High Purity Alumina Market Report Scope & Overview:

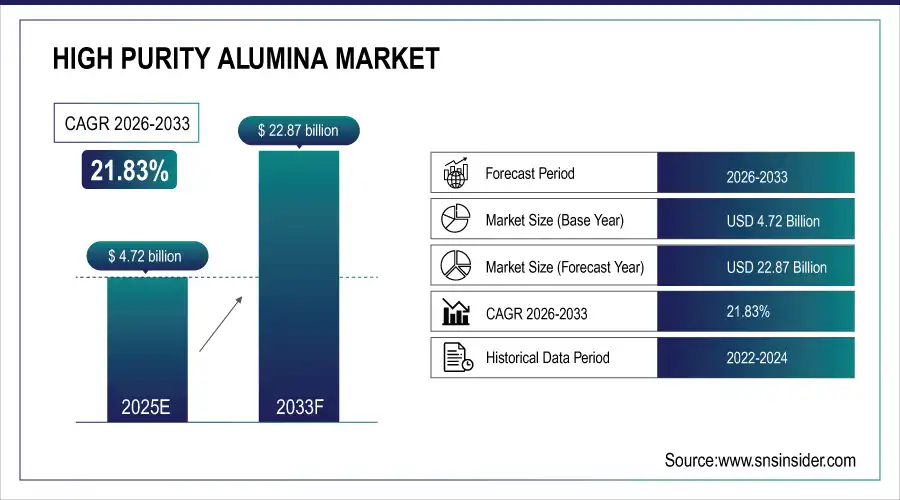

The High Purity Alumina Market Size was valued at USD 4.72 Billion in 2025E and is projected to reach USD 22.87 Billion by 2033, growing at a CAGR of 21.83% during the forecast period 2026–2033.

The High Purity Alumina Market analysis emphasizes growing demand in LEDs, lithium-ion batteries, and advanced ceramics. Growing penetration in electronics and energy storage, advancing manufacturing processes and increasing use across industries is facilitating quick market expansion in all regional markets.

High Purity Alumina consumption reached 126 kilotons in 2025, driven by demand in LEDs, batteries, and advanced ceramics across electronics and automotive industries.

Market Size and Forecast:

-

Market Size in 2025: USD 4.72 Billion

-

Market Size by 2033: USD 22.87 Billion

-

CAGR: 21.83% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On High Purity Alumina Market - Request Free Sample Report

High Purity Alumina Market Trends:

-

Increasing use of LED lighting, lithium-ion batteries and advanced ceramics is driving the need for HPA globally.

-

Advancements in manufacturing techniques including CVD, Sol-Gel and Hydrothermal are increasing quality, purity and application flexibility.

-

Rising usage due to growth of electronics, energy storage and automotive sectors across the region is increasing demand.

-

Growing demand for performance, durability, and efficiency in high-tech applications is also driving manufacturers to introduce tailor-made HPA grades.

-

Competitive Landscape Competitive differentiation is through suppliers providing high purity, tailor made and application specific HPA product based on industries changing requirements.

U.S. High Purity Alumina Market Insights:

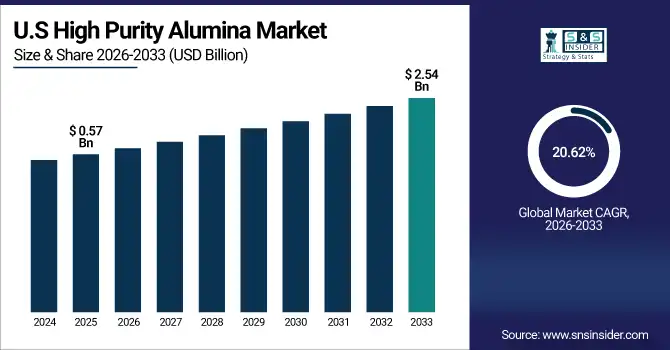

The U.S. High Purity Alumina Market is projected to grow from USD 0.57 Billion in 2025E to USD 2.54 Billion by 2033, at a CAGR of 20.62%. This growth is attributed to the rising demand in LEDs, lithium-ion batteries, advanced ceramics, electric vehicles and growth in end-use industries of electronics & energy storage.

High Purity Alumina Market Growth Drivers:

-

Rapid adoption of lithium-ion batteries in EVs and energy storage is accelerating High Purity Alumina market growth.

Rapid adoption of lithium-ion batteries in electric vehicles and energy storage systems is the primary driver of High Purity Alumina market growth. Rising requirement for high performance, durable and effective batteries is also driving the market for ultra-pure alumina. Advancements in production technology and broader industrial use across electronics, automotive and energy storage explain further market growth with high-performance HPA grades offering better product performance and risk mitigation in critical applications.

High Purity Alumina demand grew by 22% in 2025, driven by increasing adoption in lithium-ion batteries, LEDs, and advanced ceramics across electronics and automotive.

High Purity Alumina Market Restraints:

-

High production costs and complex manufacturing processes are limiting widespread adoption and supply expansion of High Purity Alumina.

High production costs and complex manufacturing processes are significant factors restraining the growth of the High Purity Alumina market. The use of sophisticated methods including Chemical Vapor Deposition and Sol-Gel adds to the capital and operating costs. In addition, constraints in the supply chain and variations in raw material availability can also break an uninterrupted chain of production. Smaller suppliers also struggle in continuing to ramp up production and distribution, restricting market growth despite increasing demand from electronics, auto and energy storage industries.

High Purity Alumina Market Opportunities:

-

Expanding electric vehicle and energy storage markets create opportunities for innovative, high-performance High Purity Alumina applications globally.

Rising demand for electric vehicles and energy storage solutions presents a significant opportunity for the High Purity Alumina market. The creation of such high-end, ultrapure alumina products for batteries, LEDs and advanced ceramics allows producers to serve the high-tech market. Furthermore, market prospects are further extended by expansion in developing sectors such as aerospace and polishing abrasives. Specialty grades and new production methods can help companies stand out, introduce a broader base of industrial customers to OTR products and promote long-term growth.

High-purity alumina accounted for 28% of new industrial applications in 2025, driven by demand from EVs, energy storage, and electronics.

High Purity Alumina Market Segmentation Analysis:

-

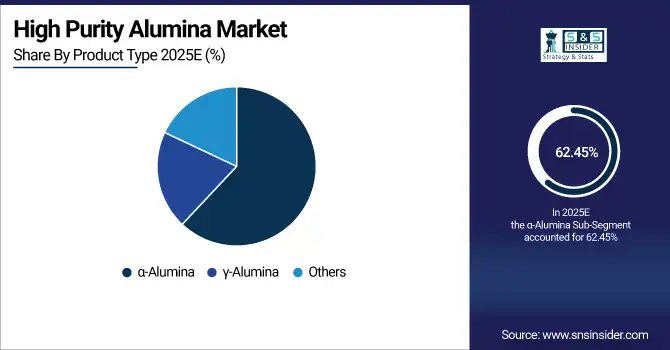

By Product Type, α-Alumina held the largest market share of 62.45% in 2025, while γ-Alumina is expected to grow at the fastest CAGR of 27.38%.

-

By Purity Level, 99.99% dominated with a 54.62% share in 2025, while ≥99.999% is projected to expand at the fastest CAGR of 29.14%.

-

By Application, LEDs & Optoelectronics accounted for the highest market share of 51.34% in 2025, and Lithium-Ion Batteries is projected to record the fastest CAGR of 32.56%.

-

By Production Method, Chemical Vapor Deposition (CVD) held the largest share of 48.71% in 2025, while Sol-Gel is expected to grow at the fastest CAGR of 28.11%.

-

By End-Use Industry, Electronics accounted for the highest market share of 46.85% in 2025, and Energy Storage is projected to record the fastest CAGR of 33.22%.

By Product Type, α-Alumina Dominates While γ-Alumina Expands Rapidly:

The α-Alumina segment dominated the market on account of its purity, stability and wide industrial usage in LEDs and electronics. It is desirable to provide an adoption incentive through reliable performance, availability of large-scale manufacturing facility and cost. γ-Alumina is the fastest growing segment is also said to be applications in polishing, ceramics and battery technology. Changes in the methods for processing and an increase in demand for niche high-tech applications are causing rapid development of this market.

By Purity Level, 99.99% Dominates While ≥99.999% Expands Rapidly:

The 99.99% segment dominated the market as it offers both high performance and cost-effectiveness; the segment finds widespread applications across LEDs, electronics and ceramic substrates. Industrial usage and available production support took first place. The ≥99.999% is the fastest growing segment as ultra-high purity alumina becomes necessary for lithium-ion batteries, aerospace and advanced electronics. Growing performance requirements and specialized applications are driving demand.

By Application, LEDs & Optoelectronics Dominate While Lithium-Ion Batteries Expand Rapidly:

LEDs & Optoelectronics segment dominated the market due to the high demand for energy-efficient lightning, sapphire substrates and continued industrial acceptance. LED penetration and continued technology advancements solidify domination. The lithium-ion is the fastest growing segment due to the exploding EV, renewable energy storage, and portable electronics adoption. The rising demand for high-performance batteries and the increased requirement for high-purity alumina in separators and coatings has led to a strong growth potential of this market.

By Production Method, Chemical Vapor Deposition (CVD) Dominates While Sol-Gel Expands Rapidly:

Chemical Vapor Deposition (CVD) segment dominated the market, owing to its capability to produce high quality, uniform HPA for LEDs and electronics. Iterative urban heat model, scalability and prevailing industrial application favour dominancy. Sol-Gel is the fastest growing segment, with its flexible sculpturally shaped capabilities for polishing, ceramics, and special purposes. Growth is being driven by technological advances and broader acceptance of new high value-added HPA grades in industry.

By End-Use Electronics Industry Dominates While Energy Storage Expands Rapidly:

The Electronics industry segment dominated the market supported largely by demand in high-tech LED, semiconductors and other electronics products where ultra-pure alumina was required. Dominance is strengthened via longer-term contracts and deep industrial integration. Energy Storage is the fastest growing segment as penetration of lithium-ion batteries in Electric Vehicle (EV) and renewable applications prevails. The demand for green energy and rising EV production is driving the segment.

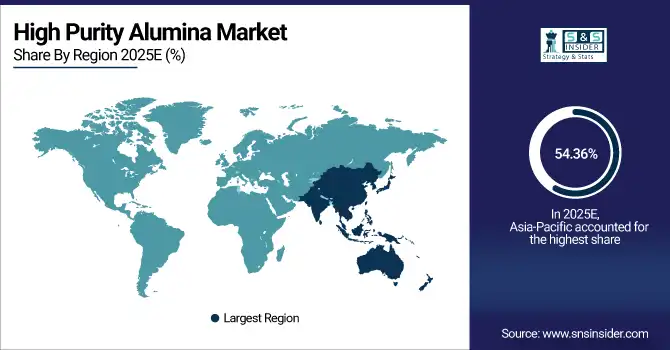

High Purity Alumina Market Regional Analysis:

Asia-Pacific High Purity Alumina Market Insights:

The Asia-Pacific High Purity Alumina market dominates with 54.36% in 2025, and it is the largest region with demand for LED manufacturing, lithium-ion batteries and advanced electronics. Market leadership is facilitated by large-scale industrial production, established supply chains and technological competencies in countries including China, Japan and Korea. Increasing application across electric vehicles, renewable energy storage and high-tech ceramic utilization further enhances regional dominance and supports growth throughout the projected timeframe.

Get Customized Report as per Your Business Requirement - Enquiry Now

China High Purity Alumina Market Insights:

China represents the largest High Purity Alumina market in Asia-Pacific, supported by robust LED, lithium-ion battery, and electronics manufacturing. Expanding EV adoption, advanced ceramics production, and growing industrial applications, along with technological expertise and large-scale HPA production, are further driving regional market dominance and creating new growth opportunities.

North America High Purity Alumina Market Insights:

The North America High Purity Alumina market is an important one for High Purity Alumina, enjoying steady growth due to demand from the electronic device, lithium-ion battery and advanced ceramics sectors. Growth in electric vehicle production, energy storage solutions and industrial applications are the key factors driving market growth. Investment in R&D, advanced manufacturing technologies and supply chains are driving uptake, with the region benefiting from technological prowess, though falling behind Asia-Pacific in market share.

U.S. High Purity Alumina Market Insights:

The U.S. High Purity Alumina market is poised to grow on account of robust demand for electronics, LEDs and lithium-ion batteries coupled with advanced production techniques and supply chain. Increasing applications in electric vehicles, energy and high-performance ceramics in addition to industrial innovation will continue to drive the market through the forecast time.

Europe High Purity Alumina Market Insights:

The Europe High Purity Alumina market is growing on account of rising demand for lithium-ion batteries, LEDs and advanced ceramics. Main markets include Germany, France and the UK. Increasing adoption in electronics and energy storage, growing electric vehicle (EV) production, advancements in technology and introduction of government initiatives supporting clean energy and sustainable manufacturing are the factors that will propel growth. Robust supply chains and high-performance applications are other growth drivers of the region market.

Germany High Purity Alumina Market Insights:

Germany is a major market for High Purity Alumina with the demand coming from LEDs, Li-ion batteries and advanced ceramics. Robust industrial infrastructure and supply chains drive adoption, while technological advancements and increasing EV production continue to catalyze expansion. Market growth is further supported by sustainability efforts and high-end applications.

Latin America High Purity Alumina Market Insights:

The Latin America High Purity Alumina Market is the fastest growing region at a CAGR of 27.51%, supported by increased demand for lithium-ion batteries LEDs, and high-performance ceramics. Increasing industrial applications, growing electric vehicle penetration, advanced technology and rising developments in supply chain will support the growth. Strategic investments in high performance materials and renewable energy projects are driving the markets growth within the region.

Middle East and Africa High Purity Alumina Market Insights:

The Middle East & Africa High Purity Alumina market is anticipated to show moderate growth due to increasing utilization in LEDs, lithium-ion batteries and industrial ceramics. Growth is backed up by growing investments in renewable energy, infrastructure, developing manufacturing capabilities and government’s support toward high performance materials across the region.

High Purity Alumina Market Competitive Landscape:

Altech Chemicals Ltd., headquartered in Australia, dominates the High Purity Alumina (HPA) market through its advanced chemical and metallurgical processes. By continuing working primarily to meet the high demand of lithium-ion batteries, LEDs, and ceramics, the company widens its presence in the HPA industry. However, such success is unincludingly without the company’s high-quality strategic partnership, innovative production methods, and a desire to dominate the industry by offering the highest-performance applications, providing quality, and achieving ecological sustainability standards.

-

In March 2025, Altech Chemicals expanded its technical capability by acquiring a controlling interest in Advanced Ceramics Pty Ltd. The move strengthens its HPA production for medical and aerospace applications. This strategic expansion reinforces Altech’s leadership in high-performance alumina within the industry.

Alcoa Corporation, based in the U.S., is a leading player in the HPA industry due to its extensive experience in aluminium production and advanced materials. As an industry leader, Alcoa uses its large-scale industrial infrastructure and R&D facilities to produce and supply quality alumina suitable for electronics, LEDs, and battery applications. The proven track record in the high-purity alumina markets can be attributed to the technological advancements and leadership, supply chain, and green and cost-effective production.

-

In May 2025, Alcoa Corporation launched its low-carbon EcoLum® aluminum billet in North America. The product supports sustainable manufacturing and high-performance industrial applications. It enhances Alcoa’s position as a key player in the high-purity alumina and advanced materials industry.

Nippon Light Metal Holdings, headquartered in Japan, dominates the HPA industry through specialized alumina production for LEDs, semiconductors, and ceramics. Through high-performance materials expertise, constant innovation, and robust industrial partnerships, the company has become a market leader. By guaranteeing top-quality, top-precision, industrial-scale manufacturing for essential applications, Nippon Light Metal Holdings has established itself as a key player in the world high-purity alumina arena.

-

In April 2025, Nippon Light Metal introduced new high-purity alumina for functional ceramics at Ceramics Expo 2025. The product targets LEDs, semiconductors, and advanced ceramic applications. This launch strengthens its market presence and innovation leadership in the HPA industry.

High Purity Alumina Market Key Players:

Some of the High Purity Alumina Market Companies are:

-

Altech Chemicals Ltd.

-

Alcoa Corporation

-

Nippon Light Metal Holdings Co., Ltd.

-

Sumitomo Chemical Co., Ltd.

-

Baikowski SAS

-

Orbite Technologies Inc.

-

Alpha HPA

-

Sasol Limited

-

FYI Resources Ltd.

-

Polar Sapphire Ltd.

-

Almatis, Inc.

-

CoorsTek Inc.

-

Honghe Chemical Co., Ltd.

-

Xuancheng Jingrui New Materials Co., Ltd.

-

Hebei Pengda Advanced Materials Technology Co., Ltd.

-

Zibo Honghe Chemical Co., Ltd.

-

Chongqing Research Better Science & Technology Co., Ltd.

-

Hefei Crystal Material Co., Ltd.

-

Taimei Chemicals Co., Ltd.

-

Hindalco Industries Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.72 Billion |

| Market Size by 2033 | USD 22.87 Billion |

| CAGR | CAGR of 21.83% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (α-Alumina, γ-Alumina, Others) • By Purity Level (99.99%, 99.999%, ≥99.999%, Others) • By Application (LEDs & Optoelectronics, Lithium-Ion Batteries, Polishing & Abrasives, Ceramic Substrates, Others) • By Production Method (Chemical Vapor Deposition, Sol-Gel, Hydrothermal, Others) • By End-Use Industry (Electronics, Energy Storage, Automotive, Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Altech Chemicals Ltd., Alcoa Corporation, Nippon Light Metal Holdings Co., Ltd., Sumitomo Chemical Co., Ltd., Baikowski SAS, Orbite Technologies Inc., Alpha HPA, Sasol Limited, FYI Resources Ltd., Polar Sapphire Ltd., Almatis, Inc., CoorsTek Inc., Honghe Chemical Co., Ltd., Xuancheng Jingrui New Materials Co., Ltd., Hebei Pengda Advanced Materials Technology Co., Ltd., Zibo Honghe Chemical Co., Ltd., Chongqing Research Better Science & Technology Co., Ltd., Hefei Crystal Material Co., Ltd., Taimei Chemicals Co., Ltd., Hindalco Industries Ltd. |