Horizontal Grinder Market Size & Trends:

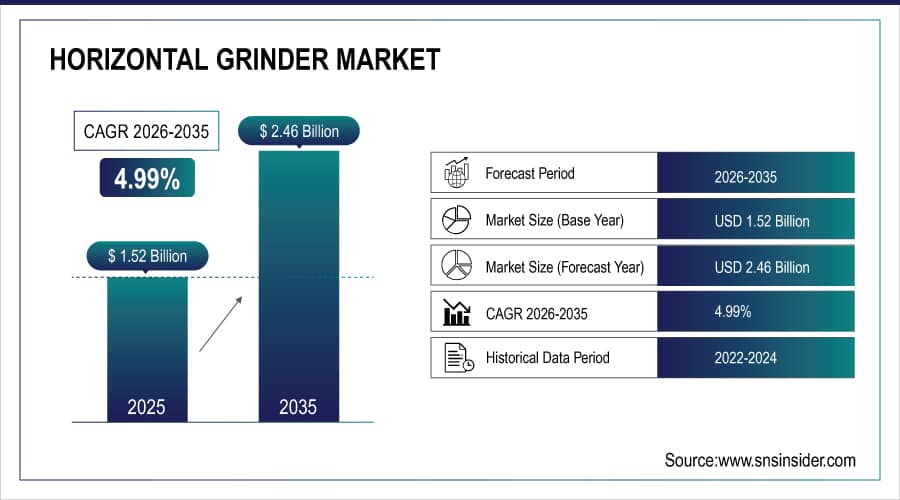

The Horizontal Grinder Market size was valued at USD 1.52 billion in 2025 and is projected to reach USD 2.46 billion by 2035, growing CAGR of 4.99% during 2026–2035.

The market is experiencing significant growth due to increasing demand for efficient wood and biomass processing, rising adoption of eco-friendly waste management solutions, and expanding forestry, construction, and demolition activities. Advanced designs in portable and stationary grinders, hybrid power systems, and automation are improving productivity, reducing operational costs, and enabling versatile applications in municipal, industrial, and agricultural sectors. The horizontal grinder market trends are expected to expand as industries increasingly adopt energy-efficient and smart grinding solutions.

Horizontal Grinder Market Size and Forecast:

-

Market Size in 2025: USD 1.52 Billion

-

Market Size by 2035: USD 2.46 Billion

-

CAGR: 4.99%

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get More Information On Horizontal Grinder Market - Request Free Sample Report

Key trends in the Horizontal Grinder Market:

-

Increasing demand for biomass and renewable energy is driving adoption of high-capacity grinders.

-

Growing municipal and industrial waste volumes are boosting eco-friendly waste processing equipment.

-

Development of portable and mobile grinders is enhancing operational flexibility in forestry and land clearing.

-

Advancements in diesel-electric hybrid and electric grinders are reducing emissions and lowering operational costs.

-

Integration of automation and smart controls is improving safety, efficiency, and material handling.

-

Expansion of construction, demolition, and landscaping projects is increasing demand for versatile grinding solutions.

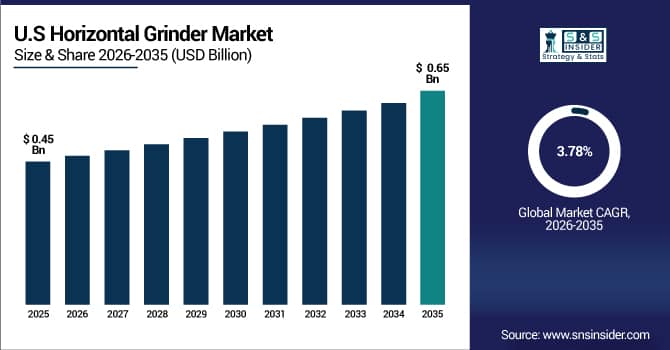

U.S. Horizontal Grinder Market Size & Trends:

The U.S. Horizontal Grinder Market size was valued at USD 0.45 billion in 2025 and is projected to reach USD 0.65 billion by 2035, growing at a CAGR of 3.78% during 2026–2035.

The market is witnessing strong growth due to increasing demand for efficient wood and biomass processing, rising adoption of eco-friendly waste management solutions, and expanding construction, forestry, and demolition activities. Technological advancements in portable and stationary grinders, diesel-electric hybrid systems, and automation are enhancing operational efficiency, reducing costs, and enabling versatile applications across municipal, industrial, and agricultural sectors. Key trends include growing interest in sustainable energy solutions, mobile grinding equipment, and smart, energy-efficient machinery.

Horizontal Grinder Market Driver:

Growing Demand for Efficient Biomass and Waste Processing Solutions Drives Expansion of Horizontal Grinder Market Globally

The increasing emphasis on sustainable waste management and renewable energy production is driving the growth of the horizontal grinder market. Rising municipal and industrial waste volumes, coupled with growing demand for wood chips and biomass for energy generation, is prompting industries to adopt high-capacity, technologically advanced grinders. These grinders enable efficient processing of construction and demolition waste, forestry residues, and green waste, reducing operational costs while supporting eco-friendly initiatives. Additionally, advancements in hybrid and electric-powered systems are improving energy efficiency and reducing emissions, further boosting market adoption. Governments and municipalities increasingly encourage eco-conscious equipment, leading to increased procurement by waste management, forestry, and landscaping operators. As a result, manufacturers are investing in R&D to introduce portable and stationary grinders with automation and smart controls, ensuring higher throughput and versatile material processing. The combination of regulatory support, operational efficiency, and sustainable practices continues to act as a key driver of market growth.

In May 2025, Vermeer Corporation launched the HG6000TX hybrid horizontal grinder, capable of processing up to 300 tons per hour. This machine reduces fuel consumption by 15% while delivering consistent output, showcasing how technological innovation addresses growing demand for eco-friendly, high-efficiency grinding solutions.

Horizontal Grinder Market Restraint:

-

High Initial Investment Costs and Maintenance Requirements Limit Widespread Adoption of Horizontal Grinders Across Emerging Markets

The significant upfront costs of purchasing horizontal grinders, combined with maintenance, repair, and operational expenses, act as a key restraint in market expansion. Small and medium-scale waste management firms and forestry operators often face budgetary constraints, limiting their ability to adopt advanced grinding equipment. Additionally, hybrid and electric-powered grinders require specialized components and trained personnel for operation and maintenance, further increasing total ownership costs. High capital expenditure discourages adoption in emerging economies despite the availability of biomass and green waste resources. Market growth is also constrained by logistical challenges related to transporting large, stationary grinders and procuring spare parts in remote locations. As a result, companies may continue relying on low-cost, conventional grinding methods or outsourcing waste processing, slowing market penetration. The combination of cost-related barriers and technical maintenance challenges continues to limit market growth, especially in regions where financing options and technical support are limited.

In February 2024, a mid-sized waste management company in Brazil reported delaying investment in stationary horizontal grinders due to initial costs exceeding USD 500,000 and limited local servicing options, highlighting financial and logistical challenges in emerging markets.

Horizontal Grinder Market Opportunity:

-

Rising Adoption of Hybrid and Electric-Powered Horizontal Grinders Presents Significant Growth Potential in Energy-Efficient Waste Processing

The growing focus on sustainability and reduction of carbon emissions is creating opportunities for hybrid and electric-powered horizontal grinders. These machines combine diesel and electric power to reduce fuel consumption, operational costs, and environmental impact while maintaining high processing capacity. Industries increasingly adopt these grinders for municipal, forestry, and biomass applications, enabling compliance with environmental regulations and improving energy efficiency. Technological advancements in automation, sensor-based controls, and remote monitoring further enhance operational efficiency and lower labor requirements. As a result, companies can expand offerings in energy-conscious regions while tapping into government incentives for green machinery. The market is poised to benefit from the global push for renewable energy and carbon neutrality, especially in North America and Europe, where sustainable waste management is a priority. Manufacturers investing in hybrid and electric grinder development are likely to capture significant market share.

In September 2025, Morbark, LLC introduced its hybrid-electric HG5400 grinder with automated load sensing and fuel optimization, reducing emissions by 20% and demonstrating how innovative, energy-efficient solutions create growth opportunities in the horizontal grinder market.

Horizontal Grinder Market Segmentation Analysis:

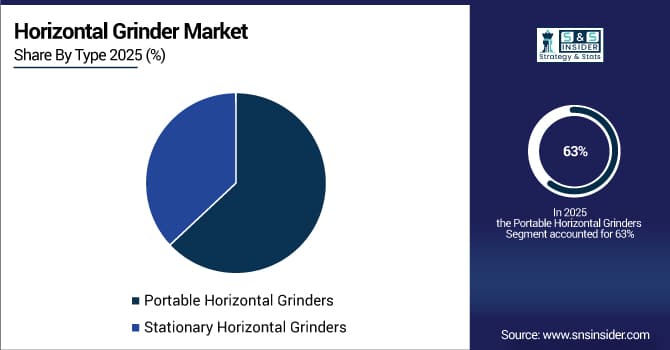

By Type, Portable Horizontal Grinders Segment Dominates Market with 63% Revenue Share in 2025, Stationary Horizontal Grinders to Record Fastest Growth with 6.12% CAGR

The Portable Horizontal Grinders segment held a dominant revenue share of 63% in 2025. The high adoption is driven by their mobility, versatility, and ability to process forestry, green, and construction waste on-site, reducing transportation costs and operational delays. Product developments such as improved feeding mechanisms, hybrid power options, and automation features have enhanced operational efficiency and throughput. This widespread adoption of portable grinders directly supports horizontal grinder market growth by enabling efficient, cost-effective waste and biomass processing across multiple industries.

The Stationary Horizontal Grinders segment is expected to experience the fastest growth during 2026–2035 with a CAGR of 6.12%. The growth is fueled by the increasing demand for high-capacity grinders in large-scale municipal, industrial, and forestry facilities. Technological improvements, including reinforced shafts, advanced feed rollers, and automated material handling, allow continuous and reliable operations. As stationary grinders can handle higher volumes efficiently, they are driving horizontal grinder market expansion by improving large-scale processing capabilities and reducing operational downtime in industrial and municipal applications.

By Power Source, Diesel-Powered Segment Dominates Market with 69% Revenue Share in 2025, Hybrid (Diesel–Electric) Segment to Record Fastest Growth with 9.11% CAGR

The Diesel-Powered segment held the largest revenue share of 69% in 2025 due to its high power output, durability, and suitability for remote forestry, land-clearing, and construction operations. Continuous product development, including fuel-efficient engines and low-emission technology, enhances performance while complying with environmental regulations. Diesel grinders’ reliability in processing heavy materials supports the horizontal grinder market by enabling consistent throughput and efficient large-scale biomass, green, and construction waste processing.

The Hybrid (Diesel–Electric) segment is projected to record the fastest growth during 2026–2035 with a CAGR of 9.11%. Hybrid grinders are gaining traction due to energy efficiency, reduced fuel consumption, and lower emissions. Technological advancements, such as automated load-sensing controls and electric drive systems, improve productivity while reducing operating costs. As industries increasingly adopt sustainable and eco-friendly equipment, hybrid grinders contribute to horizontal grinder market growth by supporting carbon-conscious municipal and industrial operations.

By Capacity, Medium Capacity Segment Dominates Market with 45% Revenue Share in 2025, High Capacity Segment to Record Fastest Growth with 7.98% CAGR

The Medium Capacity segment accounted for 45% of revenue in 2025, supported by its versatility in municipal, construction, and forestry applications. These grinders provide a balance between operational efficiency and cost-effectiveness, making them ideal for mid-scale operations. Product innovations such as reinforced shafts, advanced feed rollers, and hybrid power options enhance productivity and durability. The widespread adoption of medium-capacity grinders stimulates horizontal grinder market growth by enabling reliable, cost-efficient material processing in diverse end-user sectors.

The High Capacity segment is projected to grow at the fastest CAGR of 7.98% during 2026–2035. The growth is driven by demand for large-scale municipal, industrial, and biomass processing facilities that require continuous, high-volume grinding. Product developments including high-capacity feed systems, automation, and energy-efficient drives allow these grinders to process heavy volumes with minimal downtime. Adoption of high-capacity grinders is contributing to horizontal grinder market expansion by enabling efficient large-scale processing of wood, green waste, and construction debris.

By End User, Waste Management & Recycling Companies Segment Dominates Market with 35% Revenue Share in 2025, Biomass Power Plants Segment to Record Fastest Growth with 6.08% CAGR

The Waste Management & Recycling Companies segment accounted for 35% of revenue in 2025, driven by increasing municipal and industrial waste volumes and stricter regulatory requirements for eco-friendly processing. Technological advancements in portable and stationary grinders, hybrid engines, and automation improve operational efficiency and material throughput. The adoption of these grinders in recycling operations supports the horizontal grinder market by enabling cost-effective, large-scale processing of wood, green waste, and construction debris across municipal and industrial sectors.

The Biomass Power Plants segment is projected to register the fastest growth during 2026–2035 with a CAGR of 6.08%. Increasing demand for renewable energy, coupled with government incentives for carbon-neutral operations, is driving adoption of high-capacity grinders in biomass facilities. Product innovations, including hybrid and electric power systems, automated feed controls, and high-capacity shafts, improve efficiency and reliability. The adoption of biomass-specific grinders enhances horizontal grinder market growth by enabling efficient, sustainable energy production from wood, agricultural residues, and green waste.

Horizontal Grinder Market Regional Analysis:

North America Dominates Horizontal Grinder Market in 2025

The North America region dominated the Horizontal Grinder Market in 2025, holding an estimated market share of 42%. High adoption of advanced grinding equipment is driven by large-scale forestry operations, increasing municipal and industrial waste volumes, and stringent environmental regulations, which collectively boost the need for efficient and eco-friendly material processing.

The United States is the dominating country in North America due to its extensive forestry and biomass resources, well-established construction and recycling industries, and advanced municipal waste management infrastructure. Technological innovations by local manufacturers, including hybrid and electric-powered grinders with automation features, improve productivity and energy efficiency. Additionally, government incentives promoting renewable energy and carbon-neutral operations encourage wide-scale adoption of horizontal grinders. The country’s strong focus on research and development in heavy machinery and sustainable waste processing directly supports market growth, maintaining North America’s leadership position in the global horizontal grinder market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia-Pacific Expected to Exhibit Fastest Growth in Horizontal Grinder Market 2026–2035

Asia-Pacific is projected to grow at the fastest CAGR of 6.97% during 2026–2035. Rising urbanization, rapid industrialization, and growing construction and forestry activities are driving demand for efficient horizontal grinders.

China dominates the Asia-Pacific horizontal grinder market due to its large-scale forestry, construction, and biomass-based energy production initiatives. Increasing municipal and industrial waste volumes, coupled with government policies encouraging renewable energy and sustainable waste management, drive demand for high-capacity and hybrid grinders. Chinese manufacturers are increasingly investing in advanced grinding technology, such as automated feed systems, electric drives, and hybrid engines, which improve efficiency and reduce operational costs. The expanding biomass power and construction sectors further support market growth, making China the key contributor to Asia-Pacific’s rapid adoption of horizontal grinders.

Europe Horizontal Grinder Market in 2025

Europe held a significant share of the horizontal grinder market in 2025, driven by strict environmental regulations, high demand for biomass energy, and advanced municipal waste management systems. Germany is the dominating country due to its extensive forestry industry, increasing adoption of renewable energy, and proactive government policies supporting low-emission machinery. Advanced stationary and hybrid grinders are widely used to process wood, construction debris, and green waste efficiently, which boosts productivity and sustainability. Europe’s focus on energy efficiency and eco-friendly waste processing drives horizontal grinder adoption.

Middle East & Africa and Latin America Horizontal Grinder Market in 2025

The Middle East & Africa and Latin America regions accounted for smaller shares of the horizontal grinder market in 2025, primarily due to limited large-scale industrial and municipal operations. However, growing construction, agricultural, and biomass activities are increasing the demand for portable and medium-capacity grinders. Countries such as South Africa and Brazil are investing in hybrid and diesel-powered grinders to manage forestry residues and green waste efficiently. The market growth in these regions is supported by emerging government initiatives promoting sustainable waste management and energy-efficient processing solutions.

Horizontal Grinder Market Companie are:

-

Vermeer Corporation

-

Morbark, LLC

-

Bandit Industries, Inc.

-

Peterson Pacific Corporation

-

CBI (Continental Biomass Industries)

-

Rotochopper, Inc.

-

Doppstadt

-

Komptech

-

Diamond Z

-

Rexworks

-

Duratech

-

Fecon

-

Precision Husky

-

Norco Equipment

-

Terex Corporation

-

600 Group

-

ACETI MACCHINE

-

ANG International

-

DELTA

-

DISKUS WERKE Schleiftechnik GmbH

Competitive Landscape for the Horizontal Grinder Market:

Vermeer Corporation

Vermeer Corporation is a U.S.-based leader in industrial and forestry equipment, specializing in horizontal grinders, trenchers, and wood processing machinery. With decades of experience, the company designs, engineers, and manufactures advanced portable and stationary horizontal grinders, diesel and hybrid-powered systems, and automation-enabled solutions. Vermeer operates globally, providing direct sales, service, and support through its extensive dealer network. Its role in the horizontal grinder market is vital, as it delivers reliable, high-capacity solutions for waste management, biomass energy, forestry, and construction applications, enhancing operational efficiency and sustainable material processing.

-

In May 2025, Vermeer launched its HG6000TX hybrid horizontal grinder featuring diesel-electric power, automated load sensing, and high-throughput capabilities, reducing fuel consumption by 15% while maintaining consistent processing for forestry and municipal operations.

Morbark, LLC

Morbark, LLC is a U.S.-based manufacturer of forestry and recycling equipment, focusing on horizontal grinders, chippers, and shredders. The company engineers heavy-duty portable and stationary grinders designed for biomass, wood, and construction debris processing. By integrating hybrid and diesel power systems, automated feed controls, and reinforced grinding mechanisms, Morbark enhances operational efficiency and energy savings. Its role in the horizontal grinder market is significant, supporting industrial, municipal, and biomass sectors by delivering versatile, high-capacity grinders that reduce operational costs and improve sustainability across applications.

-

In September 2025, Morbark introduced the HG5400 hybrid-electric grinder with automated feed control and fuel optimization, cutting emissions by 20% while processing large volumes of green waste and biomass efficiently.

Bandit Industries, Inc.

Bandit Industries, Inc. is a U.S.-based manufacturer of forestry, wood recycling, and waste processing machinery, specializing in horizontal grinders, stump grinders, and wood chippers. With extensive experience, the company focuses on robust, high-capacity grinders for portable and stationary applications, integrating advanced feed systems and diesel-powered engines. Bandit plays a key role in the horizontal grinder market by providing solutions that improve throughput, reduce downtime, and enable efficient material processing for municipal, forestry, and construction industries.

-

In April 2025, Bandit launched its 3680XP horizontal grinder with enhanced feed rollers and high-torque diesel engine, enabling continuous operation while processing heavy construction and forestry debris.

Peterson Pacific Corporation

Peterson Pacific Corporation is a U.S.-based leader in wood and biomass processing equipment, specializing in horizontal grinders, disc chippers, and industrial shredders. The company develops high-capacity grinders with stationary and portable configurations, diesel and hybrid power systems, and automation features to maximize productivity. Peterson Pacific plays a crucial role in the horizontal grinder market by delivering reliable, energy-efficient solutions for municipal waste management, forestry, and biomass applications, supporting sustainability and operational cost reduction.

-

In March 2025, Peterson Pacific introduced its Model 6800GX grinder with hybrid power and smart feed control, allowing high-volume processing while reducing fuel usage and maintenance costs for large-scale municipal and industrial projects.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | US$ 1.52 Billion |

| Market Size by 2035 | US$ 2.46 Billion |

| CAGR | CAGR of 4.99 % From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Portable Horizontal Grinders, Stationary Horizontal Grinders) • By Power Source (Diesel-Powered, Electric-Powered, Hybrid Diesel–Electric) • By Capacity (Low Capacity, Medium Capacity, High Capacity) • By Application (Wood Recycling & Processing, Land Clearing & Forestry, Biomass & Energy Production, Municipal & Organic Waste Processing, Construction & Demolition Waste, Green Waste / Composting) • By End User (Waste Management & Recycling Companies, Forestry & Logging Operators, Municipal Authorities, Construction & Demolition Firms, Biomass Power Plants, Landscaping & Agricultural Operators) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Vermeer Corporation, Morbark, LLC, Bandit Industries, Inc., Peterson Pacific Corporation, CBI (Continental Biomass Industries), Rotochopper, Inc., Doppstadt, Komptech, Diamond Z, Rexworks, Duratech, Fecon, Precision Husky, Norco Equipment, Terex Corporation, 600 Group, ACETI MACCHINE, ANG International, DELTA, DISKUS WERKE Schleiftechnik GmbH |