High-Integrity Pressure Protection System (HIPPS) Market Size

Get more information on High-Integrity Pressure Protection System (HIPPS) Market - Request Sample Report

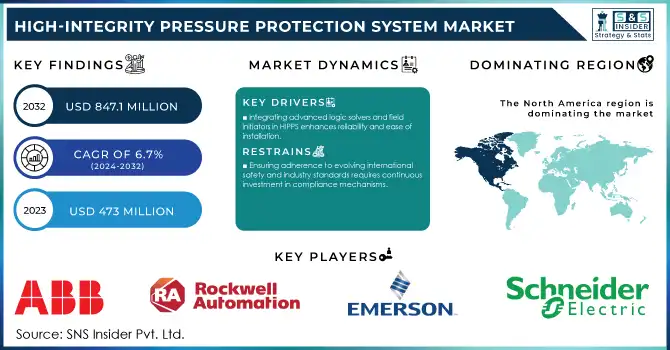

The High-Integrity Pressure Protection System Market Size was valued at USD 473 Million in 2023 and is expected to reach USD 847.1 Million by 2032, growing at a CAGR of 6.7% over the forecast period 2024-2032.

The High Integrity Pressure Protection System (HIPPS) market is experiencing substantial growth due to the rising regulatory requirements, in addition to the increasing focus on industrial safety, specifically in the oil & gas, chemicals, and power generation industries. With the introduction of high-pressure systems and their subsequent risks, people are urging governments to implement stringent safety standards worldwide. The U.S. Department of Energy (DOE) forecasts that global industrial energy demand will increase by 28% in 2035, highlighting the dire need for better safety systems. The rise in energy demand has resulted in the proliferation of oil refineries, petrochemical plants, and natural gas facilities and HIPPS are crucial for operational safety as they help prevent pressure-related problems.

Besides regulatory requirements, the market is being propelled by international initiatives such as the European Green Deal to enforce stringent emission norms on industries and consequently encourage the utilization of HIPPS. Such a trend can be seen more widely in industrial-oriented economies where HIPPS are increasingly used to comply with standards while avoiding operational hitches. These, in addition to investments in energy infrastructure, e.g. the $369 billion in subsidies provided under the U.S. Inflation Reduction Act (IRA), are laying the foundations for HIPPS to penetrate large-scale deployments. Such initiatives ascertain industries exceed mere compliance and implement advanced safety solutions to meet emerging threats.

However, the increasing adoption of advanced technologies in the field such as IoT integration and real-time monitoring capabilities has significantly driven the sales of HIPPS outlets. These advancements align with the ongoing Industry 4.0 transformation, where smart safety systems are becoming a critical component of automated industrial setups. Utilizing such technologies, HIPPS can also offer protection, as well as predictive maintenance, for both environment and serviceability management, thus minimizing downtimes and costs incurred during operation due to environmental system failure. Combined, these issues have made HIPPS an indispensable solution for the industries for which high-pressure operations are the norm.

High-Integrity Pressure Protection System Market Dynamics

Drivers

-

There is an increasing need to reduce gas flaring and venting in oil and gas operations to meet stringent environmental protection standards. Governments and regulatory bodies are imposing stricter guidelines on emissions and hazardous waste, boosting demand for HIPPS.

-

Rising awareness and investment in systems that enhance safety for employees and industrial assets in high-pressure environments.

-

Integrating advanced logic solvers and field initiators in HIPPS enhances reliability and ease of installation.

The growth of High Integrity Pressure Protection Systems (HIPPS) in the oil & gas industry is primarily attributed to environmental regulations. Due to the current worldwide pressure to limit greenhouse gas emissions and combat climate change, regulators like the Environmental Protection Agency (EPA) and the European Union (EU) have started to impose stringent requirements on sectors of the economy to reduce gas flaring and venting. Gas flaring emitted around 400 million metric tons of CO₂ equivalents worldwide each year, according to a 2023 report from the World Bank, emphasizing the need for advanced safety systems such as HIPPS to prevent overpressure incidents and downstream emissions.

HIPPS is specifically designed to protect pipelines and infrastructure from high-pressure failures, minimizing unplanned emissions. For instance, companies like ExxonMobil and Chevron are leveraging HIPPS to comply with regulatory frameworks such as the EU's Methane Strategy, which targets a 50% reduction in methane emissions by 2030. Furthermore, the International Energy Agency (IEA) reports that advanced technologies, including HIPPS, can help reduce up to 75% of flaring and venting volumes in upstream operations. The growth of ESG (Environmental, Social, and Governance) programs across sectors also catalyzes HIPPS adoption. By adopting HIPPS, companies go on to eliminate the risk of environmental disasters and at the same time, they bolster their sustainability credentials to match the expectations of investors and society. There is this growing trend that puts the spotlight on the importance of HIPPS in the attainment of international ecological objectives.

Restraints

-

Significant upfront costs for HIPPS components and installation hinder adoption, especially for small-scale industries. Maintenance and testing services further add to the overall cost.

-

Ensuring adherence to evolving international safety and industry standards requires continuous investment in compliance mechanisms.

High installation costs are one of the major restraints in the High-Integrity Pressure Protection System (HIPPS) market. HIPPS consists of sophisticated components, including logic solvers, field initiators, and final elements, with each component programmed to comply with strict safety standards. These components not only demand substantial upfront capital but also involve complex installation processes requiring skilled labor and adherence to strict safety protocols. Furthermore, industries often incur additional expenses for regular testing, inspection, and maintenance to ensure system reliability over time. This can be a financial strain on small and medium-sized enterprises, and it can also limit the adoption of HIPPS for safety reasons. Furthermore, the cost of customization necessary to include HIPPS in current infrastructures restricts its availability for some industries or regions.

HIPPS Market Segment Analysis

By Type

Hydraulic/Mechanical HIPPS alone held the highest share in the revenue, contributing 58% to the market in 2023. This segment is expected to dominate the market due to low maintenance costs, reliable performance under extreme conditions, and easy integration into existing systems. Hydraulic/Mechanical systems are predominantly used in sectors where high-pressure handling is essential such as oil & gas, chemical processing, etc.

Another key factor contributing to this segment's growth is government regulations. For example, the Occupational Safety and Health Administration (OSHA) mandates the use of safety systems like HIPPS in pressure-intensive operations, particularly in the energy and chemical sectors. The emphasis on explosion-proof systems due to the ATEX Directive of the European Union also facilitates its adoption in hazardous zones. Likewise, infrastructure upgrades, for example, the India Hydrocarbon Vision 2030 are urging enterprises to utilize advanced HIPPS instead of legacy pressure protection systems. All these factors in totality propel the dominance of the Hydraulic/Mechanical systems in the HIPPS market.

By End-User

In 2023, oil & gas dominated the HIPPS market with a revenue share of 25%. This is because the segment inherent needs strong safety systems to avoid the catastrophic failures that can occur during high-pressure operations. According to global statistics, the forecast for Oil Production is on the rise with a forecast of 4.1% from 2024 to 2026, with the Middle East contributing 30% of global production alone, further promoting the need for HIPPS solutions.

Governments globally are prioritizing safety in oil exploration and refining. Recently enforced regulations in the U.S. Bureau of Safety and Environmental Enforcement (BSEE) inspection protocols have made this safety functionality a requirement during offshore drilling operations. HIPPS is also promising in Norway where the Norwegian Petroleum Directorate (NPD) enforces stringent safety compliance making it an essential element of any oil exploration project. As environmental and safety standards become more stringent, the oil & gas sector is expected to maintain its dominance in adopting HIPPS solutions.

By Offering

The Component segment was the largest in the High-Integrity Pressure Protection System (HIPPS) market in 2023 due to the development of key technologies, particularly actuators and valves. These elements are key to the reliability and performance of HIPPS in limiting overpressure events. Components like sensors, logic solvers, and final control elements form the backbone of HIPPS, working in synchronization to prevent catastrophic failures in high-pressure systems.

Technological advancements in these key components have been largely propelled by the increased need for safety measures in sectors such as oil & gas, chemicals, and power. Recent developments in sensors provide more accurate readings in real-time which enables better monitoring and in case of an emergency a quicker response. Similarly, logic solvers have evolved with improved computational capabilities, ensuring more precise decision-making during critical operations. Final elements like actuators and valves have also seen considerable enhancements in design and material durability, allowing them to withstand extreme conditions.

High-Integrity Pressure Protection System (HIPPS) Market Regional Overview

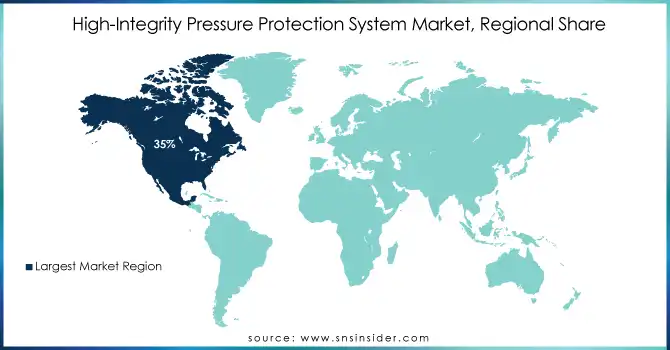

In 2023, North America dominated the market and accounted for 35% of the global revenue share. This dominance is mainly due to the region's long-standing oil & gas industry, which continues to play a crucial role in the global energy landscape. Stringent safety regulations and safety assessment tools have been imposed by regulatory agencies such as OSHA (Occupational Safety and Health Administration) and industry organizations such as the American Petroleum Institute (API), which has forced the industry to use high-end safety solutions such as HIPPS. In addition, large-scale infrastructure investments, such as the Infrastructure Investment and Jobs Act ($1.2 trillion), have resulted in modernization projects designed to include HIPPS to make operations safer and more efficient.

The highest growth for this market is seen in the Asia-Pacific region, at a significant CAGR. This growth is driven by rapidly industrializing countries such as India and China as well as increased energy demand. The Indian Ministry of Petroleum and Natural Gas expects natural gas consumption to rise by 25% by 2030 with the growth of its population and urbanization. As a result, there has been a boom in refinery and gas infrastructure development, each requiring sophisticated pressure protection systems to meet safety standards. Likewise, China also emphasizes the modernization of industrial infrastructure and the adoption of new innovative safety solutions such as HIPPS, as reflected in its 14th Five-Year Plan. China's move to become a leader in industrial sustainability revolves around improving both energy efficiency and industrial safety. Together with the increasing investments in energy projects around Asia-Pacific due to favorable policies, these initiatives are driving the demand for HIPPS at an all-time high.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Service Providers / Manufacturers

-

Schneider Electric (Triconex Safety Systems, EcoStruxure Triconex)

-

Emerson Electric Co. (DeltaV SIS, Fisher Valves)

-

ABB Group (800xA Safety System, S800 I/O)

-

Rockwell Automation (GuardLogix Safety Controllers, AADvance Systems)

-

Siemens AG (SIMATIC Safety Integrated, SITRANS P)

-

Yokogawa Electric Corporation (ProSafe-RS, CENTUM VP)

-

Honeywell International Inc. (Safety Manager SC, SmartLine Pressure Transmitters)

-

Schlumberger Limited (Cameron HIPPS, Avocet Integrated Operations)

-

General Electric (GE) Company (Mark VIeS, Masoneilan Valves)

-

IMI Critical Engineering (Triple Offset Valves, RHPS Series)

Key Users

-

Shell Global

-

ExxonMobil Corporation

-

BP plc

-

Chevron Corporation

-

TotalEnergies SE

-

Saudi Aramco

-

PetroChina Company Limited

-

Indian Oil Corporation Limited (IOCL)

-

Norwegian Equinor ASA

-

Pertamina (Indonesia)

Recent Developments

-

The U.S. Department of Energy announced in May 2024, a $50 million grant to support the development of new and innovative safety systems, with HIPPS forming an integral part of Oil & Gas Infrastructure.

-

IMI launched a HIPPS solution for hydrogen after-production overpressure protection in May 2024. The system, by using electronic transmitters and a logic solver, rapidly identifies and isolates high-pressure sources rather than just relieving overpressure flow. IMI highlighted its role in safety as hydrogen generation ramps up to serve heavy industry and transport.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 473 Million |

| Market Size by 2032 | USD 847.1 Million |

| CAGR | CAGR of 6.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Electronic HIPPS, Hydraulic/Mechanical HIPPS) • By Offering (Component {Field Initiators, Logic Solver, Final Element, Others}, Services {Testing, Inspection and Certification, Maintenance, Training and Consultation}) • By End Use (Oil & Gas, Water & Wastewater, Food & Beverage, Chemicals, Food & Beverage, Pharmaceutical, Power Generation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schneider Electric, Emerson Electric Co., ABB Group, Rockwell Automation, Siemens AG, Yokogawa Electric Corporation, Honeywell International Inc., Schlumberger Limited, General Electric (GE) Company, IMI Critical Engineering. |

| Key Drivers | • There is an increasing need to reduce gas flaring and venting in oil and gas operations to meet stringent environmental protection standards. Governments and regulatory bodies are imposing stricter guidelines on emissions and hazardous waste, boosting demand for HIPPS. • Rising awareness and investment in systems that enhance safety for employees and industrial assets in high-pressure environments. |

| Restraints | • Significant upfront costs for HIPPS components and installation hinder adoption, especially for small-scale industries. Maintenance and testing services further add to the overall cost. |