Eco-Friendly Plasticizers Market Analysis & Overview:

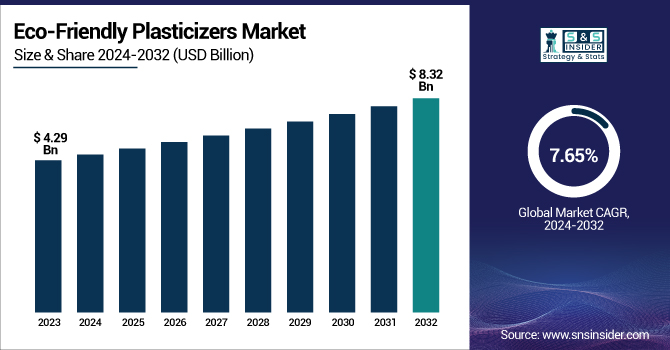

The Eco-Friendly Plasticizers Market size was USD 4.29 billion in 2023 and is expected to reach USD 8.32 billion by 2032 and grow at a CAGR of 7.65% over the forecast period of 2024-2032.

To Get more information on Eco-Friendly Plasticizers Market - Request Free Sample Report

The report provides detailed insights on production capacity and utilization rates by country and product type for 2023. The report covers fluctuations in feedstock prices impacting eco-friendly plasticizer production across key regions. It analyzes the regulatory impact on sustainable plasticizer development and adoption worldwide. Additionally, the report highlights environmental metrics such as emission reductions and waste management practices by major players. It also includes innovation trends and R&D activities focused on bio-based and non-toxic plasticizers, along with the adoption rate of eco-friendly alternatives across industries.

The United States held the largest share in the Eco-Friendly Plasticizers market in 2023, with a market size of USD 804 million, projected to reach USD 1610 million by 2032, growing at a CAGR of 8.02% during 2024–2032. This is due to its strong emphasis on sustainability regulations and increasing demand for non-toxic materials across various industries. The country’s strict environmental policies, such as those enforced by the Environmental Protection Agency (EPA) and initiatives promoting green chemistry, have accelerated the shift from conventional plasticizers to eco-friendly alternatives. Additionally, robust growth in sectors like packaging, automotive, and construction, where eco-friendly plasticizers are increasingly used to meet safety and environmental standards, has further fueled market expansion. Rising consumer awareness regarding health hazards linked to traditional phthalate-based plasticizers and the surge in investments by key players in research and innovation for bio-based solutions have also played a critical role. Moreover, collaborations between industries and government bodies to promote sustainable materials continue to strengthen the U.S. leadership in this market

Eco-Friendly Plasticizers Market Dynamics

Drivers

-

Rising preference for non-toxic, bio-based alternatives across end-use sectors fuels the eco-friendly plasticizers market growth.

Growing health concerns and regulatory restrictions surrounding traditional phthalate plasticizers have driven industries to adopt safer, bio-based alternatives. Eco-friendly plasticizers derived from renewable sources like soybean oil, castor oil, and citrates are witnessing increased demand in packaging, medical devices, automotive interiors, and toys. This shift is further supported by consumer awareness about environmental and health hazards. Key manufacturers are expanding their product portfolios with innovative, biodegradable plasticizers to meet evolving compliance and consumer needs. In addition, government initiatives promoting green chemistry and the circular economy are contributing to the demand surge, making bio-based plasticizers a strategic focus in the long-term sustainability goals of several industries.

Restrain

-

High cost and limited availability of raw materials restrain the eco-friendly plasticizers market.

Despite rising demand, the high production cost and limited raw material availability for bio-based plasticizers hinder widespread adoption. Compared to conventional phthalate plasticizers, eco-friendly alternatives require more complex synthesis and specialized feedstocks such as epoxidized oils, citrates, and castor derivatives. These inputs often face price fluctuations and availability issues due to seasonal factors, agricultural constraints, and competition for food resources. This increases production costs, which in turn impacts the final pricing of plasticizer-infused products. As a result, cost-sensitive industries like packaging and construction remain hesitant to switch completely to green plasticizers. Moreover, the lack of standardized processing technologies in certain regions adds to the inconsistency in supply and quality. These factors collectively create a barrier for small and mid-sized players trying to enter or expand within the eco-friendly plasticizer space.

Opportunity

-

Increasing adoption of green packaging solutions presents significant opportunities for the eco-friendly plasticizers market.

The growing global focus on sustainable packaging solutions presents lucrative opportunities for eco-friendly plasticizer manufacturers. Governments and corporations are increasingly shifting toward biodegradable and recyclable packaging to minimize environmental impact. As plasticizers play a crucial role in enhancing flexibility and durability in packaging films and containers, the demand for non-toxic and biodegradable alternatives is on the rise. Major FMCG brands and e-commerce giants are adopting green packaging solutions as part of their ESG (Environmental, Social, and Governance) commitments. This creates a promising avenue for bio-based plasticizers in flexible packaging, food wraps, and molded packaging. In addition, innovations in mono-material packaging systems that require compatible and sustainable plasticizers are expanding the market potential. This growing interest in green packaging is expected to unlock substantial growth opportunities across developed and emerging markets.

Challenge

-

Performance limitations and compatibility issues challenge the mass adoption of eco-friendly plasticizers globally.

Despite their eco-friendly nature, bio-based plasticizers often face challenges in achieving performance parity with traditional phthalates, particularly in demanding industrial applications. In sectors such as automotive, electronics, and high-performance flooring, plasticizers must deliver exceptional thermal stability, flexibility, and compatibility with various polymers. However, certain eco-friendly plasticizers may underperform in extreme conditions or show limited compatibility with conventional PVC and other synthetic polymers. These shortcomings can result in inferior product durability or inconsistent quality. Furthermore, the lack of standardized testing protocols and certifications across different regions creates additional uncertainty for manufacturers considering a switch to green plasticizers. Overcoming these technical barriers requires ongoing R&D investment and collaboration between raw material providers, formulators, and end-users to optimize performance and develop polymer systems that fully support eco-friendly additives without compromising product functionality.

Eco-Friendly Plasticizers Market Segmentation Analysis

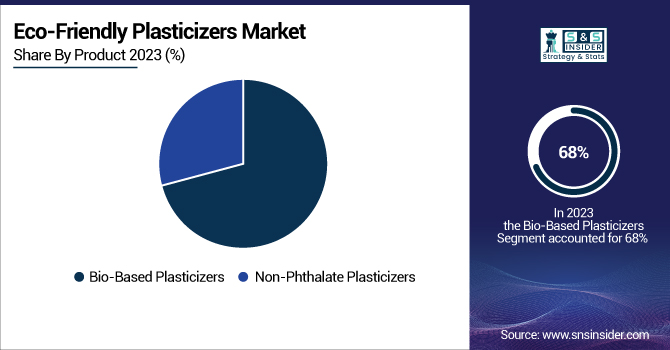

By Product

Bio-Based Plasticizers held the largest market share, around 68%, in 2023. It is driven largely by its favorable environmental profile, increasing regulatory compliance, and rising demand for sustainable products. Bio-based plasticizers, which originate from renewable resources, e.g., vegetable oils, citrates, and castor oil, provide non-toxic and biodegradable substitutes to traditional phthalates. Many major economies, such as the U.S., Europe, and even parts of Asia, have implemented stringent regulations, such as REACH and the U.S. EPA Safer Choice Program, to mandate the use of safer, bio-based chemicals in consumer products. Moreover, as sustainability becomes the latest trend, end-use industries such as packaging, automotive, and healthcare are utilizing bio-based plasticizers to achieve sustainability objectives and fulfill the customer's requirement for eco-friendly options. Their capability to provide similar performance attributes like flexibility, durability and low volatility while having a lower carbon footprint has powered their market prevalence in the last few years.

By Application

Packaging held the largest market share, around 38%, in 2023. The packaging industry, especially in food, beverages, personal care, and pharmaceuticals, embraces materials with stringent health, safety, and environmental standards. Green plasticizers, particularly bio-based plasticizers, with non-toxicity, low migration, and durability, are requisite for packaging applications. The introduction of safe additives through agencies such as the FDA and European Food Safety Authority (EFSA) has sped up the conversion of environmentally friendly plasticizers. Furthermore, to enhance their sustainable practices in line with corporate social responsibility (CSR) initiatives and customer expectations for environmentally friendly products, major packaging firms are also focusing on sustainability. This significant regulatory impetus, coupled with industry-wide sustainability targets, has paved the way for packaging to establish itself as the leading application segment.

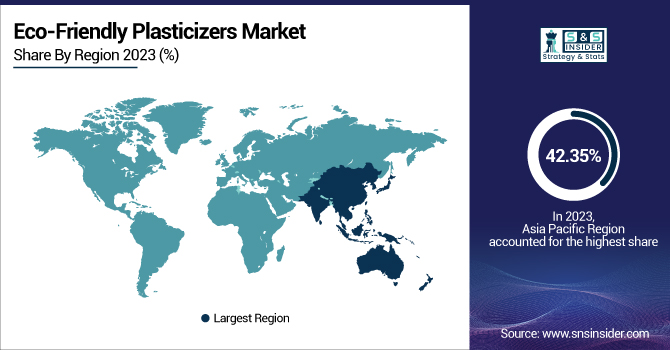

Eco-Friendly Plasticizers Market Regional Outlook

Asia Pacific held the largest market share, around 42.35%, in 2023. The region is also witnessing robust end-use industry growth, including packaging, automotive, and construction, particularly in countries such as China, India, Japan, and South Korea, where the demand for non-toxic, sustainable plasticizers has surged. Moreover, mandates that promote green manufacturing methods by the government, including Indian "National Action Plan on Climate Change" and Green Development Guidelines China have led to a greater uptake of bio-based plasticizers. A major manufacturing base and lower production costs allow prominent players to extend their facilities and offer environmentally friendly options in the market. In addition, the rising consumer consciousness regarding health and environmental safety has spurred the demand for sustainable products, thus bolstering the market in Asia Pacific.

North America held a significant market share. It is due to strong regulatory support and rising sustainability initiatives. The region, led by the U.S. and Canada, has implemented stringent regulations such as the U.S. Environmental Protection Agency (EPA) guidelines and the Canadian Environmental Protection Act, promoting the use of non-toxic, bio-based plasticizers across industries. Additionally, increasing consumer awareness regarding the environmental impact of conventional plasticizers has accelerated the demand for safer alternatives in applications like packaging, automotive, and construction. Major manufacturers in North America are investing heavily in R&D to develop innovative, eco-friendly plasticizer solutions to meet evolving environmental standards. Furthermore, growing corporate commitments toward carbon neutrality and the circular economy have further fueled market growth, making North America the leading region in adopting sustainable plasticizer technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Palatinol, Hexamoll)

-

Evonik Industries AG (ELATUR, VESTINOL)

-

Eastman Chemical Company (Benzoflex, Eastman 168)

-

Dow Chemical Company (DOW ECOLIBRIUM, DOW VERSIFY)

-

Arkema Group (PLANTROZ, BIOVYNYL)

-

Perstorp Holding AB (Pevalen, Emoltene 100)

-

LG Chem Ltd. (ECO-DEH, BIO-DEH)

-

LANXESS AG (Mesamoll, Ultramoll)

-

ExxonMobil Chemical (Jayflex, Vistamaxx)

-

UPC Technology Corporation (Polymol, Polyol)

-

Wacker Chemie AG (VINNAPAS, ECOSIL)

-

Asahi Kasei Corporation (Tufdene, Asaflex)

-

Hexion Inc. (ECO-LOY, VEOVA)

-

PolyOne Corporation (Geon BIO, OnFlex BIO)

-

Shandong Hongxin Chemical Co., Ltd. (HX-168, HX-510)

-

Grupa Azoty ZAK S.A. (OXOVIFLEX, Oxoplast Medica)

-

Nan Ya Plastics Corporation (Nan Ya 168, Nan Ya 108)

-

Meltem Kimya (MELFLEX, MELBIO)

-

KLJ Group (KLJ 610, KLJ 810)

-

Vertellus Holdings LLC (Citroflex, FlexaTrac)

Recent Development:

-

In 2024, Dow launched DOW ECOLIBRIUM bio-based plasticizers specifically for wire and cable applications, focusing on lowering carbon emissions and enhancing environmental sustainability.

-

In May 2024, Arkema entered a partnership to expand the production of PLANTROZ plasticizers made from renewable castor oil, supporting the advancement of low-carbon materials.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.29 Billion |

| Market Size by 2032 | USD 8.32 Billion |

| CAGR | CAGR of 7.65% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Bio-Based Plasticizers, Non-Phthalate Plasticizers) •By Application (Packaging, Consumer Goods, Automotive & Transportation, Building & Construction, Textile, Agriculture & Horticulture) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Evonik Industries AG, Eastman Chemical Company, Dow Chemical Company, Arkema Group, Perstorp Holding AB, LG Chem Ltd., LANXESS AG, ExxonMobil Chemical, UPC Technology Corporation, Wacker Chemie AG, Asahi Kasei Corporation, Hexion Inc., PolyOne Corporation, Shandong Hongxin Chemical Co., Ltd., Grupa Azoty ZAK S.A., Nan Ya Plastics Corporation, Meltem Kimya, KLJ Group, Vertellus Holdings LLC |