High-Performance Polyamides Market Report Scope & Overview

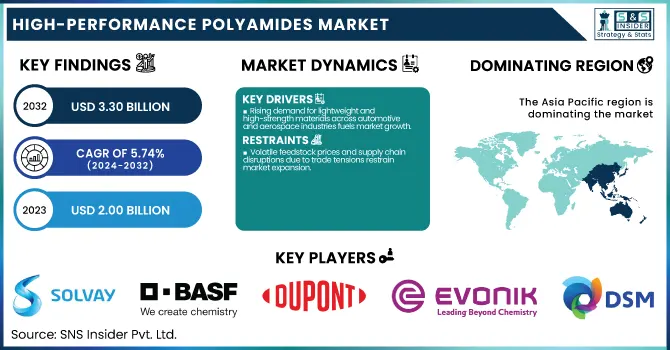

The High-Performance Polyamides Market size was USD 2.00 billion in 2023 and is expected to reach USD 3.30 billion by 2032 and grow at a CAGR of 5.74% over the forecast period of 2024-2032.

To Get more information on High-Performance Polyamides Market - Request Free Sample Report

The report offers comprehensive statistical insights and emerging trends that drive strategic decision-making. It includes data on global and regional production capacities and utilization rates by polymer type for 2023. The report examines feedstock price fluctuations and supply chain dynamics influencing cost structures. Regulatory impact assessments by region highlight how evolving standards affect manufacturing and distribution. Environmental metrics such as emissions data and waste management practices, are also analyzed, emphasizing industry sustainability efforts. Furthermore, the report explores innovation trends, focusing on R&D investments and the commercialization of bio-based and recyclable polyamides. These insights collectively provide a robust foundation for understanding market direction and identifying growth opportunities.

The U.S. tariff uncertainties have significantly impacted the high-performance polyamides market, particularly through disruptions in the nylon supply chain, a key component in automotive and industrial applications. “The imposition and fluctuation of tariffs on Chinese and other imported nylon materials have created volatility in raw material pricing and procurement, leading to cost pressures for U.S.-based manufacturers. This uncertainty has dampened investment confidence and slowed production planning, especially in downstream sectors like automotive, which rely heavily on high-performance nylons such as PA 6, PA 66, and PA 12 for lightweight components.” The reduced competitiveness of domestically produced nylon due to higher feedstock costs and limited access to affordable imports has, in turn, affected market growth. These trade tensions underscore the critical need for stable supply frameworks and policy clarity to support long-term expansion in the high-performance polyamides sector.

The United States held the largest share in the High-Performance Polyamides market in 2023, with a market size of USD 366 million, projected to reach USD 632 million by 2032, growing at a CAGR of 6.26% during 2024–2032. It is due to its strong presence of well-established automotive, aerospace, and electronics industries, which are key end-users of high-performance polyamides. The country benefits from advanced manufacturing infrastructure, significant R&D investments, and the presence of major players such as DuPont, Solvay, and Ascend Performance Materials, which continue to innovate and expand product portfolios to meet evolving performance demands. Furthermore, government initiatives promoting lightweight and fuel-efficient vehicles have increased the adoption of high-performance polyamides in under-the-hood and structural components. According to recent industry trends, the U.S. market also benefits from a relatively stable regulatory environment that encourages innovation in high-performance materials. The availability of high-quality feedstocks and integration of sustainable practices, including the use of bio-based polyamides, have further contributed to the country’s dominance in the global market.

Market Dynamics

Drivers

-

Rising demand for lightweight and high-strength materials across automotive and aerospace industries fuels market growth.

The growing focus on fuel efficiency, emissions reduction, and performance enhancement in the automotive and aerospace sectors is significantly boosting demand for high-performance polyamides. These materials offer superior mechanical strength, thermal resistance, and lightweight properties, making them ideal for components such as fuel lines, air intake manifolds, and structural elements. Automakers and aerospace manufacturers are increasingly replacing metal parts with high-performance polyamides to meet regulatory standards and consumer expectations for sustainability and efficiency. The integration of electric vehicles (EVs) and aircraft lightweighting programs further propels this trend. With the push for environmental compliance and energy efficiency, high-performance polyamides are becoming an essential material in advanced engineering applications, thereby driving market growth across developed and emerging economies.

Restrain

-

Volatile feedstock prices and supply chain disruptions due to trade tensions restrain market expansion.

The high-performance polyamides market faces challenges from the fluctuating prices of raw materials, especially petroleum-based feedstocks like caprolactam and adipic acid. These price volatilities are often exacerbated by geopolitical instability, trade disputes, and regional supply disruptions. In particular, U.S. tariff uncertainties on imported nylon materials have led to procurement delays and increased production costs for domestic manufacturers. Such supply chain instability limits manufacturers’ ability to offer cost-effective solutions, making it difficult to sustain long-term contracts with OEMs. Additionally, dependence on select global suppliers for specialty monomers further intensifies vulnerability to market shocks. These uncertainties not only affect pricing strategies but also hinder expansion plans, especially in sectors like automotive and electronics, where cost competitiveness is critical.

Opportunity

-

Expansion of bio-based and recyclable polyamides to offer sustainable growth opportunities for market players.

As industries increasingly emphasize sustainability, the development of bio-based and recyclable high-performance polyamides presents a promising opportunity for market players. Companies are investing in green chemistry to produce polyamides from renewable sources such as castor oil, which is used in PA 11 and PA 610. These eco-friendly alternatives offer comparable performance to petroleum-based counterparts while reducing carbon footprints and reliance on fossil fuels. Regulatory support and consumer preference for sustainable materials further accelerate this shift. Innovations in closed-loop recycling systems are also gaining traction, allowing for the reuse of high-performance polyamides without significant degradation in quality. These advancements open new revenue streams for manufacturers and enable industries like automotive, electronics, and consumer goods to meet circular economy goals.

Challenge

-

Intensive processing requirements and high production costs pose challenges for widespread industrial adoption.

Despite their superior properties, high-performance polyamides come with significant processing complexities and high manufacturing costs, limiting their adoption in cost-sensitive applications. These materials often require specialized equipment, high-temperature processing, and precise handling techniques, which increase overall production expenditure. Small and medium-scale manufacturers may find it difficult to invest in such infrastructure, narrowing the market to large-scale players. Additionally, the cost differential between standard engineering plastics and high-performance polyamides can deter usage in industries with thin profit margins. The challenge becomes more pronounced in developing regions, where affordability often takes precedence over performance. Overcoming these barriers requires continued innovation to simplify processing and reduce material costs without compromising performance, making these advanced polymers more accessible to broader markets.

Segmentation Analysis

By Type

The polyamide 12 (PA 12) segment held the largest market share at around 28% in 2023. It owing to their excellent combination of mechanical strength, flexibility, chemical resistance, and low moisture absorption, which makes them suitable for demanding applications. Because of its light weight and high strength characteristics, PA 12 is widely used in automotive fuel lines, brake systems, and electrical cable sheathing. Beyond this, its excellent high and low-temperature performance and resistance to fuel, oil, and grease make it one of the most used materials in aerospace and industrial applications as well. In addition, the growing market share of PA 12 is attributable to expanding usage of PA 12 in medical devices and 3D printing technologies, owing to its processability and biocompatibility. The investment in environmentally friendly and bio-based PA 12 solutions by various manufacturers will push PA 12 at the global high-performance polyamides landscape as a true and valued polymer.

By End-Use Industry

Automotive held the largest market share, around 38%, in 2023. It is owing to the ongoing industry trend toward lightweight, fuel-efficient, high-performance vehicles, automotive was the largest market for high-performance polyamides. They are high-performance polyamides that provide outstanding mechanical properties, high thermal stability, chemical resistance, etc., and can be used as substitutes for metals in automobile components, including air intake manifolds, fuel systems, engine covers, and electrical connectors. This has complemented the existing demand for high-temperature resistant and insulating materials for use in electric vehicles (EVs) and hybrid models, in which polyamides are critical. In addition to that, it is anticipated that strict environmental regulations regarding emission optimization to reduce the weight of the vehicle will also drive the demand for polymer because the automotive industry is looking towards lightweight alternatives. Such trends are anticipated to contribute to the fortified position of this segment within the global market, especially when coupled with the ongoing development of application-specific polyamide formulations for automobiles.

Regional Analysis

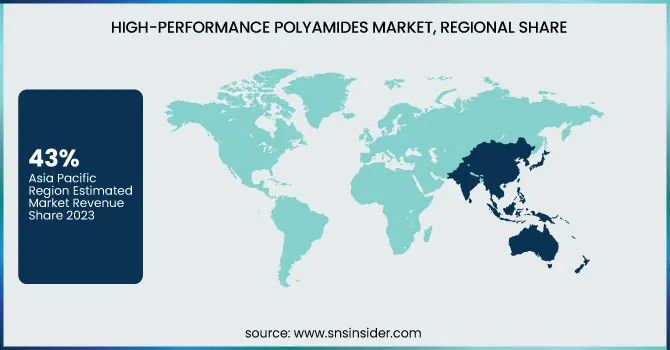

Asia Pacific held the largest market share, around 43%, in 2023. This is owing to a strong manufacturing base, expanding automotive and electronics industries, and rising need for advanced material for various end-user applications. Vehicle production and consumer electronics manufacturing in China, India, Japan, and South Korea, countries with relatively high-income manufacturing (including high-performance polyamide), have increased, with the plays of requisite high heat resistance, durability, and lightweight properties in components driving growth within these sectors. Additionally, supportive government policies for industrial growth and various initiatives to enhance infrastructure and foster technological innovations in the region have continued to grow the demand for performance polymers. Hence, the increasing presence of global and regional chemical producers setting up regional manufacturing sites in Asia Pacific to tap rising domestic and export demand has further enhanced competitive supply chain and cost advantages in the region and consolidated its market dominance.

North America held a significant market share. It is is driven by the well-established automotive, aerospace, and electronics industries and the critical performance of advanced-materials components used in these industries, which held a comparatively larger market share for the high-performance polyamides market in the North America high-performance polyamides market. In North America, the United States specifically stands as home to multiple leading automotive OEMs and aerospace companies that are becoming increasingly reliant on high-performance polyamides; materials that offer lightweight and durable properties as the automotive industry continues to battle strict fuel efficiency and emission standards. The increasing emphasis on R&D and innovation in the region coupled with the presence of leading manufacturers has led to a new level of polyamide formulations specifically designed for high-end applications. Also, the rising acceptance of electric cars and technology in North America is further increasing the consumption of heat- and chemical-resistant polymer. This high amount in conjunction with favorable trade as well as environmental policies will further prove the US supremacy in the global high-performance polyamides market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Solvay (Technyl, Amodel)

-

BASF (Ultramid, Ultramid Advanced)

-

DuPont (Zytel, Minlon)

-

Evonik Industries (VESTAMID, VESTAMID HTplus)

-

DSM (Stanyl, Akulon)

-

EMS-Chemie (Grilamid, Grilon)

-

PolyOne (Valox, Optima)

-

Ube Industries (Zytel, Tuffamide)

-

Mitsui Chemicals (Ailoy, Trevira)

-

Sumitomo Chemical (Sumika Super LCP, Sumika Nylons)

-

Toray Industries (TohoTenax, Toraynylon)

-

Royal DSM (Stanyl, Akulon)

-

Honeywell International (Solef, Aegis)

-

Saudi Basic Industries Corporation (SABIC) (Ultem, Noryl)

-

LG Chem (Zytel, LEXAN)

-

DowDuPont (Delrin, Zytel)

-

Nyloncraft (Polyamide 66, Polyamide 12)

-

BASF (Ultramid, Ultramid Advanced)

-

SABIC (Ultem, Lexan)

-

LANXESS (Durethan, Pocan)

Recent Development:

-

In November 2024, Arkema collaborated with Authentic Material to develop innovative compounds that blend recycled leather with Rilsan polyamide 11 and Pebax TPE pellets. This partnership aims to target sectors including luxury goods, fashion, consumer electronics, automotive interiors, and sports equipment.

-

In October 2024, Evonik and BASF reached an agreement for the first delivery of biomass-balanced ammonia with a lower CO₂ footprint. Evonik intends to use this ammonia to manufacture sustainable products, such as VESTAMIN IPD eCO and VESTAMID eCO Polyamide 12.

-

In July 2024, BASF partnered with Ningbo Yaohua Electric Technology Co., Ltd. to design a concept switchgear cabinet that incorporates BASF’s high-performance materials, Ultramid polyamide and Ultradur polybutylene terephthalate, aimed at improving recyclability and energy efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.00 Billion |

| Market Size by 2032 | USD3.30 Billion |

| CAGR | CAGR of5.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Polyamide 6T (PA 6T), Polyarylamide (PARA), Polyamide 12 (PA 12), Polyamide 9T (PA 9T), Polyamide 11 (PA 11), Polyamide 46 (PA 46), Polyphthalamide (PPA)) • By End-Use Industry (Automotive, Electrical & Electronics, Consumer Goods, Medical & Healthcare, Building & Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Solvay, BASF, DuPont, Evonik Industries, DSM, EMS-Chemie, PolyOne, Ube Industries, Mitsui Chemicals, Sumitomo Chemical, Toray Industries, Royal DSM, Honeywell International, Saudi Basic Industries Corporation (SABIC), LG Chem, DowDuPont, Nyloncraft, LANXESS |