Hydroxyapatite Market Report Scope & Overview:

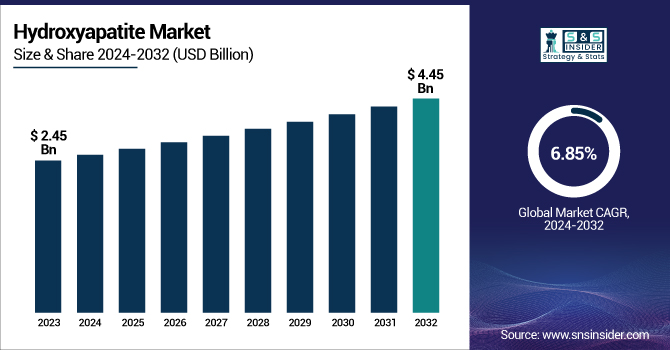

The Hydroxyapatite Market size was USD 2.45 billion in 2023 and is expected to reach USD 4.45 billion by 2032 and grow at a CAGR of 6.85% over the forecast period of 2024-2032.

To Get more information on Hydroxyapatite Market - Request Free Sample Report

This report provides in-depth statistical insights and trends on the hydroxyapatite market, covering key aspects such as production capacity and utilization by region in 2023, highlighting supply- demand dynamics. It analyzes raw material pricing trends for calcium phosphate and other feedstocks, along with regulatory impacts and compliance across major markets. The report explores environmental metrics, focusing on waste management and sustainability initiatives in manufacturing. Additionally, it delves into R&D investments, emphasizing advancements in nano-hydroxyapatite and biocompatibility. Market adoption trends in medical and dental applications are also examined, providing insights into growth drivers. This analysis helps stakeholders understand evolving industry dynamics, innovation trends, and regulatory challenges shaping the market.

The U.S. dominated the hydroxyapatite market with a 76% market share, reaching a market size of USD 540 million in 2023. This leadership is driven by strong demand in medical and dental applications, particularly in orthopedic implants, bone grafts, and dental coatings. The country benefits from advanced healthcare infrastructure, high adoption rates of biocompatible materials, and increasing investments in R&D for nanotechnology-based hydroxyapatite. Additionally, stringent FDA regulations ensure the use of high-quality, bioactive materials in medical implants, boosting domestic production. The presence of major players, such as Zimmer Biomet and Medtronic, further strengthens the market. Growing awareness of biomaterials, coupled with rising geriatric populations requiring bone and dental treatments, continues to fuel demand, solidifying the U.S. as the leading market for hydroxyapatite.

Hydroxyapatite Market Dynamics

Drivers

-

Rising demand for biocompatible and bioactive materials in orthopedic and dental applications drives hydroxyapatite market.

The growing preference for biocompatible and bioactive materials in orthopedic and dental applications is a key driver of the hydroxyapatite market. With an increasing number of orthopedic surgeries, bone grafting procedures, and dental implant placements, hydroxyapatite is widely used for its ability to promote bone regeneration and integrate seamlessly with human tissues. Government initiatives and FDA approvals for advanced biomaterials have further accelerated its adoption in medical devices and dental care. The aging population and rising cases of osteoporosis have also contributed to the demand for bone replacement materials, where hydroxyapatite plays a crucial role. Additionally, ongoing R&D efforts in nanotechnology-based hydroxyapatite formulations are expanding its applications in cosmetics, coatings, and drug delivery systems, further propelling market growth globally.

Restrain

-

High production costs and complex manufacturing processes restrain the growth of the hydroxyapatite market.

Despite its increasing adoption, the hydroxyapatite market faces challenges due to high production costs and complex manufacturing processes. The extraction and synthesis of high-purity hydroxyapatite require advanced technology, making production capital-intensive. Additionally, strict regulatory requirements for medical-grade hydroxyapatite led to prolonged approval timelines and increased compliance costs for manufacturers. The need for high-temperature synthesis and controlled production environments further adds to the overall cost burden. Small and mid-sized players often struggle with scalability issues, limiting their market participation. Furthermore, supply chain disruptions for raw materials, such as calcium phosphate, contribute to price volatility. These factors create barriers for new entrants and restrict the widespread commercialization of hydroxyapatite-based products, especially in cost-sensitive markets like developing economies.

Opportunity

-

Advancements in nanotechnology-based hydroxyapatite open new growth avenues in regenerative medicine.

The development of nanotechnology-based hydroxyapatite presents a significant opportunity for expanding its applications in regenerative medicine, drug delivery, and tissue engineering. Nano-hydroxyapatite offers superior bioactivity, enhanced bone regeneration properties, and improved surface modification capabilities, making it ideal for next-generation medical implants and bone graft substitutes. Leading research institutes and biomaterials companies are investing in nanostructured hydroxyapatite coatings for orthopedic implants, improving osteointegration and reducing implant failures. Additionally, nano-hydroxyapatite is gaining popularity in cosmetics and personal care products, particularly in toothpaste formulations for enamel remineralization. Growing collaborations between healthcare companies and nanotechnology researchers are further accelerating commercialization efforts. As demand for advanced biomaterials in precision medicine grows, nanotechnology-based hydroxyapatite is expected to create new revenue streams for market players.

Challenge

-

Regulatory challenges and stringent approval processes delay hydroxyapatite market expansion.

The hydroxyapatite market faces significant regulatory challenges due to strict approval processes and compliance standards in medical applications. Regulatory bodies like the FDA, EMA, and ISO impose rigorous testing requirements to ensure the safety, efficacy, and biocompatibility of hydroxyapatite-based implants and coatings. These regulations often lead to longer product development cycles, increased costs, and delays in commercialization. Companies must invest heavily in clinical trials, quality control measures, and regulatory documentation, making it difficult for new entrants to establish themselves in the market. Additionally, regional variations in medical device approvals create further complications for global market expansion. Non-compliance with these regulations can result in product recalls and legal liabilities, posing financial risks to manufacturers. Addressing these regulatory hurdles is crucial for the smoother adoption and growth of hydroxyapatite-based products.

Hydroxyapatite Market Segmentation Analysis

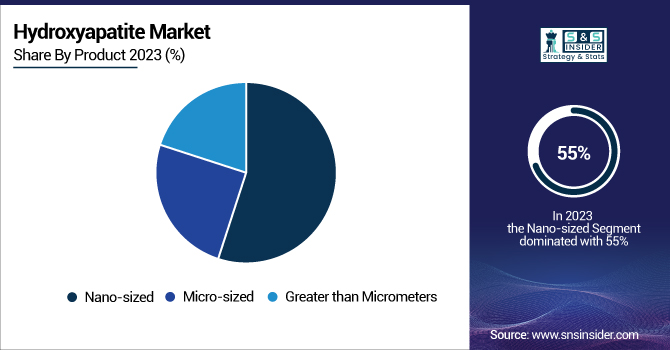

By Product

Nano-sized held the largest market share around 55% in 2023. It is owing to the high bioactivity, increased surface area with pores, and improved bone regrowth properties that the market was led by the nano-sized hydroxyapatite, which accounted for the largest market share. Due to its similar nanoscale structure to natural bone, it is especially suitable for orthopedic implants, bone grafting, and dental coatings. The increased usage of nano-hydroxyapatite in medical and dental applications is due to its enhanced abilities to provide osseointegration, faster bone healing, and reduce implant failures. It is also an ingredient in various cosmetics and personal care products, especially in toothpaste for enamel remineralization and whitening. Also, increasing investment in nanotech-based biomaterials combined with continuous R&D in drug delivery applications have fortified its position in the market. Expanding regulatory approvals and greater needs for advanced biomaterials are making nano-sized hydroxyapatite the material of choice in multiple industries.

By End-Use Industry

Orthopedics held the largest market share, around 52%, in 2023. It is owing to their use in bone grafts, joint replacements, and implant coatings. Driven by its unique biocompatibility and osteoconductive features, hydroxyapatite is a case of interest in the improvement of bone regenerative potential or the integration of implants. Increased cases of osteoporosis, arthritis, and fractured bones are on the rise, demanding hydroxyapatite-coated orthopedic implants. Moreover, it has also extended its application on customized bone implants through 3D printing and in nanotechnology-based hydroxyapatite formulations. Around the world, this has also led to a huge number of orthopedic procedures taken merely as a result of the increasing elderly population, particularly in developed areas. This, along with the government support for biocompatible materials in medical applications, coupled with the stringent quality standards for orthopedic implants, has further strengthened its foothold in the market.

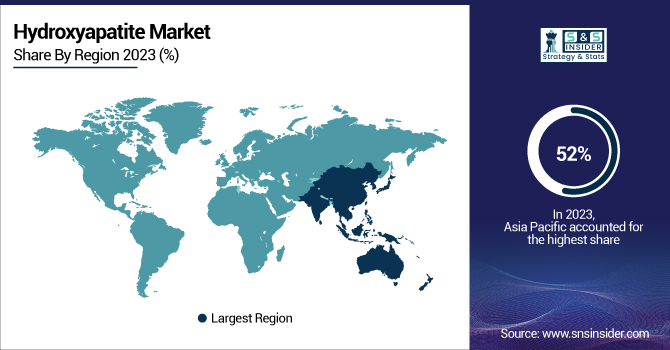

Hydroxyapatite Market Regional Outlook

Asia Pacific held the largest market share, around 52%, in 2023. It is owing to factors such as rapid development in the healthcare infrastructure, rise in medical tourism, and demand for orthopedic and dental implants across the region. Additionally, the presence of a large geriatric population, especially in countries like China, Japan, and India, is expected to create an increase in cases of osteoporosis, arthritis, and dental disorders, thus adopting hydroxyapatite-based implants and coatings. Government initiatives concerning the manufacture of advanced biomaterials and medical devices have also fueled the growth of this market. Moreover, the dominance of the region is attributed to the presence of low-cost production plants in addition to huge R&D investments in nanotechnology-based hydroxyapatite. Demand is also propelled by the gradually increasing awareness of biocompatible materials for personal care and cosmetic uses, including nano-hydroxyapatite in toothpaste formulations. Asia-Pacific dominated the global hydroxyapatite market due to growing healthcare expenses, and robust industrial investment.

North America held a significant market share. This is owing to high demand for advanced biomaterials used in orthopedic and dental application, supported with robust healthcare infrastructure and high adoption of medical implants. An increase in geriatric population, osteoporosis, arthritis, and dental disorders are some of the rises in cases in the U.S. and Canada, which are also expected to increase the demand for hydroxyapatite-based bone grafts, joint replacements, and dental coatings. Finally, the strict regulations that are required for FDA approval assure quality, but also provoke the use of biocompatible material in medical devices. Moreover, the presence of key players operating in the medical devices and continuous investment in research and development of nanotechnology-based hydroxyapatite support the market further. In addition, the demand for customized hydroxyapatite implants has been driven by the growing trend of minimally invasive surgeries and personalized medicine. North America is anticipated to hold a significant share in the hydroxyapatite market, supported by the presence of a strong regulatory framework and continual investments toward the development of technologically advanced products.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Cam Bioceramics B.V. (HAp Granules, HAp Coating)

-

SofSera Corporation (NanoXIM HAp, HAp Coating Powder)

-

Fluidinova (nanoXIM CarePaste, nanoXIM FoodPaste)

-

Berkeley Advanced Biomaterials (HAP-91, OsteoHAP)

-

Taihei Chemical Industrial Co., Ltd. (TCP-HAp, HA-Fine Powder)

-

SigmaGraft (PermaBone, PermaBlock)

-

Bio-Rad Laboratories, Inc. (HAP Ceramic Hydroxyapatite, Macro-Prep Ceramic HAP)

-

Merz North America, Inc. (Radiesse+, Radiesse Volume Advantage)

-

Premier Biomaterials (Hydroxyapatite Microparticles, BoneGraft HAp)

-

Himed (CAPTAL 60, CAPTAL 75)

-

Nano Interface Technology (nHAp Powder, nHAp Dispersion)

-

Sangi Co., Ltd. (NanoAmor, MedDent)

-

Osartis GmbH (Osbone, Osbond)

-

Zellwerk GmbH (HAp Scaffold, HAp Microspheres)

-

Himed Japan Co., Ltd. (CAPTAL 50, CAPTAL 85)

-

Medtronic (MasterGraft HAp, NanOss Bioactive)

-

Collagen Matrix, Inc. (HydroxyMatrix, BoneGraftPlus)

-

Kuros Biosciences (MagnetOs Granules, MagnetOs Putty)

-

BioInteractions Ltd. (HAp BioCoat, HAp Antibacterial Coating)

-

Xtant Medical (OsteoSponge HA, OsteoWrap HA)

Recent Development:

-

In February 2024, Sangi Co., Ltd. introduced a remineralizing toothpaste formulated with Medical Hydroxyapatite. Developed using NASA-inspired technology, the product is designed to prevent tooth decay and has been recognized by the U.S. Space Technology Hall of Fame.

-

In October 2023, Superior Polymers launched Magnolia Trinity PEEK, an advanced material integrating carbon fiber, hydroxyapatite, and polyether ether ketone (PEEK). This innovation enhances versatility, biocompatibility, and durability, making it ideal for medical applications such as orthopedic and cardiovascular implants.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.45 Billion |

| Market Size by 2032 | USD 4.45 Billion |

| CAGR | CAGR of 6.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Nano-sized, Micro-sized, Greater than Micrometers) •By End-Use Industry (Dental Care, Plastic Surgery, Orthopedics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cam Bioceramics B.V., SofSera Corporation, Fluidinova, Berkeley Advanced Biomaterials, Taihei Chemical Industrial Co., Ltd., SigmaGraft, Bio-Rad Laboratories, Inc., Merz North America, Inc., Premier Biomaterials, Himed, Nano Interface Technology, Sangi Co., Ltd., Osartis GmbH, Zellwerk GmbH, Himed Japan Co., Ltd., Medtronic, Collagen Matrix, Inc., Kuros Biosciences, BioInteractions Ltd., Xtant Medical |