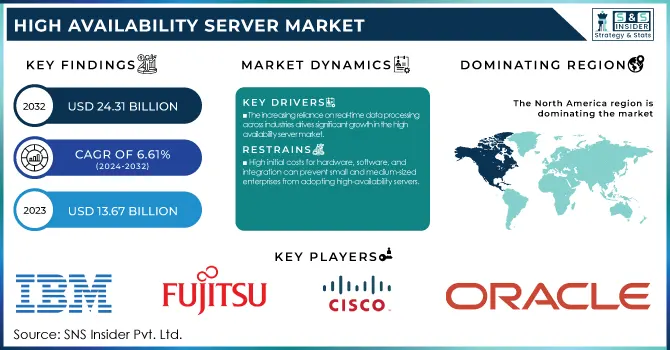

The High Availability Server Market Size was valued at USD 13.67 Billion in 2023 and is expected to reach USD 24.31 Billion by 2032 with a growing CAGR of 6.61% over the forecast period 2024-2032.

Get more information on High Availability Server Market - Request Sample Report

The High Availability Server Market is driven by the increasing need for reliable and uninterrupted business operations. As organizations across industries prioritize minimizing downtime and ensuring seamless functionality of critical systems, the demand for high availability (HA) servers continues to surge. These servers offer enhanced fault tolerance and redundancy, making them essential for industries such as BFSI, IT and telecom, healthcare, and manufacturing, where system failures can result in significant operational and financial losses.

A major trend influencing the market is the growing adoption of cloud-based solutions and virtualization technologies. Cloud environments are increasingly integrating HA capabilities, enabling businesses to achieve resilience without significant infrastructure investments. Virtualization, on the other hand, allows organizations to manage workloads across multiple servers dynamically, ensuring high availability and load balancing. The rise of edge computing and the Internet of Things (IoT) has further accelerated demand for HA servers. Edge deployments often operate in critical environments where even minimal downtime can disrupt processes, such as autonomous vehicles, industrial automation, and healthcare monitoring. This has prompted vendors to develop solutions optimized for real-time processing and fault tolerance in distributed systems.

Additionally, advancements in software-defined infrastructure are reshaping the HA server landscape. Software-defined solutions provide flexibility in managing server resources, automating failover mechanisms, and ensuring continuous availability, even in complex IT ecosystems. Businesses are also increasingly adopting predictive analytics and artificial intelligence to enhance server uptime by proactively addressing potential hardware or software failures. The competitive landscape is marked by innovations, including modular server designs, which offer scalable HA solutions tailored to specific business needs. Partnerships and acquisitions among tech giants and startups are fueling the development of more sophisticated HA server systems.

High Availability Server Market Dynamics

Drivers

-

The increasing reliance on real-time data processing across industries drives significant growth in the high availability server market

The growing dependence on real-time data processing and analysis is a significant driver for the high availability server market. In today's data-driven world, industries such as healthcare, banking, retail, and manufacturing increasingly rely on instantaneous data insights to optimize operations, enhance decision-making, and deliver superior customer experiences. This reliance creates a critical need for servers that can operate with minimal downtime and ensure seamless data availability, even during peak loads or unforeseen disruptions. High availability servers are designed to provide uninterrupted service, making them essential for businesses that cannot afford downtime due to the potential impact on revenue, reputation, and operational efficiency.

This demand is further amplified by the increasing adoption of advanced technologies like artificial intelligence (AI), machine learning (ML), and big data analytics, all of which require robust server infrastructure to handle complex computations and massive data streams in real time. As organizations continue to digitize and leverage real-time analytics to gain a competitive edge, the market for high availability servers is poised for substantial growth.

Restrain

-

High initial costs for hardware, software, and integration can prevent small and medium-sized enterprises from adopting high-availability servers.

One of the primary challenges in the adoption of high-availability (HA) servers is the high initial costs associated with the purchase of hardware and software. High-availability servers are designed to ensure minimal downtime, often incorporating redundant systems, failover mechanisms, and advanced monitoring tools. These features, while essential for business continuity, come with significant price tags, which include the costs of specialized equipment, licensing, and the integration of complex software. For small and medium-sized enterprises (SMEs), these expenses can be prohibitive, especially when their IT budgets are limited.

Despite the high upfront investment, the growth of the high-availability server market is driven by the increasing demand for uninterrupted business operations across industries. As digital transformation continues to accelerate, even SMEs are recognizing the critical need for systems that can guarantee minimal service disruption. This shift is often spurred by the need to maintain competitive advantage, meet customer expectations for uptime, and avoid the costly repercussions of service outages. As the market matures, economies of scale, improved efficiencies in manufacturing, and the availability of more cost-effective cloud-based high-availability solutions may help reduce the barriers to entry. This will enable broader adoption, facilitating the growth of the high-availability server market.

High Availability Server Market Segmentation Analysis

By Deployment Mode

The On-Premises segment dominated with the market share over 62% in 2023. This dominance is attributed to the strong preference for on-premises solutions among industries such as banking, government, and healthcare, where data security and regulatory compliance are critical. These industries rely heavily on on-premises servers to maintain stringent control over their data, ensure compliance with local and international regulations, and protect sensitive information from potential breaches associated with external infrastructures. Additionally, organizations in these sectors often have legacy systems that integrate seamlessly with on-premises setups, further driving their preference.

By End-Use Industry

In 2023, the BFSI segment dominated the High Availability Server Market, accounting for over 32% market share. This prominence is attributed to the rising demand for reliable server solutions in the banking industry to ensure uninterrupted operations. High-availability servers are essential for maintaining seamless transactions and minimizing downtime, critical for safeguarding sensitive financial operations. Beyond banking, these servers find extensive applications across finance, insurance, telecommunications, and other sectors. Their ability to prevent major disruptions and secure mission-critical systems makes them invaluable in industries where failures can lead to significant financial and reputation losses.

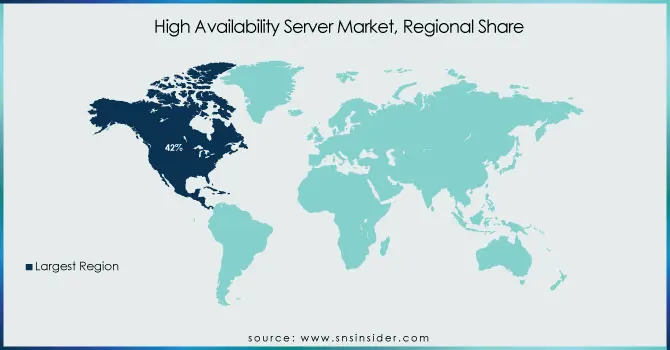

High Availability Server Market Regional Overview

North America region dominated with the market share over 42% in 2023. This supremacy is attributed to the region’s advanced technological landscape, robust IT infrastructure, and high concentration of key market players. The adoption of high availability servers is widespread across industries like banking, financial services, insurance (BFSI), and IT, which demand minimal downtime and continuous operations. Additionally, the rising reliance on cloud computing and the increasing focus on data security further boost the market in this region. Government initiatives and regulations around cybersecurity also drive investments in high-availability systems to ensure compliance and business continuity.

Europe is emerging as the fastest-growing region in the High Availability Server Market, driven by the rapid adoption of advanced IT infrastructure and high demand for reliable server systems. Industries like BFSI, healthcare, and manufacturing are increasingly leveraging high availability solutions to maintain seamless operations and reduce downtime. Governments and private organizations across the region are investing in digital transformation, further fueling the need for resilient server systems. The shift toward Industry 4.0, involving automation and smart manufacturing, significantly contributes to this growth.

Need any customization research on High Availability Server Market - Enquire Now

Some of the major key players of High Availability Server Market

-

IBM Corporation (IBM Power Systems, IBM z Systems)

-

Fujitsu (Fujitsu PRIMEQUEST, FUJITSU Server SPARC M12)

-

Cisco Systems (Cisco UCS C-Series, Cisco UCS B-Series)

-

Oracle Corporation (Oracle Exadata Database Machine, Oracle SPARC Servers)

-

HP Development Company L.P. (HP ProLiant Servers, HP Integrity Servers)

-

NEC Corporation (NEC Express5800, NEC UNIVERSE)

-

Unisys Global Technologies (Unisys ClearPath Forward, Unisys ES7000)

-

Dell Inc. (Dell PowerEdge Servers, Dell VRTX Servers)

-

Stratus Technologies (Stratus ftServer, Stratus everRun)

-

Centerserv (Centerserv High Availability Servers)

-

Huawei Technologies (Huawei FusionServer, Huawei KunLun Servers)

-

Microsoft Corporation (Microsoft Windows Server, Azure Stack HCI)

-

Lenovo Group (Lenovo ThinkSystem Servers, Lenovo ThinkAgile)

-

Supermicro (Supermicro SuperServer, Supermicro TwinPro)

-

Toshiba Corporation (Toshiba High Availability Servers, Toshiba Server Solutions)

-

Hitachi Vantara (Hitachi Compute Blade, Hitachi Virtual Storage Platform)

-

VCE (part of Dell Technologies) (Vblock Systems)

-

VMware (VMware vSphere, VMware vSAN)

-

Zebra Technologies (Zebra SmartEdge Servers, Zebra QL Servers)

-

Micron Technology (Micron High Availability Memory Solutions, Micron Storage Solutions)

Suppliers for fault-tolerant systems, seamless scalability, and redundancy for enterprise and cloud environments of High Availability Server Market

-

Dell Technologies

-

Hewlett Packard Enterprise (HPE)

-

IBM

-

Cisco Systems

-

Oracle

-

Fujitsu

-

Lenovo

-

Super Micro Computer

-

Huawei

-

NEC Corporation

RECENT DEVELOPMENT

-

In November 2024 – IBM has released a security bulletin addressing a vulnerability affecting the IBM Sterling Global High Availability Mailbox. This vulnerability stems from the Apache Santuario library within the IBM WebSphere Application Server Liberty.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 13.67 Billion |

| Market Size by 2032 | USD 24.31 Billion |

| CAGR | CAGR of 6.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Truck Mounted Crane, Trailer Mounted Crane, and Crawler Crane) • By Application (Construction, Industrial, Utility) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, Fujitsu, Cisco Systems, Oracle Corporation, HP Development Company L.P., NEC Corporation, Unisys Global Technologies, Dell Inc., Stratus Technologies, Centerserv, Huawei Technologies, Microsoft Corporation, Lenovo Group, Supermicro, Toshiba Corporation, Hitachi Vantara, VCE (part of Dell Technologies), VMware, Zebra Technologies, Micron Technology. |

| Key Drivers | • The increasing reliance on real-time data processing across industries drives significant growth in the high availability server market by ensuring minimal downtime and seamless operations. |

| Restraints | • High initial costs for hardware, software, and integration can prevent small and medium-sized enterprises from adopting high-availability servers. |