High-k And CVD ALD Metal Precursors Market Size:

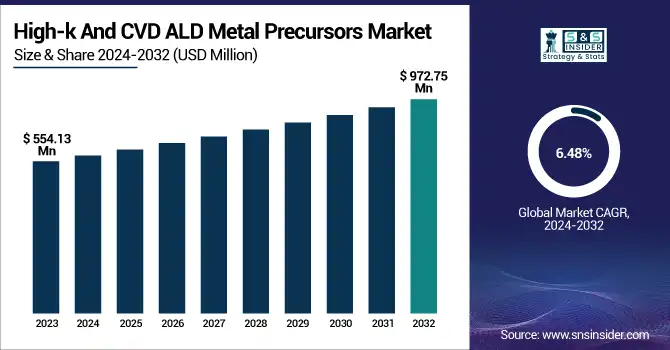

The High-k And CVD ALD Metal Precursors Market size was valued at USD 554.13 million in 2023 and is expected to reach USD 972.75 million by 2032, growing at a CAGR of 6.48% over the forecast period 2024-2032. The demand for precision and scalable deposition techniques in advanced semiconductor manufacturing drives technology adoption in the High-k & CVD/ALD Metal Precursors market. It utilizes high-purity feedstocks from specialized suppliers, taking the supply chain into a network that is complicated and fragile and affected by geopolitical power plays and sourcing conundrums. Increased demand from AI, 5G, and consumer electronics drives manufacturers to follow through on production capacity and utilization rates. Metrics of process efficiency such as deposition rate and film uniformity are also vital for quality control and to comply with the stringent requirements of modern microelectronics.

To Get more information on High-k And CVD ALD Metal Precursors Market - Request Free Sample Report

High-k And CVD ALD Metal Precursors Market Dynamics

Key Drivers:

-

Advanced Semiconductor Demands Drive Growth in High-k and CVD ALD Metal Precursors Market

Increasing requirements for advanced semiconductor technologies is the major driving factor of the global High-k and CVD/ALD metal precursors market. As devices become smaller and ever more powerful, we need better materials that both improve performance and decrease device power consumption. High-k dielectrics are necessary in state-of-the-art semiconductor devices, allowing transistors to switch at lower voltages and higher speeds. Both ALD and CVD techniques provide precise deposition control, leading to high-purity films with excellent electronic properties. With the increasing of the Internet of Things, artificial intelligence, and 5G technology, this need only grows, because those applications need the newest semiconductor materials to work.

Restrain:

-

High Production Costs and Complexities Challenge Growth in the High-k and CVD ALD Metal Precursors Market

High-k and CVD/ALD metal precursors Market is mainly hindered by very high production prices and diagnosis between techno-economic complexities. Production of high-k materials along with CVD and ALD precursors synthesis is complex and involves expensive processing technologies and ultra-pure raw chemicals. Such complexity usually requires costly hardware and stringent process control which squeezes profit margins and lowers market access for, mid-tier, or companies from emerging markets.

Opportunity:

-

Emerging Economies and Renewable Energy Drive Opportunities in High-k and CVD ALD Metal Precursors Market

There are plenty of opportunities in this market especially emerging economies that are undergoing fast industrialization and urbanization. Demand for electronic devices is growing in these regions and this is leading to investments in semiconductor manufacturing infrastructure. This trend is further supported by government initiatives towards technological innovation and local production additions. Additionally, the global transition towards renewables is a massive opportunity that presents itself. This includes developing advanced materials to improve the efficiency and capacity of solar cells and energy storage systems, thereby making high-k dielectrics and metal precursors critical components of sustainable energy technologies.

Challenges:

-

Supply Chain Constraints and Raw Material Challenges Impact High-k and CVD ALD Metal Precursors Market

These are supplemented by supply chain constraints which compound these challenges. Availability and pricing of raw materials can affect the production and supply chain of high-k and metal precursors significantly. Because many of these materials are specialized, they are often only sourced from certain suppliers, creating gaps in the supply chain. Geopolitical situations, transport-related issues, or any global event like a pandemic can disrupt the entire chain which can delay production and availability which can cost more.

High-k And CVD ALD Metal Precursors Market Segment Analysis

By Technology

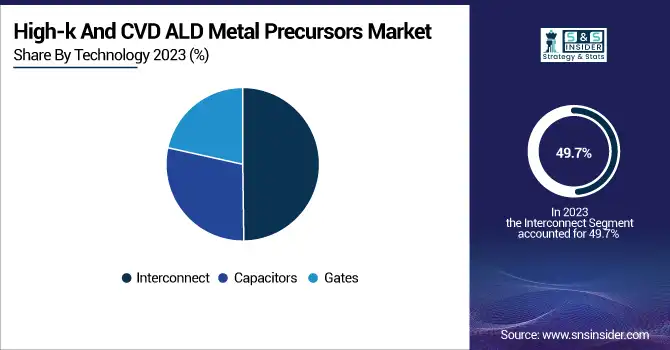

The interconnect segment dominated with a significant 49.7% market share in 2023. This market dominance has been attributed to the growing complexity of semiconductor devices that require new levels of interconnect technology to enable better signal transmission and power distribution. When it comes to high-performance interconnects, resistance and capacitance need to be minimized, as with integrated circuits getting smaller and more effective, devices should function well. With all these technologies like AI, 5G, and IoT being so widely adopted, the demand for highly reliable interconnects reinforces their market leadership.

The gates segment is anticipated to experience the highest CAGR throughout the forecast period (2024-2032). It is driven by the strong demand for low-voltage and low-power transistors in advanced semiconductor nodes. Increased complexity in gate structures to optimize device performance and the requirement of high-k dielectrics and optimized ALD/CVD processes have made gates one of the important growth segments.

High-k And CVD ALD Metal Precursors Market Regional Overview

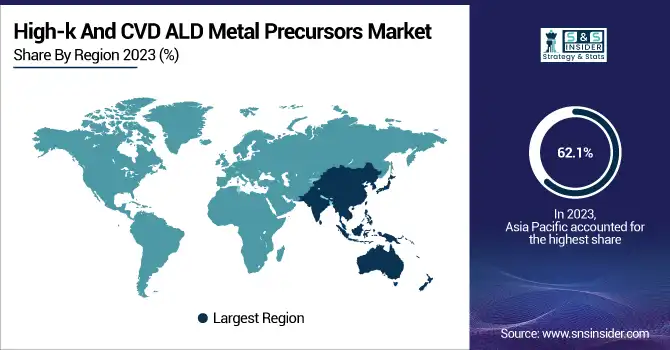

Asia Pacific held the largest share in the overall High-k and CVD/ALD metal precursors market in 2023, with a 62.1% share. This leadership formation is influenced by the presence of major semiconductor manufacturers in Taiwan, South Korea, and China Key players are companies like TSMC and Samsung Electronics, using state-of-the-art high-k materials and ALD/CVD technologies to manufacture the latest generation of chips for consumer electronics, automotive, and telecommunications. Moreover, China's relentless push towards semiconductor self-sufficiency will further accelerate the demand and supply for these materials. Asia Pacific's Market Dominance Remains Strong with Players Like SMIC (Semiconductor Manufacturing International Corporation) Expanding their Production Capabilities.

North America is expected to grow at the fastest CAGR from 2024 to 2032, owing to advancements in AI, 5G, and quantum computing. To improve transistor performance beyond Moores law using high-k and metal gate technologies, R&D efforts are still being heavily funded by leading semiconductor companies, e.g. GlobalFoundries, Intel, et al. As an example, Intel is using high-k dielectrics to improve power and speed on its next-generation nodes. The U.S. CHIPS Act which aims to incentivize Domestically Produced Semiconductor manufacturing has also aided the region immensely with local production and local innovation complementing one another.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the High-k And CVD ALD Metal Precursors Market are:

-

ASM International (Pulsar ALD System)

-

Aixtron (AIX 2800G4-TM MOCVD System)

-

Versum Materials (Dynaloy Surface Prep and Cleans)

-

Lam Research (ALTUS Max E Series)

-

Veeco Instruments (EPIK 868 MOCVD System)

-

Applied Materials (Producer GT PECVD System)

-

Entegris (Purasol Solvent Purifiers)

-

Air Liquide Electronics (EnScribe ALD Precursors)

-

Merck KGaA (AZ 9100 Photoresist)

-

Dow Chemical Company (SOLDERON BP TS 6000 Tin-Silver)

-

Linde plc (Zirconium Oxide Precursors)

-

Praxair (UpTime Electronic Process Materials)

-

SAFC Hitech (Trimethylaluminum (TMA))

-

Strem Chemicals (Bis(ethylcyclopentadienyl)ruthenium(II))

-

Tri Chemical Laboratories (Tetrakis(dimethylamido)titanium)

Recent Trends

-

In November 2024, Veeco Instruments secured over USD50 million in orders for its WaferStorm wet processing systems, driven by growing AI packaging demands. Deliveries are set for the first half of 2025.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 554.13 Million |

| Market Size by 2032 | USD 972.75 Million |

| CAGR | CAGR of 6.48% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Interconnect, Capacitors, Gates) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ASM International, Aixtron, Versum Materials, Lam Research, Veeco Instruments, Applied Materials, Entegris, Air Liquide Electronics, Merck KGaA, Dow Chemical Company, Linde plc, Praxair, SAFC Hitech, Strem Chemicals, Tri Chemical Laboratories. |